- Sign Up Now

- -- Navigate To -- CR Dashboard Connect for Researchers Connect for Participants

- Log In Log Out Log In

- Recent Press

- Papers Citing Connect

- Connect for Participants

- Connect for Researchers

- Connect AI Training

- Managed Research

- Prime Panels

- MTurk Toolkit

- Health & Medicine

- Enterprise Accounts

- Conferences

- Knowledge Base

- The Online Researcher’s Guide To Sampling

How to Build a Sampling Process for Marketing Research

Quick Navigation:

When is it necessary to use sampling for market research, defining your target population, questions to ask when building a sampling strategy, how easy is it to reach your target audience, how much money do you have available for your project, how quickly do you need the data, what kind of information are you seeking from participants, calculating and justifying required sample size, selecting a method for sourcing participants.

By Cheskie Rosenzweig, MS, Aaron Moss, PhD, & Leib Litman, PhD

Online Researcher’s Sampling Guide, Part 3: How to Build a Sampling Process for Marketing Research

Most businesses can’t survive without conducting some research. What is our market share? Are our customers happy? Who is likely to buy this product? Questions like these are what lead businesses around the world to spend tens of billions of dollars per year on market research.

Regardless of whether you have a significant market research budget or one with very limited resources, it is of paramount importance for your business that your funds are spent efficiently and effectively. How do you do that? The first step might be recognizing when you do and do not need to gather your own data.

Not all market research requires a team of people to go out and gather data. Sometimes, your business has internal data, or you can use data other people have collected (known as secondary data) to answer your research questions. Internal data can help companies understand consumer behavior, and secondary data might help a company understand the market or its competitors.

But there are some questions no amount of internal or secondary data can answer. How do customers feel about our brand compared to others? How can we improve our product or service? Finding answers to questions like these requires talking to your customers or potential customers, and that means sampling people for the purpose of primary research.

As an example, imagine we lead the research team at a young company based in Minneapolis, Minnesota. Our company, aptly named SunVac, developed a new vacuum that runs on solar energy and never needs to be plugged in. As you might guess, we are excited that our hard work has come to fruition. We did it! We created an environmentally friendly vacuum with no more pesky wires to get tangled!

The problem we have now is that we aren’t sure how much our vacuum is worth on the open market. Although we have some secondary data on how much people will pay for wireless vacuums, we decide our product is sufficiently different from other models that we need to gather data to determine pricing sensitivity and the best way to market our product. The first step is determining who we need to sample.

Before embarking on any research project, it’s important to spend time clearly defining your objectives. Defining what you want to learn will guide your decisions about which source of data is best, how you should sample, and who you should sample.

Consider our company, SunVac. Our research team knows that we should conduct some studies investigating how much people will pay for our product and what kind of messages will convince people to buy it. From here, we need to define a target population for our studies, and while doing so, it is a good time to think about potential sources of sampling bias.

Is it important that our study represent certain demographic groups or people from various regions of the country? Should we make sure men and women are equally represented in the study? Does how much money people make influence whether they will buy our vacuum? Thinking about potential sources of bias can help us clarify who to sample.

Based on intuition and some secondary data, the research team at SunVac has a sense of who may have an interest in our product, who buy the product at different price points, and who respond to different marketing campaigns.

We decide we should sample people who may be in the market for a vacuum cleaner. We also decide it is important to collect data from people in various regions of the country to account for regional differences in environmental attitudes. If we limited our sampling to people in Minneapolis, we might end up with biased results, because Minneapolis is a city ranked cleanest in the U.S. and 6 th -most eco-friendly in the world , meaning people in Minneapolis may value our product more than potential customers elsewhere. Finally, we consider data we have seen that married people vacuum more than single adults. We decide we should sample more married people than singles. So, our target sample is adults from various regions of the US who may be interested in buying a vacuum. Let us next consider where we could collect our sample.

Once you identify a target population, you need to form a plan to reach them and to gather your data. There are several related issues to consider.

Some people are harder to find as research participants than others. CEOs and managers are less plentiful than entry-level employees. There are fewer older adults online than younger adults. When forming a sampling plan, it is important to consider how hard it is to reach your target audience.

The amount of money budgeted for your project will affect your decisions about how to reach your target audience. For example, gathering a nationally representative sample based on probability sampling is often quite expensive. If it isn’t essential that your project be based on probability sampling, many researchers find it more affordable to collect a controlled sample that uses quotas to match to the U.S. census.

The amount of money you have budgeted for your project can also affect other considerations, such as where to find participants. Some online platforms allow researchers to do more of the work in data collection, which lowers overall costs. Other online platforms manage data collection for researchers, which adds to overall costs. How much money you have will influence the decisions you make.

How quickly you need your data will affect not only the total cost of your study, but also your decisions of how to sample. If you need the data quickly, then it doesn’t make sense to adopt a slow strategy like voluntary sampling or face-to-face interviewing.

When researchers need data quickly, they often turn to online sampling sources. The internet makes it possible to run faster and more affordable studies than many other methods of data collection.

The information you’re asking participants to provide may influence how and where you decide to gather data. Specifically, if you are looking for participants to engage in an hour-long task, during which they rate several products and provide detailed responses about each one, then you will probably get the best results from a crowdsourcing platform like Mechanical Turk. Crowdsourcing platforms allow you to control participant compensation, and by paying participants adequately for their time, it is possible to get data from crowdsourcing sites that participants from most online panels would never take the time to provide.

On the other hand, if you are gathering simple survey responses from participants, then there are many platforms that are suited to the type of data you seek to collect.

How might the questions above affect the research decisions we make at SunVac?

First, we know it’s relatively easy to reach our target audience. Any sizeable online panel should have access to adults from around the U.S. and allow us to target married couples.

Second, as a small company, we don’t have a massive budget for research. Because a random sample isn’t necessary for our research questions, we will gather a non-random sample and aim to control for potential sources of bias. For example, we will use quotas in our data collection to ensure we gather data from people of various ethnic and age groups.

Third, we want the data quickly. We know our competitors are close to developing a similar product, and we want to make sure our product hits the market first. As a result, we want to conduct our project within the next two weeks, meaning we should choose a sampling method and source that yield quick data.

Finally, our study asks participants to answer some questions about our product and to tell us which features of different marketing messages are most persuasive. Because our study isn’t too long or too demanding, we can consider a wide range of online panels with which to run our study.

To summarize, we know that most online panels will allow us to sample the people we are interested in, but we need our data quickly and we have a tight budget to stick to. The ideal platform for our project may be something like CloudResearch’s Prime Panels, or if we want to do some of the work ourselves, we might run the study on Mechanical Turk using CloudResearch’s MTurk Toolkit.

Now that we’ve built a sampling plan, we have to decide how many people to sample.

How many people you recruit into your study depends on your goals, the type of study you’re conducting, and how you plan to use your data.

If you’re conducting a survey, as our company, SunVac, is, then you need to consider a few factors when determining sample size. First, how large is the population you’re studying? As the size of the population you seek to understand grows, so does the number of people you need to sample. Our population for the SunVac project is quite large, encompassing nearly all adults in the U.S.

Second, how much inaccuracy are you willing to accept in the results? While your initial reaction may be “none,” it’s important to keep in mind that all sampling entails some margin of error. The question you have to answer is how important it is for your project to minimize the margin of error while balancing the increased costs of gathering a larger sample.

At SunVac, someone on our team has a background in statistical methods. She informs us it would be wise to run a conjoint analysis project asking people to rate the attractiveness of a series of descriptions of vacuum cleaners at different price points and with different features. She explains to us that it will take some time to design the survey itself, but she estimates that for appropriate statistical power to analyze the results among the different market segments we are interested in (region, relationship status, age groups), we will need data from 2,000 potential customers.

Now, you’re ready to find participants. The problem is that there is an overwhelming number of online options to choose from.

Depending on who you want to sample and what you want them to do within your study, online panels and crowdsourcing platforms both offer options for obtaining the sample you are interested in.

Online panels offer access to tens of millions of participants worldwide. When using online panels, researchers can easily target participants based on demographic characteristics, geographic location, psychographics and more. At SunVac, we could easily run our study using an online panel.

In addition to online panels, crowdsourcing platforms like Amazon’s Mechanical Turk are increasingly popular among market researchers. Crowdsourcing platforms give researchers more control over how their study is setup, how communication with participants takes place, and how much participants are compensated. Each of these features can be used to elicit more participant engagement than is typical in online panels.

If we decide at SunVac to conduct our study with an online panel, we will need the ability to collect high-quality data from a diverse sample of 2,000 adults, with a quota for a particular number of men and women who come from different age groups and regions of the country, and are either married or single. This means we will need a platform that allows us to selectively recruit 2,000 vacuum cleaner users for a 15—20 minute survey, and we want to make sure we collect good data from participants who are paying attention.

Ideally, what might happen next for SunVac, and hopefully to you, our reader, is that, in the process of researching how to find the best sample for your needs, you come to this website, read this page, and realize that CloudResearch has what you need. At CloudResearch, we have the ability to connect researchers with samples for nearly any project. In addition, we can provide advice for your data collection or gather the sample for you . Our solutions are tailored to your needs.

Why wait? Reach out today and see how we can help you achieve your research goals. Collect participants via Prime Panels or our MTurk Toolkit by signing up for a CloudResearch account , or ask for our assistance in designing your survey or sampling approach or for help with data collection or analysis today.

Continue Reading: The Online Researcher’s Guide to Sampling

Part 4: Pros and Cons of Different Sampling Methods

Part 1: What Is the Purpose of Sampling in Research?

Part 2: How to Reduce Sampling Bias in Research

Related articles, what is data quality and why is it important.

If you were a researcher studying human behavior 30 years ago, your options for identifying participants for your studies were limited. If you worked at a university, you might be...

How to Identify and Handle Invalid Responses to Online Surveys

As a researcher, you are aware that planning studies, designing materials and collecting data each take a lot of work. So when you get your hands on a new dataset,...

SUBSCRIBE TO RECEIVE UPDATES

2024 grant application form, personal and institutional information.

- Full Name * First Last

- Position/Title *

- Affiliated Academic Institution or Research Organization *

Detailed Research Proposal Questions

- Project Title *

- Research Category * - Antisemitism Islamophobia Both

- Objectives *

- Methodology (including who the targeted participants are) *

- Expected Outcomes *

- Significance of the Study *

Budget and Grant Tier Request

- Requested Grant Tier * - $200 $500 $1000 Applicants requesting larger grants may still be eligible for smaller awards if the full amount requested is not granted.

- Budget Justification *

Research Timeline

- Projected Start Date * MM slash DD slash YYYY Preference will be given to projects that can commence soon, preferably before September 2024.

- Estimated Completion Date * MM slash DD slash YYYY Preference will be given to projects that aim to complete within a year.

- Project Timeline *

- Comments This field is for validation purposes and should be left unchanged.

- Name * First Name Last Name

- I would like to request a demo of the Sentry platform

- Phone This field is for validation purposes and should be left unchanged.

- Name * First name Last name

- Name * First Last

- Name This field is for validation purposes and should be left unchanged.

- Name * First and Last

- Please select the best time to discuss your project goals/details to claim your free Sentry pilot for the next 60 days or to receive 10% off your first Managed Research study with Sentry.

- Email This field is for validation purposes and should be left unchanged.

- Email * Enter Email Confirm Email

- Organization

- Job Title *

Learning Materials

- Business Studies

- Combined Science

- Computer Science

- Engineering

- English Literature

- Environmental Science

- Human Geography

- Macroeconomics

- Microeconomics

- Sampling Plan

Do you like free samples? I do too! Unfortunately, this is not an explanation of free samples, but it's an article about something that sounds quite similar - a sampling plan.

Create learning materials about Sampling Plan with our free learning app!

- Instand access to millions of learning materials

- Flashcards, notes, mock-exams and more

- Everything you need to ace your exams

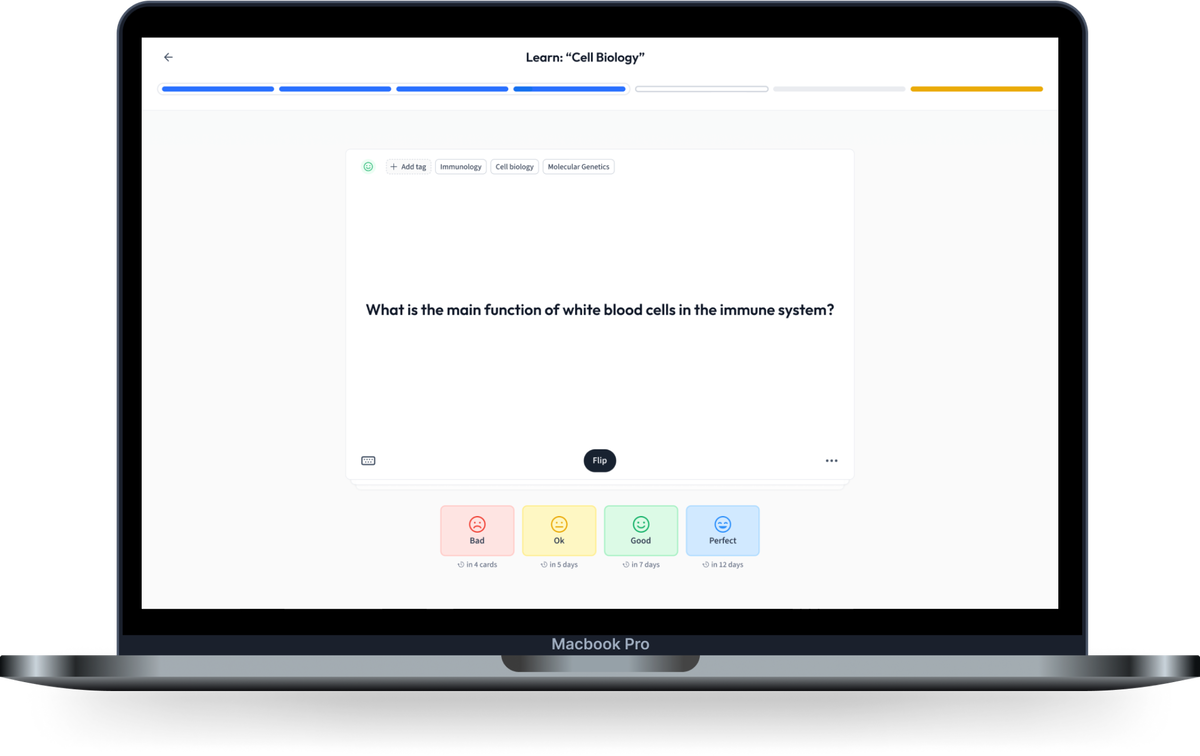

Millions of flashcards designed to help you ace your studies

- Cell Biology

During a sampling plan in research, _____________, ___________, and the sampling procedure are decided.

The researcher selects individuals at a regular interval, for example, every 15th person will be selected for the research. This is

__________ is used when trying to find people with traits that are difficult to trace.

T his involves collecting information from a homogenous group.

The ___________ involves deciding the target population.

The sample size

Steps of a sampling plan:

- Sample definition

- _____________

- Sample design

T his step makes sure that the samples chosen were representative enough and ensures quality data collection.

What are the two types of sampling plans?

Select the probability sampling methods:

What happens in the sample determination stage?

- Customer Driven Marketing Strategy

- Digital Marketing

- Integrated Marketing Communications

- International Marketing

- Introduction to Marketing

- Marketing Campaign Examples

- Marketing Information Management

- Behavioral Targeting

- Customer Relationship Management

- Ethics in Marketing

- Experimental Research

- Focus Groups

- Interview in Research

- Market Calculations

- Market Mapping

- Market Research

- Marketing Analytics

- Marketing Information System

- Marketing KPIs

- Methods of Market Research

- Multi level Marketing

- Neuromarketing

- Observational Research

- Online Focus Groups

- PED and YED

- Primary Market Research

- Research Instrument

- Secondary Market Research

- Survey Research

- Understanding Markets and Customers

- Marketing Management

- Strategic Marketing Planning

This might not be a term you are very familiar with, but it is a significant part of marketing. We know how important research is for marketing. We need to know the target audience to plan a successful marketing campaign, and a sampling plan is essential to make it successful. Wondering how? Keep reading to find out!

Sampling Plan Definition

Knowing the target audience is vital to understanding their needs and wants. Researchers need to study the population to draw conclusions. These conclusions will serve as a basis for constructing a suitable marketing campaign. But observing every person in the selected location is impractical and, at times, impossible. Therefore, researchers select a group of individuals representative of the population. A sampling plan is an outline based on which research is conducted.

A sampling plan outlines the individuals chosen to represent the target population under consideration for research purposes.

It is crucial to verify that the sampling plan is representative of all kinds of people to draw accurate conclusions.

Sampling Plan Research

The sampling plan is an essential part of the implementation phase in market research - it is the first step of implementing market research.

Check out our explanation of market research to find out more.

Researchers decide the sampling unit, size, and procedure when creating a sampling plan.

Deciding the sampling unit involves defining the target population. The area of interest for the research may contain people that may be out of the scope of the research. Therefore, the researcher must first identify the type of people within the research's parameters.

The sample size will specify how many people from the sampling unit will be surveyed or studied. Usually, in realistic cases, the target population is colossal. Analyzing every single individual is an arduous task. Therefore, the researcher must decide which individuals should be considered and how many people to survey.

The sampling procedure decides how the sample size is chosen. Researchers can do this based on both probability sampling methods and non-probability sampling methods. We will talk about this in more detail in the following sections.

Sampling Plan Types

The sampling plan mainly consists of two different types of methods - one based on probability methods and the other based on non-probability methods .

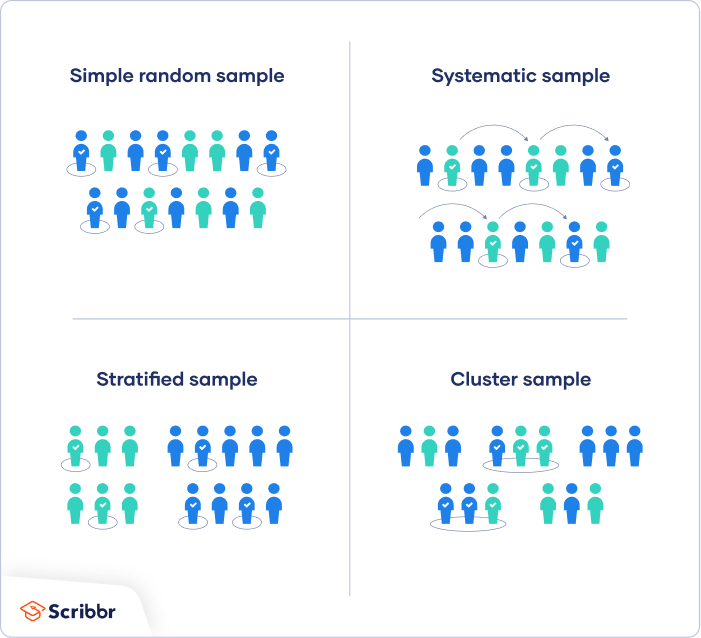

In the probability sampling method, the researcher lists a few criteria and then chooses people randomly from the population. In this method, all people of the population have an equal chance to be selected. The probability methods are further classified into:

1. Simple Random Sampling - as the name suggests, this type of sampling picks individuals randomly from the selection.

2. Cluster Sampling - the whole population gets divided into groups or clusters. Researchers then survey people from the selected clusters.

3. Systematic Sampling - researchers select individuals at a regular interval; for example, the researcher will select every 15th person on the list for interviews.

4. Stratified Sampling - researchers divide the group into smaller subgroups called strata based on their characteristics. Researchers then pick individuals at random from the strata.

Difference between cluster sampling and stratified sampling

In cluster sampling, all individuals are put into different groups, and all people in the selected groups are studied.

In stratified sampling, all the individuals are put into different groups, and some people from all groups are surveyed.

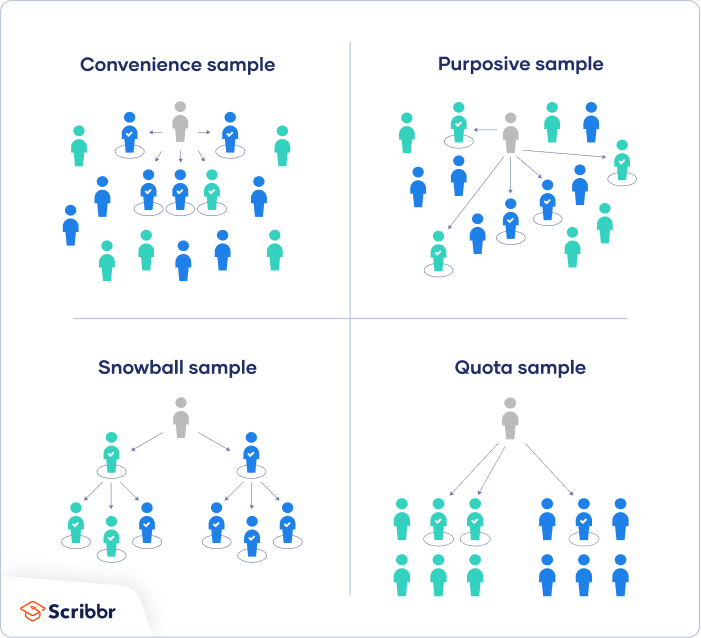

A non-probability method involves choosing people at random without any defined criteria. This means that not everybody has an equal chance of being selected for the survey. N on-probability techniques can be further classified into:

1. Convenience Sampling - this depends on the ease of accessing a person of interest.

2. Judgemental Sampling - also known as purposive sampling, includes selecting people with a particular characteristic that supports the scope of the research.

3. Snowball Sampling - used when trying to find people with traits that are difficult to trace. In such cases, the researcher would find one or two people with the traits and then ask them to refer to people with similar characteristics.

4. Quota Sampling - this involves collecting information from a homogenous group.

Steps of a Sample Plan

A sampling plan helps researchers collect data and get results quicker, as only a group of individuals is selected to be studied instead of the whole population. But how is a sampling plan conducted? What are the steps of a sample plan?

A sampling plan study consists of 5 main steps:

1. Sample Definition - this step involves identifying the research goals or what the research is trying to achieve. Defining the sample will help the researcher identify what they have to look for in the sample.

2. Sample Selection - after the sample definition, researchers now have to obtain a sample frame. The sample frame will give the researchers a list of the population from which the researcher chooses people to sample.

3. Sample Size Determination - the sample size is the number of individuals that will be considered while determining the sampling plan. This step defines the number of individuals that the researcher will survey.

4. Sample Design - in this step, the samples are picked from the population. Researchers can select individuals based on probability or non-probability methods.

5. Sample Assessment - this step ensures that the samples chosen are representative enough of the population and ensures quality data collection.

After these processes are finalized, researchers carry forward with the rest of the research, such as drawing conclusions that form a basis for the marketing campaign.

Probability sampling methods are more complex, costly, and time-consuming than non-probability methods.

Sampling Plans Example

Different methods of sampling plans help to yield different types of data. The sampling plan will depend on the company's research goals and limitations. Given below are a few examples of companies that use different types of sampling plans:

1. Simple Random Sampling - A district manager wants to evaluate employee satisfaction at a store. Now, he would go to the store, pick a few employees randomly, and ask them about their satisfaction. Every employee has an equal chance of being selected by the district manager for the survey.

2. Cluster Sampling - A reputed private school is planning to launch in a different city. To gain a better insight into the city, they divided the population based on families with school-aged kids and people with high incomes. These insights will help them decide if starting a branch in that particular city would be worth it or not.

3. Systematic Sampling - A supermarket with many branches decides to reallocate its staff to improve efficiency. The manager decides that every third person, chosen per their employee number, would be transferred to a different location.

4. Stratified Sampling - A research startup is trying to understand people's sleep patterns based on different age groups. Therefore, the whole sampling unit gets divided into different age groups (or strata), such as 0-3 months, 4-12 months, 1-2 years, 3-5 years, 6-12 years, and so on. Some people from all the groups are studied.

5. Convenience Sampling - An NGO is trying to get people to sign up for a "street-clean" program as part of the Earth Day campaign. They have stationed themselves on the sidewalks of a busy shopping street, and are approaching people who pass them by to try and pursue them to join the program.

6. Judgemental Sampling - A real estate company is trying to determine how the rental price hike affects people. To find the answer to this question, they would only have to consider people that live in rented houses, meaning that people who own a home would be excluded from this survey.

7. Snowball Sampling - A pharmaceutical company is trying to get a list of patients with leukemia. As the company cannot go to hospitals to ask for patients' information, they would first find a couple of patients with the illness and then ask them to refer patients with the same illness.

8. Quota Sampling - Recruiters that want to hire employees with a degree from a particular school will group them into a separate subgroup. This type of selection is called quota selection.

Sampling plan - Key takeaways

- During a sampling plan in research, the sampling unit, the sampling size, and the sampling procedure are determined.

- The sample size will specify how many people from the sampling unit will be surveyed or studied.

- The sampling procedure decides how researchers will select the sample size.

- The methods of probability sampling include simple random, cluster, systematic, and stratified sampling.

- The non-probability sampling plan methods include convenience, judgemental, snowball, and quota sampling.

- Sample definition, sample selection, sample size determination, sample design, and sample assessment are the steps of a sample plan.

Flashcards in Sampling Plan 18

During a sampling plan in research, the sampling unit , the sampling size , and the sampling procedure are decided.

Systematic sampling

Snowball sampling

Quota Sampling

sampling unit

will specify how many people from the sampling unit will be surveyed or studied.

Learn with 18 Sampling Plan flashcards in the free StudySmarter app

We have 14,000 flashcards about Dynamic Landscapes.

Already have an account? Log in

Frequently Asked Questions about Sampling Plan

What is a sample plan in marketing?

Researchers need to study the population to draw conclusions. But observing every person in the selected location is impractical and, at times, impossible. Therefore, researchers select a group of individuals representative of the population. A sampling plan outlines the individuals chosen to represent the target population under consideration for research purposes.

What is a sampling plan and its types?

The sampling plan mainly consists of two different types of methods - one based on probability methods and the other based on non-probability methods. Probability sampling methods include simple random, cluster, systematic, and stratified sampling. The non-probability sampling methods include convenience, judgemental, snowball, and quota sampling.

Why is the sampling plan important?

The sampling plan is an essential part of the implementation phase in market research - it is the first step of implementing market research. Observing every person in the selected location is impractical. Therefore, researchers select a group of individuals representative of the population called the sampling unit. This is outlined in the sampling plan.

What should a marketing plan include?

A good marketing plan should include the target market, the unique selling proposition, SWOT analysis, marketing strategies, the budget, and the duration of the research.

What are the components of a sampling plan?

The sample definition, sample selection, sample size determination, sample design, and sample assessment are the components of a sampling plan.

Test your knowledge with multiple choice flashcards

This involves collecting information from a homogenous group.

The ___________ involves deciding the target population.

Join the StudySmarter App and learn efficiently with millions of flashcards and more!

Keep learning, you are doing great.

Discover learning materials with the free StudySmarter app

About StudySmarter

StudySmarter is a globally recognized educational technology company, offering a holistic learning platform designed for students of all ages and educational levels. Our platform provides learning support for a wide range of subjects, including STEM, Social Sciences, and Languages and also helps students to successfully master various tests and exams worldwide, such as GCSE, A Level, SAT, ACT, Abitur, and more. We offer an extensive library of learning materials, including interactive flashcards, comprehensive textbook solutions, and detailed explanations. The cutting-edge technology and tools we provide help students create their own learning materials. StudySmarter’s content is not only expert-verified but also regularly updated to ensure accuracy and relevance.

StudySmarter Editorial Team

Team Marketing Teachers

- 9 minutes reading time

- Checked by StudySmarter Editorial Team

Study anywhere. Anytime.Across all devices.

Create a free account to save this explanation..

Save explanations to your personalised space and access them anytime, anywhere!

By signing up, you agree to the Terms and Conditions and the Privacy Policy of StudySmarter.

Sign up to highlight and take notes. It’s 100% free.

Join over 22 million students in learning with our StudySmarter App

The first learning app that truly has everything you need to ace your exams in one place

- Flashcards & Quizzes

- AI Study Assistant

- Study Planner

- Smart Note-Taking

Get unlimited access with a free StudySmarter account.

- Instant access to millions of learning materials.

- Flashcards, notes, mock-exams, AI tools and more.

- Everything you need to ace your exams.

Effective Market Research: Sampling Plan Example

Understanding the significance of market research.

Comprehending the profound significance of market research is paramount for businesses aiming for sustained growth and success.

It is fundamental to strategic decision-making, ensuring businesses remain adaptive, competitive, and well-positioned for sustainable success in dynamic markets.

The Role of Market Research in Business Growth

Market research is a critical tool that guides companies toward success by allowing them to understand market dynamics, customer preferences, behaviors, and evolving industry trends.

By understanding their target audience on a deep level, businesses can tailor their products, services, and marketing strategies to resonate with consumers, thereby enhancing customer satisfaction and loyalty.

Essentially, it helps businesses make informed decisions, adapt to market changes, and identify new opportunities, leading to business growth.

Top Benefits of Conducting Quality Market Research

Enhancing customer understanding.

Quality market research dives into the intricacies of consumer behavior, providing nuanced insights into preferences, habits, and purchasing trends. By going beyond surface-level data, businesses can effectively segment their target audience, allowing for the creation of personalized marketing strategies that resonate with specific customer groups.

Additionally, through methodologies such as surveys or interviews, businesses gather valuable feedback, enabling them to address customer concerns promptly and improve overall satisfaction.

Mitigating Risks

Thorough market research includes a comprehensive analysis of competitors, uncovering their strategies, strengths, and weaknesses. This competitive intelligence is instrumental in mitigating risks by helping businesses anticipate challenges and respond proactively.

Market trend forecasting allows businesses to stay ahead of consumer behavior and preference shifts while staying informed about regulatory changes. This reduces the risk of non-compliance and associated penalties.

Supporting Strategic Planning

Quality market research serves as the cornerstone of data-driven decision-making. By providing a rich dataset, businesses can formulate effective strategic plans based on accurate and relevant information.

Conducting a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) enables businesses to identify internal and external factors affecting their operations, guiding strategic decisions.

When considering new markets or product launches, market research helps develop entry strategies, minimizing uncertainties and maximizing the potential for success.

Improving Competitiveness

Market research aids businesses in identifying their Unique Selling Proposition (USP) by understanding what sets them apart from competitors.

Benchmarking against industry standards allows businesses to set realistic goals and continually improve their performance compared to competitors.

Furthermore, the ability to adapt to market dynamics by staying informed about industry changes positions businesses to maintain a competitive edge in the marketplace.

Ready to get started?

Key components of a market research sampling plan.

- Define your target population

- Determine the optimal sample size

- Select a sampling method that aligns with your research objectives and unique audience

Defining the Target Population for Your Sampling Plan

Identifying the right target population is crucial to the success of your market research initiative. A nuanced understanding of your customer base is essential, encompassing not only who they are but also their behaviors, preferences, and needs.

This involves a comprehensive analysis of demographic factors, such as age, gender, income, and geographic location, as well as psychographic elements, including lifestyles, interests, and values.

By dissecting and categorizing your audience in these terms, you gain a clearer picture of the specific segments that are most relevant to your research. This approach ensures that the data collected is accurate and directly applicable to the areas of your business that matter most.

Ultimately, defining the target population is akin to laying the groundwork for precise and actionable insights, allowing you to tailor your market research efforts to the pulse of your customer base.

Deciding on the Appropriate Sample Size

Deciding on the right sample size is a delicate balance that directly influences the reliability and cost-effectiveness of your market research.

Achieving statistical significance is paramount, ensuring the data collected accurately reflects patterns within the broader target population. However, it’s equally crucial to strike a balance to avoid overextending resources.

The chosen sample size should be substantial enough to capture the diversity and nuances of the target population, minimizing the risk of skewed or misleading results. At the same time, optimization is key to managing costs and streamlining efforts efficiently.

A carefully selected sample size not only enhances the precision of your findings but also allows for a more focused allocation of resources, maximizing the impact of your research endeavors.

This thoughtful approach to sample size determination is instrumental in ensuring that your market research meets the highest standards of statistical rigor and remains practical and resource-efficient.

Check out our market research sample calculator if you need help determining your sample size.

Selecting the Right Sampling Method for Your Research

Choosing the right sampling technique for your market research project is vital. Several key considerations must be considered to make an informed choice:

Research Goal

Begin by determining whether you require results that need to be generalized. If you do, probability sampling methods are your best choice.

If your research focuses on exploratory or qualitative insights, non-probability methods may be more suitable.

Resource Availability

Evaluate your available resources, including time, budget, and expertise.

Keep in mind that some sampling methods are more labor-intensive or costly than others.

Population Characteristics

Consider the specific attributes and characteristics of your target population. Are there distinct subgroups within the population that warrant individual study? Assess whether you have access to the entire population or only a part of it.

Sampling methods are fundamentally categorized into two main branches: probability-based and non-probability sampling.

Probability Sample

Probability sampling is a method in which each member of the target population has a known, non-zero chance of being selected for the sample. This means that every element in the population has a quantifiable likelihood of inclusion.

Probability sampling methods are designed to be objective and free from bias, providing a solid foundation for generalizing research findings to the entire population.

Some common probability sampling techniques used in market research include:

- Simple random sampling

- Stratified sampling

- Systematic sampling

- Cluster sampling

These methods ensure that every element in the population has an equal or known probability of being part of the sample, making it possible to draw statistically valid inferences and make accurate generalizations about the population as a whole.

Non-Probability Sample

Non-probability sampling is a method where the likelihood of any particular member of the target population being included in the sample is unknown and not quantifiable.

Non-probability sampling methods are typically used when it’s challenging or impractical to establish a precise probability of selection for each element in the population. These methods are often more subjective and may involve the researcher’s judgment or convenience in selecting sample members.

Some common non-probability sampling techniques in market research include:

- Convenience sampling

- Judgmental or purposive sampling

- Quota sampling

- Snowball sampling

Non-probability samples are generally more accessible and cost-effective, but their findings are typically less generalizable to the entire population.

Best Practices for Conducting Effective Quantitative Market Research

Engaging in effective market research involves a commitment to a set of best practices that not only meet regulatory standards but elevate the overall quality and impact of the research efforts.

By utilizing them collectively, they contribute to the robustness of market research, enabling businesses to gather insights that are not only legally sound but also strategically valuable in informing key decisions.

Approaching Market Research Ethically

Ethical considerations are not just regulatory requirements but integral components that underscore the reliability and integrity of your market research.

Prioritizing informed consent and safeguarding data privacy are paramount. Transparent communication about the purpose and implications of the research builds trust with respondents, fostering a positive relationship that, in turn, enhances the quality of data collected.

Adhering to ethical practices is not only a legal obligation but a strategic choice that elevates the ethical standing of your research endeavors.

Involving Diverse Groups in Your Sample Selection

The inclusivity of your sample selection is a key factor in ensuring the relevance and reliability of your research findings.

By intentionally incorporating diverse groups that mirror the entire target market, you capture a broader spectrum of perspectives, behaviors, and preferences.

This approach leads to more comprehensive and actionable insights, allowing your market research to transcend biases and offer a more accurate representation of the varied dynamics within your audience.

Ensuring Data Accuracy and Validity

The success of any market research endeavor hinges on the accuracy and validity of the collected data. Rigorous data collection and analysis methodologies are essential to maintain the integrity of the research findings.

Continuous review and refinement of these processes further enhance data quality. By consistently validating and cross-referencing data points, businesses can ensure that the insights derived from the research are reliable and can be confidently used to inform strategic decisions.

The commitment to data accuracy is foundational to the overall effectiveness of your market research initiatives.

Market Research Sample Plan Example

A quality sample plan should have the following information:

Recap of Project Specifications

The project specifications that have been determined should be recapped, including the following components:

- Target Audience

- Incidence Rate (IR)

- Length of Interview (LOI)

- Sample Size (N)

- Targetable Quotas

- Non-Targetable Quotas

- Device Type Allowed

- Survey Languages

Sample Costs and Feasibility

A quality sample plan should also contain a breakdown of feasibility and costs. These costs can include the sample cost and any additional costs like programming, hosting, etc.

One aspect that should be included is a breakdown of the sample providers being used. If your sample provider does not provide that information, ask them for it.

Additional Notes

There should also be a section with any additional notes relevant to the study.

Want a real example of a sample plan?

Sample aggregating versus sample blending.

There have been many changes in the industry over the last decade, from industry consolidation to technological advancements and more. All of the changes have led to a shift in market researchers using multiple sample sources in their sample plans.

There are two main ways of utilizing multiple sample sources in a sample plan: Sample Aggregating and Sample Blending.

Sample Aggregating

Sample aggregating is when multiple suppliers are used because a single sample source cannot provide all the completes needed for a particular study.

Other sample sources are added at the end of the study to gather the rest of the required completes.

There is no magic number of sample sources added with this method; sources are added until the needed feasibility is achieved. This method can lead to duplication and sample bias.

Sample Blending

Sample blending is the process of using multiple suppliers, usually three or more, and setting limits on the number of completes each panel can get.

Strategic Sample Blending

Strategic sample blending takes sample blending to the next level.

It is the best sample design to ensure confident business decisions. It is blending three or more sample providers. Still, the selection and blending of the selected providers is done in an intentional and controlled manner.

Providers are selected to complement one another while reducing the overall sample bias and any potential behavior or attitudinal impacts a panel can have. This method ensures that sample blending isn’t done simply for blending’s sake.

Utilizing EMI’s strategic methodology, we build customized blends that best meet clients’ needs while ensuring the best results possible.

Additionally, by strategically selecting providers and managing their allocation, you increase overall feasibility while avoiding “top-up” situations and panel bias, both of which can skew your data.

IntelliBlend

IntelliBlend® is EMI’s patented methodology of strategically blending sample sources in an intentional and controlled approach to deliver the most representative and accurate demographic, behavioral, and attitudinal data. This approach includes double opt-in research panels but may also include non-traditional sources such as social media, which is utilized in a limited and controlled manner. IntelliBlend® can vary from project to project based on the research needs. Each project’s unique blend is developed by leveraging proprietary research-on-research data and over 20 years of sample experience.

EMI’s Approach to Sampling

Founded in 1999, EMI has been a leader in online sample and strategic sample blending for over 20 years. We have been a sample consultancy since not only our inception but since the infancy of online sample.

Over the years, we have developed a knowledge of the sample industry that is unrivaled when combined with our transparent strategic sample blending approach. We have built this knowledge by not only working with panel partners throughout the industry but also conducting research-on-research into the online sample industry for more than a decade to understand the differences between consumer panels and how they change over time.

This unparalleled industry knowledge is the driver to providing transparent sample consulting and advice to our clients that emphasizes what is right for their research and not what is right for any specific panel.

EMI’s Panel Network

EMI has built a global network of sample partners that gives you access to one of the highest quality pools of respondents of varying demographic, socio-economic, geographical, behavioral, and psychographic characteristics. EMI can create strategic sample blends that best fit your study and provide you with high-quality, deep insights needed to make better business decisions.

Every market research sample panel in our network has passed our rigorous Partner Assessment Process so we can best understand the recruiting methods, validation process, and other data quality measures they have in place, as well as the ins and outs of their panel. Our strict vetting process ensures we only allow the best sample providers into our network and maintain high data quality for our clients.

Get started today.

Privacy overview.

6.3 Steps in a Successful Marketing Research Plan

Learning outcomes.

By the end of this section, you will be able to:

- 1 Identify and describe the steps in a marketing research plan.

- 2 Discuss the different types of data research.

- 3 Explain how data is analyzed.

- 4 Discuss the importance of effective research reports.

Define the Problem

There are seven steps to a successful marketing research project (see Figure 6.3 ). Each step will be explained as we investigate how a marketing research project is conducted.

The first step, defining the problem, is often a realization that more information is needed in order to make a data-driven decision. Problem definition is the realization that there is an issue that needs to be addressed. An entrepreneur may be interested in opening a small business but must first define the problem that is to be investigated. A marketing research problem in this example is to discover the needs of the community and also to identify a potentially successful business venture.

Many times, researchers define a research question or objectives in this first step. Objectives of this research study could include: identify a new business that would be successful in the community in question, determine the size and composition of a target market for the business venture, and collect any relevant primary and secondary data that would support such a venture. At this point, the definition of the problem may be “Why are cat owners not buying our new cat toy subscription service?”

Additionally, during this first step we would want to investigate our target population for research. This is similar to a target market, as it is the group that comprises the population of interest for the study. In order to have a successful research outcome, the researcher should start with an understanding of the problem in the current situational environment.

Develop the Research Plan

Step two is to develop the research plan. What type of research is necessary to meet the established objectives of the first step? How will this data be collected? Additionally, what is the time frame of the research and budget to consider? If you must have information in the next week, a different plan would be implemented than in a situation where several months were allowed. These are issues that a researcher should address in order to meet the needs identified.

Research is often classified as coming from one of two types of data: primary and secondary. Primary data is unique information that is collected by the specific researcher with the current project in mind. This type of research doesn’t currently exist until it is pulled together for the project. Examples of primary data collection include survey, observation, experiment, or focus group data that is gathered for the current project.

Secondary data is any research that was completed for another purpose but can be used to help inform the research process. Secondary data comes in many forms and includes census data, journal articles, previously collected survey or focus group data of related topics, and compiled company data. Secondary data may be internal, such as the company’s sales records for a previous quarter, or external, such as an industry report of all related product sales. Syndicated data , a type of external secondary data, is available through subscription services and is utilized by many marketers. As you can see in Table 6.1 , primary and secondary data features are often opposite—the positive aspects of primary data are the negative side of secondary data.

There are four research types that can be used: exploratory, descriptive, experimental, and ethnographic research designs (see Figure 6.4 ). Each type has specific formats of data that can be collected. Qualitative research can be shared through words, descriptions, and open-ended comments. Qualitative data gives context but cannot be reduced to a statistic. Qualitative data examples are categorical and include case studies, diary accounts, interviews, focus groups, and open-ended surveys. By comparison, quantitative data is data that can be reduced to number of responses. The number of responses to each answer on a multiple-choice question is quantitative data. Quantitative data is numerical and includes things like age, income, group size, and height.

Exploratory research is usually used when additional general information in desired about a topic. When in the initial steps of a new project, understanding the landscape is essential, so exploratory research helps the researcher to learn more about the general nature of the industry. Exploratory research can be collected through focus groups, interviews, and review of secondary data. When examining an exploratory research design, the best use is when your company hopes to collect data that is generally qualitative in nature. 7

For instance, if a company is considering a new service for registered users but is not quite sure how well the new service will be received or wants to gain clarity of exactly how customers may use a future service, the company can host a focus group. Focus groups and interviews will be examined later in the chapter. The insights collected during the focus group can assist the company when designing the service, help to inform promotional campaign options, and verify that the service is going to be a viable option for the company.

Descriptive research design takes a bigger step into collection of data through primary research complemented by secondary data. Descriptive research helps explain the market situation and define an “opinion, attitude, or behavior” of a group of consumers, employees, or other interested groups. 8 The most common method of deploying a descriptive research design is through the use of a survey. Several types of surveys will be defined later in this chapter. Descriptive data is quantitative in nature, meaning the data can be distilled into a statistic, such as in a table or chart.

Again, descriptive data is helpful in explaining the current situation. In the opening example of LEGO , the company wanted to describe the situation regarding children’s use of its product. In order to gather a large group of opinions, a survey was created. The data that was collected through this survey allowed the company to measure the existing perceptions of parents so that alterations could be made to future plans for the company.

Experimental research , also known as causal research , helps to define a cause-and-effect relationship between two or more factors. This type of research goes beyond a correlation to determine which feature caused the reaction. Researchers generally use some type of experimental design to determine a causal relationship. An example is A/B testing, a situation where one group of research participants, group A, is exposed to one treatment and then compared to the group B participants, who experience a different situation. An example might be showing two different television commercials to a panel of consumers and then measuring the difference in perception of the product. Another example would be to have two separate packaging options available in different markets. This research would answer the question “Does one design sell better than the other?” Comparing that to the sales in each market would be part of a causal research study. 9

The final method of collecting data is through an ethnographic design. Ethnographic research is conducted in the field by watching people interact in their natural environment. For marketing research, ethnographic designs help to identify how a product is used, what actions are included in a selection, or how the consumer interacts with the product. 10

Examples of ethnographic research would be to observe how a consumer uses a particular product, such as baking soda. Although many people buy baking soda, its uses are vast. So are they using it as a refrigerator deodorizer, a toothpaste, to polish a belt buckle, or to use in baking a cake?

Select the Data Collection Method

Data collection is the systematic gathering of information that addresses the identified problem. What is the best method to do that? Picking the right method of collecting data requires that the researcher understand the target population and the design picked in the previous step. There is no perfect method; each method has both advantages and disadvantages, so it’s essential that the researcher understand the target population of the research and the research objectives in order to pick the best option.

Sometimes the data desired is best collected by watching the actions of consumers. For instance, how many cars pass a specific billboard in a day? What website led a potential customer to the company’s website? When are consumers most likely to use the snack vending machines at work? What time of day has the highest traffic on a social media post? What is the most streamed television program this week? Observational research is the collecting of data based on actions taken by those observed. Many data observations do not require the researched individuals to participate in the data collection effort to be highly valuable. Some observation requires an individual to watch and record the activities of the target population through personal observations .

Unobtrusive observation happens when those being observed aren’t aware that they are being watched. An example of an unobtrusive observation would be to watch how shoppers interact with a new stuffed animal display by using a one-way mirror. Marketers can identify which products were handled more often while also determining which were ignored.

Other methods can use technology to collect the data instead. Instances of mechanical observation include the use of vehicle recorders, which count the number of vehicles that pass a specific location. Computers can also assess the number of shoppers who enter a store, the most popular entry point for train station commuters, or the peak time for cars to park in a parking garage.

When you want to get a more in-depth response from research participants, one method is to complete a one-on-one interview . One-on-one interviews allow the researcher to ask specific questions that match the respondent’s unique perspective as well as follow-up questions that piggyback on responses already completed. An interview allows the researcher to have a deeper understanding of the needs of the respondent, which is another strength of this type of data collection. The downside of personal interviews it that a discussion can be very time-consuming and results in only one respondent’s answers. Therefore, in order to get a large sample of respondents, the interview method may not be the most efficient method.

Taking the benefits of an interview and applying them to a small group of people is the design of a focus group . A focus group is a small number of people, usually 8 to 12, who meet the sample requirements. These individuals together are asked a series of questions where they are encouraged to build upon each other’s responses, either by agreeing or disagreeing with the other group members. Focus groups are similar to interviews in that they allow the researcher, through a moderator, to get more detailed information from a small group of potential customers (see Figure 6.5 ).

Link to Learning

Focus groups.

Focus groups are a common method for gathering insights into consumer thinking and habits. Companies will use this information to develop or shift their initiatives. The best way to understand a focus group is to watch a few examples or explanations. TED-Ed has this video that explains how focus groups work.

You might be asking when it is best to use a focus group or a survey. Learn the differences, the pros and cons of each, and the specific types of questions you ask in both situations in this article .

Preparing for a focus group is critical to success. It requires knowing the material and questions while also managing the group of people. Watch this video to learn more about how to prepare for a focus group and the types of things to be aware of.

One of the benefits of a focus group over individual interviews is that synergy can be generated when a participant builds on another’s ideas. Additionally, for the same amount of time, a researcher can hear from multiple respondents instead of just one. 11 Of course, as with every method of data collection, there are downsides to a focus group as well. Focus groups have the potential to be overwhelmed by one or two aggressive personalities, and the format can discourage more reserved individuals from speaking up. Finally, like interviews, the responses in a focus group are qualitative in nature and are difficult to distill into an easy statistic or two.

Combining a variety of questions on one instrument is called a survey or questionnaire . Collecting primary data is commonly done through surveys due to their versatility. A survey allows the researcher to ask the same set of questions of a large group of respondents. Response rates of surveys are calculated by dividing the number of surveys completed by the total number attempted. Surveys are flexible and can collect a variety of quantitative and qualitative data. Questions can include simplified yes or no questions, select all that apply, questions that are on a scale, or a variety of open-ended types of questions. There are four types of surveys (see Table 6.2 ) we will cover, each with strengths and weaknesses defined.

Let’s start off with mailed surveys —surveys that are sent to potential respondents through a mail service. Mailed surveys used to be more commonly used due to the ability to reach every household. In some instances, a mailed survey is still the best way to collect data. For example, every 10 years the United States conducts a census of its population (see Figure 6.6 ). The first step in that data collection is to send every household a survey through the US Postal Service (USPS). The benefit is that respondents can complete and return the survey at their convenience. The downside of mailed surveys are expense and timeliness of responses. A mailed survey requires postage, both when it is sent to the recipient and when it is returned. That, along with the cost of printing, paper, and both sending and return envelopes, adds up quickly. Additionally, physically mailing surveys takes time. One method of reducing cost is to send with bulk-rate postage, but that slows down the delivery of the survey. Also, because of the convenience to the respondent, completed surveys may be returned several weeks after being sent. Finally, some mailed survey data must be manually entered into the analysis software, which can cause delays or issues due to entry errors.

Phone surveys are completed during a phone conversation with the respondent. Although the traditional phone survey requires a data collector to talk with the participant, current technology allows for computer-assisted voice surveys or surveys to be completed by asking the respondent to push a specific button for each potential answer. Phone surveys are time intensive but allow the respondent to ask questions and the surveyor to request additional information or clarification on a question if warranted. Phone surveys require the respondent to complete the survey simultaneously with the collector, which is a limitation as there are restrictions for when phone calls are allowed. According to Telephone Consumer Protection Act , approved by Congress in 1991, no calls can be made prior to 8:00 a.m. or after 9:00 p.m. in the recipient’s time zone. 12 Many restrictions are outlined in this original legislation and have been added to since due to ever-changing technology.

In-person surveys are when the respondent and data collector are physically in the same location. In-person surveys allow the respondent to share specific information, ask questions of the surveyor, and follow up on previous answers. Surveys collected through this method can take place in a variety of ways: through door-to-door collection, in a public location, or at a person’s workplace. Although in-person surveys are time intensive and require more labor to collect data than some other methods, in some cases it’s the best way to collect the required data. In-person surveys conducted through a door-to-door method is the follow-up used for the census if respondents do not complete the mailed survey. One of the downsides of in-person surveys is the reluctance of potential respondents to stop their current activity and answer questions. Furthermore, people may not feel comfortable sharing private or personal information during a face-to-face conversation.

Electronic surveys are sent or collected through digital means and is an opportunity that can be added to any of the above methods as well as some new delivery options. Surveys can be sent through email, and respondents can either reply to the email or open a hyperlink to an online survey (see Figure 6.7 ). Additionally, a letter can be mailed that asks members of the survey sample to log in to a website rather than to return a mailed response. Many marketers now use links, QR codes, or electronic devices to easily connect to a survey. Digitally collected data has the benefit of being less time intensive and is often a more economical way to gather and input responses than more manual methods. A survey that could take months to collect through the mail can be completed within a week through digital means.

Design the Sample

Although you might want to include every possible person who matches your target market in your research, it’s often not a feasible option, nor is it of value. If you did decide to include everyone, you would be completing a census of the population. Getting everyone to participate would be time-consuming and highly expensive, so instead marketers use a sample , whereby a portion of the whole is included in the research. It’s similar to the samples you might receive at the grocery store or ice cream shop; it isn’t a full serving, but it does give you a good taste of what the whole would be like.

So how do you know who should be included in the sample? Researchers identify parameters for their studies, called sample frames . A sample frame for one study may be college students who live on campus; for another study, it may be retired people in Dallas, Texas, or small-business owners who have fewer than 10 employees. The individual entities within the sampling frame would be considered a sampling unit . A sampling unit is each individual respondent that would be considered as matching the sample frame established by the research. If a researcher wants businesses to participate in a study, then businesses would be the sampling unit in that case.

The number of sampling units included in the research is the sample size . Many calculations can be conducted to indicate what the correct size of the sample should be. Issues to consider are the size of the population, the confidence level that the data represents the entire population, the ease of accessing the units in the frame, and the budget allocated for the research.

There are two main categories of samples: probability and nonprobability (see Figure 6.8 ). Probability samples are those in which every member of the sample has an identified likelihood of being selected. Several probability sample methods can be utilized. One probability sampling technique is called a simple random sample , where not only does every person have an identified likelihood of being selected to be in the sample, but every person also has an equal chance of exclusion. An example of a simple random sample would be to put the names of all members of a group into a hat and simply draw out a specific number to be included. You could say a raffle would be a good example of a simple random sample.

Another probability sample type is a stratified random sample , where the population is divided into groups by category and then a random sample of each category is selected to participate. For instance, if you were conducting a study of college students from your school and wanted to make sure you had all grade levels included, you might take the names of all students and split them into different groups by grade level—freshman, sophomore, junior, and senior. Then, from those categories, you would draw names out of each of the pools, or strata.

A nonprobability sample is a situation in which each potential member of the sample has an unknown likelihood of being selected in the sample. Research findings that are from a nonprobability sample cannot be applied beyond the sample. Several examples of nonprobability sampling are available to researchers and include two that we will look at more closely: convenience sampling and judgment sampling.

The first nonprobability sampling technique is a convenience sample . Just like it sounds, a convenience sample is when the researcher finds a group through a nonscientific method by picking potential research participants in a convenient manner. An example might be to ask other students in a class you are taking to complete a survey that you are doing for a class assignment or passing out surveys at a basketball game or theater performance.

A judgment sample is a type of nonprobability sample that allows the researcher to determine if they believe the individual meets the criteria set for the sample frame to complete the research. For instance, you may be interested in researching mothers, so you sit outside a toy store and ask an individual who is carrying a baby to participate.

Collect the Data

Now that all the plans have been established, the instrument has been created, and the group of participants has been identified, it is time to start collecting data. As explained earlier in this chapter, data collection is the process of gathering information from a variety of sources that will satisfy the research objectives defined in step one. Data collection can be as simple as sending out an email with a survey link enclosed or as complex as an experiment with hundreds of consumers. The method of collection directly influences the length of this process. Conducting personal interviews or completing an experiment, as previously mentioned, can add weeks or months to the research process, whereas sending out an electronic survey may allow a researcher to collect the necessary data in a few days. 13

Analyze and Interpret the Data

Once the data has been collected, the process of analyzing it may begin. Data analysis is the distillation of the information into a more understandable and actionable format. The analysis itself can take many forms, from the use of basic statistics to a more comprehensive data visualization process. First, let’s discuss some basic statistics that can be used to represent data.

The first is the mean of quantitative data. A mean is often defined as the arithmetic average of values. The formula is:

A common use of the mean calculation is with exam scores. Say, for example, you have earned the following scores on your marketing exams: 72, 85, 68, and 77. To find the mean, you would add up the four scores for a total of 302. Then, in order to generate a mean, that number needs to be divided by the number of exam scores included, which is 4. The mean would be 302 divided by 4, for a mean test score of 75.5. Understanding the mean can help to determine, with one number, the weight of a particular value.

Another commonly used statistic is median. The median is often referred to as the middle number. To generate a median, all the numeric answers are placed in order, and the middle number is the median. Median is a common statistic when identifying the income level of a specific geographic region. 14 For instance, the median household income for Albuquerque, New Mexico, between 2015 and 2019 was $52,911. 15 In this case, there are just as many people with an income above the amount as there are below.

Mode is another statistic that is used to represent data of all types, as it can be used with quantitative or qualitative data and represents the most frequent answer. Eye color, hair color, and vehicle color can all be presented with a mode statistic. Additionally, some researchers expand on the concept of mode and present the frequency of all responses, not just identifying the most common response. Data such as this can easily be presented in a frequency graph, 16 such as the one in Figure 6.9 .

Additionally, researchers use other analyses to represent the data rather than to present the entirety of each response. For example, maybe the relationship between two values is important to understand. In this case, the researcher may share the data as a cross tabulation (see Figure 6.10 ). Below is the same data as above regarding social media use cross tabulated with gender—as you can see, the data is more descriptive when you can distinguish between the gender identifiers and how much time is spent per day on social media.

Not all data can be presented in a graphical format due to the nature of the information. Sometimes with qualitative methods of data collection, the responses cannot be distilled into a simple statistic or graph. In that case, the use of quotations, otherwise known as verbatims , can be used. These are direct statements presented by the respondents. Often you will see a verbatim statement when reading a movie or book review. The critic’s statements are used in part or in whole to represent their feelings about the newly released item.

Infographics

As they say, a picture is worth a thousand words. For this reason, research results are often shown in a graphical format in which data can be taken in quickly, called an infographic .

Check out this infographic on what components make for a good infographic. As you can see, a good infographic needs four components: data, design, a story, and the ability to share it with others. Without all four pieces, it is not as valuable a resource as it could be. The ultimate infographic is represented as the intersection of all four.

Infographics are particularly advantageous online. Refer to this infographic on why they are beneficial to use online .

Prepare the Research Report

The marketing research process concludes by sharing the generated data and makes recommendations for future actions. What starts as simple data must be interpreted into an analysis. All information gathered should be conveyed in order to make decisions for future marketing actions. One item that is often part of the final step is to discuss areas that may have been missed with the current project or any area of further study identified while completing it. Without the final step of the marketing research project, the first six steps are without value. It is only after the information is shared, through a formal presentation or report, that those recommendations can be implemented and improvements made. The first six steps are used to generate information, while the last is to initiate action. During this last step is also when an evaluation of the process is conducted. If this research were to be completed again, how would we do it differently? Did the right questions get answered with the survey questions posed to the respondents? Follow-up on some of these key questions can lead to additional research, a different study, or further analysis of data collected.

Methods of Quantifying Marketing Research

One of the ways of sharing information gained through marketing research is to quantify the research . Quantifying the research means to take a variety of data and compile into a quantity that is more easily understood. This is a simple process if you want to know how many people attended a basketball game, but if you want to quantify the number of students who made a positive comment on a questionnaire, it can be a little more complicated. Researchers have a variety of methods to collect and then share these different scores. Below are some of the most common types used in business.

Is a customer aware of a product, brand, or company? What is meant by awareness? Awareness in the context of marketing research is when a consumer is familiar with the product, brand, or company. It does not assume that the consumer has tried the product or has purchased it. Consumers are just aware. That is a measure that many businesses find valuable. There are several ways to measure awareness. For instance, the first type of awareness is unaided awareness . This type of awareness is when no prompts for a product, brand, or company are given. If you were collecting information on fast-food restaurants, you might ask a respondent to list all the fast-food restaurants that serve a chicken sandwich. Aided awareness would be providing a list of products, brands, or companies and the respondent selects from the list. For instance, if you give a respondent a list of fast-food restaurants and ask them to mark all the locations with a chicken sandwich, you are collecting data through an aided method. Collecting these answers helps a company determine how the business location compares to those of its competitors. 17

Customer Satisfaction (CSAT)

Have you ever been asked to complete a survey at the end of a purchase? Many businesses complete research on buying, returning, or other customer service processes. A customer satisfaction score , also known as CSAT, is a measure of how satisfied customers are with the product, brand, or service. A CSAT score is usually on a scale of 0 to 100 percent. 18 But what constitutes a “good” CSAT score? Although what is identified as good can vary by industry, normally anything in the range from 75 to 85 would be considered good. Of course, a number higher than 85 would be considered exceptional. 19

Customer Acquisition Cost (CAC) and Customer Effort Score (CES)

Other metrics often used are a customer acquisition cost (CAC) and customer effort score (CES). How much does it cost a company to gain customers? That’s the purpose of calculating the customer acquisition cost. To calculate the customer acquisition cost , a company would need to total all expenses that were accrued to gain new customers. This would include any advertising, public relations, social media postings, etc. When a total cost is determined, it is divided by the number of new customers gained through this campaign.