Skip to content

Quick Links

- IFoA Public Website

- Continuous Mortality Investigation

Research projects

You are here, ifoa research programme typically comprises over 100 initiatives at any one time..

A full list of current IFoA research working parties can be found here.

The IFoA supports and sponsors research through member-led working parties in various practice areas and through commissioned external research such as that undertaken in universities. By supporting new research, we continue to further actuarial science and aim to provide members with cutting edge knowledge attuned to the realities of their working lives. This listing contains all IFoA research.

Research outputs can be accessed via Sessional Research Programme recordings and Research papers.

Similarly, IFoA research papers provide a way for members and academics to communicate their findings. Research papers can be accessed via the Sessional Research Programme and knowledge exchange page and via the main site search .

Can’t find what you’re looking for? Email us .

Events calendar

No results found.

Filter Research Projects

Most Recent Publications

Opportunities & open calls, research grants.

The CAS offers research grants to further the body of knowledge in actuarial science and encourage researchers to submit proposals that address emerging and classic industry challenges through various methodologies.

To apply for a grant, please fill out a Research Grant Proposal Form .

Loss Simulation Model and Documentation

The Loss Simulation Model (the "model") has been developed by the CAS using committee volunteers, non-committee reviewers and consultants engaged by the CAS (collectively the “Developers”) for the sole purpose of assisting CAS members and subscribers (the "Users") with an educational and research tool.

The model should ONLY be used for this purpose. Please refer to the Loss Simulation Model Working Party paper for a fuller discussion of the model’s features and additional testing and development work that is needed. The CAS and the Developers disclaim any responsibility regarding use of the results of this model and any decisions made based upon those results.

In the event that any defect in this model is discovered, the CAS may, at the CAS’s sole and exclusive option, remedy, repair or replace the defective model to the extent reasonably possible. The CAS is providing the model for your educational and research use only. The model is not intended to be an industry standard or to represent a CAS endorsement. It is merely one approach that CAS members and others in the industry might want to consider when estimating unpaid claim distributions. The different facts and circumstances of any particular company situation require specific analysis, review, and advice from competent and experienced actuarial professionals.

THE MODEL IS PROVIDED “AS IS” AND FREE OF CHARGE AND YOU ACCEPT THE ENTIRE RISK AS TO THE QUALITY, PERFORMANCE AND RESULTS OF USE OF THE MODEL. THE CAS AND THE DEVELOPERS AND THEIR RESPECTIVE EMPLOYEES, OFFICERS AND DIRECTORS, MAKE NO WARRANTIES OR REPRESENTATIONS, EXPRESSED OR IMPLIED, ORAL OR IN WRITING, WITH RESPECT TO THE MODEL, INCLUDING ITS FITNESS FOR A PARTICULAR PURPOSE, MERCHANTABILITY, QUALITY OR ITS NON-INFRINGEMENT. THE CAS AND THE DEVELOPERS AND THEIR RESPECTIVE EMPLOYEES, OFFICERS AND DIRECTORS, WILL NOT BE LIABLE FOR ANY DAMAGES, INCLUDING INDIRECT, SPECIAL, INCIDENTAL, CONSEQUENTIAL OR PUNITIVE DAMAGES (INCLUDING LOST PROFITS AND LOST DATA) ARISING OUT OF THE USE OF, OR THE INABILITY TO USE THE MODEL. THE CAS AND THE DEVELOPERS SHALL HAVE NO LIABILITY, AND EACH USER AGREES TO HOLD THE CAS AND THE DEVELOPERS HARMLESS FROM ANY LIABILITY, RESULTING FROM THE MODIFICATION OR REVISION OF THE MODEL BY OR ON BEHALF OF SAID USERS, INCLUDING MODIFICATIONS MADE BY THE CAS OR THE DEVELOPERS.

The program code, user interface, data storage, calculations, results, exhibits and graphs generated by the model are only for educational and research purposes. The model may be freely distributed to any other user without the express written permission of the CAS. In the event such distribution is made, the entire model must be provided, including the license agreement in electronic form. This license agreement and any proprietary notices or legends included in the model MUST NOT be removed or modified in any way for any reason or purpose.

I have read the statements above, agree with the statements, and wish to continue.

Downloadable Programs, Spreadsheets and Workbooks

The CAS has received information delivered through internet-based technology that is relevant for actuaries. Examples of such information include online searchable databases, web-based educational mechanisms, or technology designed to address a specific actuarial problem.

Nothing submitted is of a proprietary nature, or violates antitrust regulations. Contributions are submitted in a format that can be accessed through the CAS Web Site.

DISCLAIMER: The CAS makes no warranty or representation regarding the performance of any files submitted to this Spreadsheet Site. Questions regarding any file should be communicated to the person that posted the file on this site.

Many of the files on this Spreadsheet Site contain macros. Many well known viruses are written as macros within spreadsheets. The CAS exposes all Spreadsheet Site files to anti-virus software but makes no claim that every file is virus-free. Download the file at your own risk -- the CAS is not responsible for damages to hardware or software resulting from downloading files from the Spreadsheet Site.

I have read the disclaimer and wish to continue.

Cyber risk research in business and actuarial science

- Survey Paper

- Published: 14 October 2020

- Volume 10 , pages 303–333, ( 2020 )

Cite this article

- Martin Eling ORCID: orcid.org/0000-0002-9528-555X 1

2938 Accesses

34 Citations

Explore all metrics

We review the academic literature on “cyber risk” and “cyber insurance” in the fields of business (management, economics, finance, risk management and insurance) and actuarial science. Our results show that cyber risk is an increasingly important research topic in many disciplines, but one that so far has received little attention in business and actuarial science. Business research has documented the manifold detrimental effects of cyber risks using event studies and scenario analyses, while economic research is especially concerned with trade-offs between different risk management activities. Quantitative research including papers published in actuarial journals mainly focuses on loss modelling, especially taking dependencies and network structure into account. We categorize the empirical literature on cyber risk to filter out what we know on the frequency, severity and dependence structure of cyber risk. Finally, we list open research questions which demonstrate that cyber risk research is still in its infancy and that there is ample room for future research.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

Modeling and pricing cyber insurance

Cyber Risk Management: A New Challenge for Actuarial Mathematics

Cyber risk assessment and mitigation (cram) framework using logit and probit models for cyber insurance, explore related subjects.

- Artificial Intelligence

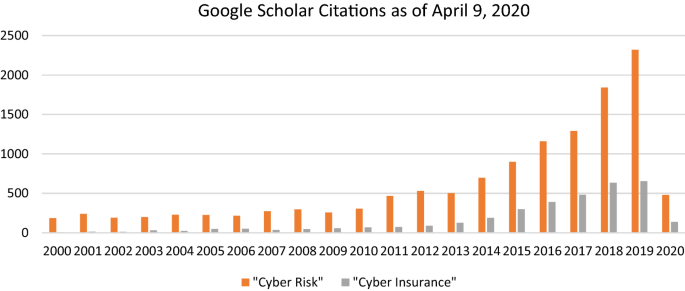

As shown in “ Appendix A ”, research on cyber risk and cyber insurance was scarce until 2010, but since then it has grown exponentially, emphasizing the increasing practical and academic relevance of the topic. We also note a number of working parties studying cyber risk from a more applied perspective for professional organizations, such as the Society of Actuaries (SOA), the International Actuarial Association (IAA) or the Canadian Institute of Actuaries.

The selection of journals in management, finance and economics is based on the journal ranking of the German Academic Association of Business Research (VHB-Jourqual 3; see https://vhbonline.org/vhb4you/vhb-jourqual ). The journals are presented in alphabetical order.

The only exception is the Geneva Papers on Risk and Insurance which published a special issue on cyber risk in 2018 and will publish another special issue this year.

The search strategy certainly has limitations, so our selection of papers should not necessarily be considered comprehensive. One example is that articles that do not contain the words “cyber risk” or “cyber insurance” in the title, abstract or key words are not included in the list. One example is the often-cited article on data breaches by Romanonsky et al. [ 66 ]. Still the selection of papers should provide a good overview of research in the different fields.

Bai [ 5 ] focuses on sentiment analysis from online texts and is the only one in the set of 40 articles that is just loosely related to the topic of cyber risk. The author proposes a Markov blanket model to capture dependencies among words and provide a vocabulary for extracting sentiments. The advantages of their approach compared to other state-of-the-art algorithms for sentiment analysis is illustrated in two applications (online movie reviews, online news). The article is included in the review, because the authors position their tool not only to gauge online customers' preferences for economic or marketing research, but also for detecting cyber risk and security threats.

They also show that stock prices of information security providers increase on average in value by 1.36% or US$1.06 billion after the announcement of another company’s security breach.

Other analyses on related topics are Srinidhi, Yan and Tayi [ 75 ]; Johnson, Böhme and Grossklags [ 49 ] and Pal et al. [ 62 ]. Srinidhi, Yan and Tayi [ 75 ] show that cyber insurance has the effect of reducing managers' overinvestment in specific security-enhancing assets. Johnson, Böhme and Grossklags [ 49 ] present security games with market insurance. Pal et al. [ 62 ] ask whether cyber insurance can improve the security in a network and show that in equilibrium insurers cannot make more than zero expected profits, again questioning the insurability of cyber risk.

Romanosky [ 64 ] provides a first attempt to quantify the costs of cyber events considering US data from Advisen; he mainly presents descriptive statistics that can be used to validate and verify the plausibility cyber loss estimates; moreover, he presents a logistic regression model to analyze the costs of cyber events, but for data breaches only. Furthermore, a few industry studies exist (NetDilligence [ 59 ]; Ponemon [ 47 ]) that also are of descriptive nature.

Another related modelling paper is Eling and Loperfido [ 27 ] who consider the PRC dataset and use multidimensional scaling and goodness-of-fit tests to analyze the distribution of data breach information. The results show that different types of data breaches need to be modeled as distinct risk categories. For severity modeling, the log-skew-normal distribution provides promising results. The findings add to the discussion on the use of skewed distributions in actuarial modeling (Vernic [ 30 ]; Bolancé et al. [ 12 ]; Eling [ 25 ]) and provide insights for actuaries working on the implementation of cyber insurance policies.

The largest cyber loss has been WannaCry which resulted in a US$8 billion economic loss (Gallin [ 38 ]). Mahalingam et al. [ 53 ] illustrate that for an event to have an impact on the capital market, at least an economic loss of US$1 trillion (or at least 1–2% world GDP) is necessary. This extreme magnitude that is necessary to create a systematic impact is very likely also the reason why event studies for other catastrophic events come to more mixed and inconclusive results.

Anderson R, Moore T (2006) The economics of information security. Science 314:610–613

Google Scholar

Ashby S, Buck T, Nöth-Zahn S, Peisl T (2018) Emerging IT risks: Insights from German banking. Geneva Pap Risk Insur Issues Pract 43:180–207

Augsburger-Bucheli I, Bangerter E, Brunoni L et al (2017) Forschung zu Cyber-Risiken in der Schweiz. Bern. https://www.isb.admin.ch/dam/isb_kp/de/dokumente/themen/ncs/Expertenbericht_forschung.pdf.download.pdf/Expertenbericht_forschung.pdf

August T, Dao D, Kim K (2019) Market segmentation and software security: pricing patching rights. Manage Sci 65:4575–4597

Bai X (2011) Predicting consumer sentiments from online text. Decision Support Syst 50:732–742

Bandyopadhyay T, Mookerjee V, Rao R (2009) Why IT managers don’t go for cyber-insurance products. Commun ACM 52:68–73

Bentley M, Stephenson A, Toscas P, Zhu Z (2020) A multivariate model to quantify and mitigate cybersecurity risk. Risks 8:61

Berliner B (1982) Limits of insurability of risks. Englewood Cliffs, New Jersey

Biancotti C (2017) The price of cyber (in)security: evidence from the Italian private sector. In: Bank of Italy occasional paper

Biener C, Eling M, Wirfs JH (2015) Insurability of cyber risk: an empirical analysis. Geneva Pap Risk Insur Issues Pract 40:131–158

Böhme R, Kataria G (2006) Models and measures for correlation in cyber-insurance. Boston. https://www.econinfosec.org/archive/weis2006/docs/16.pdf

Bolance C, Guillen M, Pelican E, Vernic R (2008) Skewed bivariate models and nonparametric estimation for the CTE risk measure. Insur Math Econ 43:386–393

MathSciNet MATH Google Scholar

Campbell K, Gordon LA, Loeb MP, Zhou L (2003) The economic cost of publicly announced information security breaches: empirical evidence from the stock market. J Comput Secur 11:431–448

Cartagena S, Gosrani V, Grewal J, Pikinska J (2020) Silent cyber assessment framework. Br Actuarial J 2020:25

Cavusoglu H, Mishra B, Raghunathan S (2004) The effect of internet security breach announcements on market value: capital market reactions for breached firms and internet security developers. Int J Electron Commerce 9:69–104

Cebula J, Young L (2010) A taxonomy of operational cyber security risks. Carnegie Mellon, https://resources.sei.cmu.edu/library/asset-view.cfm?AssetID=9395

Ceross A, Simpson A (2017) The use of data protection regulatory actions as a data source for privacy economics. In: Tonetta S, Schoitsch E, Bitsch F (eds) Computer safety, reliability, and security. Springer International Publishing, Cham, pp 350–360

Daffron J, Ruffle S, Andrew C, et al (2019) Bashe attack: Global infection by contagious malware. Cambridge Centre for Risk Studies, Lloyd’s of London and Nanyang Technological University. https://www.lloyds.com/news-and-risk-insight/risk-reports/library/technology/bashe-attack

Dal Moro E (2020) Towards an economic cyber loss index for parametric cover based on IT security indicator: a preliminary analysis. Risks 8:45

de Smidt G, Botzen W (2018) Perceptions of corporate cyber risks and insurance decision-making. Geneva Pap Risk Insur Issues Pract 43:239–274

Dejung S (2017) Economic impact of cyber accumulation scenarios. Swiss Insurance Association SVV Cyber Working Group, Zürich. https://www.vvb-alumni.de/wp-content/uploads/2020/03/Economic_impact_Cyber_loss_accumulation_scenarios_SVV.pdf

Dondossola G, Garrone F, Szanto J (2011) Cyber risk assessment of power control systems—a metrics weighed by attack experiments. In: 2011 IEEE power and energy society general meeting, pp 1–9

Edwards B, Hofmeyr S, Forrest S (2016) Hype and heavy tails: a closer look at data breaches. J Cybersecur 2:3–14

Egan R, Cartagena S, Mohamed R et al (2019) Cyber operational risk scenarios for insurance companies. Br Actuarial J 2019:24

Eling M (2012) Fitting insurance claims to skewed distributions: are the skew-normal and skew-student good models? Insur Math Econ 51:239–248

MathSciNet Google Scholar

Eling M, Jung K (2018) Copula approaches for modeling cross-sectional dependence of data breach losses. Insur Math Econ 82:167–180

Eling M, Loperfido N (2017) Data breaches: goodness of fit, pricing, and risk measurement. Insur Math Econ 75:126–136

Eling M, Schnell W (2020) Extreme cyber risks and the nondiversification trap. Working Paper University of St. Gallen. https://www.alexandria.unisg.ch/260004/

Eling M, Schnell W (2016) What do we know about cyber risk and cyber risk insurance? J Risk Financ 17:474–491

Eling M, Schnell W (2019) Capital requirements for cyber risk and cyber risk insurance: an analysis of solvency II, the US Risk-based capital standards, and the swiss solvency test. N Am Actuarial J 2019:1–23

Eling M, Wirfs J (2019) What are the actual costs of cyber risk events? Eur J Oper Res 272:1109–1119

Eling M, Zhu J (2018) Which insurers write cyber insurance? Evidence from the US property and casualty insurance industry. J Insur Issues 41:22–56

Fahrenwaldt MA, Weber S, Weske K (2018) Pricing of cyber insurance contracts in a network model. ASTIN Bull J IAA 48:1175–1218

Falco G, Eling M, Jablanski D et al (2019) Cyber risk research impeded by disciplinary barriers. Science 366:1066–1069

Long Finance (2015) Financing the transition: sustainable infrastructure in cities. Z/Yen Group, London. https://www.longfinance.net/media/documents/Financing_the_transition_March2015.pdf

Franke U, Holm H, König J (2014) The distribution of time to recovery of enterprise it services. IEEE Trans Reliab 63:858–867

Gai K, Qiu M, Elnagdy S (2016) A novel secure big data cyber incident analytics framework for cloud-based cybersecurity insurance. In: 2016 IEEE 2nd international conference on big data security on cloud (BigDataSecurity), IEEE international conference on high performance and smart computing (HPSC), and IEEE international conference on intelligent data and security (IDS, pp 171–176

Gallin L (2017) Re/insurance to take minimal share of $8 billion WannaCry economic loss: A.M. Best. In: ReinsuranceNews. https://www.reinsurancene.ws/reinsurance-take-minimal-share-8-billion-wannacry-economic-loss-m-best/ . Accessed 31 Jul 2020

Gordon LA, Loeb M (2002) The economics of information security investment. ACM Trans Inf Syst Secur 5:438–457

Gordon L, Loeb M, Sohail T (2003) A framework for using insurance for cyber-risk management. Commun ACM 46:81–85

Heitzenrater CD, Simpson AC (2016) Policy, statistics and questions: Reflections on UK cyber security disclosures. J Cybersecur 2:43–56

Herath H, Herath T (2011) Copula-based actuarial model for pricing cyber-insurance policies. Insur Markets Companies Anal Actuarial Comput 2:7–20

Hoang DT, Wang P, Niyato D, Hossain E (2017) Charging and discharging of plug-in electric vehicles (pevs) in vehicle-to-grid (v2g) systems: a cyber insurance-based model. IEEE Access. https://doi.org/10.1109/ACCESS.2017.2649042

Article Google Scholar

Hofmann A, Ramaj H (2011) Interdependent risk networks: the threat of cyber attack. Int J Manage Decision Making 11:312–323

Hofmann A, Rothschild C (2019) On the efficiency of self-protection with spillovers in risk. Geneva Risk Insur Rev 44:207–221

Hovav A, D’Arcy J (2003) The impact of denial-of-service attack announcements on the market value of firms. Risk Manag Insur Rev 6:97–121

Ponemon Institute (2017) 2017 cost of data breach study. Traverse City. https://www.ibm.com/downloads/cas/ZYKLN2E3

Jevtić P, Lanchier N (2020) Dynamic structural percolation model of loss distribution for cyber risk of small and medium-sized enterprises for tree-based LAN topology. Insur Math Econ 91:209–223

Johnson B, Böhme R, Grossklags J (2011) Security games with market insurance. In: Baras JS, Katz J, Altman E (eds) Decision and game theory for security. Springer, Berlin, Heidelberg, pp 117–130

MATH Google Scholar

Kamiya S, Kang J-K, Kim J et al (2020) Risk management, firm reputation, and the impact of successful cyberattacks on target firms. J Financ Econ. https://doi.org/10.1016/j.jfineco.2019.05.019

Kelly S, Leverett E, Copic J et al (2016) Integrated infrastructure: cyber resiliency in society: mapping the consequences of an interconnected digital economy. In: Centre for Risk Studies, University of Cambridge. https://www.jbs.cam.ac.uk/faculty-research/centres/risk/publications/technology-and-space/integrated-infrastructure-cyber-resiliency-in-society/

Lloyd’s (2015) Business blackout: The insurance implications of a cyber attack on the US power grid. https://www.lloyds.com/news-and-risk-insight/risk-reports/library/society-and-security/business-blackout . Accessed 31 Jul 2020

Mahalingam A, Coburn AW, Jung CJ, et al (2018) Impacts of severe natural catastrophes on financial markets. Centre for Risk Studies, University of Cambridge. https://www.jbs.cam.ac.uk/faculty-research/centres/risk/publications/natural-catastrophe-and-climate/impacts-of-severe-natural-catastrophes-on-financial-markets/

Maillart T, Sornette D (2010) Heavy-tailed distribution of cyber-risks. Eur Phys J B 75:357–364

Marotta A, McShane M (2018) Integrating a proactive technique into a holistic cyber risk management approach. Risk Manag Insur Rev 21:435–452

Marotta A, Martinelli F, Nanni S et al (2017) Cyber-insurance survey. Comput Sci Rev 24:35–61

McQueen M, Boyer W, Flynn M, Beitel G (2006) Time-to-compromise model for cyber risk reduction estimation. In: Gollmann D, Massacci F, Yautsiukhin A (eds) Quality of protection. Springer, New York, pp 49–64

Mukhopadhyay A, Chatterjee S, Saha D et al (2013) Cyber-risk decision models: to insure IT or not? Decision Support Syst 56:11–26

NetDiligence (2016) 2016 cyber claims study. Gladwyne, PA. https://netdiligence.com/wp-content/uploads/2016/10/P02_NetDiligence-2016-Cyber-Claims-Study-ONLINE.pdf

Nikolakopoulos T, Darra E, Tofan D (2016) The cost of incidents affecting CIIsSystematic review of studies concerning the economic impact of cyber-security incidents on critical information infrastructures (CII). In: ENISA, Herklion. https://www.enisa.europa.eu/publications/the-cost-of-incidents-affecting-ciis

Oughton E, Copic J, Skelton A et al (2016) Helios solar storm scenario. Centre for Risk Studies, University of Cambridge. https://www.jbs.cam.ac.uk/faculty-research/centres/risk/publications/technology-and-space/helios-solar-storm-scenario/

Pal R, Golubchik L, Psounis K, Hui P (2014) Will cyber-insurance improve network security? A market analysis. In: IEEE INFOCOM 2014—IEEE conference on computer communications, pp 235–243

Pooser DM, Browne MJ, Arkhangelska O (2018) Growth in the perception of cyber risk: evidence from US P&C insurers. Geneva Pap Risk Insur Issues Pract 43:208–223

Romanosky S (2016) Examining the costs and causes of cyber incidents. J Cyber Secur 2:121–135

Risk Management Solutions Inc. (2016) Managing cyber insurance accumulation risk. In: Centre for Risk Studies, Cambridge. https://www.jbs.cam.ac.uk/faculty-research/centres/risk/publications/technology-and-space/cyber-risk-outlook/managing-cyber-insurance-accumulation-risk-2016/

Romanosky S, Telang R, Acquisti A (2011) Do data breach disclosure laws reduce identity theft? J Policy Anal Manag 30:256–286

Romanosky S, Hoffman D, Acquisti A (2014) Empirical analysis of data breach litigation. J Empir Legal Stud 11:74–104

Ruffle SJ, Bowman G, Caccioli F et al (2014) Stress Test Scenario: Sybil Logic Bomb Cyber Catastrophe. In: Centre for Risk Studies, University of Cambridge. https://www.jbs.cam.ac.uk/faculty-research/centres/risk/publications/technology-and-space/sybil-logic-bomb-cyber-catastrophe-stress-test-scenario/

Schnell W (2020) Does cyber risk pose a systemic threat to the insurance industry? Working Paper University of St. Gallen. https://www.alexandria.unisg.ch/260003/

Schroeder B, Gibson GA (2010) A large-scale study of failures in high-performance computing systems. IEEE Trans Depend Secure Comput 7:337–350

Shackelford SJ (2012) Should your firm invest in cyber risk insurance? Bus Horiz 55:349–356

Shetty N, Schwartz G, Felegyhazi M, Walrand J (2010) Competitive cyber-insurance and internet security. In: Moore T, Pym D, Ioannidis C (eds) Economics of information security and privacy. Springer, Boston, pp 229–247

Shetty S, McShane M, Zhang L et al (2018) Reducing informational disadvantages to improve cyber risk management. Geneva Pap Risk Insur Issues Pract 43:224–238

Sinanaj G, Muntermann J (2013) Assessing corporate reputational damage of data breaches: an empirical analysis. BLED 2013 Proc 2013:29

Srinidhi B, Yan J, Tayi GK (2015) Allocation of resources to cyber-security: the effect of misalignment of interest between managers and investors. Decision Support Syst 75:49–62

Trautman LJ, Ormerod P (2019) Wannacry, ransomware, and the emerging threat to corporations. Tennessee Law Rev 86:505–556

Verizon LLC (2018) 2018 data breach investigations report. New York. https://enterprise.verizon.com/resources/reports/DBIR_2018_Report.pdf

Vernic R (2006) Multivariate skew-normal distributions with applications in insurance. Insur Math Econ 38:413–426

Vishwanath A, Harrison B, Ng YJ (2018) Suspicion, cognition, and automaticity model of phishing susceptibility. Commun Res 45:1146–1166

Wheatley S, Maillart T, Sornette D (2016) The extreme risk of personal data breaches and the erosion of privacy. Eur Phys J B 89:7

Woods DW, Moore T, Simpson AC (2019) The county fair cyber loss distribution: drawing inferences from insurance prices. Boston, MA

World Economic Forum (2010) The global competitiveness report 2010–2011. World Economic Forum, Geneva. https://www3.weforum.org/docs/WEF_GlobalCompetitivenessReport_2010-11.pdf

Xu M, Hua L (2019) Cybersecurity insurance: modeling and pricing. N Am Actuarial J 23:220–249

Xu M, Schweitzer KM, Bateman RM, Xu S (2018) Modeling and predicting cyber hacking breaches. IEEE Trans Inf Forensics Secur 13:2856–2871

Download references

Acknowledgements

I thank Sebastian Kimm-Friedenberg and Werner Schnell for their assistance in preparing this paper.

Author information

Authors and affiliations.

University of St. Gallen, St. Gallen, Switzerland

Martin Eling

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Martin Eling .

Ethics declarations

Conflict of interest.

The author(s) declare that they have no conflicts of interest.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A: Google Scholar Citations

7 and Fig.

Google Scholar citations as of April 09, 2020

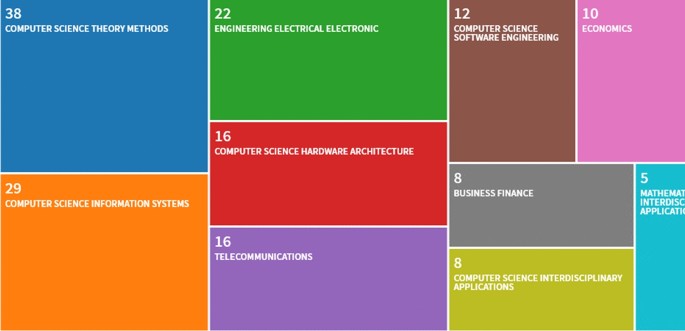

Appendix B: Visualization Treemap on “Cyber Insurance”

Visualization Treemap for 95 hits on “cyber insurance” in the Web of Science as of March 30, 2020

Rights and permissions

Reprints and permissions

About this article

Eling, M. Cyber risk research in business and actuarial science. Eur. Actuar. J. 10 , 303–333 (2020). https://doi.org/10.1007/s13385-020-00250-1

Download citation

Received : 11 August 2020

Revised : 26 September 2020

Accepted : 30 September 2020

Published : 14 October 2020

Issue Date : December 2020

DOI : https://doi.org/10.1007/s13385-020-00250-1

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Cyber insurance

- Event studies

- Dependence modelling

- Network modelling

- Find a journal

- Publish with us

- Track your research

- Publications and Research

- Education and Events

MAGAZINE & NEWSLETTERS

Actuarial Update , the monthly newsletter for all Academy members, covers public policy and professionalism news and issues. Update also is a key source for news about the Academy itself and Academy membership.

The Actuarial Standards Board's newsletter, with progress reports on the ASB's work developing and updating standards.

Casualty Quarterly covers stories of interest to property/casualty actuaries. In addition to a roundup of the most recent quarter’s Academy P/C news, it highlights key federal and state legislation and regulations.

Contingencies is the bimonthly magazine of the Academy that takes readers into the world of the actuary — insurance, casualty, health, pension, financial and risk management - through a wide array of feature stories, commentaries, interviews, how-to columns, and more.

Essential Elements , a new series of concise and informative papers developed by the Academy, is designed to provide a quick and easy-to-understand overview of key public policy issues of interest to Academy members, policy makers and the general public. Each paper provides the important points and analysis, supplemented by graphics, so that the reader can quickly understand the issue and its significance to the public debate.

HealthCheck is the Academy’s quarterly digital newsletter covering the actuarial perspective on health care policy.

Life Perspectives is a quarterly newsletter designed to keep you up to date on activities of the Academy’s Life Practice Council.

Retirement Report is a quarterly newsletter that collects pension news for enrolled actuaries and Academy members in the pension and retirement practice areas.

This Week is the Academy’s end-of-week digital newsletter, compiling a week’s worth of news, updates, events, and media coverage in one convenient, easy-to-use publication.

PROFESSIONALISM

Discussion papers are primarily written and developed through the Academy’s Committee on Professional Responsibility to promote actuarial professionalism, including knowledge of standards of conduct, qualification, and practice within the profession. These Discussion Papers suggest ways to assist actuaries in improving their daily practice and increasing their awareness of professionalism.

PRACTICE NOTES

Practice Notes

Practice notes offer examples of current and emerging approaches to selected actuarial tasks. They are intended to supplement the available actuarial literature, especially where the practices addressed are subject to evolving technology, recently adopted external requirements, or advances in actuarial science and other applicable disciplines.

PUBLIC POLICY RESEARCH

Recent Research Papers from the Academy’s cross-practice committee that oversees the Academy’s research functions, especially in respect to mortality, morbidity, and industry experience studies in joint ventures with external research partners as appropriate with relevant research bodies to facilitate the public policy application of those studies.

ANNUAL PUBLICATIONS

| The Record is the Academy’s annual report to the membership and the public, recapping the work of Academy volunteers over the past year in serving the public and the profession. | The Academy are an archived resource on Academy bylaws, organization, operations, history, and activities, providing a year-by-year record of organizational and member involvement. The last Yearbook was published in 2009. Since that time, the policies and other information on member involvement formerly printed once a year have instead been updated dynamically on the Academy website. | -->

| The North American Actuarial Council compiles the cross-border work and collaboration of the nine actuarial organizations serving the United States, Canada, and Mexico. |

Law Manuals

| The , updated annually, is designed to help appointed actuaries comply with the requirements of the NAIC model Standard Valuation Law and the Model Actuarial Opinion and Memorandum Regulation. It outlines key valuation developments and state guidance, NAIC model laws and regulations that have an effect on reserve calculations, a discussion of generally distributed interpretations, and copies of the current actuarial guidelines from the . | |

| The , updated annually, contains useful information to help appointed actuaries comply with the National Association of Insurance Commissioners (NAIC) Annual Statement requirements for a Statement of Actuarial Opinion (SAOs). It includes SAO requirements and state laws and regulations establishing those requirements; Annual Statement instructions for the SAOs for P/C, title loss, and loss expense reserves; and other pertinent Annual Statement instructions. |

Other Publications and Resources

| -->

-->

|

- A-Z Publications

Annual Review of Statistics and Its Application

Volume 9, 2022, review article, recent challenges in actuarial science.

- Paul Embrechts 1 , and Mario V. Wüthrich 1

- View Affiliations Hide Affiliations Affiliations: RiskLab, Department of Mathematics, ETH Zurich, Zurich, Switzerland, CH-8092; email: [email protected] [email protected]

- Vol. 9:119-140 (Volume publication date March 2022) https://doi.org/10.1146/annurev-statistics-040120-030244

- First published as a Review in Advance on August 20, 2021

- Copyright © 2022 by Annual Reviews. All rights reserved

For centuries, mathematicians and, later, statisticians, have found natural research and employment opportunities in the realm of insurance. By definition, insurance offers financial cover against unforeseen events that involve an important component of randomness, and consequently, probability theory and mathematical statistics enter insurance modeling in a fundamental way. In recent years, a data deluge, coupled with ever-advancing information technology and the birth of data science, has revolutionized or is about to revolutionize most areas of actuarial science as well as insurance practice. We discuss parts of this evolution and, in the case of non-life insurance, show how a combination of classical tools from statistics, such as generalized linear models and, e.g., neural networks contribute to better understanding and analysis of actuarial data. We further review areas of actuarial science where the cross fertilization between stochastics and insurance holds promise for both sides. Of course, the vastness of the field of insurance limits our choice of topics; we mainly focus on topics closer to our main areas of research.

Article metrics loading...

Full text loading...

Literature Cited

- Acerbi C , Tasche D. 2002 . On the coherence of expected shortfall. J. Bank. Finance 26 : 1487– 503 [Google Scholar]

- Ágoston KC , Gyetvai M. 2020 . Joint optimization of transition rules and the premium scale in a bonus-malus system. ASTIN Bull . 50 : 743– 76 [Google Scholar]

- Albrecher H , Beirlant J , Teugels JL. 2017 . Reinsurance: Actuarial and Statistical Aspects New York: Wiley [Google Scholar]

- Antonio K , Plat R. 2014 . Micro-level stochastic loss reserving for general insurance. Scand. Actuar. J. 2014 : 7 649– 69 [Google Scholar]

- Arjas E. 1989 . The claims reserving problem in non-life insurance: some structural ideas. ASTIN Bull . 19 : 139– 52 [Google Scholar]

- Avanzi B , Taylor G , Wang M , Wong B. 2021 . SynthETIC: an individual insurance claim simulator with feature control. Insur. Math. Econ 100 296 – 308 [Google Scholar]

- Ayuso M , Guillén M , Nielsen JP. 2019 . Improving automobile insurance ratemaking using telematics: incorporating mileage and driver behaviour data. Transportation 46 : 735– 52 [Google Scholar]

- Ayuso M , Guillén M , Pérez-Marín AM. 2016 . Using GPS data to analyse the distance traveled to the first accident at fault in pay-as-you-drive insurance. Transp. Res. Part C 68 : 160– 67 [Google Scholar]

- Barndorff-Nielsen O. 2014 . Information and Exponential Families: In Statistical Theory New York: Wiley [Google Scholar]

- Barrieu P , Albertini L. 2009 . The Handbook of Insurance-Linked Securities New York: Wiley [Google Scholar]

- Baudry M , Robert CY. 2019 . A machine learning approach for individual claims reserving in insurance. Appl. Stoch. Model. Bus. Ind. 35 : 1127– 55 [Google Scholar]

- Bengio Y , Courville A , Vincent P. 2013 . Representation learning: a review and new perspectives. IEEE Trans. Pattern Anal. 35 : 1798– 828 [Google Scholar]

- Bengio Y , Ducharme R , Vincent P , Jauvin C. 2003 . A neural probabilistic language model. J. Mach. Learn. Res. 3 : 1137– 55 [Google Scholar]

- Benjamin B , Redington FM. 1968 . Presentation of Institute Gold Medal to Mr Frank Mitchell Redington. J. Inst. Actuar. 94 : 345– 48 [Google Scholar]

- Bernhardt T , Donnelly C. 2021 . Quantifying the trade-off between income stability and the number of members in a pooled annuity fund. ASTIN Bull . 51 : 101– 30 [Google Scholar]

- Bevere L , Gloor M. 2020 . Natural catastrophes in times of economic accumulation and climate change . Rep. Sigma 2 Swiss Re Inst. Zurich, Switz:. [Google Scholar]

- Bolthausen E , Wüthrich MV. 2013 . Bernoulli's law of large numbers. ASTIN Bull . 43 : 73– 79 [Google Scholar]

- Boucher J-P , Côté S , Guillén M. 2017 . Exposure as duration and distance in telematics motor insurance using generalized additive models. Risks 5 : 4 54 [Google Scholar]

- Boucher J-P , Inoussa R. 2014 . A posteriori ratemaking with panel data. ASTIN Bull . 44 : 587– 12 [Google Scholar]

- Box GEP , Jenkins GM. 1976 . Time Series Analysis: Forecasting and Control San Francisco: Holden-Day [Google Scholar]

- Breiman L. 2001 . Statistical modeling: the two cultures. Stat. Sci. 16 : 199– 15 [Google Scholar]

- Brouhns N , Denuit M , Vermunt JK. 2002 . A Poisson log-bilinear regression approach to the construction of projected lifetables. Insur. Math. Econ. 31 : 373– 93 [Google Scholar]

- Brouhns N , Guillén M , Denuit M , Pinquet J. 2003 . Bonus-malus scales in segmented tariffs with stochastic migration between segments. J. Risk Insur. 70 : 577– 99 [Google Scholar]

- Bühlmann H. 1970 . Mathematical Methods in Risk Theory New York: Springer [Google Scholar]

- Bühlmann H. 1989 . Editorial: actuaries of the Third Kind?. ASTIN Bull . 19 : 5– 6 [Google Scholar]

- Cairns AJG , Blake D , Dowd K. 2006 . A two-factor model for stochastic mortality with parameter uncertainty: theory and calibration. J. Risk Insur. 73 : 687 – 718 [Google Scholar]

- Cairns AJG , Blake D , Dowd K , Coughlan GD , Epstein D et al. 2009 . A quantitative comparison of stochastic mortality models using data from England and Wales and the United States. N. Am. Actuar. J. 13 : 1– 35 [Google Scholar]

- Cairns AJG , Kallestrup-Lamb M , Rosenskjold C , Blake D , Dowd K. 2019 . Modelling socio-economic differences in mortality using a new affluence index. ASTIN Bull . 49 : 555– 90 [Google Scholar]

- Chavez-Demoulin V , Embrechts P , Hofert M. 2016 . An extreme value approach for modeling operational risk losses depending on covariates. J. Risk Insur. 83 : 735– 76 [Google Scholar]

- Chen A , Guillén M , Vigna E. 2018 . Solvency requirement in a unisex mortality model. ASTIN Bull . 48 : 1219– 43 [Google Scholar]

- Chen A , Rach M , Sehner T. 2020 . On the optimal combination of annuities and tontines. ASTIN Bull . 50 : 95– 129 [Google Scholar]

- Cramér H. 1930 . On the Mathematical Theory of Risk Stockholm: Centraltryckeriet [Google Scholar]

- Cramér H. 1994 . Collected Works , Vols. I & II New York: Springer [Google Scholar]

- CRO (Chief Risk Off.) Forum 2019 . The heat is on—insurability and resilience in a changing climate . Position Pap. CRO Forum Amstelveen, Neth:. [Google Scholar]

- Cruz MG , Peters GW , Shevchenko PV. 2015 . Fundamental Aspects of Operational Risk and Insurance Analytics New York: Wiley [Google Scholar]

- Culp CL. 2002 . The ART of Risk Management: Alternative Risk Transfer, Capital Structure, and the Convergence of Insurance and Capital Markets New York: Wiley [Google Scholar]

- Cummins D , Geman H. 1995 . Pricing catastrophe insurance futures and call spreads: an arbitrage approach. J. Fixed Income 4 : 46– 57 [Google Scholar]

- Cybenko G. 1989 . Approximation by superpositions of a sigmoidal function. Math. Control Signals Syst. 2 : 303– 14 [Google Scholar]

- Davis MHA. 2016 . Verification of internal risk measure estimates. Stat. Risk Model. 33 : 67– 93 [Google Scholar]

- Davis MHA. 2017 . Discussion of “Elicitability and backtesting: perspectives for banking regulation. .” Ann. Appl. Stat. 11 : 1886– 7 [Google Scholar]

- De Pril N. 1978 . The efficiency of a bonus-malus system. ASTIN Bull . 10 : 59– 72 [Google Scholar]

- Deelstra G , Devolder P , Gnameho K , Hieber P. 2020 . Valuation of hybrid financial and actuarial products in life insurance by a novel three-step method. ASTIN Bull . 50 : 709– 42 [Google Scholar]

- Delong Ł , Dhaene J , Barigou K. 2019a . Fair valuation of insurance liability cash-flow streams in continuous time: applications. ASTIN Bull . 49 : 299– 33 [Google Scholar]

- Delong Ł , Dhaene J , Barigou K. 2019b . Fair valuation of insurance liability cash-flow streams in continuous time: theory. Insur. Math. Econ. 88 : 196– 08 [Google Scholar]

- Delong Ł , Lindholm M , Wüthrich MV. 2021 . Collective reserving using individual claims data. Scand. Actuar. J. https://doi.org/10.1080/03461238.2021.1921836 [Crossref] [Google Scholar]

- Denuit M. 2020 . Investing in your own and peers' risks: the simple analytics of P2P insurance. Eur. Actuar. J. 10 : 335– 59 [Google Scholar]

- Denuit M , Maréchal X , Pitrebois S , Walhin J-F. 2007 . Actuarial Modelling of Claim Counts: Risk Classification, Credibility and Bonus-Malus Systems New York: Wiley [Google Scholar]

- Dhaene J , Vanduffel S , Goovaerts MJ , Kaas R , Tang Q , Vyncke D. 2006 . Risk measures and comonotonicity: a review. Stoch. Models 22 : 573– 606 [Google Scholar]

- Dutang C , Charpentier A. 2019 . CASdatasets R package vignette . Ref. Manual, Version 1.0–10. http://cas.uqam.ca/ [Google Scholar]

- Economist . 2020 . Ping An. Metamorphosis. The world's most valuable insurer has transformed itself into a fintech super-app. Could others follow its lead?. Economist Dec. 5–11 61– 62 [Google Scholar]

- EIOPA (Eur. Insur. Occup. Pension Auth.) 2019 . Opinion on the supervision of the management of operational risks faced by IORPs Work. Pap. EIOPA-BoS-19-247, EIOPA, Frankfurt am Main, Ger . [Google Scholar]

- Elbrächter D , Perekrestenko D , Grohs P , Bölcskei H. 2021 . Deep neural network approximation theory. IEEE Trans. Inform. Theory 67 : 5 2581– 623 [Google Scholar]

- Eling M , Schnell W. 2020 . Capital requirements for cyber risk and cyber risk insurance: an analysis of Solvency II, the US Risk-Based Capital Standards, and the Swiss Solvency Test. N. Am. Actuar. J. 24 : 370– 92 [Google Scholar]

- Embrechts P. 2002 . Insurance analytics. Br. Actuar. J. 8 : 639– 41 [Google Scholar]

- Embrechts P , Klüppelberg C , Mikosch T. 1997 . Modelling Extremal Events for Insurance and Finance New York: Springer [Google Scholar]

- Embrechts P , Meister S. 1997 . Pricing insurance derivatives, the case of CAT-futures. Proceedings of the 1995 Bowles Symposium on Securitization of Risk 15– 26 Schaumburg, IL: Soc. Actuar. [Google Scholar]

- Embrechts P , Mizgier KJ , Chen X 2018 . Modeling operational risk depending on covariates: an empirical investigation. J. Oper. Risk 13 : 17– 46 [Google Scholar]

- Falco G , Eling M , Jablanski D , Weber M , Miller V et al 2019 . Cyber risk research impeded by disciplinary barriers. Science 6469 : 1066– 69 [Google Scholar]

- Föllmer H , Schied A. 2011 . Stochastic Finance: An Introduction in Discrete Time Berlin: Walter de Gruyter. , 4th ed.. [Google Scholar]

- Franke U. 2017 . The cyber insurance market in Sweden. Comput. Secur. 68 : 130– 44 [Google Scholar]

- Friedman JH. 2001 . Greedy function approximation: a gradient boosting machine. Ann. Stat. 29 : 1189– 32 [Google Scholar]

- Fung TC , Badescu AL , Lin XS. 2019 . A class of mixture of experts models for general insurance: application to correlated claim frequencies. ASTIN Bull . 49 : 647– 88 [Google Scholar]

- Gabrielli A. 2020 . A neural network boosted double overdispersed Poisson claims reserving model. ASTIN Bull . 50 : 25– 60 [Google Scholar]

- Gabrielli A , Wüthrich MV. 2018 . An individual claims history simulation machine. Risks 6 : 2 29 [Google Scholar]

- Gale EL , Saunders MA. 2013 . The 2011 Thailand flood: climate causes and return periods. Weather 68 : 226– 38 [Google Scholar]

- Gao G , Wang H , Wüthrich MV. 2021 . Boosting Poisson regression models with telematics car driving data. Mach. Learn. https://doi.org/10.1007/s10994-021-05957-0 [Crossref] [Google Scholar]

- Gao G , Wüthrich MV. 2019 . Convolutional neural network classification of telematics car driving data. Risks . 7 1 6

- Gao G , Wüthrich MV , Yang H. 2019 . Driving risk evaluation based on telematics data. Insur. Math. Econ. 88 : 108– 19 [Google Scholar]

- Gneiting T. 2011 . Making and evaluating point forecast. J. Am. Stat. Assoc. 106 : 494 746– 62 [Google Scholar]

- Gollier C. 2001 . The Economics of Risk and Time Cambridge, MA: MIT Press [Google Scholar]

- Gollier C. 2013 . Pricing the Planet's Future: The Economics of Discounting in an Uncertain World Princeton, NJ: Princeton Univ. Press [Google Scholar]

- Goodfellow I , Bengio Y , Courville A. 2016 . Deep Learning Cambridge, MA: MIT Press [Google Scholar]

- Gordy MB , McNeil AJ. 2020 . Spectral backtests of forecast distributions with application to risk management. J. Bank. Finance 116 : 105817 [Google Scholar]

- Guillén M. 2012 . Sexless and beautiful data: from quantity to quality. Ann. Actuar. Sci. 6 : 231– 34 [Google Scholar]

- Hainaut D , Denuit M. 2020 . Wavelet-based feature extraction for mortality projection. ASTIN Bull . 50 : 675– 707 [Google Scholar]

- Haueter NV , Jones G. 2016 . Managing Risk in Reinsurance: From City Fires to Global Warming Oxford, UK: Oxford Univ. Press [Google Scholar]

- Hornik K , Stinchcombe M , White H. 1989 . Multilayer feedforward networks are universal approximators. Neural Netw . 2 : 359– 66 [Google Scholar]

- Huang Y , Meng S. 2019 . Automobile insurance classification ratemaking based on telematics driving data. Decis. Support Syst. 127 : 113156 [Google Scholar]

- Hyndman RJ , Booth H , Yasmeen F. 2013 . Coherent mortality forecasting: the product-ratio method with functional time series models. Demography 50 : 261– 83 [Google Scholar]

- Hyndman RJ , Ullah MS. 2007 . Robust forecasting of mortality and fertility rates: a functional data approach. Comput. Stat. Data Anal. 51 : 4942– 56 [Google Scholar]

- Ibragimov M , Ibragimov R , Walden J. 2015 . Heavy-Tailed Distributions and Robustness in Economics and Finance New York: Springer [Google Scholar]

- Ibragimov R , Jaffee D , Walden J. 2009 . Nondiversification traps in catastrophe insurance markets. Rev. Financ. Stud. 22 : 959– 99 [Google Scholar]

- Ibragimov R , Jaffee D , Walden J. 2011 . Diversification disasters. J. Financ. Econ. 99 : 333– 48 [Google Scholar]

- Isenbeck M , Rüschendorf L. 1992 . Completeness in location families. Probab. Math. Stat. 13 : 321– 43 [Google Scholar]

- James H , Borscheid P , Gugerli D , Straumann T. 2013 . Value of Risk: Swiss Re and the History of Reinsurance Oxford, UK: Oxford Univ. Press [Google Scholar]

- Jørgensen B. 1986 . Some properties of exponential dispersion models. Scand. J. Stat. 13 : 187– 97 [Google Scholar]

- Jørgensen B. 1987 . Exponential dispersion models. J. R. Stat. Soc. Ser. B 49 : 127– 45 [Google Scholar]

- Jørgensen B. 1997 . The Theory of Dispersion Models London: Chapman & Hall [Google Scholar]

- Jorion P. 2007 . Value-at-Risk: The New Benchmark for Managing Financial Risk New York: McGraw-Hill. , 3rd ed.. [Google Scholar]

- Kleinow T. 2015 . A common age effect model for the mortality of multiple populations. Insur. Math. Econ. 63 : 147– 52 [Google Scholar]

- Kuo K. 2020 . Individual claims forecasting with Bayesian mixture density networks. arXiv:2003.02453 [stat.AP]

- Lee GY , Manski S , Maiti T. 2020 . Actuarial applications of word embedding models. ASTIN Bull . 50 : 1– 24 [Google Scholar]

- Lee RD , Carter LR. 1992 . Modeling and forecasting US mortality. J. Am. Stat. Assoc. 87 : 419 659– 71 [Google Scholar]

- Lee SCK , Lin XS. 2010 . Modeling and evaluating insurance losses via mixtures of Erlang distributions. N. Am. Actuar. J. 14 : 107– 30 [Google Scholar]

- Lemaire J. 1995 . Bonus-Malus Systems in Automobile Insurance Amsterdam: Kluwer Acad. [Google Scholar]

- Lemaire J , Park SC , Wang K. 2016 . The use of annual mileage as a rating variable. ASTIN Bull . 46 : 39– 69 [Google Scholar]

- Lester R. 2004 . Quo vadis actuarius? Paper presented at IACA, PBSS and IAA Colloquium, Sydney, Aust., Oct. 31–Nov. 5 [Google Scholar]

- Li N , Lee R. 2005 . Coherent mortality forecasts for a group of populations: an extension of the Lee–Carter method. Demography 42 : 575– 94 [Google Scholar]

- Lindholm M , Richman R , Tsanakas A , Wüthrich MV. 2020 . Discrimination-free insurance pricing . Work. Pap. ETH Zurich Zurich: http://dx.doi.org/10.2139/ssrn.3520676 [Crossref] [Google Scholar]

- Loimaranta K. 1972 . Some asymptotic properties of bonus systems. ASTIN Bull . 6 : 233– 45 [Google Scholar]

- Lopez O , Milhaud X , Thérond P-E. 2019 . A tree-based algorithm adapted to microlevel reserving and long development claims. ASTIN Bull . 49 : 741– 62 [Google Scholar]

- Mack T. 1993 . Distribution-free calculation of the standard error of chain ladder reserve estimates. ASTIN Bull . 23 : 213– 25 [Google Scholar]

- McCullagh P , Nelder JA. 1983 . Generalized Linear Models London: Chapman & Hall [Google Scholar]

- McNeil AJ , Frey R. 2000 . Estimation of tail-related risk measures for heteroscedastic financial time series: an extreme value approach. J. Empir. Finance 7 : 271– 300 [Google Scholar]

- McNeil AJ , Frey R , Embrechts P. 2015 . Quantitative Risk Management: Concepts, Techniques and Tools Princeton, NJ: Princeton Univ. Press. , 2nd ed.. [Google Scholar]

- Meeusen P , Sorniotti A. 2017 . Blockchain in re/insurance: technology with a purpose Presentation Swiss Re Inst. Rüschlikon, Switz.: Nov. 7 [Google Scholar]

- Merz M , Wüthrich MV. 2008 . Modelling the claims development result for solvency purposes. CAS E-Forum 2008 : Fall 542– 68 [Google Scholar]

- Merz M , Wüthrich MV. 2014 . Claims run-off uncertainty: the full picture Res. Pap. 14– 69 Swiss Finance Inst. Geneva: https://dx.doi.org/10.2139/ssrn.2524352 [Crossref] [Google Scholar]

- Milevsky MA , Salisbury TS. 2015 . Optimal retirement income tontines. Insur. Math. Econ. 64 : 91 – 105 [Google Scholar]

- Miljkovic T , Grün B. 2016 . Modeling loss data using mixtures of distributions. Insur. Math. Econ. 70 : 387– 96 [Google Scholar]

- Nelder JA , Wedderburn RWM. 1972 . Generalized linear models. J. R. Stat. Soc. Ser. A 135 : 370– 84 [Google Scholar]

- Nešlehová J , Embrechts P , Chavez-Demoulin V. 2006 . Infinite mean models and the LDA for operational risk. J. Oper. Risk 1 : 3– 25 [Google Scholar]

- Nolde N , Ziegel JF. 2017 . Elicitability and backtesting: perspectives for banking regulation, with discussion. Ann. Appl. Stat. 11 : 1833– 74 [Google Scholar]

- Norberg R. 1993 . Prediction of outstanding liabilities in non-life insurance. ASTIN Bull . 23 : 95– 115 [Google Scholar]

- Norberg R. 1999 . Prediction of outstanding liabilities II. Model variations and extensions. ASTIN Bull . 29 : 5– 25 [Google Scholar]

- Nordhaus WD. 2009 . An analysis of the Dismal Theorem . Discuss. Pap. 1686 Cowles Found. Res. Econ., Yale Univ. New Haven, CT: [Google Scholar]

- Nordhaus WD. 2011 . The economics of tail events with an application to climate change. Rev. Environ. Econ. Policy 5 : 240– 57 [Google Scholar]

- Paefgen J , Staake T , Fleisch E. 2014 . Multivariate exposure modeling of accident risk: insights from pay-as-you-drive insurance data. Rev. Environ. Econ. Policy 61 : 27– 40 [Google Scholar]

- Perla F , Richman R , Scognamiglio S , Wüthrich MV. 2021 . Time-series forecasting of mortality rates using deep learning. Scand. Actuar. J. 7 : 572 – 98 [Google Scholar]

- Pigeon M , Antonio K , Denuit M 2013 . Individual loss reserving with the multivariate skew normal framework. ASTIN Bull . 43 : 399 – 428 [Google Scholar]

- R Core Team 2018 . R: A language and environment for statistical computing. Statistical Software R Found. Stat. Comput. Vienna: [Google Scholar]

- Redington F. 1986 . A Ramble Through the Actuarial Countryside London: Staple Inn [Google Scholar]

- Renshaw AE , Haberman S. 2006 . A cohort-based extension to the Lee-Carter model for mortality reduction factors. Insur. Math. Econ. 38 : 556– 70 [Google Scholar]

- Renshaw AE , Verrall RJ. 1998 . A stochastic model underlying the chain-ladder technique. Br. Actuar. J. 4 : 903– 23 [Google Scholar]

- Richman R. 2021a . AI in actuarial science—a review of recent advances—part 1. Ann. Actuar. Sci. 15 : 2 207 – 29 [Google Scholar]

- Richman R. 2021b . AI in actuarial science—a review of recent advances—part 2. Ann. Actuar. Sci. 15 : 2 230 – 58 [Google Scholar]

- Richman R , Wüthrich MV. 2020 . The nagging predictor. Risks 8 : 3 83 [Google Scholar]

- Richman R , Wüthrich MV. 2021 . LocalGLMnet: interpretable deep learning for tabular data. arXiv:2107.11059 [cs.LG]

- Röhr A. 2016 . Chain-ladder and error propagation. ASTIN Bull . 46 : 293– 30 [Google Scholar]

- Sabin MJ. 2010 . Fair tontine annuity. SSRN Electron. J. https://dx.doi.org/10.2139/ssrn.1579932 [Crossref] [Google Scholar]

- Shang HL. 2019 . Dynamic principal component regression: application to age-specific mortality forecasting. ASTIN Bull . 49 : 619– 45 [Google Scholar]

- Shang HL , Haberman S. 2020 . Forecasting multiple functional time series in a group structure: an application to mortality. ASTIN Bull . 50 : 357– 79 [Google Scholar]

- Sun S , Bi J , Guillén M , Pérez-Marín AM. 2020 . Assessing driving risk using internet of vehicles data: an analysis based on generalized linear models. Sensors 20 : 9 2712 [Google Scholar]

- Tripart. Auth 2008 . Market wide pandemic exercise 2006 progress report Rep., Financ. Serv. Auth., H.M. Treas. Bank Engl. London: [Google Scholar]

- Verbelen R , Antonio K , Claeskens G 2018 . Unraveling the predictive power of telematics data in car insurance pricing. J. R. Stat. Soc. Ser. C 67 : 1275– 304 [Google Scholar]

- Verschuren RM. 2021 . Predictive claim scores for dynamic multi-product risk classification in insurance. ASTIN Bull . 51 : 1– 25 [Google Scholar]

- Villegas AM , Millossovich P , Kaishev VK. 2018 . StMoMo: stochastic mortality modeling in R. J. Stat. Softw. 84 : 1– 32 [Google Scholar]

- Wang Z , Wu X , Qiu C. 2021 . The impacts of individual information on loss reserving. ASTIN Bull . 51 : 303– 47 [Google Scholar]

- Weidner W , Transchel FWG , Weidner R. 2016 . Classification of scale-sensitive telematic observables for riskindividual pricing. Eur. Actuar. J. 6 : 13– 24 [Google Scholar]

- Weitzman M. 2009 . On modeling and interpreting the economics of catastrophic climate change. Rev. Econ. Stat. 91 : 1– 19 [Google Scholar]

- Weitzman M. 2011 . Fat-tailed uncertainty in the economics of catastrophic climate change. Rev. Environ. Econ. Policy 5 : 275– 92 [Google Scholar]

- Wüthrich MV. 2018 . Machine learning in individual claims reserving. Scand. Actuar. J. 2018 : 6 465– 80 [Google Scholar]

- Wüthrich MV. 2020a . Bias regularization in neural network models for general insurance pricing. Eur. Actuar. J. 10 : 179– 202 [Google Scholar]

- Wüthrich MV. 2020b . Non-life insurance: mathematics & statistics . Work. Pap., RiskLab ETH Zurich Zurich: https://dx.doi.org/10.2139/ssrn.2319328 [Crossref] [Google Scholar]

- Wüthrich MV , Merz M. 2008 . Stochastic Claims Reserving Methods in Insurance New York: Wiley [Google Scholar]

- Wüthrich MV , Merz M. 2019 . Editorial: Yes, we CANN!. ASTIN Bull. 49 : 1– 3 [Google Scholar]

- Yan H , Peters GW , Chan JSK. 2020 . Multivariate long-memory cohort mortality models. ASTIN Bull . 50 : 223– 63 [Google Scholar]

- Yin C , Lin XS. 2016 . Efficient estimation of Erlang mixtures using iSCAD penalty with insurance application. ASTIN Bull . 46 : 779– 99 [Google Scholar]

- Zhao Q , Hastie T. 2021 . Causal interpretations of black-box models. J. Bus. Econ. Stat. 39 : 1 272– 81 [Google Scholar]

- Ziegel JF. 2016 . Coherence and elicitability. Math. Financ. 26 : 901– 18 [Google Scholar]

Data & Media loading...

- Article Type: Review Article

Most Read This Month

Most cited most cited rss feed, functional data analysis, probabilistic forecasting, bayesian computing with inla: a review, functional regression, algorithmic fairness: choices, assumptions, and definitions, topological data analysis, microbiome, metagenomics, and high-dimensional compositional data analysis, learning deep generative models, on p -values and bayes factors, finite mixture models.

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

FUNDAMENTAL CONCEPTS OF ACTUARIAL SCIENCE

Related Papers

Jef Teugels

A Century of Mathematics in America, Part III

Likotsi Mpele

Journal of Insurance and Financial Management

[JIFM] Journal of Insurance and Financial Management

Actuarial function is one of the four key functions of an insurance company according to the Solvency II framework. Actuaries have numerous stakeholders both inside and outside the company. In the present article we show that duties for actuaries are really diverse in an insurance company. After a review on current literature, we discuss the role of actuarial function in solvency, investments, reinsurance, risk management and product management. We discuss also actuarial rules, actuarial administration, and stakeholders of the actuarial function. We conclude by considering the challenges of the actuarial profession and the many opportunities it offers to a young mathematician.

Kangkong Kernets

Motivation. Provide an introduction to data quality and data management directed at actuaries. Method. Expand on the concepts in Actuarial Standard of Practice No. 23 (Data Quality), then introduce practical methods that actuaries, actuarial analysts, and management can apply to improve their situation, with references for more information. Results. Information quality is about more than coding data: processes affect quality. There are many principles and practices an actuarial department can employ immediately to improve the quality of the information it deals with. Actuaries have a unique role to play in the bigger arena of improving their organizations' information for decision making and it is in their interests to do so. Conclusions. What every actuary should know about data quality and data management. Availability. Code for creating Box Plots in Excel is a link with this paper at

British Actuarial Journal

John Pemberton

This paper considers actuarial science within the context of the framework provided by the formal study of scientific method. A review of key points of recent developments within the methodology (study of method) of science and the methodology of economics is presented. A characterisation of actuarial science and its methods is then developed using as inputs the United Kingdom actuarial education syllabus and recent work of the profession, most notably Bell et al. (1998). The methods of actuarial science are then considered within the framework provided by formal methodology to propose an articulation of the methodology of actuarial science. This methodology is explored in relation to that of other sciences, and some of the implications and opportunities for actuarial science which arise from this investigation are identified. The paper concludes that actuarial science has a distinctive and potentially powerful empirical method of applied approximation. This methodological analysis is intended, in part, to add to the momentum of the programme concerned with furthering the use of actuarial methods within broader spheres (e.g. Nowell el al., 1996).

Pravin Verma

North American Actuarial Journal

Angus Macdonald

kurdistan rasul

Pickering & Chatto

Christofer Stadlin

Suleman Patel

Loading Preview

Sorry, preview is currently unavailable. You can download the paper by clicking the button above.

RELATED PAPERS

Work, Employment & Society

David Collins

Michael Hafeman

Accounting History

Paul Miranti

ASTIN Bulletin

Svein-Arne Persson

Corina Constantinescu

Fred Rowley

cordoba uba

Taonaziso Chowa PhD

International Journal of Management Science Research (IJMSR)

yohanna jugu

Far Western Review

Om Prakash Bhatt

Journal of Natural History - J NATUR HIST

edwin osubo

Journal of Risk and Insurance

David Sommer , Lee Colquitt

Journal of Statistical Software

Christophe Dutang

Symon Sarisi

Pacific Accounting Review

Mauktar Kader Saganogo

Decisions in Economics and Finance

Marcello Galeotti

Sholom Feldblum

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

- Browse Works

- Natural & Applied Sciences

Actuarial Science

Actuarial science research papers/topics, comparative analysis of turn-around time among selected seaports in west african sub-region.

Turnaround time of a vessel in a seaport exhibits the capability and ability of a port in providing efficient and effective services. Ship turnaround time is one of the most significant Port performance indicator. This is the total time, spent by the vessel in port, during a given call. It is the sum of waiting time, berthing time, service time (i.e., ship’s time at berth) and sailing delay. West African ports play a crucial role in trade and economy, as 95% of merchandise trade is handled ...

Deterministic mathematical model for fish harvesting

Abstract/Overview Differential equations have been used to create mathematical models of real world systems in which rates of change are involved, for example in the study of how population grows or shrinks. One of the earliest models by Thomas Malthus has been found to be unrealistic since it predicts that population will grow exponentially and without bound – a prospect that defies physical limitations. Verhulst in his logistic population model developed a generalized version of the M...

Mathematical modelling of HIV infection

Abstract/Overview We formulate a deterministic mathematical model for the HIV/AIDS.

Mathematical model for co-infection of HIV/AIDS and pneumonia with treatment

Abstract/Overview Pneumonia occurs commonly in HIV-infected patients. In this paper, we study a simple mathematical model for the co-infection of HIV/AIDS and Pneumonia. We establish that the model is well presented epidemiologically and mathematically. The disease-free equilibrium point is determined. We establish the basic reproduction number R0 for the model, which is a measure of the course of co-infection.

Optimal Allocation in Double Sampling for Stratification in the Presence of Nonresponse and Measurement Errors

Abstract/Overview The present study addresses the problem of minimum cost and precision in the estimation of the population mean in the presence of nonresponse and measurement errors. It is assumed that both the survey variable and the auxiliary variable suffer from nonresponse and measurement errors in the second phase sample. A ratio, exponential ratio-ratio type, and exponential product-ratio type estimators of the population mean are proposed using the information on a single auxiliar...

Volatility Estimation Using European-Logistic Brownian Motion with Jump Diffusion Process

Abstract/Overview Volatility is the measure of how we are uncertain about the future of stock or asset prices. Black-Scholes model formed the foundation of stock or asset pricing. However, some of its assumptions like constant volatility and interest among others are practically impossible to implement hence other option pricing models have been explored to help come up with a much reliable way of predicting the price trends of options. The measure of volatility and good forecasts of futu...

Lie Symmetry Analysis of Modified Diffusive Predator-prey Competition System of Equations

Abstract/Overview In this paper, a nonlinear fourth order evolution equation is investigated by the Lie symmetry analysis approach. All the geometric vector fields and the Lie groups of the evolution equation are obtained. Finally, the symmetry reduction and the exact solutions of the equation are obtained by means of power series method.

Formulating Black Scholes Equation Using a Jump Diffusion Heston’s Model

Abstract/Overview In modern financial mathematics, accurate values are obtained by taking into account a considerable number of more realistic assumptions in logistic Black Scholes equation. The aspects considered here are cost of transactions in trading, perfect illiquid markets and risks that occur from non – protected portfolio or large investments that have a lot of impact on price of the assets, volatility, the percentage drift and the life of the portfolio itself. In modern world ...

On Certain Spaces of Ideal Operators

Abstract We determine some important spaces of ideal operators and ideal characteristics. Special consideration is given to Frechet spaces, Spaces of finite rank operators and spaces of Hahn-Banach extension operators. The characteristics of ideals and related properties in these spaces as well as in some of their dual spaces are obtained.

Characterization of Topological Fuzzy Sets in Hausdorff Spaces

Abstract/Overview In this paper, we have characterized big data fuzzy sets and shown that topological data points form singleton fuzzy sets which are closed. Besides, fuzzy sets of topological data points are compact and have at least one closed point. We have also shown that the fuzzy set of all condensation points of a fuzzy Hausdorff space is infinite and the cardinality of a topological data fuzzy set is also infinite and arbitrarily distributed in fuzzy Hausdorff spaces.

SARS-CoV-2 Detection in Fecal Samples in Sym-asymptotic Patients with Typical Findings of COVID-19 on Ag-RDT and SARS-CoV-2 RT-PCR Tests

Abstract Coronavirus is a disease caused by a severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) which emerged as a global pandemic in 2019 from Wuhan, China. Since its emergence, it has caused immense suffering to human life, 6.27 million lives have been lost, movement curtailed and social dynamics disrupted. The golden standard for getting samples for SARS-CoV-2 detection is through oral- nasopharyngeal swab, this method of sample collection is invasive and uncomfortable, thus st...

Extensions of Lefkovitch Matrix for Modeling Invasive Cestrum Aurantiacum Population Dynamics

Abstract/Overview Modeling of invasive species using stage based matrix methods can be exploited to understand population dynamics of plants using stage based Leftkovitch matrix models. This study reviewed and extended the stage based matrix incorporating invasion variables of invasive Cestrum aurantiacum across different forest types, ecological zones and altitudes. The estimation of eigenvalues of the extended stage based Lefkovitch matrix and its corresponding right and left eigenvecto...

On the Effects of Motocycle Accidents and its Trends (A Case of Kenya)

Abstract/Overview This study analyzes recent data of accidents’ prevalence in Kenya and investigates whether there might be new trends in areas formerly not prone to accidents. Polynomials of order 6 are found best suited for accidents’ prevalence data. The graphs show that seasonal variations explain over 90% of prevalence in Central, Eastern, Nyanza, Rift-Valley and Western Provinces. The highest variation is in Nyanza with 98.54% of the prevalence rate explained by the seasonal var...

The Actuarial Conditions for the Valuation of Pension Liability to Become Zero Under Minimum Funding Standard Architecture

Abstract Pension valuation exercises for a defined benefit scheme requires an appraisal of both the schemes assets and its liabilities in different circumstances. The valuations are required to comply with regulatory standards, most notably the minimum funding standard. The objectives of this study are: (i) to compute the estimate of minimum funding standard of pension liability (ii) to establish the actuari...

A Mathematical Technique of Computing Technical Provisions and Premiums in General Business Insurance Under the Influence of Chain-Ladder and Cape Cod Framework

ABSTRACT An insurance company promises its policyholders to pay out benefits if certain events occur, for example, events such as a car accident and health conditions. When this is happens, the insurance company has a liability to pay the claims by technical provisions or claim reserving. The calculation of claim reserving must be done carefully in such a way that it should not cause loss to the company. Two of the common methods to calculate technical provisions in non-life insurance are the...

Actuarial science is a discipline that assesses financial risks in the insurance, finance and other fields and professions, using mathematical and statistical methods. Actuarial science applies mathematical skills to the social sciences to solve important problems for insurance, government, commerce, industry and academic researchers. Afribary provides list of academic papers and project topics in Actuarial science. You can browse Actuarial science project topics, Actuarial science thesis topics, Actuarial science dissertation topics, Actuarial science seminar topics, Actuarial science essays/papers, Actuarial science text books and lesson notes in Actuarial science field.

Popular Papers/Topics

Portfolio optimization of small enterprises against adverse changes in interest rate, assessing the awareness level of actuarial science among staff and students of nigerian universities: a study of university of jos., investment of pension funds in nigerian bond market, effects of firm specific factors on non-life insurance companies’ profitability in uganda; a case study of uganda insurance market, on mathematical models for pension fund optimal selection strategies, a review of mortality differential, estimating insurance loss distributions in general insurance contracts: a case study in ghana, performance measurement of probability distributions in modelling non-life insurance claims, modelling asset returns in a portfolio using ornstein-uhlenbeck stochastic proce, application of discrete and continous time models in valuation of credit insurance for asset-based lending companies, forecasting mortality rate and modelling longevity risk of ssnif pensioners, a stochastic analysis of investment prospects in west africa: a case of ghana and nigeria, effects of dependent claims on the probability of ruins, the time to ruin given ruin occurs, assessing the impact of risk based insurance supervision methodology on non-life insurance companies in ghana.

Privacy Policy | Refund Policy | Terms | Copyright | © 2024, Afribary Limited. All rights reserved.

IMAGES

VIDEO

COMMENTS

Explore the latest full-text research PDFs, articles, conference papers, preprints and more on ACTUARIAL SCIENCE. Find methods information, sources, references or conduct a literature review on ...

The SOA develops, sponsors and publishes research on a variety of topics, including retirement, pensions, mortality, risk management, LTC, health and finance.

Insurance: Mathematics and Economics publishes leading research spanning all fields of actuarial science research. It appears six times per year and is the largest journal in actuarial science research around the world. Insurance: Mathematics and Economics is an international academic journal that aims to strengthen the communication between individuals and groups who develop and apply ...

By supporting new research, we continue to further actuarial science and aim to provide members with cutting edge knowledge attuned to the realities of their working lives. This listing contains all IFoA research. Research outputs can be accessed via Sessional Research Programme recordings and Research papers.

EAJ is designed for the promotion and development of actuarial science and actuarial finance. For this, we publish original actuarial research papers, either theoretical or applied, with innovative applications, as well as case studies on the evaluation and implementation of new mathematical methods in insurance and actuarial finance.

Papers on any area of actuarial research or practice are welcome and will be considered for publication. Suitable topics include, but are not restricted to: new developments in actuarial practice; original research in actuarial science and related fields; or reviews of developments in a field of interest to the actuarial profession. All papers ...

Abstract. A program of undergraduate research in actuarial science and financial mathematics has been implemented at the University of Illinois over the last two years. This program has included two National Science Foundation-sponsored Research Experiences for Undergraduates (in Summer 2007 and Summer 2009) on the topic "Stochastic Modeling ...

CAS Research Papers are funded, peer-reviewed, in-depth works focusing on important topics within property-casualty actuarial practice. Funding for CAS Research Papers comes from CAS member dues, individual grants and other sources. Topics are solicited through a variety of means including CAS committees and formal requests for proposals.

This article provides an overview of all papers published on the special issue, Advances in Actuarial Science and Quantitative Finance. The special issue is intended to collect articles that reflect the latest development and emerging topics in these closely related two areas. Topics included in this special issue range from actuarial and risk theory, to optimal control for finance and ...

This page includes past calls for papers, funded research projects, and working party/task force reports. Learn More. Research Grants. The CAS offers research grants to further the body of knowledge in actuarial science and encourage researchers to submit proposals that address emerging and classic industry challenges through various methodologies.

The intention of this paper is to review the academic literature on "cyber risk" and "cyber insurance" in the fields of business (i.e. journals in the field of management, economics, finance, risk management and insurance) and actuarial science. The results document that cyber risk is an increasingly important research topic in many ...

Retirement Report is a quarterly newsletter that collects pension news for enrolled actuaries and Academy members in the pension and retirement practice areas. This Week. This Week is the Academy's end-of-week digital newsletter, compiling a week's worth of news, updates, events, and media coverage in one convenient, easy-to-use publication.

presentations and papers presented in association with the research, and an Excel-based scenario generator model) (3) "Foreign Exchange Rate Risk: Institutional Issues and Stochastic Modeling," 2001, by ... Actuarial Research,Actuarial Research Conference,Actuarial Science,Financial Mathematics,Research Created Date:

For centuries, mathematicians and, later, statisticians, have found natural research and employment opportunities in the realm of insurance. By definition, insurance offers financial cover against unforeseen events that involve an important component of randomness, and consequently, probability theory and mathematical statistics enter insurance modeling in a fundamental way. In recent years, a ...

The IAA regularly publishes educational and informational documents to be made publicly available to stakeholders. These papers have been categorized by subject area which you can access by clicking the links below. In some cases, translations of certain IAA papers have been made by local member associations or members.

Exam papers and examiners' reports: 1999 to 2004; 101 Statistical modelling 2000-2004: 102 Financial mathematics 2000-2004: 103 Stochastic modelling 2000-2004: 104 Survival models 2000-2004: 105 Actuarial mathematics 1 2000-2004: 106 Actuarial mathematics 2 2000-2004: 107 Economics 2000-2004: 108 Finance and financial reporting 2000-2004

Many actuarial science researchers on stochastic modeling and forecasting of systematic mortality risk use Cairns-Blake-Dowd (CBD) Model (2006) due to its ability to consider the cohort effects.

This paper considers actuarial science within the context of the framework provided by the formal study of scientific method. A review of key points of recent developments within the methodology (study of method) of science and the methodology of economics is presented. ... Actuarial Science Studies Research Project Topics in Actuarial Science ...

The primary audience, however, remains the actuarial profession. Other audiences and other purposes must be secondary. Geographical Range The sponsor of this monograph is the Actuarial Education and Research Fund, a North American organization devoted to education Introduction 3 and research in actuarial science.