Essay on Money for Students and Children

500+ words essay on money.

Money is an essential need to survive in the world. In today’s world, almost everything is possible with money. Moreover, you can fulfill any of your dreams by spending money. As a result, people work hard to earn it. Our parents work hard to fulfill our dreams .

Furthermore various businessmen , entrepreneurs have startup businesses to earn profits. They have made use of their skills and intelligence in getting an upper hand in earning. Also, the employee sector works day and night to complete their tasks given to them. But still, there are many people who take shortcuts to success and get involved in corruption.

Black Money

Black money is the money that people earn with corruption . For your information corruption involves the misuse of the power of high posts. For instance, it involves taking bribes, extra money for free services, etc. Corruption is the main cause of the lack of proper growth of the country .

Moreover, money that people having authority earns misusing their powers is black money. Furthermore, these earnings do not have proper documentation. As a result, the people who earn this do not pay income tax . Which is a great offense and the person who does this can be behind bars.

Money Laundering

In simple terms, money laundering is converting black money into white money. Also, this is another illegal offense. Furthermore, money laundering also encourages various crimes. Because it is the only way criminal can use their money from illegal sources. Money laundering is a crime, and the people who practice it are liable to go to jail.

Therefore the Government is taking various preventive measures to abolish money laundering. The government is linking bank accounts to AADHAR Card. To get all the transaction detail of each bank account. As a result, the government comes to know if any transaction is from an illegal source .

Also, every bank account has its own KYC (Know your Customer) this separates different categories of income of people. Businessmen are in the high-risk category. Then comes the people who are on a high post they are in the medium-risk category. Further, the last category is of the Employee sector they are at the lowest risk.

Get the huge list of more than 500 Essay Topics and Ideas

White Money

White money is the money that people earn through legal sources. Moreover, it is the money on which the people have already paid the tax. The employee sector of any company always has white money income.

Because the tax is already levied on their income. Therefore the safest way to earn money is in the employment sector. But your income will be limited here. As a result, many people take a different path and choose entrepreneurship. This helps them in starting their own company and make profitable incomes .

Every person in this world works hard to earn money. People try different methods and set of skills to increase their incomes. But it is always not about earning money, it’s about saving and spending it. People should spend money wisely. Moreover, things should always be bought by judging their worth. Because money is not precious but the efforts you make for it are.

Q1. What is Black Money?

A1. Black money is the money that people earn through illegal ways. It is strictly prohibited in our country. And the people who have it can go to jail.

Q2. What is the difference between Black money and White money?

A2. The difference between black money and white money is, Black money comes from illegal earnings. But white money comes from legal sources with taxation levied on it.

Customize your course in 30 seconds

Which class are you in.

- Travelling Essay

- Picnic Essay

- Our Country Essay

- My Parents Essay

- Essay on Favourite Personality

- Essay on Memorable Day of My Life

- Essay on Knowledge is Power

- Essay on Gurpurab

- Essay on My Favourite Season

- Essay on Types of Sports

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Download the App

Essays About Money: Top 5 Examples and 6 Prompts

With money comes great power; however, power must always come with responsibility. Discover thought-provoking essays about money in our guide.

Money is everywhere. We use it to eat, drink, clothe ourselves, and get shelter, among many other uses. Nowadays, it is an undisputed fact that “money makes the world go round.” The earliest known form of money dates back to around 5,000 years ago ; trade was previously carried out using a barter system. However, over the centuries, more and more nations began implementing a currency system, and money has become more critical.

In the contemporary world, it seems to be “all about money.” However, it is important not to lose sight of what is important; we must maintain good physical and mental health and healthy relationships with the people around us. Money is necessary; it is just not the only thing necessary. To start your essay, read these examples to write insightful essays about money.

| IMAGE | PRODUCT | |

|---|---|---|

| Grammarly | ||

| ProWritingAid |

5 Top Examples On Essay About Money

1. essay on money by prasanna, 2. how money changed human history by jacob wilkins, 3. capitalism: money that make money by ernestine montgomery, 4. is money the most important thing by seth higgins.

- 5. An Introduction to Saving Money by Jeremy Vohwinkle

Writing Prompts For Essays About Money

1. good uses for money, 2. the “dark side” of money, 3. money’s role in history, 4. morality vs. money, 5. can money buy happiness, 6. how to save money.

“Imagine the world without money. We will eventually come to a point where we will be asking questions like “what’s the point of life”. Hope and goals are some of the important things that will keep a man going in life. Without any sense of achievement or motivation, there wouldn’t be any inventions or progress in the world. People work to get money and then people work harder to get more money. This cycle of life that keeps a man motivated and hopeful is one of the biggest advantages of the system of money”

This essay gives readers a general outlook on money and its advantages and disadvantages. It gives people equal opportunity to work for their dreams and motivates them to be productive members of society, while it also raises the question of greed. Money, without a doubt, has its positive and negative aspects, but it exists and is only becoming more critical.

“But the barter economy was flawed. There was no universal measure for determining the value of an item. It was all based on the subjective opinion of the individuals involved. And to make matters worse, the barter economy relied on both sides wanting something the other had to offer. Trade, therefore, could be sluggish and frustrating. Human beings needed something different, and money was the answer.”

Wilkins writes about how money revolutionized the way trade was conducted. The barter system involved trading any objects if both parties agreed to a deal, such as trading animal skins for fish or medicine for timber. However, the only measure of an item’s value was how much one party wanted it- both sides needed to have something the other wanted. The introduction of money allowed people to put a solid value on commodities, making trade easier.

“So, if you were to closely observe the dirty, disordered canvas of economic progress during the 20th and 21 st century, you should conclude that, for all its warts, capitalism has been the winner. It has sometimes caused pain; suffered from serious cycles; and often needed the clout of the state- such as we have seen from September 2008. It has also been quite resistant to sensible regulation. Even so, the basic institutions of capitalism have worked, not just in the US and the OECD (Organization for Economic Co-operation and development) nations, but also many developing countries, of which India is one.”

Albeit lengthy, Montgomery’s essay discusses the debate between socialism and capitalism, a topic of which money is at the core. Montgomery describes Karl Marx’s criticism of capitalism: all the money goes to a few people, not the workers. She believes these are valid to an extent and criticizes certain forms of capitalism and socialism. Neither capitalism nor socialism is perfect, but according to Montgomery, capitalism creates a better economy.

“Being the richest man in the world does not mean you are the happiest man in the world, although money can buy you happiness sometimes, but not always. If we could all appreciate the way life is, the fun, and the beauty I think the world would be better. If people weren’t power hungry maybe we’d have a lesser demand for money. Those people who is money hungry and power hungry need to relax. Money can’t buy you happiness. These individuals need to understand that.”

Higgins implores readers to remember that money is not the only thing people need in the world. He stresses the necessity of money, as it is used to pay for various necessary goods and services; however, he believes it is not a prerequisite for happiness. Material things are temporary, and there are other things we should focus on, like family and friends.

5. An Introduction to Saving Money by Jeremy Vohwinkle

“A financial emergency may take the form of a job loss, significant medical or dental expense, unexpected home or auto repairs, a hurricane or major storm, or something unthinkable, such as a global pandemic. The last thing you want to do is to rely on credit cards with their hefty interest fees or to be forced to take out a loan. That’s where your emergency fund can come in handy. Historically, the formula for an emergency account is to have enough readily available cash to cover three to six months of living expenses.“

Vohwinkle’s essay gives readers some suggestions on how to save more money. Most importantly, he suggests setting up an emergency fund, as all other saving techniques stem from there. He also suggests creating an automatic savings plan and cutting down on “spending leaks,” like buying coffee. You might also be interested in these essays about celebration .

In this essay, write about why money is necessary and the ways to use it for the greater good, and include ways in which it can be used (investing, donating, etc.). For each point, you make, be sure to explain why. Of course, this is entirely subjective; feel free to write about what you consider “good uses” for money.

On the other hand, money also has a negative side —research on money-related issues, such as taxpayer-funded corruption and trading of illegal goods. In your essay, explore this side of money and perhaps give solutions on how to stop these problems.

Money has played a progressively more important role throughout human history. Discuss the development of currency and the economy, from the barter system to the digital world we live in today. You need not go too in-depth, as there is a lot of ground to cover and many eras to research. Be sure to cite reputable sources when discussing history.

Many people warn of “selling your soul” for financial gain. In your essay, you can write about the importance of having solid values in this day and age, where money reigns supreme. What principles do you need to keep in mind? Explain how you can still value money while staying grounded; mention the balance between material needs and others.

As stated in Higgins’ essay, more people have begun to prioritize money over all else. Do you believe that money is truly the most important thing? Can it alone make you happy? Discuss both sides of this question and choose your position accordingly. Be sure to provide precise supporting details for a stronger argument.

Enumerate tips on how you can save money. Anything works, from saving certain things for special occasions to buying more food in the grocery rather than eating out. This is your opinion; however, feel free to consult online sources and the people around you for extra advice.

For help with your essays, check out our round-up of the best essay checkers .If you’re still stuck, check out our general resource of essay writing topics .

Can Money Really Buy Happiness?

Money and happiness are related—but not in the way you think..

Updated November 10, 2023 | Reviewed by Chloe Williams

- More money is linked to increased happiness, some research shows.

- People who won the lottery have greater life satisfaction, even years later.

- Wealth is not associated with happiness globally; non-material things are more likely to predict wellbeing.

- Money, in and of itself, cannot buy happiness, but it can provide a means to the things we value in life.

Money is a big part of our lives, our identities, and perhaps our well-being. Sometimes, it can feel like your happiness hinges on how much cash is in your bank account. Have you ever thought to yourself, “If only I could increase my salary by 12 percent, I’d feel better”? How about, “I wish I had an inheritance. How easier life would be!” I don’t blame you — I’ve had the same thoughts many times.

But what does psychological research say about the age-old question: Can money really buy happiness? Let’s take a brutally honest exploration of how money and happiness are (and aren’t) related. (Spoiler alert: I’ve got bad news, good news, and lots of caveats.)

Higher earners are generally happier

Over 10 years ago, a study based on Gallup Poll data on 1,000 people made a big headline in the news. It found that people with higher incomes report being happier... but only up to an annual income of $75,000 (equivalent to about $90,000 today). After this point, a high emotional well-being wasn’t directly correlated to more money. This seemed to show that once a persons’ basic (and some “advanced”) needs are comfortably met, more money isn’t necessary for well-being.

But a new 2021 study of over one million participants found that there’s no such thing as an inflection point where more money doesn’t equal more happiness, at least not up to an annual salary of $500,000. In this study, participants’ well-being was measured in more detail. Instead of being asked to remember how well they felt in the past week, month, or year, they were asked how they felt right now in the moment. And based on this real-time assessment, very high earners were feeling great.

Similarly, a Swedish study on lottery winners found that even after years, people who won the lottery had greater life satisfaction, mental health, and were more prepared to face misfortune like divorce , illness, and being alone than regular folks who didn’t win the lottery. It’s almost as if having a pile of money made those things less difficult to cope with for the winners.

Evaluative vs. experienced well-being

At this point, it's important to suss out what researchers actually mean by "happiness." There are two major types of well-being psychologists measure: evaluative and experienced. Evaluative well-being refers to your answer to, “How do you think your life is going?” It’s what you think about your life. Experienced well-being, however, is your answer to, “What emotions are you feeling from day to day, and in what proportions?” It is your actual experience of positive and negative emotions.

In both of these studies — the one that found the happiness curve to flatten after $75,000 and the one that didn't — the researchers were focusing on experienced well-being. That means there's a disagreement in the research about whether day-to-day experiences of positive emotions really increase with higher and higher incomes, without limit. Which study is more accurate? Well, the 2021 study surveyed many more people, so it has the advantage of being more representative. However, there is a big caveat...

Material wealth is not associated with happiness everywhere in the world

If you’re not a very high earner, you may be feeling a bit irritated right now. How unfair that the rest of us can’t even comfort ourselves with the idea that millionaires must be sad in their giant mansions!

But not so fast.

Yes, in the large million-person study, experienced well-being (aka, happiness) did continually increase with higher income. But this study only included people in the United States. It wouldn't be a stretch to say that our culture is quite materialistic, more so than other countries, and income level plays a huge role in our lifestyle.

Another study of Mayan people in a poor, rural region of Yucatan, Mexico, did not find the level of wealth to be related to happiness, which the participants had high levels of overall. Separately, a Gallup World Poll study of people from many countries and cultures also found that, although higher income was associated with higher life evaluation, it was non-material things that predicted experienced well-being (e.g., learning, autonomy, respect, social support).

Earned wealth generates more happiness than inherited wealth

More good news: For those of us with really big dreams of “making it” and striking it rich through talent and hard work, know that the actual process of reaching your dream will not only bring you cash but also happiness. A study of ultra-rich millionaires (net worth of at least $8,000,000) found that those who earned their wealth through work and effort got more of a happiness boost from their money than those who inherited it. So keep dreaming big and reaching for your entrepreneurial goals … as long as you’re not sacrificing your actual well-being in the pursuit.

There are different types of happiness, and wealth is better for some than others

We’ve been talking about “happiness” as if it’s one big thing. But happiness actually has many different components and flavors. Think about all the positive emotions you’ve felt — can we break them down into more specifics? How about:

- Contentment

- Gratefulness

...and that's just a short list.

It turns out that wealth may be associated with some of these categories of “happiness,” specifically self-focused positive emotions such as pride and contentment, whereas less wealthy people have more other-focused positive emotions like love and compassion.

In fact, in the Swedish lottery winners study, people’s feelings about their social well-being (with friends, family, neighbors, and society) were no different between lottery winners and regular people.

Money is a means to the things we value, not happiness itself

One major difference between lottery winners and non-winners, it turns out, is that lottery winners have more spare time. This is the thing that really makes me envious , and I would hypothesize that this is the main reason why lottery winners are more satisfied with their life.

Consider this simply: If we had the financial security to spend time on things we enjoy and value, instead of feeling pressured to generate income all the time, why wouldn’t we be happier?

This is good news. It’s a reminder that money, in and of itself, cannot literally buy happiness. It can buy time and peace of mind. It can buy security and aesthetic experiences, and the ability to be generous to your family and friends. It makes room for other things that are important in life.

In fact, the researchers in that lottery winner study used statistical approaches to benchmark how much happiness winning $100,000 brings in the short-term (less than one year) and long-term (more than five years) compared to other major life events. For better or worse, getting married and having a baby each give a bigger short-term happiness boost than winning money, but in the long run, all three of these events have the same impact.

What does this mean? We make of our wealth and our life what we will. This is especially true for the vast majority of the world made up of people struggling to meet basic needs and to rise out of insecurity. We’ve learned that being rich can boost your life satisfaction and make it easier to have positive emotions, so it’s certainly worth your effort to set goals, work hard, and move towards financial health.

But getting rich is not the only way to be happy. You can still earn health, compassion, community, love, pride, connectedness, and so much more, even if you don’t have a lot of zeros in your bank account. After all, the original definition of “wealth” referred to a person’s holistic wellness in life, which means we all have the potential to be wealthy... in body, mind, and soul.

Kahneman, D., & Deaton, A.. High income improves evaluation of life but not emotional well-being. . Proceedings of the national academy of sciences. 2010.

Killingsworth, M. A. . Experienced well-being rises with income, even above $75,000 per year .. Proceedings of the National Academy of Sciences. 2021.

Lindqvist, E., Östling, R., & Cesarini, D. . Long-run effects of lottery wealth on psychological well-being. . The Review of Economic Studies. 2020.

Guardiola, J., González‐Gómez, F., García‐Rubio, M. A., & Lendechy‐Grajales, Á.. Does higher income equal higher levels of happiness in every society? The case of the Mayan people. . International Journal of Social Welfare. 2013.

Diener, E., Ng, W., Harter, J., & Arora, R. . Wealth and happiness across the world: material prosperity predicts life evaluation, whereas psychosocial prosperity predicts positive feeling. . Journal of personality and social psychology. 2010.

Donnelly, G. E., Zheng, T., Haisley, E., & Norton, M. I.. The amount and source of millionaires’ wealth (moderately) predict their happiness . . Personality and Social Psychology Bulletin. 2018.

Piff, P. K., & Moskowitz, J. P. . Wealth, poverty, and happiness: Social class is differentially associated with positive emotions.. Emotion. 2018.

Jade Wu, Ph.D., is a clinical health psychologist and host of the Savvy Psychologist podcast. She specializes in helping those with sleep problems and anxiety disorders.

- Find a Therapist

- Find a Treatment Center

- Find a Psychiatrist

- Find a Support Group

- Find Online Therapy

- United States

- Brooklyn, NY

- Chicago, IL

- Houston, TX

- Los Angeles, CA

- New York, NY

- Portland, OR

- San Diego, CA

- San Francisco, CA

- Seattle, WA

- Washington, DC

- Asperger's

- Bipolar Disorder

- Chronic Pain

- Eating Disorders

- Passive Aggression

- Personality

- Goal Setting

- Positive Psychology

- Stopping Smoking

- Low Sexual Desire

- Relationships

- Child Development

- Self Tests NEW

- Therapy Center

- Diagnosis Dictionary

- Types of Therapy

Sticking up for yourself is no easy task. But there are concrete skills you can use to hone your assertiveness and advocate for yourself.

- Emotional Intelligence

- Gaslighting

- Affective Forecasting

- Neuroscience

Essay on Money

Introduction to The Power and Perils of Money

“Where Money Talks, Values Listen.”

Money is a fundamental aspect of modern society, serving as the lifeblood of economies and a cornerstone of daily life. Money holds immense significance in our lives, from facilitating transactions to influencing social dynamics. In this essay, we delve into the multifaceted nature of money, exploring its origins, functions, and profound impact on individuals and society.

As we navigate the complexities of money, we’ll unravel its historical roots, examine its various forms and functions, and delve into its role as a catalyst for economic growth and social change. Furthermore, we’ll explore the intricacies of personal finance, discussing the importance of financial literacy and responsible money management in achieving financial stability and well-being.

Watch our Demo Courses and Videos

Valuation, Hadoop, Excel, Mobile Apps, Web Development & many more.

Beyond its economic implications, we’ll also explore the broader societal effects of money, including its role in shaping social hierarchies, perpetuating economic inequality, and influencing political landscapes. Ultimately, this essay aims to provide a comprehensive understanding of the significance of money in our lives, shedding light on its profound impact on both individual prosperity and societal dynamics.

Origin and Evolution of Money

Money has been an essential part of human civilizations for thousands of years in all its manifestations. From basic barter systems to complex financial tools of the present day, money has always been important. Understanding the origin and evolution of money provides crucial insights into its significance and impact on society.

1. Barter Economy and the Emergence of Money:

- Barter System: In primitive societies, individuals engaged in barter, exchanging goods and services based on mutual needs, with each person trading one commodity for another. Limitations of the barter system, including the “double coincidence of wants,” led to inefficiencies and logistical challenges.

- Evolution to Commodity Money: Commodity money emerged as a solution to the shortcomings of barter, with certain items, such as cattle, grains, or precious metals, gaining widespread acceptance as mediums of exchange. Commodity money possessed intrinsic value and was universally recognized, facilitating trade and commerce across regions.

2. Development of Metal Coins:

- Introduction of Metal Coins: Metal coins, particularly gold and silver, emerged as standardized forms of currency in ancient civilizations, including Mesopotamia, Egypt, and Greece. Metal coins facilitated trade by providing a convenient and durable medium of exchange, standardized in terms of weight and purity.

- Coinage and State Authority: The minting of coins became centralized under the authority of states and rulers, leading to the establishment of monetary systems and the issuing of official currency. Coinage symbolized the sovereignty and power of states, with rulers often inscribing their images and symbols on coins as a means of propaganda and control.

3. Transition to Fiat Money:

- Rise of Paper Money: With the expansion of trade and commerce, the need for a more flexible and portable form of money led to the introduction of paper currency. Paper money initially represented claims to a specific quantity of precious metals, serving as promissory notes issued by banks and governments.

- Decoupling from Precious Metals: Over time, central banks and governments gradually abandoned the linkage between paper money and precious metals, transitioning currencies to fiat money and deriving their value from the trust and confidence of users rather than intrinsic value. Adopting fiat money allowed for greater flexibility in monetary policy and facilitated the expansion of credit and financial markets.

4. Evolution of Digital and Cryptocurrencies:

- Digital Currency: Digital currencies, electronic records with monetary value saved in digital form, result from the Internet’s and electronic banking’s development. Digital currencies, such as electronic bank transfers and payment systems, revolutionized how money is transferred and accessed, offering convenience and efficiency.

- Cryptocurrencies: Blockchain -based cryptocurrencies, like Ethereum and Bitcoin , are examples of decentralized digital money. Cryptocurrencies provide increased privacy, security, and decentralization but also present regulatory and stability concerns because they function independently of governments and central banks.

The Basic Need for Money

- Meeting Basic Needs: Money is essential for meeting basic human needs, such as food, shelter, clothes, and healthcare. Access to money enables individuals to purchase necessary goods and services for survival and well-being, ensuring a decent standard of living.

- Facilitating Economic Transactions: Money serves as a medium of exchange, enabling the exchange of goods and services in the marketplace. It enables individuals to engage in economic transactions, buy goods, pay for services, and participate in economic activities that contribute to economic growth and development.

- Access to Education and Skills Development: Money is necessary for education and skills development opportunities. Investing in education and training enhances individuals’ knowledge, skills, and employability, leading to better job prospects and higher earning potential.

- Healthcare and Medical Services: Money is vital for healthcare services and medical treatment. Individuals require financial resources to pay for medical expenses, health insurance, and access to quality healthcare facilities, ensuring their physical well-being and addressing health-related concerns.

- Housing and Shelter: Money is essential for securing housing and shelter providing individuals and families with a safe and stable living environment. Access to affordable housing options requires financial resources for rent, mortgage payments, or property ownership, ensuring adequate housing for individuals and communities.

- Transportation and Mobility: Money facilitates transportation and mobility, enabling individuals to travel for work, education, healthcare, and recreational purposes. Access to transportation choices, such as public transit, vehicles, or ride-sharing services, requires financial resources to cover transportation costs and maintain mobility.

- Emergency Preparedness and Resilience: Money is crucial for building emergency funds and financial resilience. Having savings and financial resources enables individuals to prepare for unexpected expenses, emergencies, and financial setbacks, providing a safety net during challenging times.

- Social and Recreational Activities: Money plays a role in accessing social and recreational activities that contribute to overall well-being and quality of life. Participating in leisure activities, entertainment, and social events often requires financial resources to cover expenses related to leisure pursuits and social engagements.

The Role of Money in Society

Money is a cornerstone of societal structures, influencing economic activities, social relationships, and individual well-being. Its multifaceted role extends beyond a mere medium of exchange, encompassing various functions integral to modern societies’ functioning.

1. Economic Significance of Money:

- Facilitating Trade and Commerce: Money acts as a universally accepted medium of exchange, facilitating the soft flow of goods and facilities in the market. Eliminating the need for direct barter enhances efficiency and encourages specialization in production.

- Measurement of Value: Money provides a common unit of account, allowing for the standardized measurement of the value of different goods and services. This function enables individuals to compare prices, make informed decisions, and confidently engage in economic transactions.

- Economic Growth and Development: A stable and reliable monetary system fosters economic growth and development . Governments and central banks use monetary policy tools to regulate money supply, interest rates, and inflation to maintain economic stability.

2. Social Significance of Money:

- Influence on Social Status and Power: The possession of wealth and financial resources often correlates with social status and power within a community. Economic disparities can create social hierarchies, impacting individuals’ access to opportunities and resources.

- Impact on Lifestyle and Standard of Living: The availability of financial resources influences an individual’s lifestyle and standard of living. Money provides access to education, healthcare, housing, and other essential services, shaping the quality of life for individuals and communities.

3. Money and Personal Finance:

- Importance of Financial Literacy: Financial education empowers people to make informed decisions about earning, spending, saving, and investing. Understanding the principles of personal finance is essential for achieving financial security and long-term well-being.

- Managing Personal Finances: Budgeting, saving, and investing are key to effective personal finance management. Individuals must make strategic financial decisions to meet their short-term and long-term goals.

- Psychological Aspects of Money: People often tie money to their emotions and psychological well-being. Developing a healthy money mindset involves understanding one’s relationship with money and addressing any emotional factors that may impact financial decisions.

4. Impact of Money on Society:

- Economic Inequality: The distribution of wealth and income in society can contribute to economic inequality. Addressing issues of inequality requires a nuanced understanding of the role of money and the implementation of policies that promote equitable wealth distribution.

- Consumerism and Materialism: Money influences consumer behavior , contributing to a culture of consumerism and materialism. Society’s emphasis on material possessions can impact individuals’ values and priorities.

- Influence on Politics and Governance: Money plays a significant role in political processes, affecting campaigns, lobbying, and policy decisions. The intersection of money and politics raises questions about transparency, accountability, and the democratic process.

- Environmental Implications: Economic activities driven by the pursuit of profit can have environmental consequences. Balancing economic growth with environmental sustainability requires careful consideration of the environmental impact of monetary and economic policies.

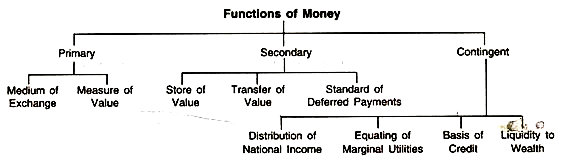

Functions of Money

- Medium of Exchange

- Money is a widely acknowledged medium of exchange for goods and services, facilitating transactions between buyers and sellers.

- It eliminates the inefficiencies of barter by providing a common unit of value that simplifies the exchange process.

- Unit of Account:

- Money provides a standardized unit of measurement for the value of goods and services, permitting easy comparison of prices and making economic calculations more efficient.

- It enables individuals and businesses to express the relative worth of different goods and services in terms of a common currency.

- Store of Value:

- Money serves as a store of value, permitting individuals to hold and accumulate wealth over time.

- Unlike perishable goods or assets with fluctuating value, money retains its purchasing power over extended periods, providing a reliable means of preserving wealth.

- Standard of Deferred Payment:

- Money facilitates transactions involving future obligations by serving as a medium for deferred payments.

- Contracts, loans, and other financial agreements often stipulate payments in a specific currency, with money as the standard for settling debts and fulfilling obligations.

- Money’s high liquidity enables it to be readily convertible into goods, services, or other assets without experiencing a significant loss of value.

- Its liquidity enables individuals to quickly access funds for urgent expenses or investment opportunities, contributing to economic flexibility and efficiency.

- Measure of Value:

- Money is a measure of value, providing a common denominator for expressing the worth of different goods and services.

- Its role as a measure of value facilitates economic decision-making, allowing individuals to assess the relative utility and worth of various goods and services.

- Facilitates Specialization and Efficiency:

- Money enables specialization and division of labor by allowing individuals and businesses to focus on producing goods and assistance in which they have a comparative advantage.

- Specialization leads to increased productivity and efficiency, driving economic growth and prosperity.

- Portability and Durability:

- Money is highly portable and durable, making it a convenient medium of interaction for transactions of varying sizes and distances.

- The physical forms of money (such as coins and banknotes) and their digital representation ensure ease of transportation and storage, contributing to its widespread use in modern economies.

The Ethics and Morality of Money

While essential for economic transactions and societal functioning, money raises ethical and moral considerations beyond its economic utility. From wealth distribution issues to the impact of financial decisions on individuals and society, exploring the ethical dimensions of money sheds light on complex moral dilemmas and societal values.

- Wealth Distribution and Economic Inequality: One of the most significant ethical concerns about money is the unequal distribution of wealth and income within societies. Critics argue that extreme wealth disparities contribute to social injustice and perpetuate systemic inequalities, raising questions about fairness and equity.

- Social Responsibility of Wealth: Accumulating wealth brings with it a moral obligation to contribute to society’s well-being. Concepts like philanthropy, corporate social responsibility, and impact investing highlight the ethical imperative for individuals and organizations to use their financial resources for the greater good.

- Ethical Consumption and Consumerism: Consumerism fueled by the pursuit of material wealth raises ethical questions about consumption patterns’ environmental and social impact. Ethical consumption movements advocate for mindful spending and sustainable lifestyles that consider the broader consequences of consumer choices.

- Ethics in Financial Services: The financial industry operates within a complex ethical landscape, with issues like transparency, conflicts of interest, and fair treatment of clients coming under scrutiny. Ethical codes of conduct and regulations aim to promote integrity and trust in financial services, ensuring that financial professionals prioritize the interests of their clients.

- Debt and Financial Vulnerability: Ethical considerations arise in lending practices, particularly regarding the responsible provision of credit and the treatment of borrowers, especially those in vulnerable financial situations. Predatory lending practices and exploitative debt arrangements raise ethical concerns about the consequences of financial transactions on individuals’ well-being.

- Corruption and Financial Crime: Money laundering, bribery, and other forms of financial crime undermine the integrity of financial systems and pose ethical challenges to businesses, governments, and individuals. Ethical frameworks and legal regulations aim to combat financial corruption and promote accountability and transparency in financial transactions.

- Psychological Impact of Money: Money’s influence on individuals’ attitudes, behaviors, and relationships raises ethical questions about the psychological effects of wealth and materialism. The pursuit of wealth can lead to ethical dilemmas related to greed, envy, and the prioritization of financial gain over other values.

- Cryptocurrency and Ethical Considerations: Emerging digital currencies, such as cryptocurrencies, introduce new ethical considerations related to privacy, security, and the potential for illegal activities like money laundering and fraud. Ethical discussions surrounding cryptocurrencies also touch on financial inclusivity, decentralization, and the democratization of finance.

Financial Education

Financial education is essential to enable people to make informed decisions concerning their money, investments, and overall economic well-being. It covers many topics, from basic budgeting and savings to more complex concepts like investing, debt relief, and retirement planning. The need for financial literacy is huge in today’s complex financial world, where individuals are more accountable for their financial future.

- Foundational Knowledge: Basic financial concepts like income, expenses, budgeting, and savings are the first things students learn about when they start their financial education. Comprehending these underlying concepts establishes the foundation for prudent financial judgment and accountable handling of finances.

- Budgeting and Saving: Effective budgeting and saving are essential for financial education. Individuals learn how to create and stick to a budget, allocate funds for essential expenses, savings, and discretionary spending, and build an emergency fund to weather unforeseen financial challenges.

- Debt Management: Financial education teaches individuals about managing debt responsibly, including understanding different types of debt, interest rates, and repayment strategies. It emphasizes the importance of avoiding excessive debt and using credit wisely to maintain financial health.

- Investing and Wealth Accumulation: Investing is a key aspect of financial education, enabling individuals to grow their wealth over the long term. Topics covered may include understanding investment options (stocks, bonds, mutual funds, etc.), risk tolerance, asset allocation, and strategies for assembling a diversified investment portfolio.

- Retirement Planning: Financial education helps individuals plan for their future financial security, including retirement. It covers retirement savings vehicles (e.g., employer-sponsored retirement plans, IRAs), estimating retirement expenses, and developing a strategy to achieve retirement goals.

- Risk Management and Insurance: Understanding risk management and insurance is integral to financial education. Individuals learn about different types of insurance (e.g., health, life, property) and how insurance can mitigate financial risks and protect against unexpected events.

- Financial Decision-making: Financial education supplies individuals with the knowledge and skills to make instructed financial decisions based on their goals, values, and circumstances. It encourages critical thinking and evaluating financial products and services, empowering individuals to navigate the financial marketplace effectively.

- Economic Empowerment: Financial education is a tool for economic empowerment, particularly for marginalized communities and underserved populations. Promoting financial literacy and capability helps individuals build financial resilience, reduce vulnerability to financial exploitation, and achieve greater economic independence.

- Lifelong Learning: Financial education is a lifelong journey with changing financial circumstances and economic conditions. It emphasizes the importance of ongoing learning, staying informed about financial trends and developments, and adapting financial strategies as needed throughout life.

- Social and Policy Implications: Financial education has broader social and policy implications, influencing financial inclusion, economic mobility, and societal well-being. Policies that promote financial education in schools, workplaces, and communities can contribute to building a financially literate society and reducing financial disparities.

Money in the Digital Age

- Digital Payments and Transactions: The addition of digital payment methods, including mobile wallets, online banking, and peer-to-peer payment platforms, has reshaped the conduct of transactions. Digital payments offer convenience, speed, and accessibility, allowing individuals to transfer funds, make purchases, and manage finances seamlessly across various digital channels.

- Cryptocurrencies and Blockchain Technology: Cryptocurrencies, such as Bitcoin and Ethereum, represent a decentralized digital currency powered by blockchain technology. Blockchain technology enables secure, transparent, and tamper-proof transactions without intermediaries like banks or financial institutions.

- Financial Inclusion and Access: The digitalization of money can promote financial inclusion by delivering access to financial services for underserved populations. Digital payment platforms and mobile banking services empower individuals in small areas or underserved communities to participate in the formal financial system.

- Challenges and Risks: Despite the benefits, the digitalization of money presents challenges and risks, including cybersecurity threats, data privacy concerns, and regulatory challenges. Fraud, hacking, and data breaches highlight the importance of robust cybersecurity measures and regulatory frameworks to protect consumers and maintain trust in digital financial systems.

- Central Bank Digital Currencies (CBDCs): Central banks are exploring the vision of central bank digital currencies (CBDCs) as a digital alternative to traditional fiat currencies. CBDCs combine the advantages of digital currencies with the stability and regulatory oversight provided by central banks, potentially reshaping the future of money and monetary policy.

- Smart Contracts and Decentralized Finance (DeFi): Smart contracts, facilitated by blockchain technology, automate and enforce the words of contracts without intermediaries. Decentralized finance (DeFi) leverages blockchain and innovative contract technology to create decentralized financial services outside traditional banking systems, including lending, borrowing, and trading.

- Cross-Border Transactions and Remittances: Digital currency and blockchain technologies promise to stream international transfers and reduce expenses and inadequacies linked to conventional remittance systems. Cryptocurrencies and stablecoins offer an alternative means of transferring value globally, bypassing traditional banking channels and intermediaries.

- Regulatory Landscape and Policy Considerations: Governments and officials face regulatory hurdles due to the rapid evolution of digital currency. Regulatory frameworks must actively update to consider the changing landscape of digital finance to preserve consumer protection, financial stability, and compliance with know-your-customer (KYC) and anti-money laundering (AML) regulations.

Money is a cornerstone of modern society, serving as a medium of exchange, store of value, and facilitator of economic activities. Its significance extends beyond financial transactions, impacting individuals’ access to basic needs, economic opportunities, and overall well-being. Understanding the multifaceted role of money is crucial for promoting financial literacy, responsible money management, and equitable access to financial resources in today’s complex socioeconomic landscape.

*Please provide your correct email id. Login details for this Free course will be emailed to you

By signing up, you agree to our Terms of Use and Privacy Policy .

Valuation, Hadoop, Excel, Web Development & many more.

Forgot Password?

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to our Privacy Policy

Explore 1000+ varieties of Mock tests View more

Submit Next Question

🚀 Limited Time Offer! - 🎁 ENROLL NOW

Essay on Importance of Money

Students are often asked to write an essay on Importance of Money in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Importance of Money

Introduction.

Money is a crucial part of our lives. It is the medium used for exchange of goods and services, and it helps us meet our basic needs.

Significance in Daily Life

Money allows us to acquire food, shelter, and clothing. Without money, survival would be difficult.

Role in Society

Money also plays a societal role. It helps us contribute to community development through taxes.

While money is important, it’s not everything. It’s a tool for survival and contribution, but happiness and fulfillment also require love, health, and peace.

250 Words Essay on Importance of Money

The significance of money.

Money, a medium of exchange, is a fundamental component of modern society. It is a tool that allows us to acquire goods, services, and experiences, thus playing a vital role in our lives.

Money as a Means of Exchange

Money simplifies trade, replacing the need for a direct barter system. It provides a standardized measure of value, enabling us to understand the worth of various commodities. This standardization facilitates smooth economic transactions and promotes economic efficiency.

Money and Freedom

Money also provides a certain level of freedom. It allows individuals to make choices about their lifestyle, from basic necessities to luxury items. It grants us the liberty to explore different opportunities, be it travel, education, or investment.

Money and Social Status

In many societies, money is often equated with power and status. While this perspective can lead to materialism and inequality, it also motivates individuals to strive for financial stability, fostering innovation and economic growth.

Money as a Tool, Not a Goal

However, it is crucial to remember that money is a means to an end, not an end in itself. The pursuit of money should not overshadow the importance of relationships, health, and personal fulfillment.

500 Words Essay on Importance of Money

Money, often seen as a simple medium of exchange, plays a pivotal role in modern society. Its importance transcends mere transactions, permeating every aspect of our lives – from the economy to social structures, personal relationships, and even our sense of self-worth.

The Economic Imperative

At its most basic level, money is the lifeblood of any economy. It facilitates trade, allowing for the efficient exchange of goods and services. Without money, barter would be the only alternative – a system fraught with inefficiencies and limitations. Money, therefore, enables economic growth by allowing for specialization and the division of labor.

Money as a Social Construct

The psychological dimension.

Money also has a profound psychological impact. It can influence our behavior, our motivations, and even our sense of self. Money can provide a sense of security and freedom, but it can also lead to stress and anxiety. The desire for money can motivate us to work harder and strive for success, but it can also lead to greed and materialism.

Money and Happiness

The relationship between money and happiness is a complex one. While money can provide for our basic needs and desires, research suggests that beyond a certain point, additional wealth does not lead to additional happiness. This suggests that while money is important, it is not the be-all and end-all of life.

That’s it! I hope the essay helped you.

Apart from these, you can look at all the essays by clicking here .

Happy studying!

Leave a Reply Cancel reply

- Skip to main content

- Skip to secondary menu

- Skip to primary sidebar

- Skip to footer

A Plus Topper

Improve your Grades

Essay on Money | Money Essay for Students and Children in English

February 13, 2024 by Prasanna

Essay on Money: The concept of money was invented somewhere in 5000 B.C by a few traders in Western Europe. Ever since the invention, different countries have adopted it and started printing their own money with specific values, which was usually backed by gold. But before money was invented, trading used to happen with a system called a barter system, where you could buy one product or service with an exchange of another product. This is basically a brief history of money.

For centuries, money has been, gradually, incorporated into every corner of our lives. Not to sound cliché, but the entire world runs on one simple thing called money. Thanks to those traders hundreds of years back, our lives now entirely revolve around the man-made concept of money.

You can also find more Essay Writing articles on events, persons, sports, technology and many more.

Long and Short Essay on Money in English for Children & Students

In this article, we provide a 600-word long essay on money for school children for projects and assignments. We also provide a 200-word short essay on money for school and college assignments and project work.

Long Essay on Money

A very informative 400 to 600-word long essay on money for school and college projects and assignments can be found below.

While not everything is about money, we will have to come at a point of realization where we simply cannot live without money. It’s a hard truth. But isn’t the world being too negative about money? No essay on money will make sense if it is just about history and facts. So let us see how money has impacted our lives. Just like every attribute in our society, money has two sides. The evil and the good.

What’s the Good Side of Money?

When we say our lives revolve around money and everyone is just chasing it, it is usually considered with a negative connotation. Not everything about money should be taken in a bad light. The whole concept of money and capitalism has given people livelihood, better standards of living and most importantly an equal platform for everyone to work hard and fulfill their dreams.

Trust and Convenience of Money

Money is one of the biggest and most valuable and trustworthy forms of trade in which businesses can thrive and consumers can be saved from fraud and cheating. One of the biggest plus points of money is the trust factor it carries with it. Imagine having to carry out the barter system even today, where, to get a kilo of rice, you need to give a kilo of wheat. Sounds funny, isn’t it?

Equality of Money

This is, surprisingly, one thing that can bring people from different walks of life to agree upon. Money can buy you a good standard of living, it can buy you respect and value in society. Every person, irrespective gender, race, ethnicity or creed will be provided with an equal level playing field to earn money and lead a better life

Motivation and Direction of Money

Imagine the world without money. We will eventually come to a point where we will be asking questions like “what’s the point of life”. Hope and goals are some of the important things that will keep a man going in life. Without any sense of achievement or motivation, there wouldn’t be any inventions or progress in the world. People work to get money and then people work harder to get more money. This cycle of life that keeps a man motivated and hopeful is one of the biggest advantages of the system of money

What is the Evil Side of Money?

Well, not everything is hunky-dory about our financial systems. It would only be fair to talk about the disadvantages of money also to have a well-informed essay on money.

Whether it is capitalism or socialism, democracy, or communism or where its India or China, our system of money in the world has many cracks and fault lines within it.

- Broken system: If the concept of money in its pure form was used properly, there would have been equality on all scales and levels in the world. But, the reality is far from our imagination. The hierarchical system, in both capitalism or socialism, has created an immense amount of inequality and large gaps in income. It is true that more than 90% of the world’s wealth is in the hands of 2% of the population. If this is not a sign of a broken system, then we don’t know what is

- Greed: We need to understand the difference between desire and greed. When the fine line between the two is made more visible, then maybe our world will start healing itself. We are not necessarily talking about individual greed for money, but we are talking about issues on a much larger scale. Businesses are solely running to make profits, the government is more concerned about saving the economy than their own people or the environment we live in. The greed for money is destroying our nature, creating an imbalance in the natural cycle of the world and led us into wars, famine, poverty and pandemics.

Short Essay on Money

A short essay on money with a word limit of 150 to 200 can be found below for school assignment and projects

We can’t deny the fact that we cannot live without money. Money is undoubtedly the more important thing to live a happy and content life. Sure, the money will help us buy our dream car or impress and give a dignified life for our parents, but we also need to remember that there is more to life than just earning money.

Money can make or break many things, but like any other thing in the world, money also needs to have limits and should be used judiciously. The gap between rich and poor is because of poorly planned financial systems and an immense amount of greed which is a pet of human tendency

On a big picture level, governments need to fix the broken financial systems and modify our capitalist and socialist mindsets to create for ourselves a better world and leave an even better society to our next generation.

10 Lines on Money Essay

- Money is the only trustworthy and convenient way of trade

- The money we use is guaranteed and backed by our government

- Money, collected in the form of tax, helps us create a better environment for us

- Earning money will give people hope and direction to lead a happy life

- Money doest just buy tangible things like car or house, money also helps you earn respect and dignity in the society

- Hard work, responsibility and dedication is what reflects in a person’s character if they have a good amount of money

- Money is the core factor in all type of economies like a capitalist, socialist and communist economies

- Money has provided equal opportunities for everyone in the world

- Wrong use of money and greed has led to certain world issues like terrorism, pandemics and famine

- The difference between the amount of money rich and poor has, reflects loopholes and problems in our system

FAQ’s on Essay on Money

Question 1. What if the concept of money was not there?

Answer: We would be back to our age-old barter system. Globalization and industrialization would never be possible and each country and each village in the country would be self-sufficient and isolated

Question 2. Is money good or bad?

Answer: This is one of the most daunting questions that economists, leaders and other experts are pondering upon for years. There is no simple answer, but the present system, if modified well, can make money the best thing in the world.

Question 3. Why can’t governments just print money?

Answer: Every money, even a Rs. 1 is backed by government securities, usually in gold or dollars. If we print more than the security we have, our fiscal deficit will increase, which means that the value of money will get reduced as it will be available everywhere to everyone. It is a simple supply and demand theory.

Question 4. What are the different types of money?

Answer: In terms of value and currencies, we have dollar, rupees, pounds, yuan and many more for each country. In terms of physical existence, we have digital money (like bitcoins) and hard paper-based cash. In terms of tangibility, we have hard cash, commodities, fiduciary, representative and fiat money.

- Picture Dictionary

- English Speech

- English Slogans

- English Letter Writing

- English Essay Writing

- English Textbook Answers

- Types of Certificates

- ICSE Solutions

- Selina ICSE Solutions

- ML Aggarwal Solutions

- HSSLive Plus One

- HSSLive Plus Two

- Kerala SSLC

- Distance Education

Understanding Economics: Why Does Paper Money Have Value?

- U.S. Economy

- Supply & Demand

- Archaeology

- Ph.D., Business Administration, Richard Ivey School of Business

- M.A., Economics, University of Rochester

- B.A., Economics and Political Science, University of Western Ontario

While it may be true that money makes the world go around, it is not inherently valuable. Unless you enjoy looking at pictures of deceased national heroes, these colorfully imprinted pieces of paper have no more use than any other piece of paper. It is only when we agree as a country to assign a value to that paper—and other countries agree to recognize that value—that we can use it as currency.

Gold and Silver Standards

It didn't always work this way. In the past, money generally took the form of coins composed of precious metals such as gold and silver. The value of the coins was roughly based on the value of the metals they contained because you could always melt the coins down and use the metal for other purposes.

Until a few decades ago, the value of paper money in many countries, including the United States, was based on a gold or silver standard, or some combination of the two. The piece of paper money was simply a convenient way of "holding" that particular bit of gold or silver. Under the gold or silver standard, you could actually take your paper money to the bank and exchange it for an amount of gold or silver based on an exchange rate set by the government. Up until 1971, the United States operated under a gold standard , which since 1946 had been governed by the Bretton Woods system, which created fixed exchange rates that allowed governments to sell their gold to the United States treasury at the price of $35 per ounce. Believing that this system undermined the U.S. economy, President Richard M. Nixon took the country off the gold standard in 1971.

Since Nixon's ruling, the United States has operated on a system of fiat money, which means our currency is not tied to any other commodity. The word "fiat" originates in the Latin, the imperative of the verb facere, "to make or become." Fiat money is money whose value is not inherent but called into being by a human system. So these pieces of paper in your pocket are just that: pieces of paper.

Why We Believe Paper Money Has Value

So why does a five-dollar bill have value and some other pieces of paper do not? It’s simple: Money is a both a good and a method of exchange. As a good, it has a limited supply, and therefore there is a demand for it. There is a demand because people can use the money to purchase the goods and services they need and want. Goods and services are what ultimately matter in the economy, and money is a way that allows people to acquire the goods and services that they need or want. They earn this method of exchange by going to work, which is a contractual exchange of one set of goods—labor, intellect, etc.—for another. People work to acquire money in the present to purchase goods and services in the future.

Our system of money operates on a mutual set of beliefs; as long as enough of us believe in the value of money, for now, and in the future, the system will work. In the United States, that faith is engendered and supported by the federal government, which explains why the phrase "backed by the full faith and credit of the government" means what it says and no more: the money may have no intrinsic value, but you can trust using it because of its federal backing.

Furthermore, it is unlikely that money will be replaced in the near future because the inefficiencies of a purely barter system, in which goods and services are exchanged for other goods and services, are well known. If one currency is to be replaced by another, there will be a period in which you can switch your old currency for new currency. This is what happened in Europe when countries switched over to the Euro . So our currencies are not going to disappear entirely, although at some future time you may be trading in the money you have now for some form of money that supersedes it.

The Future Value of Money

Some economists don't trust our system of fiat currency and believe we cannot continue to declare that it has value. If the vast majority of us come to believe that our money won't be nearly as valuable in the future as it is today, then our currency becomes inflated . Inflation of the currency, if it becomes excessive, causes people to want to get rid of their money as quickly as possible. Inflation, and the rational way citizens react to it is bad for the economy. People will not sign profitable deals that involve future payments because they’ll be unsure what the value of money will be when they get paid. Business activity sharply declines because of this. Inflation causes all sorts of other inefficiencies, from a café changing its prices every few minutes to a homemaker taking a wheelbarrow full of money to the bakery in order to buy a loaf of bread. The belief in money and the steady value of the currency are not innocuous things.

If citizens lose faith in the money supply and believe that money will be worthless in the future, economic activity can grind to a halt. This is one of the main reasons the U.S. Federal Reserve acts diligently to keep inflation within bounds—a little is actually good, but too much can be disastrous.

Supply and Demand

Money is essentially a good, so as such is ruled by the axioms of supply and demand. The value of any good is determined by its supply and demand and the supply and demand for other goods in the economy. A price for any good is the amount of money it takes to get that good. Inflation occurs when the price of goods increases—in other words when money becomes less valuable relative to those other goods. This can occur when:

- The supply of money goes up.

- The supply of other goods goes down.

- Demand for money goes down.

- Demand for other goods goes up.

The key cause of inflation increases in the supply of money. Inflation can occur for other reasons. If a natural disaster destroyed stores but left banks intact, we’d expect to see an immediate rise in prices, as goods are now scarce relative to money. These kinds of situations are rare. For the most part, inflation is caused when the money supply rises faster than the supply of other goods and services.

To summarize, money has value because people believe that they will be able to exchange this money for goods and services in the future. This belief will persist so long as people do not fear future inflation or the failure of the issuing agency and its government.

- What Does "Money" Mean in an Economic Context?

- Interest - The Economics of Interest

- Economics for Beginners: Understanding the Basics

- Purchasing Power Parity

- What Is Capital Deepening?

- The Double Coincidence of Wants

- What Is Money?

- The Gold Standard

- What You Should Know About Econometrics

- Books to Study Before Going to Graduate School in Economics

- The Trade Deficit and Exchange Rates

- The Future of Money

- Expansionary vs. Contractionary Monetary Policy

- Properties and Functions of Money as Currency vs. Wealth

- Understanding The Stock Market

- What Is the Demand For Money?

- Entertainment

- Environment

- Information Science and Technology

- Social Issues

Home Essay Samples Life

Essay Samples on Money

The effects of money on human behavior.

Money, as a ubiquitous and powerful force in modern society, has a profound impact on human behavior. Whether consciously or unconsciously, individuals' attitudes, values, and actions are influenced by the presence and pursuit of money. In this essay, we will explore the multifaceted effects of...

Exploring Why Happiness Is More Important Than Money

Happiness is more important than money — a simple yet profound statement that encapsulates the essence of a fulfilling and meaningful life. While money is undoubtedly a vital resource, it pales in comparison to the profound impact that happiness has on overall well-being. This essay...

Exploring the Age-Old Question: Can Money Buy Happiness

The relationship between money and happiness has been a subject of contemplation for centuries. Can the accumulation of wealth truly lead to a fulfilled and contented life? Or simply: can money buy happiness? This essay delves into the complex interplay between money and happiness, examining...

Transitioning to a Cashless Economy: Challenges, Opportunities, and the Path Ahead

The world is now moving on from Paper Currency based economy to Cashless economy. By embracing Alternate Delivery Channels and other Cashless modes of payment which include old ones like NEFT,RTGS etc. to newer one’s like POS, e-wallets, debit and credit cards, UPI, BHIM etc....

Being Smart With Your Money: the Importance of Financial Literacy

Many people have discussed personal finance. Articles 'Should Financial Literacy Be Taught in More Schools' by Ramsey and 'Why is Learning Personal Finance Important' by Ryan discuss the reason why personal finance is beneficial to the educational system. Benefits of adding Personal finance to our...

- Personal Finance

Stressed out with your paper?

Consider using writing assistance:

- 100% unique papers

- 3 hrs deadline option

Unlocking Financial Literacy: Exploring the World of Finance and Money Management

Finance is a business term that is associated with banking, investments, capital, debt and credit. Managing money, such as balancing a checkbook, involves finance. At one point in every person's life, one must deal with finances. An important topic among finance is assets and liabilities....

The Value of Understanding Personal Finance Management for Students

As a student, learning this course about personal financial statement is important. It shows the individual's net worth 'their assets minus their liabilities' which reflects what that person has in cash if they sell all their assets and pay off all their debts. If their...

Why Personal Finance Should Be Taught in Modern Schools

About 59% of Americans have less than 1,000 dollars in savings. I think that Financial Literacy should be a requirement in schools all around the country. Financial planning should be taught in schools because finances affect everything, a lack of financial knowledge has consequences eventually,...

Evaluation of the Benefits and Risks of Cashless Economy

In a world where cybersecurity concerns are growing, the road to a cashless society is an inflection point. With countries across the world embracing digital forms of commerce and connectivity, the need for physical currency could soon become obsolete. But despite the increasing use of...

Can Money Buy Happiness: Sharing Persuasive Personal Viewpoint

Money is a defined as “any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context”. In what way does that relate to the emotional feeling of...

- Personal Beliefs

Budgeting and Types of Personal Budget

Budget can mean different things for different people, but in each case, it is used as an effective tool for achieving a wide range of short and long-term financial objectives. Contrary to popular belief, budgeting is not a cut-and-dry, one-size-fits-all process. Rather, it needs to...

Budgeting Technique to Build a Stable Financial Future

There’s nothing like the feeling of independence of when you’re in college, but since it’s the first time away from home for many, This is the time when most young people use their first debit/credit cards, take out their first loans, and write their first...

The Ascent of Money: Is Money the Root of All Evil

In Niall Ferguson’s The Ascent of Money, Ferguson analyzes the history of money, banking, and credit. He tracks the development of currency as a form of trade, explores its growth and effects on society, and looks forward to how it may continue to develop in...

Gold: One of the Most Expensive Metals on Earth

Being one of the first metals to be discovered, gold throughout history has always had a rich past from its use in ancient Egypt, Greece, Rome and Africa. It has been used within their culture for thousands of years, and has been essential to their...

The Impacts Of Physical Cash And Developing Into A Cashless Society

Imagine a future where everything is seamlessly paid for via your phone. It’s a beautiful vision of what a cashless society would look like, however, with some dangerous unintended consequences. A cashless society is one where purchases by physical cash are no longer available and,...

- Modern Society

The Advantages Of Credit Card Debt And Usage

Credit cards are a popular way to buy Things online and in Stores and Cover The cash back in installments afterwards . It's kind of debt centre employed by customer. It's beneficial for the client and a bank. No security security is necessary for credit...

- Credit Card

Getting Rid Of The Penny Because Of Its Negative Effects

Whether or not you believe picking up a penny will bring you luck, one thing it definitely won’t bring you is wealth. In fact, the penny is so worthless, many people want to do away with them for good. The penny is detrimental in many...

Ceos Being Paid Too Much Money Is A Bad Thing

Initially, the question as to whether or not CEOs are paid too much may seem to be a matter of subjective opinion. However, research indicates that pay disparity beyond a certain ratio can lead to adverse implications in society. According to one source, income inequality...

Minimum Wage Should Be Raised: The Pros And Cons Of Making More Money

Who wants to make more money? Kind of sounds like a funny question because who doesn't? Right. Well there has been a constant debate over what the minimum wage should be in the United States. Sure, more money sounds great, but what does that mean...

- Minimum Wage

Too Much Money Is A Bad Thing: Controlling The Money Demand

Recent advancements in information technology and technical innovations in general have revolutionized trade and commerce and contributed to existing literature in the modern world. High-speed and low-cost data transfer that was made possible by information technology, created an excellent platform for e-commerce to grow rapidly....

- Economic Development

the Emergence Of The Penny Press and Getting Rid Of It

In the streets of the United States in 1838, for the first time, the newspaper the New York Sun, which sold only one cent of the smallest unit of money. In contrast with the 15th century, printing technology has just appeared, and the prices of...

- Monetary Policy

Reasons Why Money Cannot Buy Happiness

If I asked a stranger to describe a wealthy individual, they would probably use the words “privileged,” “successful,” and “happy.” When, in reality, studies have proven that having a great deal of money does not always lead to happiness. In fact, despite popular belief, money...

Money Can Buy Happiness: The Speech On Achieving Happiness

“Money can buy happiness” is a common phenomenon, widely believed by people these days, I however beg to differ. Expectancy theory states that money will motivate employees as long as their personal goals are being satisfied and the perception that their pay is dependent upon...

The Issue Of Rich Still Out Weighing The Poor

Did you know that 1% of households in the US produced more than 25 times what a family in the 99% did (“US Income Inequality”)? Income inequality between the rich and the poor has been happening since before the Great Recession, a period of time...

- Poverty in America

Money Over Morality: Being Righteous For The Wrong Reasons

They say money is what makes the world go round but yet, in true fact, money is what tears the world apart. Many people have imagined a world without it but obviously our global system could not realistically run; however, the way money is treated...

Power Of The Rich And Weakness Of The Poor

Money equals power to some, but money can just cause trouble for others. People think that just because they got money that they can just do whatever they please. What people don't understand is that you can still ruin your life with or without money....

The Role Of Money And Finances On Happiness

Money is a fundamental aspect of human life throughout the world. People spend a large fraction of their time earning and spending money. In wealthy and poor societies around the globe, there is now an enormous concern about economic development, and in most nations, it...

Having Money Is More Important Than Having Knowledge

As children, our parents try to inculcate good habits such as honesty, hard work and dedication while also narrating the story about a monkey who stole butter from the cats in order to make both the cats' share equal. Being rich or being righteous doesn't...

Priorities in Money Management as a Student

Money is extremely important in each individual’s lifestyle as it makes them independent, have more control over decision-making skills, more freedom to do what they want and can fulfil and accomplish their long-term ambitions. An individual with great wealth is able to get a rich...

Gambling and Its Positive and Negative Effects on Society

In today’s society, Gambling is becoming more and more widespread, you must look at the positives and negative aspects of the casino establishments being built and how these establishments effect the community surrounding them. It is proven that casinos boost the economy by providing jobs...

- Gambling Addiction

The Importance of Being Careful With Money When it Comes to Lottery

I believe that winning the lottery is an exhilarating experience and can cause some issue to occur in one’s life. From the general perception of society, some individuals do not make good use of their winning, and this is the reason most people do not...

Character Of Mrs. Loisel In 'The Necklace'

Mrs. Loisel isn't the brightest person and can be seen as selfish, which signifies her only thinking for and about herself. The title of the short-story is 'The Necklace' and written by Guy De Maupassant. To give a brief overview, the Loisels aren't very wealthy,...