- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. For startups, a well-crafted business plan is crucial for attracting potential lenders and investors. Established businesses use business plans to stay on track and aligned with their growth objectives. This article will explain the key components of an effective business plan and guidance on how to write one.

Key Takeaways

- A business plan is a document detailing a company's business activities and strategies for achieving its goals.

- Startup companies use business plans to launch their venture and to attract outside investors.

- For established companies, a business plan helps keep the executive team focused on short- and long-term objectives.

- There's no single required format for a business plan, but certain key elements are essential for most companies.

Investopedia / Ryan Oakley

Any new business should have a business plan in place before beginning operations. Banks and venture capital firms often want to see a business plan before considering making a loan or providing capital to new businesses.

Even if a company doesn't need additional funding, having a business plan helps it stay focused on its goals. Research from the University of Oregon shows that businesses with a plan are significantly more likely to secure funding than those without one. Moreover, companies with a business plan grow 30% faster than those that don't plan. According to a Harvard Business Review article, entrepreneurs who write formal plans are 16% more likely to achieve viability than those who don't.

A business plan should ideally be reviewed and updated periodically to reflect achieved goals or changes in direction. An established business moving in a new direction might even create an entirely new plan.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. It allows for careful consideration of ideas before significant investment, highlights potential obstacles to success, and provides a tool for seeking objective feedback from trusted outsiders. A business plan may also help ensure that a company’s executive team remains aligned on strategic action items and priorities.

While business plans vary widely, even among competitors in the same industry, they often share basic elements detailed below.

A well-crafted business plan is essential for attracting investors and guiding a company's strategic growth. It should address market needs and investor requirements and provide clear financial projections.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, gathering the basic information into a 15- to 25-page document is best. Any additional crucial elements, such as patent applications, can be referenced in the main document and included as appendices.

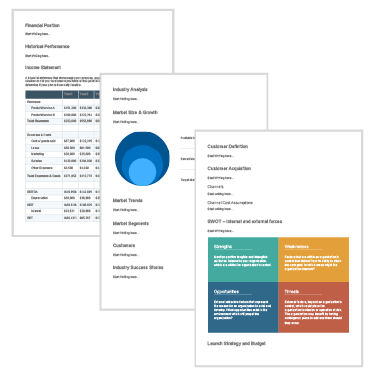

Common elements in many business plans include:

- Executive summary : This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services : Describe the products and services the company offers or plans to introduce. Include details on pricing, product lifespan, and unique consumer benefits. Mention production and manufacturing processes, relevant patents , proprietary technology , and research and development (R&D) information.

- Market analysis : Explain the current state of the industry and the competition. Detail where the company fits in, the types of customers it plans to target, and how it plans to capture market share from competitors.

- Marketing strategy : Outline the company's plans to attract and retain customers, including anticipated advertising and marketing campaigns. Describe the distribution channels that will be used to deliver products or services to consumers.

- Financial plans and projections : Established businesses should include financial statements, balance sheets, and other relevant financial information. New businesses should provide financial targets and estimates for the first few years. This section may also include any funding requests.

Investors want to see a clear exit strategy, expected returns, and a timeline for cashing out. It's likely a good idea to provide five-year profitability forecasts and realistic financial estimates.

2 Types of Business Plans

Business plans can vary in format, often categorized into traditional and lean startup plans. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These are detailed and lengthy, requiring more effort to create but offering comprehensive information that can be persuasive to potential investors.

- Lean startup business plans : These are concise, sometimes just one page, and focus on key elements. While they save time, companies should be ready to provide additional details if requested by investors or lenders.

Why Do Business Plans Fail?

A business plan isn't a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections. Markets and the economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All this calls for building flexibility into your plan, so you can pivot to a new course if needed.

How Often Should a Business Plan Be Updated?

How frequently a business plan needs to be revised will depend on its nature. Updating your business plan is crucial due to changes in external factors (market trends, competition, and regulations) and internal developments (like employee growth and new products). While a well-established business might want to review its plan once a year and make changes if necessary, a new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is ideal for quickly explaining a business, especially for new companies that don't have much information yet. Key sections may include a value proposition , major activities and advantages, resources (staff, intellectual property, and capital), partnerships, customer segments, and revenue sources.

A well-crafted business plan is crucial for any company, whether it's a startup looking for investment or an established business wanting to stay on course. It outlines goals and strategies, boosting a company's chances of securing funding and achieving growth.

As your business and the market change, update your business plan regularly. This keeps it relevant and aligned with your current goals and conditions. Think of your business plan as a living document that evolves with your company, not something carved in stone.

University of Oregon Department of Economics. " Evaluation of the Effectiveness of Business Planning Using Palo Alto's Business Plan Pro ." Eason Ding & Tim Hursey.

Bplans. " Do You Need a Business Plan? Scientific Research Says Yes ."

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

Harvard Business Review. " How to Write a Winning Business Plan ."

U.S. Small Business Administration. " Write Your Business Plan ."

SCORE. " When and Why Should You Review Your Business Plan? "

:max_bytes(150000):strip_icc():format(webp)/GettyImages-904536858-c089bc26f4fd4025b23f536345ba73ae.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

BUSINESS STRATEGIES

7 types of business plans every entrepreneur should know

- Amanda Bellucco Chatham

- Aug 3, 2023

What’s the difference between a small business that achieves breakthrough growth and one that fizzles quickly after launch? Oftentimes, it’s having a solid business plan.

Business plans provide you with a roadmap that will take you from wantrepreneur to entrepreneur. It will guide nearly every decision you make, from the people you hire and the products or services you offer, to the look and feel of the business website you create.

But did you know that there are many different types of business plans? Some types are best for new businesses looking to attract funding. Others help to define the way your company will operate day-to-day. You can even create a plan that prepares your business for the unexpected.

Read on to learn the seven most common types of business plans and determine which one fits your immediate needs.

What is a business plan?

A business plan is a written document that defines your company’s goals and explains how you will achieve them. Putting this information down on paper brings valuable benefits. It gives you insight into your competitors, helps you develop a unique value proposition and lets you set metrics that will guide you to profitability. It’s also a necessity to obtain funding through banks or investors.

Keep in mind that a business plan isn’t a one-and-done exercise. It’s a living document that you should update regularly as your company evolves. But which type of plan is right for your business?

7 common types of business plans

Startup business plan

Feasibility business plan

One-page business plan

What-if business plan

Growth business plan

Operations business plan

Strategic business plan

01. Startup business plan

The startup business plan is a comprehensive document that will set the foundation for your company’s success. It covers all aspects of a business, including a situation analysis, detailed financial information and a strategic marketing plan.

Startup plans serve two purposes: internally, they provide a step-by-step guide that you and your team can use to start a business and generate results on day one. Externally, they prove the validity of your business concept to banks and investors, whose capital you’ll likely need to make your entrepreneurial dreams a reality.

Elements of a startup business plan should include the following steps:

Executive summary : Write a brief synopsis of your company’s concept, potential audience, product or services, and the amount of funding required.

Company overview: Go into detail about your company’s location and its business goals. Be sure to include your company’s mission statement , which explains the “why” behind your business idea.

Products or services: Explain exactly what your business will offer to its customers. Include detailed descriptions and pricing.

Situation analysis: Use market research to explain the competitive landscape, key demographics and the current status of your industry.

Marketing plan: Discuss the strategies you’ll use to build awareness for your business and attract new customers or clients.

Management bios: Introduce the people who will lead your company. Include bios that detail their industry-specific background.

Financial projections: Be transparent about startup costs, cash flow projections and profit expectations.

Don’t be afraid to go into too much detail—a startup business plan can often run multiple pages long. Investors will expect and appreciate your thoroughness. However, if you have a hot new product idea and need to move fast, you can consider a lean business plan. It’s a popular type of business plan in the tech industry that focuses on creating a minimum viable product first, then scaling the business from there.

02. Feasibility business plan

Let’s say you started a boat rental company five years ago. You’ve steadily grown your business. Now, you want to explore expanding your inventory by renting out jet skis, kayaks and other water sports equipment. Will it be profitable? A feasibility business plan will let you know.

Often called a decision-making plan, a feasibility business plan will help you understand the viability of offering a new product or launching into a new market. These business plans are typically internal and focus on answering two questions: Does the market exist, and will you make a profit from it? You might use a feasibility plan externally, too, if you need funding to support your new product or service.

Because you don’t need to include high-level, strategic information about your company, your feasibility business plan will be much shorter and more focused than a startup business plan. Feasibility plans typically include:

A description of the new product or service you wish to launch

A market analysis using third-party data

The target market , or your ideal customer profile

Any additional technology or personnel needs required

Required capital or funding sources

Predicted return on investment

Standards to objectively measure feasibility

A conclusion that includes recommendations on whether or not to move forward

03. One-page business plan

Imagine you’re a software developer looking to launch a tech startup around an app that you created from scratch. You’ve already written a detailed business plan, but you’re not sure if your strategy is 100% right. How can you get feedback from potential partners, customers or friends without making them slog through all 32 pages of the complete plan?

That’s where a one-page business plan comes in handy. It compresses your full business plan into a brief summary. Think of it as a cross between a business plan and an elevator pitch—an ideal format if you’re still fine-tuning your business plan. It’s also a great way to test whether investors will embrace your company, its mission or its goals.

Ideally, a one-page business plan should give someone a snapshot of your company in just a few minutes. But while brevity is important, your plan should still hit all the high points from your startup business plan. To accomplish this, structure a one-page plan similar to an outline. Consider including:

A short situation analysis that shows the need for your product or service

Your unique value proposition

Your mission statement and vision statement

Your target market

Your management team

The funding you’ll need

Financial projections

Expected results

Because a one-page plan is primarily used to gather feedback, make sure the format you choose is easy to update. That way, you can keep it fresh for new audiences.

04. What-if business plan

Pretend that you’re an accountant who started their own financial consulting business. You’re rapidly signing clients and growing your business when, 18 months into your new venture, you’re given the opportunity to buy another established firm in a nearby town. Is it a risk worth taking?

The what-if business plan will help you find an answer. It’s perfect for entrepreneurs who are looking to take big risks, such as acquiring or merging with another company, testing a new pricing model or adding an influx of new staff.

A what-if plan is additionally a great way to test out a worst-case scenario. For example, if you’re in the restaurant business, you can create a plan that explores the potential business repercussions of a public health emergency (like the COVID-19 pandemic), and then develop strategies to mitigate its effects.

You can share your what-if plan internally to prepare your leadership team and staff. You can also share it externally with bankers and partners so that they know your business is built to withstand any hard times. Include in your plan:

A detailed description of the business risk or other scenario

The impact it will have on your business

Specific actions you’ll take in a worst-case scenario

Risk management strategies you’ll employ

05. Growth business plan

Let’s say you’re operating a hair salon (see how to create a hair salon business plan ). You see an opportunity to expand your business and make it a full-fledged beauty bar by adding skin care, massage and other sought-after services. By creating a growth business plan, you’ll have a blueprint that will take you from your current state to your future state.

Sometimes called an expansion plan, a growth business plan is something like a crystal ball. It will help you see one to two years into the future. Creating a growth plan lets you see how far—and how fast—you can scale your business. It lets you know what you’ll need to get there, whether it’s funding, materials, people or property.

The audience for your growth plan will depend on your expected sources of capital. If you’re funding your expansion from within, then the audience is internal. If you need to attract the attention of outside investors, then the audience is external.

Much like a startup plan, your growth business plan should be rather comprehensive, especially if the people reviewing it aren’t familiar with your company. Include items specific to your potential new venture, including:

A brief assessment of your business’s current state

Information about your management team

A thorough analysis of the growth opportunity you’re seeking

The target audience for your new venture

The current competitive landscape

Resources you’ll need to achieve growth

Detailed financial forecasts

A funding request

Specific action steps your company will take

A timeline for completing those action steps

Another helpful thing to include in a growth business plan is a SWOT analysis . SWOT stands for strengths, weaknesses, opportunities and threats. A SWOT analysis will help you evaluate your performance, and that of your competitors. Including this type of in-depth review will show your investors that you’re making an objective, data-driven decision to expand your business, helping to build confidence and trust.

06. Operations business plan

You’ve always had a knack for accessories and have chosen to start your own online jewelry store. Even better, you already have your eCommerce business plan written. Now, it’s time to create a plan for how your company will implement its business model on a day-to-day basis.

An operations business plan will help you do just that. This internal-focused document will explain how your leadership team and your employees will propel your company forward. It should include specific responsibilities for each department, such as human resources, finance and marketing.

When you sit down to write an operations plan, you should use your company’s overall goals as your guide. Then, consider how each area of your business will contribute to those goals. Be sure to include:

A high-level overview of your business and its goals

A clear layout of key employees, departments and reporting lines

Processes you’ll use (i.e., how you’ll source products and fulfill orders)

Facilities and equipment you’ll need to conduct business effectively

Departmental budgets required

Risk management strategies that will ensure business continuity

Compliance and legal considerations

Clear metrics for each department to achieve

Timelines to help you reach those metrics

A measurement process to keep your teams on track

07. Strategic business plan

Say you open a coffee shop, but you know that one store is just the start. Eventually, you want to open multiple locations throughout your region. A strategic business plan will serve as your guide, helping define your company’s direction and decision-making over the next three to five years.

You should use a strategic business plan to align all of your internal stakeholders and employees around your company’s mission, vision and future goals. Your strategic plan should be high-level enough to create a clear vision of future success, yet also detailed enough to ensure you reach your eventual destination.

Be sure to include:

An executive summary

A company overview

Your mission and vision statements

Market research

A SWOT analysis

Specific, measurable goals you wish to achieve

Strategies to meet those goals

Financial projections based on those goals

Timelines for goal attainment

Related Posts

What is a target market and how to define yours

21 powerful mission statement examples that stand out

How to write a business plan in 7 easy to follow steps

Was this article helpful?

What is a Business Plan? Definition, Tips, and Templates

Published: June 28, 2024

Years ago, I had an idea to launch a line of region-specific board games. I knew there was a market for games that celebrated local culture and heritage. I was so excited about the concept and couldn't wait to get started.

But my idea never took off. Why? Because I didn‘t have a plan. I lacked direction, missed opportunities, and ultimately, the venture never got off the ground.

And that’s exactly why a business plan is important. It cements your vision, gives you clarity, and outlines your next step.

In this post, I‘ll explain what a business plan is, the reasons why you’d need one, identify different types of business plans, and what you should include in yours.

Table of Contents

What is a business plan?

What is a business plan used for.

- Business Plan Template [Download Now]

Purposes of a Business Plan

What does a business plan need to include, types of business plans.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

A business plan is a comprehensive document that outlines a company's goals, strategies, and financial projections. It provides a detailed description of the business, including its products or services, target market, competitive landscape, and marketing and sales strategies. The plan also includes a financial section that forecasts revenue, expenses, and cash flow, as well as a funding request if the business is seeking investment.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Don't forget to share this post!

Related articles.

The Best AI Tools for Ecommerce & How They'll Boost Your Business

18 of My Favorite Sample Business Plans & Examples For Your Inspiration

23 of My Favorite Free Marketing Newsletters

![what are the categories of business plan The 8 Best Free Flowchart Templates [+ Examples]](https://www.hubspot.com/hubfs/free-flowchart-template-1-20240716-6679104-1.webp)

The 8 Best Free Flowchart Templates [+ Examples]

![what are the categories of business plan 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://www.hubspot.com/hubfs/gantt-chart-1-20240625-3861486-1.webp)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![what are the categories of business plan How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]](https://www.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]

20 Free & Paid Small Business Tools for Any Budget

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2024

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

How To Write A Business Plan (2024 Guide)

Updated: Apr 17, 2024, 11:59am

Table of Contents

Brainstorm an executive summary, create a company description, brainstorm your business goals, describe your services or products, conduct market research, create financial plans, bottom line, frequently asked questions.

Every business starts with a vision, which is distilled and communicated through a business plan. In addition to your high-level hopes and dreams, a strong business plan outlines short-term and long-term goals, budget and whatever else you might need to get started. In this guide, we’ll walk you through how to write a business plan that you can stick to and help guide your operations as you get started.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

Tailor Brands

$0 + state fee + up to $50 Amazon gift card

Varies by State & Package

On Tailor Brands' Website

$0 + State Fee

On Formations' Website

Drafting the Summary

An executive summary is an extremely important first step in your business. You have to be able to put the basic facts of your business in an elevator pitch-style sentence to grab investors’ attention and keep their interest. This should communicate your business’s name, what the products or services you’re selling are and what marketplace you’re entering.

Ask for Help

When drafting the executive summary, you should have a few different options. Enlist a few thought partners to review your executive summary possibilities to determine which one is best.

After you have the executive summary in place, you can work on the company description, which contains more specific information. In the description, you’ll need to include your business’s registered name , your business address and any key employees involved in the business.

The business description should also include the structure of your business, such as sole proprietorship , limited liability company (LLC) , partnership or corporation. This is the time to specify how much of an ownership stake everyone has in the company. Finally, include a section that outlines the history of the company and how it has evolved over time.

Wherever you are on the business journey, you return to your goals and assess where you are in meeting your in-progress targets and setting new goals to work toward.

Numbers-based Goals

Goals can cover a variety of sections of your business. Financial and profit goals are a given for when you’re establishing your business, but there are other goals to take into account as well with regard to brand awareness and growth. For example, you might want to hit a certain number of followers across social channels or raise your engagement rates.

Another goal could be to attract new investors or find grants if you’re a nonprofit business. If you’re looking to grow, you’ll want to set revenue targets to make that happen as well.

Intangible Goals

Goals unrelated to traceable numbers are important as well. These can include seeing your business’s advertisement reach the general public or receiving a terrific client review. These goals are important for the direction you take your business and the direction you want it to go in the future.

The business plan should have a section that explains the services or products that you’re offering. This is the part where you can also describe how they fit in the current market or are providing something necessary or entirely new. If you have any patents or trademarks, this is where you can include those too.

If you have any visual aids, they should be included here as well. This would also be a good place to include pricing strategy and explain your materials.

This is the part of the business plan where you can explain your expertise and different approach in greater depth. Show how what you’re offering is vital to the market and fills an important gap.

You can also situate your business in your industry and compare it to other ones and how you have a competitive advantage in the marketplace.

Other than financial goals, you want to have a budget and set your planned weekly, monthly and annual spending. There are several different costs to consider, such as operational costs.

Business Operations Costs

Rent for your business is the first big cost to factor into your budget. If your business is remote, the cost that replaces rent will be the software that maintains your virtual operations.

Marketing and sales costs should be next on your list. Devoting money to making sure people know about your business is as important as making sure it functions.

Other Costs

Although you can’t anticipate disasters, there are likely to be unanticipated costs that come up at some point in your business’s existence. It’s important to factor these possible costs into your financial plans so you’re not caught totally unaware.

Business plans are important for businesses of all sizes so that you can define where your business is and where you want it to go. Growing your business requires a vision, and giving yourself a roadmap in the form of a business plan will set you up for success.

How do I write a simple business plan?

When you’re working on a business plan, make sure you have as much information as possible so that you can simplify it to the most relevant information. A simple business plan still needs all of the parts included in this article, but you can be very clear and direct.

What are some common mistakes in a business plan?

The most common mistakes in a business plan are common writing issues like grammar errors or misspellings. It’s important to be clear in your sentence structure and proofread your business plan before sending it to any investors or partners.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best VPN Services

- Best Project Management Software

- Best Web Hosting Services

- Best Antivirus Software

- Best LLC Services

- Best POS Systems

- Best Business VOIP Services

- Best Credit Card Processing Companies

- Best CRM Software for Small Business

- Best Fleet Management Software

- Best Business Credit Cards

- Best Business Loans

- Best Business Software

- Best Business Apps

- Best Free Software For Business

- How to Start a Business

- How To Make A Small Business Website

- How To Trademark A Name

- What Is An LLC?

- How To Set Up An LLC In 7 Steps

- What is Project Management?

- How To Write An Effective Business Proposal

What Is SNMP? Simple Network Management Protocol Explained

What Is A Single-Member LLC? Definition, Pros And Cons

What Is Penetration Testing? Definition & Best Practices

What Is Network Access Control (NAC)?

What Is Network Segmentation?

How To Start A Business In Louisiana (2024 Guide)

Julia is a writer in New York and started covering tech and business during the pandemic. She also covers books and the publishing industry.

5 Types Of Business Plans (+ Customizable Templates)

Find the best form of business plan for your venture and learn to align your business plan model with a winning strategy. Grab a template to get started.

6 minute read

helped business professionals at:

Short answer

What are the main types of business plans?

5 main types of business plans:

Startup business plan

One-pager business plan

Operational business plan

Feasibility business plan

Growth business plan

Aligning your strategy with the wrong type of business plan leads to failure

Crafting a sharp business plan is non-negotiable if you want your project to lift off the ground.

Yet, many miss the mark by not adapting their strategy to the appropriate type of business plan. It's like trying to open a door with the wrong key, frustrating and futile. This oversight can lead to miscommunication, disinterest from crucial stakeholders, and missed growth opportunities.

Here's where I step in, offering you a master key to unlock the true potential of effective business planning.

You'll learn about the strategic value of tailoring your plan to fit specific needs, whether you're kickstarting a venture, seeking investment, or plotting growth. Let's go.

What makes a successful business plan?

Creating a business plan that stands out involves more than just outlining your business's operations. It's about highlighting how your business differentiates itself and thrives within its industry.

Drawing inspiration from expert advice on business planning, here's an overview of the key elements that make a business plan successful. 6 key elements of a winning business plan:

Precision and structure: It's sharp, structured, and zeroes in on the business's main goals and strategies without unnecessary fluff.

Grounded objectives and forecasts: It sets attainable objectives and includes grounded financial forecasts, informed by thorough market analysis and industry insights.

Flexibility: It remains adaptable, ready to evolve alongside the business and shifting market dynamics.

Audience-specific design: It's crafted with the target audience in mind, whether that's attracting investors, securing loans, or engaging customers, ensuring it resonates and meets their expectations.

Clear communication: It communicates the business idea, market potential, and growth trajectory clearly and persuasively.

Defined action plan: It provides a clear set of steps to be undertaken to reach the business's goals, making it practical and actionable.

Internal vs. external business plan

The difference between internal and external business plans is based on their intended audience.

INTERNAL BUSINESS PLAN

EXTERNAL BUSINESS PLAN

Internal business plan

Internal documents tailored for departments such as marketing or HR emphasize recruitment statistics , succinct insights about the company, and a more focused financial outlook. These documents usually adopt a less formal tone and are often managed using document management software to ensure efficient organization and accessibility.

Purpose: Align your team and streamline operations.

Key approach: Focus on strategy, flexibility, and clear metrics.

Tip: Regularly review and update the plan, and encourage team feedback.

External business plan

External documents reach out to those outside your immediate circle, such as investors or partners. They provide a thorough overview of your company, including detailed financials, and maintain a formal tone, typically aimed at securing funding or establishing partnerships.

Purpose: Impress and persuade investors or partners.

Key approach: Ensure clarity, and professionalism, and tailor content to your audience.

Tip: Understand your audience's priorities, and seek expert feedback before finalizing.

5 types of business plans to align your strategy with

Picking the right business plan is a big deal for founders, managers, and leaders. But let's be honest, diving into the sea of options can feel overwhelming.

Whether you're chasing funding, dreaming of expanding or looking to streamline your operations, I've got you covered.

I'm talking about seizing opportunities to not just meet your goals but to exceed them. Let's dive in and align your ambitions with the perfect plan.

1) Startup business plan

Audience: External stakeholders, including investors and financial institutions.

Depth: Comprehensive and detailed.

Purpose: To outline the steps for launching a new venture and securing funding.

The startup plan is your blueprint for launching a new venture.

It's packed with everything from a punchy executive summary that grabs you with the business concept to deep dives into market trends and who you're up against.

It lays out financial forecasts with precision, giving potential backers a crystal-clear picture of where you're headed in terms of profits and what you need to get there.

This plan isn't just about pulling in funds; it's your strategic playbook for carving out a successful path forward. For newbies on the entrepreneurial scene, it's nothing short of essential.

Here’s an example of a start-up business plan:

2) One-pager business plan

Audience: External parties, such as potential investors, partners, and vendors.

Depth: High-level and succinct.

Purpose: To quickly communicate the business's value proposition and growth potential.

The one-page plan condenses the core of a business strategy into a succinct and impactful document, crafted to immediately capture the attention of potential investors, partners, and vendors.

It showcases the unique value proposition, targets the market with effective strategies, and highlights financial insights and growth potential.

This streamlined plan turns out to be a game-changer for entrepreneurs looking to share their vision and strategy in a clear, easy-to-understand way.

It quickly gets the point across and sparks interest from potential stakeholders, encouraging them to dive deeper.

Here’s an example of a one-pager business plan:

3) Operational business plan

Audience: Internal management teams and department heads.

Depth: Detailed, focusing on day-to-day operations and short-term goals.

Purpose: To streamline internal processes and enhance operational efficiency.

The operational business plan is like the company's playbook, focusing on fine-tuning every single part of your operations.

It lays out the operational goals that sync up with your big-picture strategies, breaking down the exact tasks and processes you need to nail those targets.

You've got everything mapped out, from streamlining workflows to boosting efficiency, and even who's doing what to ensure you're all pulling in the same direction.

It also covers allocating resources, from budgets to materials, ensuring every department has what it needs.

Diving into the nitty-gritty of your day-to-day, this plan is key for spotting where you can do better, ramping up productivity, and hitting your short-term goals more smoothly.

Here’s an example of an operational business plan:

4) Growth business plan

Audience: Both internal stakeholders for strategic alignment and external parties for investment or partnership opportunities.

Depth: This can vary from lean to standard, depending on the audience.

Purpose: To provide a strategic framework for business expansion.

The growth plan feels like launching into a new adventure, much like a startup plan, but for your next big leap.

It's about charting a course for new markets, beefing up your product lines, or scaling operations to new heights.

This plan packs deep dives into the business, financial forecasts that map out your journey, and a rundown of the resources you'll need to expand.

It's a guiding light for businesses aiming for sustainable growth, laying out a clear path and milestones to hit along the way.

Whether it's guiding your team internally or dazzling potential investors, the growth plan pulls everyone together, focusing efforts on shared growth targets.

It's about making sure every stakeholder is in sync, marching towards the same ambitious goals.

Here’s an example of a growth business plan:

5) Feasibility business plan

Audience: Primarily internal, though it can be external if linked to funding requests.

Depth: Focused and streamlined.

Purpose: To assess the viability of a new product or service.

A feasibility plan, or feasibility study, acts as a litmus test for proposed business expansions or new product launches.

It delves into the practicality of the idea, examining market demand, technical requirements, and financial implications.

By focusing on specific growth opportunities and analyzing them against objective standards, this plan helps decision-makers within the organization determine whether to proceed with the venture.

It's a critical step in the planning process, ensuring resources are allocated to projects with the highest potential for success.

For ventures requiring external funding, a more detailed version of this plan may be necessary to convince investors of the project's feasibility.

If you want to learn more, check out our guides on business plan:

7 Key Components of a Precise Business Plan (2024)

How to Write a Business Plan (Examples & Templates)

How to Make a Killer Business Plan Presentation (+Templates)

Create a Business Plan One-Pager (+ Proven Templates)

Don’t let poor design sabotage your business plan

Designing a business plan presentation in today's digital age goes beyond mere text on a page, it's about crafting an engaging experience that captures and retains attention.

With the shift towards digital, the presentation of your plan is as crucial as its content.

5 crucial business plan design principles:

1) Transition from static to interactive

The era of static, text-heavy presentations is behind us. Modern business plans thrive on interactivity, incorporating elements like clickable links, dynamic charts, and embedded videos.

This approach not only enriches the reader's experience but also fosters a deeper engagement with the material, making your business plan far more compelling.

Here's what a static PPT looks like compared to an interactive deck:

Static PowerPoint

Interactive Storydoc

2) Implement scroll-based design

Ditch the cumbersome PDF format for a scroll-based design that mirrors the seamless experience of browsing a modern website.

This design choice is intuitive and aligns with our habitual online content consumption, making your business plan both accessible and enjoyable to navigate.

Here's an example of scroll-based design:

3) Prioritize mobile-friendliness

In a world where mobile devices dominate, ensuring your business plan looks great on any screen is non-negotiable.

Adopting responsive design guarantees that your plan is legible and appealing across all devices, from smartphones to desktops, ensuring your message resonates clearly with every reader.

4) Move to online documents

Forget about clunky Word docs or static PDFs. The future is online documents that allow for real-time updates, easy sharing, and collaboration.

They're not only convenient for you but also for your busy investors, offering access from anywhere, at any time.

For more information, check out our comparison of the best business plan document types .

5) Master visual storytelling

Leverage the power of visuals infographics, charts, and graphs to narrate your business's story.

Visuals can simplify complex information, making your key points more digestible and engaging than text alone could ever achieve.

Here's a great example of visual storytelling:

All forms of business plan templates to get you started

Just as a captivating presentation can transform the way your message is received, a well-crafted business plan is your gateway to turning your business vision into reality.

Why settle for a dry, uninspiring document when you can create a business plan that's a dynamic blueprint for success?

Consider your business plan as a journey for your readers — investors, partners, or internal team members — keeping them engaged from the executive summary to the final appendix.

These business plan templates serve as the perfect foundation for this journey.

I am a Marketing Specialist at Storydoc, I research, analyze and write on our core topics of business presentations, sales, and fundraising. I love talking to clients about their successes and failures so I can get a rounded understanding of their world.

Found this post useful?

Subscribe to our monthly newsletter.

Get notified as more awesome content goes live.

(No spam, no ads, opt-out whenever)

You've just joined an elite group of people that make the top performing 1% of sales and marketing collateral.

Make your best business plan to date

Stop losing opportunities to ineffective presentations. Your new amazing deck is one click away!

AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

INTEGRATIONS

QuickBooks Sync and compare with your QuickBooks data

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

Xero Sync and compare with your Xero data

See how easy it is to plan your business with Upmetrics: Take a Tour →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

BY USE CASE

Secure Funding, Loans, Grants Create plans that get you funded

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

E2 Visa Business Plan Create a business plan to support your E2 - Visa

Business Consultant & Advisors Plan with your team members and clients

Incubators & Accelerators Empowering startups for growth

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

WHY UPMETRICS?

Reviews See why customers love Upmetrics

Customer Success Stories Read our customer success stories

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Help Center Help & guides to plan your business

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

The Different Types of Business Plans

Free Business Plan Template

- June 29, 2023

Different situations call for different business plans.

Whether you want to acquire funds, analyze market risks, introduce a new product, or simply need a roadmap for business operations— a specifically tailored business plan is essential for different business purposes.

Identifying the type of business plan you require is quintessential so that you create a document fit for your business needs.

In this blog post, we will introduce you to the 7 different types of business plans and help you understand which suits your business needs the best.

Ready to get started? Let’s dive right in.

Types of business plans

Businesses in different business situations call for different business plans.

To understand different types of business plans, we will categorize them based on audience, scope, and purpose to instill better clarity in your minds.

Let us understand these in detail to help you choose your ideal business plan.

Based on audience

Business plans are broadly categorized into two types based on the type of audience they cater to.

1. Internal business plans

As the name suggests, an internal business plan is solely for the people inside the company. These can be specific to certain departments such as marketing, HR, production, etc.

Internal business plans focus primarily on the company’s goals, operations, finances, and personnel and define the strategies to achieve their goals.

2. External business plans

On the contrary, external business plans are intended for people outside the company, such as investors, banks, partners, etc.

These plans usually contain detailed information about the company’s background, finances, market share, and business strategies.

Based on scope

Similarly, business plans are classified into two types based on their size and the depth of information they encompass.

1. Standard business plan

A standard plan or traditional business plan is a professional document offering a comprehensive understanding of your business idea. It serves as a step-by-step guide to launching your business and offers a roadmap to operate it efficiently.

A standard plan follows a structured format and usually includes components such as

- Executive summary

- Company description

- Market analysis

- Products and services

- Marketing and sales plan

- Operations plan

- Financial plan

- Funding demand

Most entrepreneurs follow this structure to write a business plan and add depth to the sections that hold significant value to them.

Best for: Startups and businesses that require a detailed roadmap or operate in highly volatile markets. These plans are also used for getting funding approvals.

2. Lean business plans

A lean plan, also known as a startup business plan, is a condensed version of the standard business plan including highlights and summaries of all its sections.

Such plans empower entrepreneurs to kickstart their business endeavors with a minimum viable product and build it gradually by gathering real market feedback.

Lean business plans are crafted with brevity and outline your strategies, revenue model, tactics, and timeline.

- Strategies: How will you reach your goals

- Tactics: What are the KPIs to evaluate your performance

- Revenue model: How will you make money

- Timeline: Who will accomplish the tasks

Drafting such plans is not only easier, it is considered to be more efficient compared to a standard plan.

Best for: Entrepreneurs who want to quickly launch their business in a hot-moving market.

Based on purpose

Every business plan tends to solve a specific purpose. Let’s understand 7 different types of business plans based on different purposes.

1. One-page business plan

One-page business plans offer a snapshot of your entire business idea in one page. Such plans follow the same structure as traditional plans, however, they are much more concise and crisp.

One-page plans are simplified versions of detailed business plans and can be placed together in less than 10 minutes.

They are quite useful when you want to convey essential information in a brief document without missing out on important points.

Best for: One-page business plan is best suited for startups and small businesses that require rapid adjustments and quick implementation.

2. Growth business plan

A growth business plan combines the crispness of one-page business plans and the detailing of financial forecasts to enable prompt decision-making.

Such plans are quite handy when you want to upscale or grow your business without writing a full-fledged detailed business plan.

Businesses can compare their forecasts with the actuals, identify the discrepancies in the current strategy, and adjust it to ensure maximum growth when they have a clear demonstration of financials.

To prepare your growth business plan, outline the target market, business strategies, and a business model as you do in your one-page plans. And additionally, also include detailed financial projections for sales, cash flow, and revenue to help individuals make data-driven decisions.

Best for: A growth plan is best for businesses entering new markets, launching new products, scaling operations, or practicing a growth planning process.

3. Strategic business plan

Strategic business plans highlight your strategic objectives, define your business strategies, and outline a roadmap to take you there. It covers the nitty-gritty about your company’s goals, mission objectives, and long-term vision.

Such plans are extremely efficient in communicating your goals to internal teams and stakeholders, while ensuring everyone is on the same page as you.

Best for: Businesses and startups planning long-term growth and nonprofits aiming to increase their impact.

4. Feasibility business plan

A feasibility business plan is specifically designed to test the viability of a new product or business expansion in a new market. As opposed to a detailed business plan, such plans focus on two primary matters:

- Determining the existence of a market

- Determining the profits of the initiative

This type of business plan usually excludes all the other sections included in usual business plans. Instead, it concentrates mainly on the scope of a new initiative, its profitability, market analysis, competition, and associated financial implications.

It is mostly crafted for internal management and ends with recommendations on whether the decision to enter a new market or introduce a new product or service is viable or not.

Best for: Established businesses and early-stage startups to assess the viability of a specific product, market, or business idea before allocating significant resources.

5. Operational business plan

Operational plans are specific documents outlining processes and procedures of day-to-day business activities. Such plans focus on operational aspects of the business such as logistics, inventory, supply chain, production, and resource allocation.

A well-mapped operational plan serves as a guidebook for internal team and management. It streamlines the workflow, establishes SOPs, and offers a clear understanding of who will perform what tasks and what resources will be required.

There is no strict format outlining the contents of such a plan. The plan just needs to be clear, communicative, and viable enough to implement practically.

Best for: Established businesses to manage operations and resource allocation and startups to establish standard clear processes.

6. Nonprofit business plan

Nonprofit business plans are suited for businesses that operate for a charitable or social cause. Such plans are quite similar to traditional plans, however, they include an additional section where you explain the impact your non-profit organization will make in society.

Like a traditional plan, you will highlight the business concept, outline the market research, set the business goals, determine your business and promotional strategies, and demonstrate your team.

Additionally, you will include a section demonstrating the financial sustainability of the nonprofit venture. This is essential to attract donors, grants, and investors for your nonprofit business.

Best for: Nonprofit startups planning to secure funding and grants from financial institutions.

7. What-If business plan

What-if business plans are contingency plans used to draft strategies for the worst-case scenarios. This plan is usually less formal unless a funding request is included.

Such planning allows you to test and study the impact of different hypothetical situations related to the market, environment, competition, and legal regulations on your business.

Best for: Businesses in highly volatile markets and companies practicing crisis management. Also suited when considering mergers, price hikes, or undertaking any major business decision.

And those are some of the many different types of business plans you can have for your business. Wondering which one your business needs? Let us make your choice easier.

Choosing the right type of business plan

Here are the 2 criteria that will help in determining the right plan for your business.

The first step to choosing a business plan is to understand the purpose and objective of writing a business plan. For instance, your objective could be to acquire funds, guide an internal team, create a strategic roadmap, expand into a new geographic market, or prepare for contingencies.

Align your objective with the purpose of specific business plans and see which one suits you the best.

2. Scope of business

The scope and complexity of your business play a crucial role in determining the type of business plan you require. Take into account factors like products and service offerings, the scale of the business, and the business complexity to make a choice.

Even the stage of your business, depending on whether it is a startup or an established business, will influence this decision.

Start preparing your business plan with Upmetrics

You now have a proper understanding of the different types of business. If you’re not sure which one to pick, let us help you.

Our business planning software helps create stellar business plans and saves you the pain of writing one from scratch.

You can either choose a business plan sample and follow its step-by-step instructions to prepare your functional and actionable business plan.

Don’t have enough time to write the entire thing from scratch? Go ahead with our AI business plan generator ; it will quickly generate the entire plan for you..

Simply enter your business details, answer a few questions, and see your plan coming together in front of your eyes in less than 15 minutes.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

What are the 8 most common sections of a business plan.

The 8 common components of a successful business plan include

- Management team

Which type of business plan is right for me?

The answer entirely depends upon what you want to achieve with your business plan. Apart from that the scope, nature, and complexity of your business will determine the type of business plan you need.

Do I need a business plan to start a business?

A business plan is highly recommended before you kickstart your business endeavor. It builds a solid foundation for your business idea and offers a roadmap to achieve your strategic and business objectives. A well-drafted business proposal increases the chances of your business venture succeeding.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Reach Your Goals with Accurate Planning

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » startup, 5 types of business plans for startups.

If you’re a startup, here are five different types of business plans to help achieve your professional goals.

Writing a business plan is an important process for every startup. In its simplest form, a business plan is a formal document that contains your goals for the company and the timeline in which you'd like to achieve them. While many stick to writing the "standard" business plan, there are various types of business plans you can choose from, depending on your goals. Choosing the right plan for your business can ease the writing process and help you better achieve your objectives. Here are five types of business plans to help you decide which is right for you.

[Read: 5 Common Sense Reasons to Write a Business Plan and 7 Mistakes to Avoid ]

Standard plan

A standard business plan (often referred to as a “working plan”) sets an overview of your company, states your goals and outlines how and when you will achieve them. For any business, they’re an important tool in helping you secure financing, such as a loan or an investment. Lenders and investors will want to know how you plan to use their money and make a profit. A business plan will accurately state how you intend to do this, list the achievable goals and put them in a realistic time frame.

Other aspects to include in your plan depend on your audience. You may include more information about cash flow and expenses for investors, or more of the day-to-day operations and goals for your employees.

What-if plan

In business, not everything will go according to plan. A what-if business plan outlines different roadblocks your company might battle so you can be prepared for anything. Because businesses are often at the whims of external factors such as the stock market or supply chain, this plan outlines the various predictable scenarios your company could face. In writing this plan, you might consider including the worst-case scenario to reassure investors that even if something goes wrong, you will have a way to financially recover. This plan can be part of the standard business plan or exist entirely on its own.

In business, not everything will go according to plan. A what-if business plan outlines different roadblocks your company might battle so you can be prepared for anything.

One-page plan

Your business plan should be filled with detailed information about various aspects of your business. However, sometimes you'll come across someone outside of a formal pitch and want to give them a condensed version of your plan for quick reference. A one-page business plan outlines your plan in five simple, easy-to-read sections: the demand, your solution, your business model, your management team and your plan of action. The content on your one-page plan should be a summarized version of your more robust business plan.

[Read: Starting Over? How to Write a Business Plan for a Post-Pandemic World ]

Startup plan

If you're an entrepreneur who's in the early stages of planning their business, your plan may look a little different. A startup business plan is for potential investors to get an idea of your new company and what you hope to achieve as your company grows. This plan should include an executive summary, your background, what your service or product will provide, your market evaluations, startup costs and your financial projections.

Because this is a plan for a business that does not yet exist or is in its infantry, it is essential to outline who you are and your background, as well as your proven track record. Investors want to know if they can trust you with their money to start a brand-new business. They'll be more open to financing your idea if they know you have similar experience or have worked in or created a startup previously.

Expansion plan

An expansion plan is written when a business is looking to scale themselves and requires additional resources for that development. These resources can include additional employees, new materials or a financial investment. Within this plan, include details of your company's background and how you've grown to where you are today. Then, outline how these additional resources will contribute to the expansion of your company and what that expansion will mean for your overall growth.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners stories.

Join us on October 8, 2024! Tune in at 12:30 p.m. ET for expert tips from top business leaders and Olympic gold medalist Dominique Dawes. Plus, access our exclusive evening program, where we’ll announce the CO—100 Top Business! - Register Now!

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

RSVP Now for the CO—100 Small Business Forum!

Discover today’s biggest AI and social media marketing trends with top business experts! Get inspired by Dominique Dawes’ entrepreneurial journey and enjoy free access to our exclusive evening program, featuring the CO—100 Top Business reveal. Register now!

For more startup tips

How to choose a legal entity for your startup, how to choose the right business entity: sole proprietorship, 5 steps to use social media to launch your business.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

6 Types of Business Plans

Business plans guide owners, management and investors as businesses start up and grow through stages of success. A business owner or prospective business owner writes a business plan to clarify each aspect of his business, describing the objectives that will anticipate and prepare for growth. Savvy business owners write a business plan to guide management and to promote investment capital.

Types of business plans include, but are not limited to, start-up, internal, strategic, feasibility, operations and growth plans.

Advertisement

Article continues below this ad

Start-Up Business Plans

New businesses should detail the steps to start the new enterprise with a start-up business plan. This document typically includes sections describing the company, the product or service your business will supply, market evaluations and your projected management team. Potential investors will also require a financial analysis with spreadsheets describing financial areas including, but not limited to, income, profit and cash flow projections.

More For You

What are the six elements of a business plan, what are the benefits of a business plan, examples of business feasibility reports, how to write a business synopsis, how to create a new business plan, internal business plans.

Internal business plans target a specific audience within the business, for example, the marketing team who need to evaluate a proposed project. This document will describe the company's current state, including operational costs and profitability, then calculate if and how the business will repay any capital needed for the project. Internal plans provide information about project marketing, hiring and tech costs. They also typically include a market analysis illustrating target demographics, market size and the market's positive effect on the company income.

Strategic Business Plans

A strategic business plan provides a high-level view of a company's goals and how it will achieve them, laying out a foundational plan for the entire company. While the structure of a strategic plan differs from company to company, most include five elements: business vision, mission statement, definition of critical success factors, strategies for achieving objectives and an implementation schedule. A strategic business plan brings all levels of the business into the big picture, inspiring employees to work together to create a successful culmination to the company's goals.

Feasibility Business Plans

A feasibility business plan answers two primary questions about a proposed business venture: who, if anyone, will purchase the service or product a company wants to sell, and if the venture can turn a profit. Feasibility business plans include, but are not limited to, sections describing the need for the product or service, target demographics and required capital. A feasibility plan ends with recommendations for going forward.

Operations Business Plans

Operations plans are internal plans that consist of elements related to company operations. An operations plan, specifies implementation markers and deadlines for the coming year. The operations plan outlines employees' responsibilities.

Growth Business Plans

Growth plans or expansion plans are in-depth descriptions of proposed growth and are written for internal or external purposes. If company growth requires investment, a growth plan may include complete descriptions of the company, its management and officers. The plan must provide all company details to satisfy potential investors. If a growth plan needs no capital, the authors may forego obvious company descriptions, but will include financial sales and expense projections.

- Entrepreneur: The 4 Types of Business Plans

- YourBusinessPal.com: Business Plan Example

- BPlans.com: Free Sample Business Plans

Alyson Paige has a master's degree in canon law and began writing professionally in 1998. Her articles specialize in culture, business and home and garden, among many other topics.

ZenBusinessPlans

Home » Business Plan Tips

14 Types of Business Plans and Their Functions

Are you about starting a business but you don’t know what kind of business plan to write? If YES, here are 14 types of business plans and their functions.

A business plan is a formal written document that contains business goals, the methods on how these goals can be attained, and the time frame within which these goals need to be achieved. Business plans guide owners, management and investors during the start off stage of the business, and it equally guides the business as it grows from one stage to the other.

Savvy business owners write a business plan to guide management and to promote investment capital. Businesses without a solid plan typically burn out fast or fail to turn a profit in the long run. Without a well-planned business strategy, it is not possible for a business to scale through problems smoothly, and it would equally be an uphill task to achieve success.

A foolproof business plan highlights varying aspects of a potential business and integrates few essential features like business objectives, possible growth rate and many other characteristics that your business will include and assimilate. How to promote investment capital will be illustrated broadly in a business plan.

There are various kinds of business plans and in this article we will outline the various business plans and tell you the function of each.

- Start-Up Business Plans

One of the very popular business plans in the world of business is the startup business plan. The startup business plans contain an exhaustive approach for starting and growing a business. It is different from all other business plans because of its nature and the details that are taken into consideration right from the inception of the business till the growth stage along with the vision of at least five years.

With this business plan, new businesses need to detail the steps they need to take while starting a business. This document typically includes sections describing the company, the product or service the business will supply, market evaluations and the intended projected management team.

Potential investors will also require a financial analysis with spreadsheets describing financial areas including, but not limited to, income, profit and cash flow projections. Startup business plans can equally be used by established companies to launch a new product line or to enter an entirely new business segment in the market . Conglomerates use this plan if they are launching a new business.

- It xrays the Business: The startup business plan explains what a business is all about by describing the products or services in detail and what the ultimate goals of the business are. For example, your plan may stipulate what your revenue goals are for each of your first three years of operation. Your plan should also indicate why you believe there is a need for your business and who your main competitors will be.

- Helps in securing funding: It’s no secret that businesses can’t function without any operating capital to kick-start their production cycle. Entrepreneurs are often required to take loans from financial institutions to purchase property, get the equipment or hire manpower. Startup business plans would help them access funding speedily.

- Outlines Possible Weaknesses: Startup business plans helps businesses to find out the weaknesses of the business in question. Highs and lows are a part of life and without them; we wouldn’t feel the need for improvement. A startup business plan helps you preempt the lows and maximize the highs.

- It provides an execution plan: Describing how your business will function and perform in the market is important when dealing with sponsors and investors. A startup business plan will explain your products and services, your targeted customers, the required funds and what’s necessary for your startup to thrive

- Internal Business Plans

As the name suggests the internal business plan is for internal stakeholders of the business. This type of business plan helps to evaluate projects which are specific and they keep the team up to speed about the current status of the company.

The company has more chances of success if everyone in the team is entirely on board, that is why the internal business plan is needed to keep everyone in the company on the same lane. It contains strategies and ways to improve the current business working and suggests a new pattern for growth.

- It answers questions pertaining to the internal workings of the company: Is the company growing or declining? Does the working pattern need change, improvement or modification? These are the type of questions which internal business plans answer. The primary purpose of the internal business plan is not to show the balance sheet of the financial position of the company to the external stakeholders but it is to run the business as smoothly as possible.