Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- Product Demos

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

Market research definition

Market research – in-house or outsourced, market research in the age of data, when to use market research.

- Types of market research

Different types of primary research

How to do market research (primary data), how to do secondary market research, communicating your market research findings, choose the right platform for your market research, try qualtrics for free, the ultimate guide to market research: how to conduct it like a pro.

27 min read Wondering how to do market research? Or even where to start learning about it? Use our ultimate guide to understand the basics and discover how you can use market research to help your business.

Market research is the practice of gathering information about the needs and preferences of your target audience – potential consumers of your product.

When you understand how your target consumer feels and behaves, you can then take steps to meet their needs and mitigate the risk of an experience gap – where there is a shortfall between what a consumer expects you to deliver and what you actually deliver. Market research can also help you keep abreast of what your competitors are offering, which in turn will affect what your customers expect from you.

Market research connects with every aspect of a business – including brand , product , customer service , marketing and sales.

Market research generally focuses on understanding:

- The consumer (current customers, past customers, non-customers, influencers))

- The company (product or service design, promotion, pricing, placement, service, sales)

- The competitors (and how their market offerings interact in the market environment)

- The industry overall (whether it’s growing or moving in a certain direction)

Free eBook: 2024 market research trends report

Why is market research important?

A successful business relies on understanding what like, what they dislike, what they need and what messaging they will respond to. Businesses also need to understand their competition to identify opportunities to differentiate their products and services from other companies.

Today’s business leaders face an endless stream of decisions around target markets, pricing, promotion, distribution channels, and product features and benefits . They must account for all the factors involved, and there are market research studies and methodologies strategically designed to capture meaningful data to inform every choice. It can be a daunting task.

Market research allows companies to make data-driven decisions to drive growth and innovation.

What happens when you don’t do market research?

Without market research, business decisions are based at best on past consumer behavior, economic indicators, or at worst, on gut feel. Decisions are made in a bubble without thought to what the competition is doing. An important aim of market research is to remove subjective opinions when making business decisions. As a brand you are there to serve your customers, not personal preferences within the company. You are far more likely to be successful if you know the difference, and market research will help make sure your decisions are insight-driven.

Traditionally there have been specialist market researchers who are very good at what they do, and businesses have been reliant on their ability to do it. Market research specialists will always be an important part of the industry, as most brands are limited by their internal capacity, expertise and budgets and need to outsource at least some aspects of the work.

However, the market research external agency model has meant that brands struggled to keep up with the pace of change. Their customers would suffer because their needs were not being wholly met with point-in-time market research.

Businesses looking to conduct market research have to tackle many questions –

- Who are my consumers, and how should I segment and prioritize them?

- What are they looking for within my category?

- How much are they buying, and what are their purchase triggers, barriers, and buying habits?

- Will my marketing and communications efforts resonate?

- Is my brand healthy ?

- What product features matter most?

- Is my product or service ready for launch?

- Are my pricing and packaging plans optimized?

They all need to be answered, but many businesses have found the process of data collection daunting, time-consuming and expensive. The hardest battle is often knowing where to begin and short-term demands have often taken priority over longer-term projects that require patience to offer return on investment.

Today however, the industry is making huge strides, driven by quickening product cycles, tighter competition and business imperatives around more data-driven decision making. With the emergence of simple, easy to use tools , some degree of in-house market research is now seen as essential, with fewer excuses not to use data to inform your decisions. With greater accessibility to such software, everyone can be an expert regardless of level or experience.

How is this possible?

The art of research hasn’t gone away. It is still a complex job and the volume of data that needs to be analyzed is huge. However with the right tools and support, sophisticated research can look very simple – allowing you to focus on taking action on what matters.

If you’re not yet using technology to augment your in-house market research, now is the time to start.

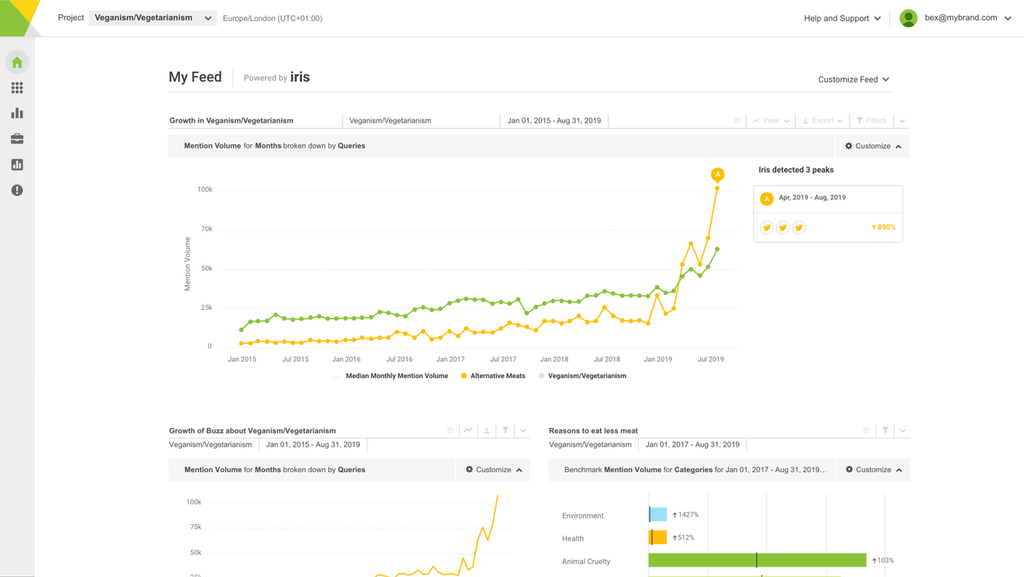

The most successful brands rely on multiple sources of data to inform their strategy and decision making, from their marketing segmentation to the product features they develop to comments on social media. In fact, there’s tools out there that use machine learning and AI to automate the tracking of what’s people are saying about your brand across all sites.

The emergence of newer and more sophisticated tools and platforms gives brands access to more data sources than ever and how the data is analyzed and used to make decisions. This also increases the speed at which they operate, with minimal lead time allowing brands to be responsive to business conditions and take an agile approach to improvements and opportunities.

Expert partners have an important role in getting the best data, particularly giving access to additional market research know-how, helping you find respondents , fielding surveys and reporting on results.

How do you measure success?

Business activities are usually measured on how well they deliver return on investment (ROI). Since market research doesn’t generate any revenue directly, its success has to be measured by looking at the positive outcomes it drives – happier customers, a healthier brand, and so on.

When changes to your products or your marketing strategy are made as a result of your market research findings, you can compare on a before-and-after basis to see if the knowledge you acted on has delivered value.

Regardless of the function you work within, understanding the consumer is the goal of any market research. To do this, we have to understand what their needs are in order to effectively meet them. If we do that, we are more likely to drive customer satisfaction , and in turn, increase customer retention .

Several metrics and KPIs are used to gauge the success of decisions made from market research results, including

- Brand awareness within the target market

- Share of wallet

- CSAT (customer satisfaction)

- NPS (Net Promoter Score)

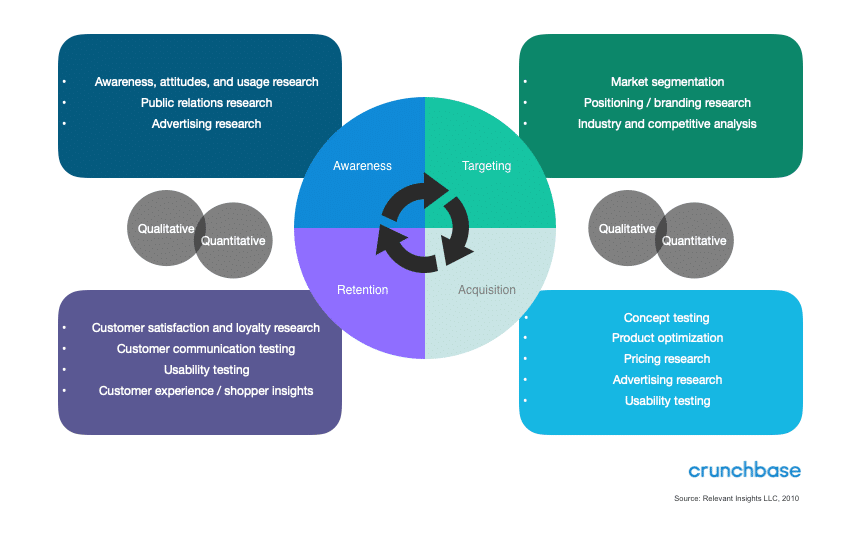

You can use market research for almost anything related to your current customers, potential customer base or target market. If you want to find something out from your target audience, it’s likely market research is the answer.

Here are a few of the most common uses:

Buyer segmentation and profiling

Segmentation is a popular technique that separates your target market according to key characteristics, such as behavior, demographic information and social attitudes. Segmentation allows you to create relevant content for your different segments, ideally helping you to better connect with all of them.

Buyer personas are profiles of fictional customers – with real attributes. Buyer personas help you develop products and communications that are right for your different audiences, and can also guide your decision-making process. Buyer personas capture the key characteristics of your customer segments, along with meaningful insights about what they want or need from you. They provide a powerful reminder of consumer attitudes when developing a product or service, a marketing campaign or a new brand direction.

By understanding your buyers and potential customers, including their motivations, needs, and pain points, you can optimize everything from your marketing communications to your products to make sure the right people get the relevant content, at the right time, and via the right channel .

Attitudes and Usage surveys

Attitude & Usage research helps you to grow your brand by providing a detailed understanding of consumers. It helps you understand how consumers use certain products and why, what their needs are, what their preferences are, and what their pain points are. It helps you to find gaps in the market, anticipate future category needs, identify barriers to entry and build accurate go-to-market strategies and business plans.

Marketing strategy

Effective market research is a crucial tool for developing an effective marketing strategy – a company’s plan for how they will promote their products.

It helps marketers look like rock stars by helping them understand the target market to avoid mistakes, stay on message, and predict customer needs . It’s marketing’s job to leverage relevant data to reach the best possible solution based on the research available. Then, they can implement the solution, modify the solution, and successfully deliver that solution to the market.

Product development

You can conduct market research into how a select group of consumers use and perceive your product – from how they use it through to what they like and dislike about it. Evaluating your strengths and weaknesses early on allows you to focus resources on ideas with the most potential and to gear your product or service design to a specific market.

Chobani’s yogurt pouches are a product optimized through great market research . Using product concept testing – a form of market research – Chobani identified that packaging could negatively impact consumer purchase decisions. The brand made a subtle change, ensuring the item satisfied the needs of consumers. This ability to constantly refine its products for customer needs and preferences has helped Chobani become Australia’s #1 yogurt brand and increase market share.

Pricing decisions

Market research provides businesses with insights to guide pricing decisions too. One of the most powerful tools available to market researchers is conjoint analysis, a form of market research study that uses choice modeling to help brands identify the perfect set of features and price for customers. Another useful tool is the Gabor-Granger method, which helps you identify the highest price consumers are willing to pay for a given product or service.

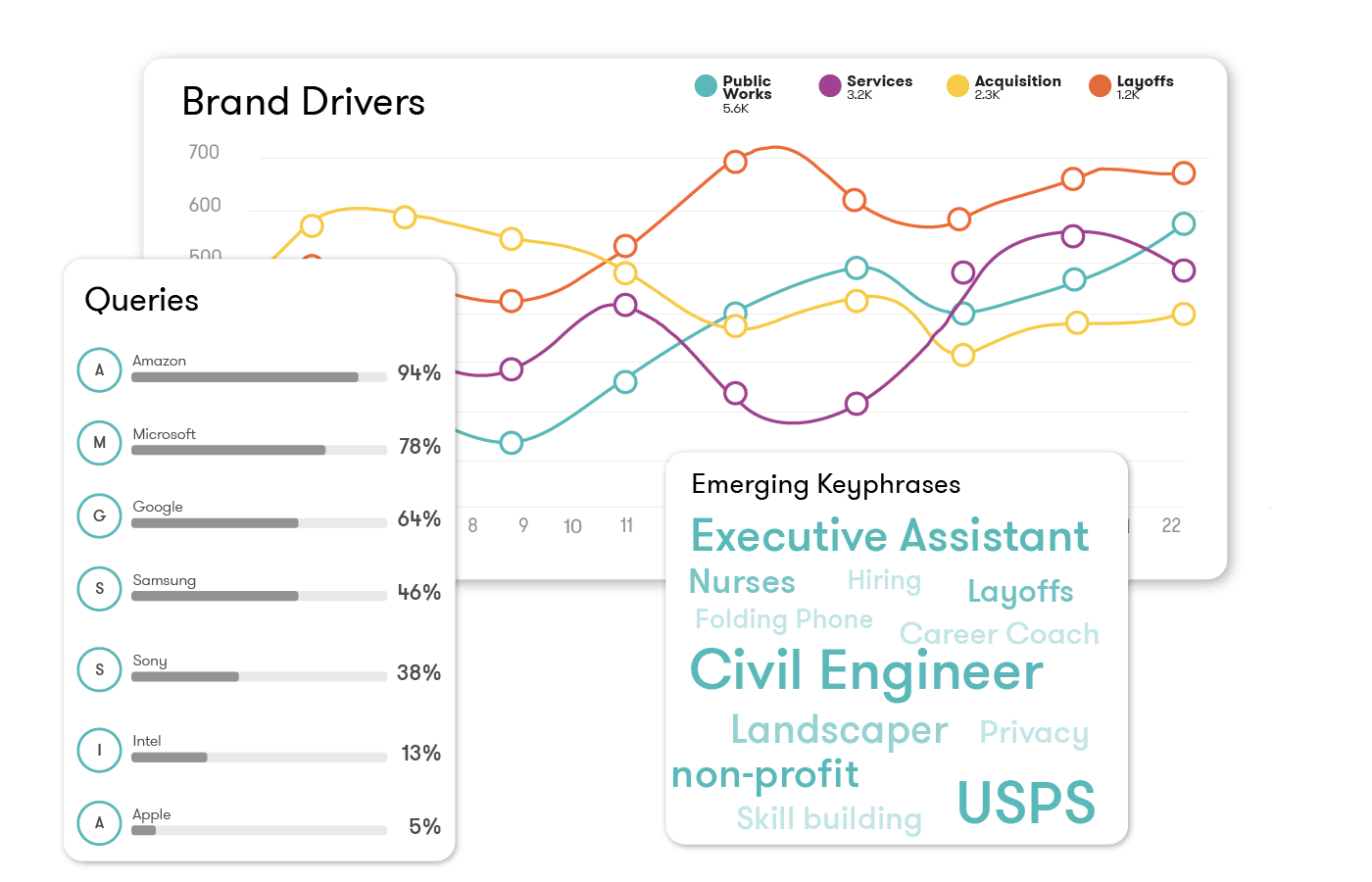

Brand tracking studies

A company’s brand is one of its most important assets. But unlike other metrics like product sales, it’s not a tangible measure you can simply pull from your system. Regular market research that tracks consumer perceptions of your brand allows you to monitor and optimize your brand strategy in real time, then respond to consumer feedback to help maintain or build your brand with your target customers.

Advertising and communications testing

Advertising campaigns can be expensive, and without pre-testing, they carry risk of falling flat with your target audience. By testing your campaigns, whether it’s the message or the creative, you can understand how consumers respond to your communications before you deploy them so you can make changes in response to consumer feedback before you go live.

Finder, which is one of the world’s fastest-growing online comparison websites, is an example of a brand using market research to inject some analytical rigor into the business. Fueled by great market research, the business lifted brand awareness by 23 percent, boosted NPS by 8 points, and scored record profits – all within 10 weeks.

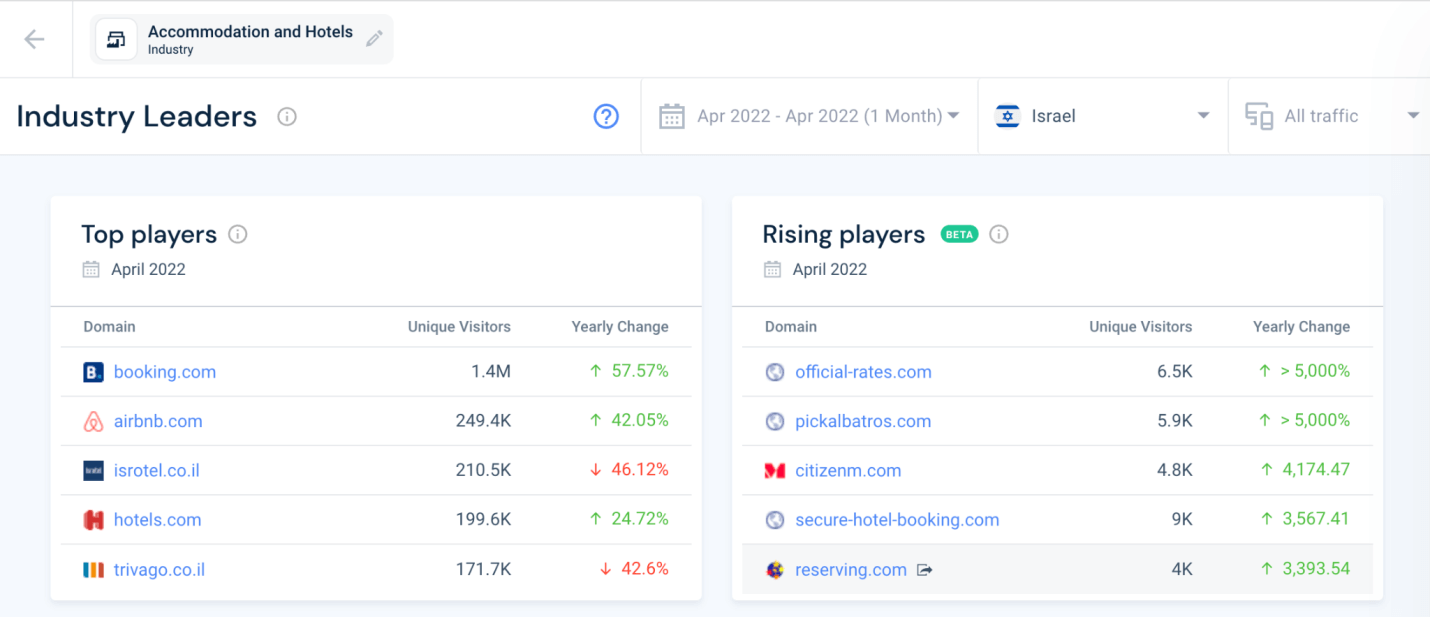

Competitive analysis

Another key part of developing the right product and communications is understanding your main competitors and how consumers perceive them. You may have looked at their websites and tried out their product or service, but unless you know how consumers perceive them, you won’t have an accurate view of where you stack up in comparison. Understanding their position in the market allows you to identify the strengths you can exploit, as well as any weaknesses you can address to help you compete better.

Customer Story

See How Yamaha Does Product Research

Types of market research

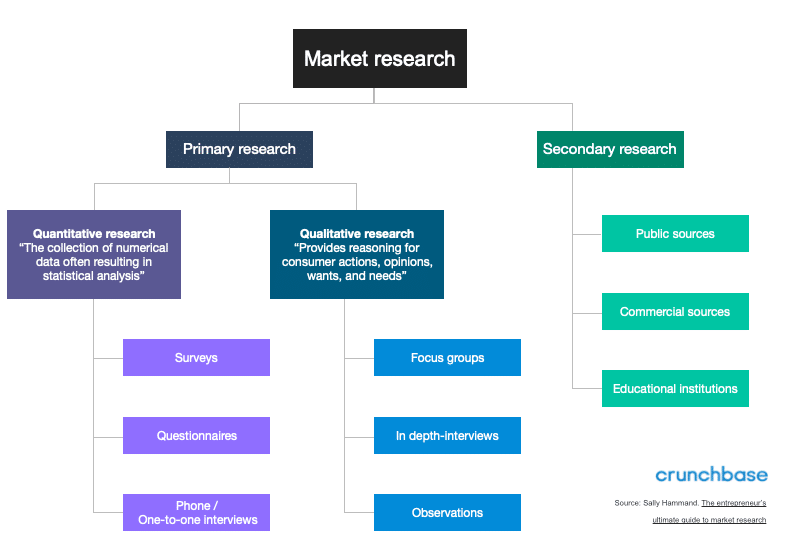

Although there are many types market research, all methods can be sorted into one of two categories: primary and secondary.

Primary research

Primary research is market research data that you collect yourself. This is raw data collected through a range of different means – surveys , focus groups, , observation and interviews being among the most popular.

Primary information is fresh, unused data, giving you a perspective that is current or perhaps extra confidence when confirming hypotheses you already had. It can also be very targeted to your exact needs. Primary information can be extremely valuable. Tools for collecting primary information are increasingly sophisticated and the market is growing rapidly.

Historically, conducting market research in-house has been a daunting concept for brands because they don’t quite know where to begin, or how to handle vast volumes of data. Now, the emergence of technology has meant that brands have access to simple, easy to use tools to help with exactly that problem. As a result, brands are more confident about their own projects and data with the added benefit of seeing the insights emerge in real-time.

Secondary research

Secondary research is the use of data that has already been collected, analyzed and published – typically it’s data you don’t own and that hasn’t been conducted with your business specifically in mind, although there are forms of internal secondary data like old reports or figures from past financial years that come from within your business. Secondary research can be used to support the use of primary research.

Secondary research can be beneficial to small businesses because it is sometimes easier to obtain, often through research companies. Although the rise of primary research tools are challenging this trend by allowing businesses to conduct their own market research more cheaply, secondary research is often a cheaper alternative for businesses who need to spend money carefully. Some forms of secondary research have been described as ‘lean market research’ because they are fast and pragmatic, building on what’s already there.

Because it’s not specific to your business, secondary research may be less relevant, and you’ll need to be careful to make sure it applies to your exact research question. It may also not be owned, which means your competitors and other parties also have access to it.

Primary or secondary research – which to choose?

Both primary and secondary research have their advantages, but they are often best used when paired together, giving you the confidence to act knowing that the hypothesis you have is robust.

Secondary research is sometimes preferred because there is a misunderstanding of the feasibility of primary research. Thanks to advances in technology, brands have far greater accessibility to primary research, but this isn’t always known.

If you’ve decided to gather your own primary information, there are many different data collection methods that you may consider. For example:

- Customer surveys

- Focus groups

- Observation

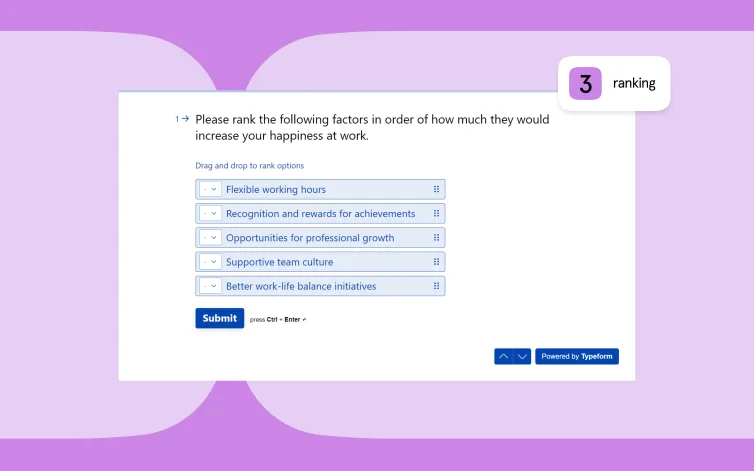

Think carefully about what you’re trying to accomplish before picking the data collection method(s) you’re going to use. Each one has its pros and cons. Asking someone a simple, multiple-choice survey question will generate a different type of data than you might obtain with an in-depth interview. Determine if your primary research is exploratory or specific, and if you’ll need qualitative research, quantitative research, or both.

Qualitative vs quantitative

Another way of categorizing different types of market research is according to whether they are qualitative or quantitative.

Qualitative research

Qualitative research is the collection of data that is non-numerical in nature. It summarizes and infers, rather than pin-points an exact truth. It is exploratory and can lead to the generation of a hypothesis.

Market research techniques that would gather qualitative data include:

- Interviews (face to face / telephone)

- Open-ended survey questions

Researchers use these types of market research technique because they can add more depth to the data. So for example, in focus groups or interviews, rather than being limited to ‘yes’ or ‘no’ for a certain question, you can start to understand why someone might feel a certain way.

Quantitative research

Quantitative research is the collection of data that is numerical in nature. It is much more black and white in comparison to qualitative data, although you need to make sure there is a representative sample if you want the results to be reflective of reality.

Quantitative researchers often start with a hypothesis and then collect data which can be used to determine whether empirical evidence to support that hypothesis exists.

Quantitative research methods include:

- Questionnaires

- Review scores

Exploratory and specific research

Exploratory research is the approach to take if you don’t know what you don’t know. It can give you broad insights about your customers, product, brand, and market. If you want to answer a specific question, then you’ll be conducting specific research.

- Exploratory . This research is general and open-ended, and typically involves lengthy interviews with an individual or small focus group.

- Specific . This research is often used to solve a problem identified in exploratory research. It involves more structured, formal interviews.

Exploratory primary research is generally conducted by collecting qualitative data. Specific research usually finds its insights through quantitative data.

Primary research can be qualitative or quantitative, large-scale or focused and specific. You’ll carry it out using methods like surveys – which can be used for both qualitative and quantitative studies – focus groups, observation of consumer behavior, interviews, or online tools.

Step 1: Identify your research topic

Research topics could include:

- Product features

- Product or service launch

- Understanding a new target audience (or updating an existing audience)

- Brand identity

- Marketing campaign concepts

- Customer experience

Step 2: Draft a research hypothesis

A hypothesis is the assumption you’re starting out with. Since you can disprove a negative much more easily than prove a positive, a hypothesis is a negative statement such as ‘price has no effect on brand perception’.

Step 3: Determine which research methods are most effective

Your choice of methods depends on budget, time constraints, and the type of question you’re trying to answer. You could combine surveys, interviews and focus groups to get a mix of qualitative and quantitative data.

Step 4: Determine how you will collect and analyze your data.

Primary research can generate a huge amount of data, and when the goal is to uncover actionable insight, it can be difficult to know where to begin or what to pay attention to.

The rise in brands taking their market research and data analysis in-house has coincided with the rise of technology simplifying the process. These tools pull through large volumes of data and outline significant information that will help you make the most important decisions.

Step 5: Conduct your research!

This is how you can run your research using Qualtrics CoreXM

- Pre-launch – Here you want to ensure that the survey/ other research methods conform to the project specifications (what you want to achieve/research)

- Soft launch – Collect a small fraction of the total data before you fully launch. This means you can check that everything is working as it should and you can correct any data quality issues.

- Full launch – You’ve done the hard work to get to this point. If you’re using a tool, you can sit back and relax, or if you get curious you can check on the data in your account.

- Review – review your data for any issues or low-quality responses. You may need to remove this in order not to impact the analysis of the data.

A helping hand

If you are missing the skills, capacity or inclination to manage your research internally, Qualtrics Research Services can help. From design, to writing the survey based on your needs, to help with survey programming, to handling the reporting, Research Services acts as an extension of the team and can help wherever necessary.

Secondary market research can be taken from a variety of places. Some data is completely free to access – other information could end up costing hundreds of thousands of dollars. There are three broad categories of secondary research sources:

- Public sources – these sources are accessible to anyone who asks for them. They include census data, market statistics, library catalogs, university libraries and more. Other organizations may also put out free data from time to time with the goal of advancing a cause, or catching people’s attention.

- Internal sources – sometimes the most valuable sources of data already exist somewhere within your organization. Internal sources can be preferable for secondary research on account of their price (free) and unique findings. Since internal sources are not accessible by competitors, using them can provide a distinct competitive advantage.

- Commercial sources – if you have money for it, the easiest way to acquire secondary market research is to simply buy it from private companies. Many organizations exist for the sole purpose of doing market research and can provide reliable, in-depth, industry-specific reports.

No matter where your research is coming from, it is important to ensure that the source is reputable and reliable so you can be confident in the conclusions you draw from it.

How do you know if a source is reliable?

Use established and well-known research publishers, such as the XM Institute , Forrester and McKinsey . Government websites also publish research and this is free of charge. By taking the information directly from the source (rather than a third party) you are minimizing the risk of the data being misinterpreted and the message or insights being acted on out of context.

How to apply secondary research

The purpose and application of secondary research will vary depending on your circumstances. Often, secondary research is used to support primary research and therefore give you greater confidence in your conclusions. However, there may be circumstances that prevent this – such as the timeframe and budget of the project.

Keep an open mind when collecting all the relevant research so that there isn’t any collection bias. Then begin analyzing the conclusions formed to see if any trends start to appear. This will help you to draw a consensus from the secondary research overall.

Market research success is defined by the impact it has on your business’s success. Make sure it’s not discarded or ignored by communicating your findings effectively. Here are some tips on how to do it.

- Less is more – Preface your market research report with executive summaries that highlight your key discoveries and their implications

- Lead with the basic information – Share the top 4-5 recommendations in bullet-point form, rather than requiring your readers to go through pages of analysis and data

- Model the impact – Provide examples and model the impact of any changes you put in place based on your findings

- Show, don’t tell – Add illustrative examples that relate directly to the research findings and emphasize specific points

- Speed is of the essence – Make data available in real-time so it can be rapidly incorporated into strategies and acted upon to maximize value

- Work with experts – Make sure you’ve access to a dedicated team of experts ready to help you design and launch successful projects

Trusted by 8,500 brands for everything from product testing to competitor analysis, Our Strategic Research software is the world’s most powerful and flexible research platform . With over 100 question types and advanced logic, you can build out your surveys and see real-time data you can share across the organization. Plus, you’ll be able to turn data into insights with iQ, our predictive intelligence engine that runs complicated analysis at the click of a button.

Related resources

Mixed methods research 17 min read, market intelligence 10 min read, marketing insights 11 min read, ethnographic research 11 min read, qualitative vs quantitative research 13 min read, qualitative research questions 11 min read, qualitative research design 12 min read, request demo.

Ready to learn more about Qualtrics?

Send us an email

How to do market research: The complete guide for your brand

Written by by Jacqueline Zote

Published on April 13, 2023

Reading time 10 minutes

Blindly putting out content or products and hoping for the best is a thing of the past. Not only is it a waste of time and energy, but you’re wasting valuable marketing dollars in the process. Now you have a wealth of tools and data at your disposal, allowing you to develop data-driven marketing strategies . That’s where market research comes in, allowing you to uncover valuable insights to inform your business decisions.

Conducting market research not only helps you better understand how to sell to customers but also stand out from your competition. In this guide, we break down everything you need to know about market research and how doing your homework can help you grow your business.

Table of contents:

What is market research?

Why is market research important, types of market research, where to conduct market research.

- Steps for conducting market research

- Tools to use for market research

Market research is the process of gathering information surrounding your business opportunities. It identifies key information to better understand your audience. This includes insights related to customer personas and even trends shaping your industry.

Taking time out of your schedule to conduct research is crucial for your brand health. Here are some of the key benefits of market research:

Understand your customers’ motivations and pain points

Most marketers are out of touch with what their customers want. Moreover, these marketers are missing key information on what products their audience wants to buy.

Simply put, you can’t run a business if you don’t know what motivates your customers.

And spoiler alert: Your customers’ wants and needs change. Your customers’ behaviors today might be night and day from what they were a few years ago.

Market research holds the key to understanding your customers better. It helps you uncover their key pain points and motivations and understand how they shape their interests and behavior.

Figure out how to position your brand

Positioning is becoming increasingly important as more and more brands enter the marketplace. Market research enables you to spot opportunities to define yourself against your competitors.

Maybe you’re able to emphasize a lower price point. Perhaps your product has a feature that’s one of a kind. Finding those opportunities goes hand in hand with researching your market.

Maintain a strong pulse on your industry at large

Today’s marketing world evolves at a rate that’s difficult to keep up with.

Fresh products. Up-and-coming brands. New marketing tools. Consumers get bombarded with sales messages from all angles. This can be confusing and overwhelming.

By monitoring market trends, you can figure out the best tactics for reaching your target audience.

Not everyone conducts market research for the same reason. While some may want to understand their audience better, others may want to see how their competitors are doing. As such, there are different types of market research you can conduct depending on your goal.

Interview-based market research allows for one-on-one interactions. This helps the conversation to flow naturally, making it easier to add context. Whether this takes place in person or virtually, it enables you to gather more in-depth qualitative data.

Buyer persona research

Buyer persona research lets you take a closer look at the people who make up your target audience. You can discover the needs, challenges and pain points of each buyer persona to understand what they need from your business. This will then allow you to craft products or campaigns to resonate better with each persona.

Pricing research

In this type of research, brands compare similar products or services with a particular focus on pricing. They look at how much those products or services typically sell for so they can get more competitive with their pricing strategy.

Competitive analysis research

Competitor analysis gives you a realistic understanding of where you stand in the market and how your competitors are doing. You can use this analysis to find out what’s working in your industry and which competitors to watch out for. It even gives you an idea of how well those competitors are meeting consumer needs.

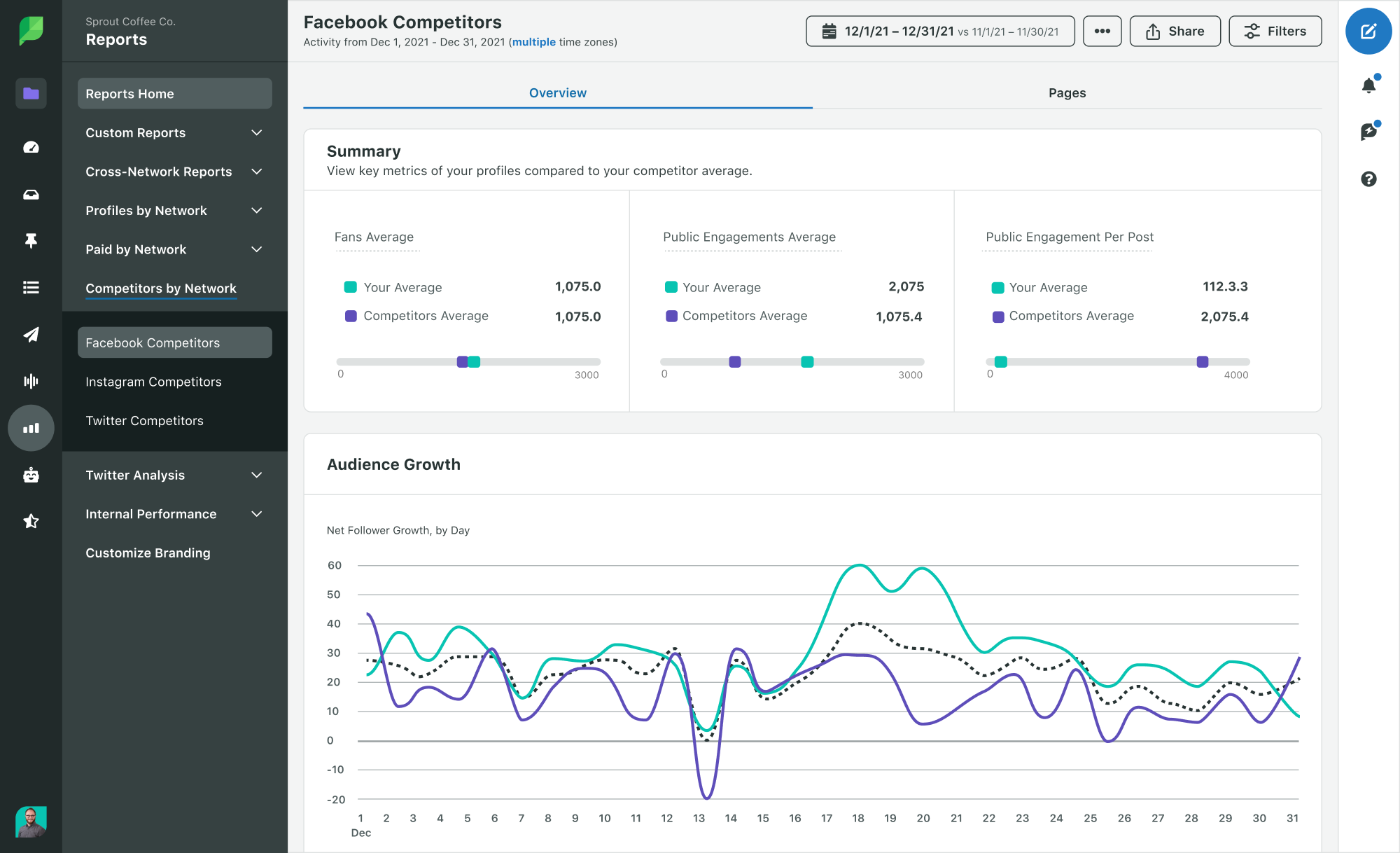

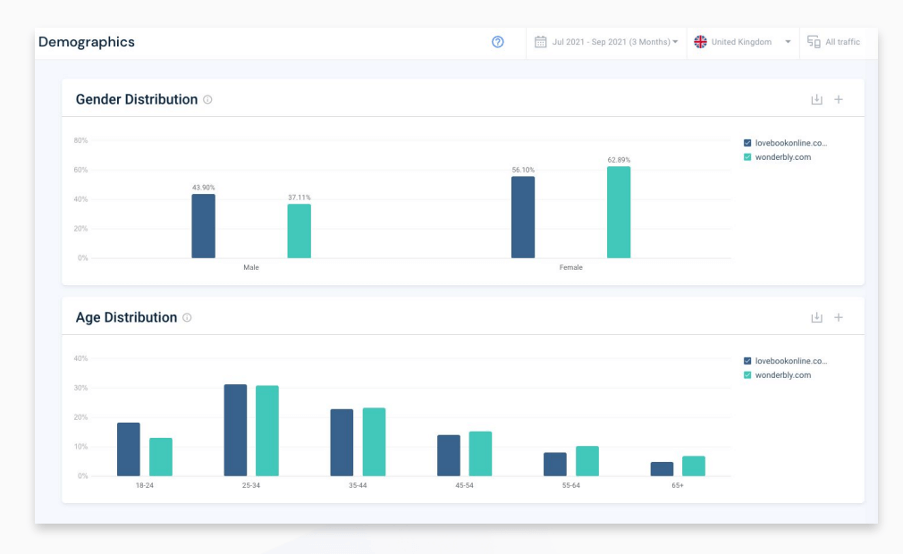

Depending on the competitor analysis tool you use, you can get as granular as you need with your research. For instance, Sprout Social lets you analyze your competitors’ social strategies. You can see what types of content they’re posting and even benchmark your growth against theirs.

Brand awareness research

Conducting brand awareness research allows you to assess your brand’s standing in the market. It tells you how well-known your brand is among your target audience and what they associate with it. This can help you gauge people’s sentiments toward your brand and whether you need to rebrand or reposition.

If you don’t know where to start with your research, you’re in the right place.

There’s no shortage of market research methods out there. In this section, we’ve highlighted research channels for small and big businesses alike.

Considering that Google sees a staggering 8.5 billion searches each day, there’s perhaps no better place to start.

A quick Google search is a potential goldmine for all sorts of questions to kick off your market research. Who’s ranking for keywords related to your industry? Which products and pieces of content are the hottest right now? Who’s running ads related to your business?

For example, Google Product Listing Ads can help highlight all of the above for B2C brands.

The same applies to B2B brands looking to keep tabs on who’s running industry-related ads and ranking for keyword terms too.

There’s no denying that email represents both an aggressive and effective marketing channel for marketers today. Case in point, 44% of online shoppers consider email as the most influential channel in their buying decisions.

Looking through industry and competitor emails is a brilliant way to learn more about your market. For example, what types of offers and deals are your competitors running? How often are they sending emails?

Email is also invaluable for gathering information directly from your customers. This survey message from Asana is a great example of how to pick your customers’ brains to figure out how you can improve your quality of service.

Industry journals, reports and blogs

Don’t neglect the importance of big-picture market research when it comes to tactics and marketing channels to explore. Look to marketing resources such as reports and blogs as well as industry journals

Keeping your ear to the ground on new trends and technologies is a smart move for any business. Sites such as Statista, Marketing Charts, AdWeek and Emarketer are treasure troves of up-to-date data and news for marketers.

And of course, there’s the Sprout Insights blog . And invaluable resources like The Sprout Social Index™ can keep you updated on the latest social trends.

Social media

If you want to learn more about your target market, look no further than social media. Social offers a place to discover what your customers want to see in future products or which brands are killin’ it. In fact, social media is become more important for businesses than ever with the level of data available.

It represents a massive repository of real-time data and insights that are instantly accessible. Brand monitoring and social listening are effective ways to conduct social media research . You can even be more direct with your approach. Ask questions directly or even poll your audience to understand their needs and preferences.

The 5 steps for how to do market research

Now that we’ve covered the why and where, it’s time to get into the practical aspects of market research. Here are five essential steps on how to do market research effectively.

Step 1: Identify your research topic

First off, what are you researching about? What do you want to find out? Narrow down on a specific research topic so you can start with a clear idea of what to look for.

For example, you may want to learn more about how well your product features are satisfying the needs of existing users. This might potentially lead to feature updates and improvements. Or it might even result in new feature introductions.

Similarly, your research topic may be related to your product or service launch or customer experience. Or you may want to conduct research for an upcoming marketing campaign.

Step 2: Choose a buyer persona to engage

If you’re planning to focus your research on a specific type of audience, decide which buyer persona you want to engage. This persona group will serve as a representative sample of your target audience.

Engaging a specific group of audience lets you streamline your research efforts. As such, it can be a much more effective and organized approach than researching thousands (if not millions) of individuals.

You may be directing your research toward existing users of your product. To get even more granular, you may want to focus on users who have been familiar with the product for at least a year, for example.

Step 3: Start collecting data

The next step is one of the most critical as it involves collecting the data you need for your research. Before you begin, make sure you’ve chosen the right research methods that will uncover the type of data you need. This largely depends on your research topic and goals.

Remember that you don’t necessarily have to stick to one research method. You may use a combination of qualitative and quantitative approaches. So for example, you could use interviews to supplement the data from your surveys. Or you may stick to insights from your social listening efforts.

To keep things consistent, let’s look at this in the context of the example from earlier. Perhaps you can send out a survey to your existing users asking them a bunch of questions. This might include questions like which features they use the most and how often they use them. You can get them to choose an answer from one to five and collect quantitative data.

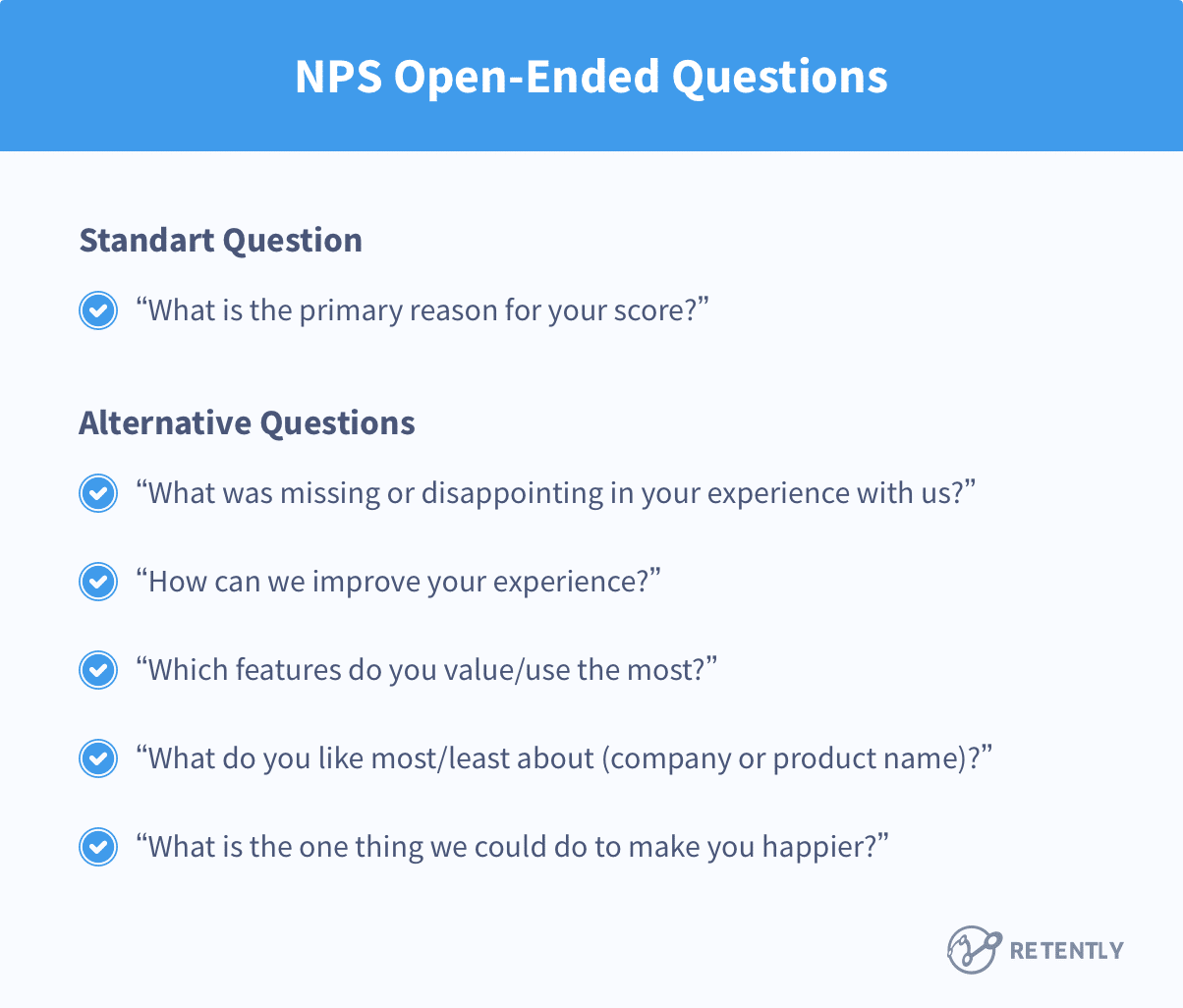

Plus, for qualitative insights, you could even include a few open-ended questions with the option to write their answers. For instance, you might ask them if there’s any improvement they wish to see in your product.

Step 4: Analyze results

Once you have all the data you need, it’s time to analyze it keeping your research topic in mind. This involves trying to interpret the data to look for a wider meaning, particularly in relation to your research goal.

So let’s say a large percentage of responses were four or five in the satisfaction rating. This means your existing users are mostly satisfied with your current product features. On the other hand, if the responses were mostly ones and twos, you may look for opportunities to improve. The responses to your open-ended questions can give you further context as to why people are disappointed.

Step 5: Make decisions for your business

Now it’s time to take your findings and turn them into actionable insights for your business. In this final step, you need to decide how you want to move forward with your new market insight.

What did you find in your research that would require action? How can you put those findings to good use?

The market research tools you should be using

To wrap things up, let’s talk about the various tools available to conduct speedy, in-depth market research. These tools are essential for conducting market research faster and more efficiently.

Social listening and analytics

Social analytics tools like Sprout can help you keep track of engagement across social media. This goes beyond your own engagement data but also includes that of your competitors. Considering how quickly social media moves, using a third-party analytics tool is ideal. It allows you to make sense of your social data at a glance and ensure that you’re never missing out on important trends.

Email marketing research tools

Keeping track of brand emails is a good idea for any brand looking to stand out in its audience’s inbox.

Tools such as MailCharts , Really Good Emails and Milled can show you how different brands run their email campaigns.

Meanwhile, tools like Owletter allow you to monitor metrics such as frequency and send-timing. These metrics can help you understand email marketing strategies among competing brands.

Content marketing research

If you’re looking to conduct research on content marketing, tools such as BuzzSumo can be of great help. This tool shows you the top-performing industry content based on keywords. Here you can see relevant industry sites and influencers as well as which brands in your industry are scoring the most buzz. It shows you exactly which pieces of content are ranking well in terms of engagements and shares and on which social networks.

SEO and keyword tracking

Monitoring industry keywords is a great way to uncover competitors. It can also help you discover opportunities to advertise your products via organic search. Tools such as Ahrefs provide a comprehensive keyword report to help you see how your search efforts stack up against the competition.

Competitor comparison template

For the sake of organizing your market research, consider creating a competitive matrix. The idea is to highlight how you stack up side-by-side against others in your market. Use a social media competitive analysis template to track your competitors’ social presence. That way, you can easily compare tactics, messaging and performance. Once you understand your strengths and weaknesses next to your competitors, you’ll find opportunities as well.

Customer persona creator

Finally, customer personas represent a place where all of your market research comes together. You’d need to create a profile of your ideal customer that you can easily refer to. Tools like Xtensio can help in outlining your customer motivations and demographics as you zero in on your target market.

Build a solid market research strategy

Having a deeper understanding of the market gives you leverage in a sea of competitors. Use the steps and market research tools we shared above to build an effective market research strategy.

But keep in mind that the accuracy of your research findings depends on the quality of data collected. Turn to Sprout’s social media analytics tools to uncover heaps of high-quality data across social networks.

- Marketing Disciplines

- Social Media Strategy

Social media RFPs: The best questions to include (plus a template)

Template: Essential Questions to Ask in Your Social Media Management Software RFP

- Team Collaboration

How to build a marketing tech stack that scales your business

- Customer Experience

Brand trust: What it is and why it matters

- Now on slide

Build and grow stronger relationships on social

Sprout Social helps you understand and reach your audience, engage your community and measure performance with the only all-in-one social media management platform built for connection.

9 Best Marketing Research Methods to Know Your Buyer Better [+ Examples]

Published: August 08, 2024

One of the most underrated skills you can have as a marketer is marketing research — which is great news for this unapologetic cyber sleuth.

From brand design and product development to buyer personas and competitive analysis, I’ve researched a number of initiatives in my decade-long marketing career.

And let me tell you: having the right marketing research methods in your toolbox is a must.

Market research is the secret to crafting a strategy that will truly help you accomplish your goals. The good news is there is no shortage of options.

How to Choose a Marketing Research Method

Thanks to the Internet, we have more marketing research (or market research) methods at our fingertips than ever, but they’re not all created equal. Let’s quickly go over how to choose the right one.

.png)

Free Market Research Kit

5 Research and Planning Templates + a Free Guide on How to Use Them in Your Market Research

- SWOT Analysis Template

- Survey Template

- Focus Group Template

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

1. Identify your objective.

What are you researching? Do you need to understand your audience better? How about your competition? Or maybe you want to know more about your customer’s feelings about a specific product.

Before starting your research, take some time to identify precisely what you’re looking for. This could be a goal you want to reach, a problem you need to solve, or a question you need to answer.

For example, an objective may be as foundational as understanding your ideal customer better to create new buyer personas for your marketing agency (pause for flashbacks to my former life).

Or if you’re an organic sode company, it could be trying to learn what flavors people are craving.

2. Determine what type of data and research you need.

Next, determine what data type will best answer the problems or questions you identified. There are primarily two types: qualitative and quantitative. (Sound familiar, right?)

- Qualitative Data is non-numerical information, like subjective characteristics, opinions, and feelings. It’s pretty open to interpretation and descriptive, but it’s also harder to measure. This type of data can be collected through interviews, observations, and open-ended questions.

- Quantitative Data , on the other hand, is numerical information, such as quantities, sizes, amounts, or percentages. It’s measurable and usually pretty hard to argue with, coming from a reputable source. It can be derived through surveys, experiments, or statistical analysis.

Understanding the differences between qualitative and quantitative data will help you pinpoint which research methods will yield the desired results.

For instance, thinking of our earlier examples, qualitative data would usually be best suited for buyer personas, while quantitative data is more useful for the soda flavors.

However, truth be told, the two really work together.

Qualitative conclusions are usually drawn from quantitative, numerical data. So, you’ll likely need both to get the complete picture of your subject.

For example, if your quantitative data says 70% of people are Team Black and only 30% are Team Green — Shout out to my fellow House of the Dragon fans — your qualitative data will say people support Black more than Green.

(As they should.)

Primary Research vs Secondary Research

You’ll also want to understand the difference between primary and secondary research.

Primary research involves collecting new, original data directly from the source (say, your target market). In other words, it’s information gathered first-hand that wasn’t found elsewhere.

Some examples include conducting experiments, surveys, interviews, observations, or focus groups.

Meanwhile, secondary research is the analysis and interpretation of existing data collected from others. Think of this like what we used to do for school projects: We would read a book, scour the internet, or pull insights from others to work from.

So, which is better?

Personally, I say any research is good research, but if you have the time and resources, primary research is hard to top. With it, you don’t have to worry about your source's credibility or how relevant it is to your specific objective.

You are in full control and best equipped to get the reliable information you need.

3. Put it all together.

Once you know your objective and what kind of data you want, you’re ready to select your marketing research method.

For instance, let’s say you’re a restaurant trying to see how attendees felt about the Speed Dating event you hosted last week.

You shouldn’t run a field experiment or download a third-party report on speed dating events; those would be useless to you. You need to conduct a survey that allows you to ask pointed questions about the event.

This would yield both qualitative and quantitative data you can use to improve and bring together more love birds next time around.

Best Market Research Methods for 2024

Now that you know what you’re looking for in a marketing research method, let’s dive into the best options.

Note: According to HubSpot’s 2024 State of Marketing report, understanding customers and their needs is one of the biggest challenges facing marketers today. The options we discuss are great consumer research methodologies , but they can also be used for other areas.

Primary Research

1. interviews.

Interviews are a form of primary research where you ask people specific questions about a topic or theme. They typically deliver qualitative information.

I’ve conducted many interviews for marketing purposes, but I’ve also done many for journalistic purposes, like this profile on comedian Zarna Garg . There’s no better way to gather candid, open-ended insights in my book, but that doesn’t mean they’re a cure-all.

What I like: Real-time conversations allow you to ask different questions if you’re not getting the information you need. They also push interviewees to respond quickly, which can result in more authentic answers.

What I dislike: They can be time-consuming and harder to measure (read: get quantitative data) unless you ask pointed yes or no questions.

Best for: Creating buyer personas or getting feedback on customer experience, a product, or content.

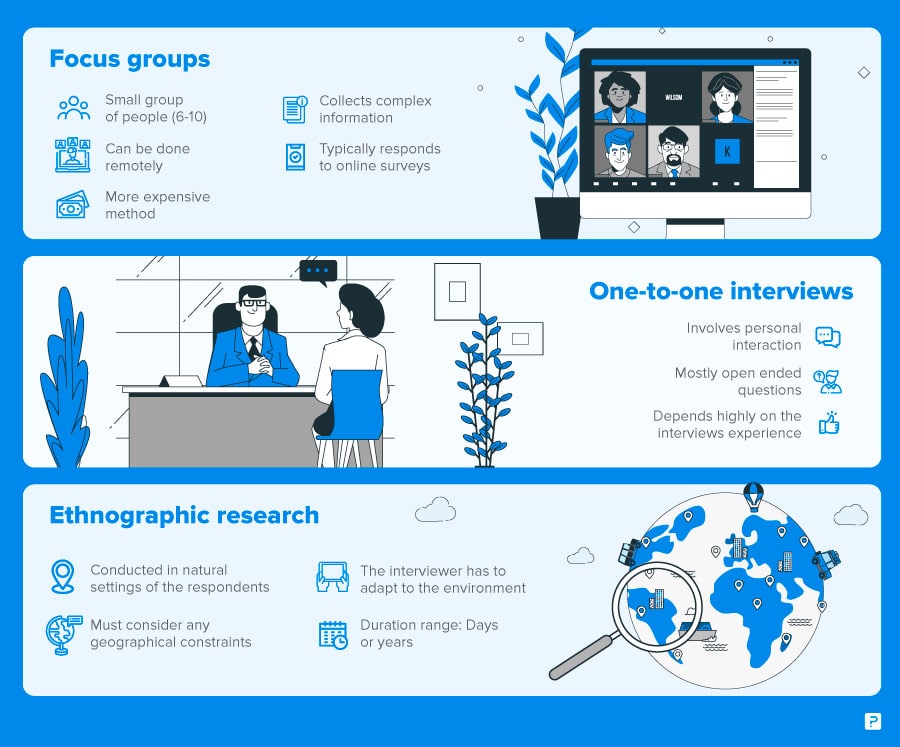

2. Focus Groups

Focus groups are similar to conducting interviews but on a larger scale.

In marketing and business, this typically means getting a small group together in a room (or Zoom), asking them questions about various topics you are researching. You record and/or observe their responses to then take action.

They are ideal for collecting long-form, open-ended feedback, and subjective opinions.

One well-known focus group you may remember was run by Domino’s Pizza in 2009 .

After poor ratings and dropping over $100 million in revenue, the brand conducted focus groups with real customers to learn where they could have done better.

It was met with comments like “worst excuse for pizza I’ve ever had” and “the crust tastes like cardboard.” But rather than running from the tough love, it took the hit and completely overhauled its recipes.

The team admitted their missteps and returned to the market with better food and a campaign detailing their “Pizza Turn Around.”

The result? The brand won a ton of praise for its willingness to take feedback, efforts to do right by its consumers, and clever campaign. But, most importantly, revenue for Domino’s rose by 14.3% over the previous year.

The brand continues to conduct focus groups and share real footage from them in its promotion:

What I like: Similar to interviewing, you can dig deeper and pivot as needed due to the real-time nature. They’re personal and detailed.

What I dislike: Once again, they can be time-consuming and make it difficult to get quantitative data. There is also a chance some participants may overshadow others.

Best for: Product research or development

Pro tip: Need help planning your focus group? Our free Market Research Kit includes a handy template to start organizing your thoughts in addition to a SWOT Analysis Template, Survey Template, Focus Group Template, Presentation Template, Five Forces Industry Analysis Template, and an instructional guide for all of them. Download yours here now.

3. Surveys or Polls

Surveys are a form of primary research where individuals are asked a collection of questions. It can take many different forms.

They could be in person, over the phone or video call, by email, via an online form, or even on social media. Questions can be also open-ended or closed to deliver qualitative or quantitative information.

A great example of a close-ended survey is HubSpot’s annual State of Marketing .

In the State of Marketing, HubSpot asks marketing professionals from around the world a series of multiple-choice questions to gather data on the state of the marketing industry and to identify trends.

The survey covers various topics related to marketing strategies, tactics, tools, and challenges that marketers face. It aims to provide benchmarks to help you make informed decisions about your marketing.

It also helps us understand where our customers’ heads are so we can better evolve our products to meet their needs.

Apple is no stranger to surveys, either.

In 2011, the tech giant launched Apple Customer Pulse , which it described as “an online community of Apple product users who provide input on a variety of subjects and issues concerning Apple.”

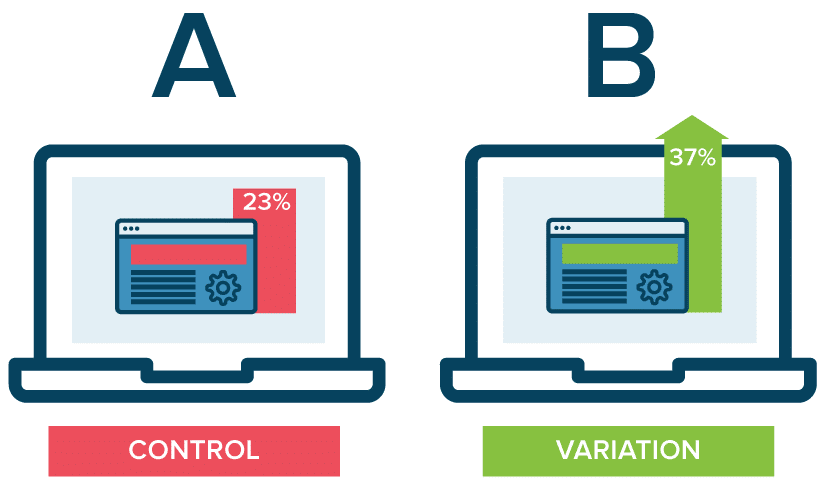

"For example, we did a large voluntary survey of email subscribers and top readers a few years back."

While these readers gave us a long list of topics, formats, or content types they wanted to see, they sometimes engaged more with content types they didn’t select or favor as much on the surveys when we ran follow-up ‘in the wild’ tests, like A/B testing.”

Pepsi saw similar results when it ran its iconic field experiment, “The Pepsi Challenge” for the first time in 1975.

The beverage brand set up tables at malls, beaches, and other public locations and ran a blindfolded taste test. Shoppers were given two cups of soda, one containing Pepsi, the other Coca-Cola (Pepsi’s biggest competitor). They were then asked to taste both and report which they preferred.

People overwhelmingly preferred Pepsi, and the brand has repeated the experiment multiple times over the years to the same results.

What I like: It yields qualitative and quantitative data and can make for engaging marketing content, especially in the digital age.

What I dislike: It can be very time-consuming. And, if you’re not careful, there is a high risk for scientific error.

Best for: Product testing and competitive analysis

Pro tip: " Don’t make critical business decisions off of just one data set," advises Pamela Bump. "Use the survey, competitive intelligence, external data, or even a focus group to give you one layer of ideas or a short-list for improvements or solutions to test. Then gather your own fresh data to test in an experiment or trial and better refine your data-backed strategy."

Secondary Research

8. public domain or third-party research.

While original data is always a plus, there are plenty of external resources you can access online and even at a library when you’re limited on time or resources.

Some reputable resources you can use include:

- Pew Research Center

- McKinley Global Institute

- Relevant Global or Government Organizations (i.e United Nations or NASA)

It’s also smart to turn to reputable organizations that are specific to your industry or field. For instance, if you’re a gardening or landscaping company, you may want to pull statistics from the Environmental Protection Agency (EPA).

If you’re a digital marketing agency, you could look to Google Research or HubSpot Research . (Hey, I know them!)

What I like: You can save time on gathering data and spend more time on analyzing. You can also rest assured the data is from a source you trust.

What I dislike: You may not find data specific to your needs.

Best for: Companies under a time or resource crunch, adding factual support to content

Pro tip: Fellow HubSpotter Iskiev suggests using third-party data to inspire your original research. “Sometimes, I use public third-party data for ideas and inspiration. Once I have written my survey and gotten all my ideas out, I read similar reports from other sources and usually end up with useful additions for my own research.”

9. Buy Research

If the data you need isn’t available publicly and you can’t do your own market research, you can also buy some. There are many reputable analytics companies that offer subscriptions to access their data. Statista is one of my favorites, but there’s also Euromonitor , Mintel , and BCC Research .

What I like: Same as public domain research

What I dislike: You may not find data specific to your needs. It also adds to your expenses.

Best for: Companies under a time or resource crunch or adding factual support to content

Which marketing research method should you use?

You’re not going to like my answer, but “it depends.” The best marketing research method for you will depend on your objective and data needs, but also your budget and timeline.

My advice? Aim for a mix of quantitative and qualitative data. If you can do your own original research, awesome. But if not, don’t beat yourself up. Lean into free or low-cost tools . You could do primary research for qualitative data, then tap public sources for quantitative data. Or perhaps the reverse is best for you.

Whatever your marketing research method mix, take the time to think it through and ensure you’re left with information that will truly help you achieve your goals.

Don't forget to share this post!

Related articles.

![market research to sales The Beginner's Guide to the Competitive Matrix [+ Templates]](https://www.hubspot.com/hubfs/competitive-matrix-1-20240828-9831599.webp)

The Beginner's Guide to the Competitive Matrix [+ Templates]

What is a Competitive Analysis — and How Do You Conduct One?

![market research to sales SWOT Analysis: How To Do One [With Template & Examples]](https://www.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

28 Tools & Resources for Conducting Market Research

Market Research: A How-To Guide and Template

TAM, SAM & SOM: What Do They Mean & How Do You Calculate Them?

![market research to sales How to Run a Competitor Analysis [Free Guide]](https://www.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![market research to sales 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://www.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Free Guide & Templates to Help Your Market Research

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

The Ultimate Guide to Market Research: Types, Benefits, and Real-World Examples

Ryan Fratzke

Partner & Executive Strategist

Today's consumers hold a lot of power when making purchase decisions. With a quick inquiry in a search engine or search bar within a social media platform, they can access genuine reviews from their peers without relying on sales reps.

Considering this shift in consumer behavior, adjusting your marketing strategy so it caters to the modern-day buying process is essential . To achieve this, you must thoroughly understand your target audience, the market you operate in, and the factors influencing their decision-making.

This is where market research can be leveraged so you stay current with your audience and industry.

Article Overview

In this article, we’ll walk you through everything you need to know about how to conduct market research, including:

- Why market research is essential for understanding your target audience, the market you operate in, and factors influencing decision-making

- What are the different types of market research, such as primary and secondary market research

- How to collect information about your customers and target market to determine the success of a new or existing product, improve your brand, and communicate your company's value

- Real-world examples of companies leveraging market research

What is market research?

Market research is a necessary process that involves collecting and documenting information about your target market and customers. This helps you determine the success of a new product, improve an existing one, or understand how your brand is perceived. You can then turn this research into profits by developing marketing strategies and campaigns to effectively communicate your company's value .

While market research can provide insights into various aspects of an industry, it is not a crystal ball that can predict everything about your customers. Market researchers typically explore multiple areas of the market, which can take several weeks or even months to get a complete picture of the business landscape.

Even by researching just one of those areas, you can gain better insights into who your buyers are and what unique value proposition you can offer them that no other business currently provides.

Of course, you can simply use your industry experience and existing customer insights to make sound judgment calls. However, it's important to note that market research provides additional benefits beyond these strategies. There are two things to consider:

- Your competitors also have experienced individuals in the industry and a customer base. Your immediate resources may equal those of your competition's immediate resources. Seeking a larger sample size for answers can provide a better edge.

- Your brand's customers do not represent the entire market's attitudes, only those who are attracted to your brand.

The market research services industry is experiencing rapid growth , indicating a strong interest in market research as we enter 2024. The market is expected to grow from approximately $75 billion in 2021 to $90.79 billion in 2025, with a compound annual growth rate of 5%.

Your competitors have highly skilled individuals within the industry, meaning your available personnel resources are likely similar to those of your competitors. So what are you going to do to get ahead?

You’re going to do thorough market research, which is why seeking answers from a larger sample size is essential. Remember that your customers represent only a portion of the market already attracted to your brand, and their attitudes may not necessarily reflect those of the entire market. You could be leaving money on the table by leaving out untapped customers .

Why do market research?

Market research helps you meet your buyers where they are. Understanding your buyer's problems, pain points, and desired outcomes is invaluable as our world becomes increasingly noisy and demanding. This knowledge will help you tailor your product or service to appeal to them naturally.

What’s even better is when you're ready to grow your business, market research can also guide you in developing an effective market expansion strategy.

Market research provides valuable insights into factors that impact your profits and can help you to :

- Identify where your target audience and current customers are conducting their product or service research

- Determine which competitors your target audience looks to for information, options, or purchases

- Keep up with the latest trends in your industry and understand what your buyers are interested in

- Understand who makes up your market and what challenges they are facing

- Determine what influences purchases and conversions among your target audience

- Analyze consumer attitudes about a particular topic, pain, product, or brand

- Assess the demand for the business initiatives you're investing in

- Identify unaddressed or underserved customer needs that can be turned into selling opportunities

- Understand consumer attitudes about pricing for your product or service.

Market research provides valuable information from a larger sample size of your target audience, enabling you to obtain accurate consumer attitudes. By eliminating any bias or assumptions you have about your target audience, you can make better business decisions based on the bigger picture.

As you delve deeper into your market research, you will come across two types of research: primary and secondary market research . Simply put, think of two umbrellas beneath market research - one for primary and one for secondary research. In the next section, we will discuss the difference between these two types of research. That way, if you work with a market who wants to use them, you’ll be ready with an understanding of how they can each benefit your business.

Primary vs. Secondary Research

Both primary and secondary research are conducted to collect actionable information on your product. That information can then be divided into two types: qualitative and quantitative research. Qualitative research focuses on public opinion and aims to determine how the market feels about the products currently available. On the other hand, quantitative research seeks to identify relevant trends in the data gathered from public records.

Let's take a closer look at these two types.

Primary Research

Primary research involves gathering first-hand information about your market and its customers. It can be leveraged to segment your market and create focused buyer personas . Generally, primary market research can be categorized into exploratory and specific studies.

Exploratory Primary Research

This type of primary market research is not focused on measuring customer trends; instead, it is focused on identifying potential problems worth addressing as a team. It is usually conducted as an initial step before any specific research is done and may involve conducting open-ended interviews or surveys with a small group of people.

Specific Primary Research

After conducting exploratory research, businesses may conduct specific primary research to explore issues or opportunities they have identified as necessary. Specific research involves targeting a smaller or more precise audience segment and asking questions aimed at solving a suspected problem. Specific primary research reveals problems that are unique to your audience so you can then offer a unique (and valuable) solution.

Secondary Research

Secondary research refers to collecting and analyzing data that has already been published or made available in public records. This may include market statistics, trend reports, sales data, and industry content you already can access. Secondary research really shines when you go to your competitors . The most commonly used sources of secondary market research include:

- Public sources

- Commercial sources

- Internal sources

Public Sources

When conducting secondary market research, the first and most accessible sources of information are usually free . That’s right–these public sources are free and at your fingertips so there’s no reason for you to not be checking them out and leveraging them for your own gain.

One of the most common types of public sources is government statistics. According to Entrepreneur, two examples of public market data in the United States are the U.S. Census Bureau and the Bureau of Labor & Statistics. These sources offer helpful information about the state of various industries nationwide including:

Commercial Sources

Research agencies such as Pew, Fratzke, Gartner, or Forrester often provide market reports containing industry insights from their own in-depth studies . These reports usually come at a cost if you want to download and obtain the information, but these agencies are experts at what they do, so the research is most likely valuable.

Internal Sources

Internal sources of market data can include average revenue per sale, customer retention rates, and other data on the health of old and new accounts. They are often overlooked when it comes to conducting market research because of how specific the data is; however, these sources can be valuable as they provide information on the organization's historical data.

By analyzing this information, you can gain insights into what your customers want now . In addition to these broad categories, there are various ways to conduct market research. Let’s talk about them.

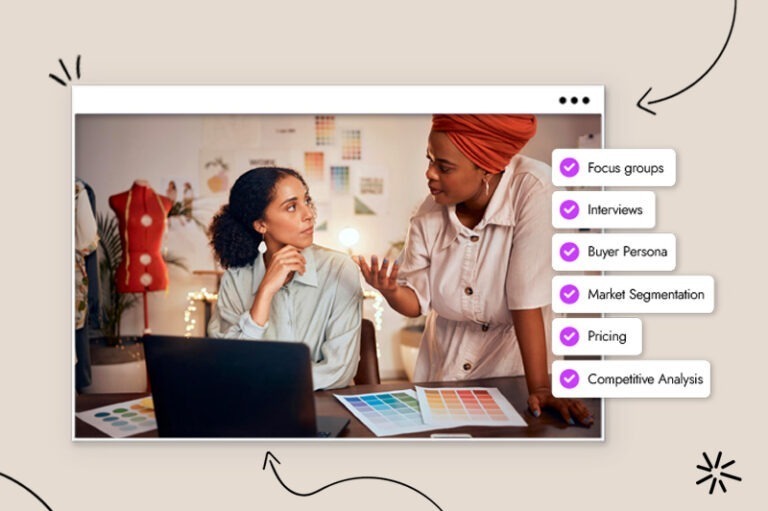

Types of Market Research

- Interviews (in-person or remote)

Focus Groups

- Product/ Service Use Research

Observation-Based Research

Buyer persona research, market segmentation research, pricing research.

- Competitive Analysis Research

Customer Satisfaction and Loyalty Research

Brand awareness research, campaign research.

Interviews can be conducted face-to-face or virtually, allowing for a natural conversation flow while observing the interviewee's body language. By asking questions about themselves, the interviewee can help you create buyer personas , which are made by using information about the ideal customer, such as:

- Family size

- Challenges faced at work or in life

And other aspects of their lifestyle. This buyer profile can shape your entire marketing strategy , from the features you add to your product to the content you publish on your website. Your target audience will feel that the marketing was made just for them and will be drawn to your product or service.

Focus groups are market research involving a few carefully selected individuals who can test your product, watch a demonstration, offer feedback, and answer specific questions. This research can inspire ideas for product differentiation or highlight the unique features of your product or brand that set it apart from others in the market. This is a great market research option to gain specific feedback, which you can use to improve your services .

Product/Service Use Research

Product or service usage research provides valuable insights into how and why your target audience uses your product or service. This research can help in various ways including:

- Identifying specific features of your offering that appeal to your audience.

- Allowing you to assess the usability of your product or service for your target audience.

According to a report published in 2020, usability testing was rated the most effective method for discovering user insights, with a score of 8.7 out of 10. In comparison, digital analytics scored 7.7, and user surveys scored 6.4.

Observation-based research is a process that involves observing how your target audience members use your product or service. The way that you intended your product or service to be used may not be the actual way that it is used. Observation-based research helps you understand what works well in terms of customer experience (CX) and user experience (UX), what problems they face, and which aspects of your product or service can be improved to make it easier for them to use.

To better understand how your potential customers make purchasing decisions in your industry, it is essential to know who they are. This is where buyer persona research comes in handy. Buyer or marketing personas are fictional yet generalized representations of your ideal customers. They give you someone to whom you want your marketing efforts to empathize and move, even though they don’t really exist.

Gathering survey data and additional research to correctly identify your buyer personas will help you to visualize your audience so you can streamline your communications and inform marketing strategy . Key characteristics to include in a buyer persona are:

- Job title(s)

- Family size

- Major challenges

Market segmentation research enables you to classify your target audience into various groups or segments based on specific and defining characteristics. This method allows you to understand their needs, pain points, expectations, and goals more effectively.

Pricing research can provide valuable insights about the prices of similar products or services in your market. It can help you understand what your target audience expects to pay for your offerings and what would be a reasonable price for you to set. Correct pricing is important because if you set it too high, consumers will go to your cheaper competitor; but if you set it too low, your consumers may become suspicious of your product or service and still end up with your competitor. This information allows you to develop a solid pricing strategy aligning with your business goals and objectives.

Competitive Analysis

Competitive analyses are incredibly valuable as they provide a deep understanding of your market and industry competition. Through these analyses, you can gain insights like:

- What works well in your industry

- What your target audience is already interested in regarding products like yours

- Which competitors you should work to keep up with and surpass

- How you can differentiate yourself from the competition

Understanding customer satisfaction and loyalty is crucial to encouraging repeat business and identifying what drives customers to return (such as loyalty programs, rewards, and exceptional customer service). Researching this area will help you determine the most effective methods to keep your customers coming back again and again. If you have a CRM system, consider further utilizing automated customer feedback surveys to improve your understanding of their needs and preferences.

Brand awareness research helps you understand the level of familiarity your target audience has with your brand. It provides insights into your audience members' perceptions and associations when they think about your business.This type of research reveals what they believe your brand represents. This information is valuable for developing effective marketing strategies, improving your brand's reputation, and increasing customer loyalty .

To improve your marketing campaigns, you need to research by analyzing the success of your past campaigns among your target audience and current customers. This requires experimentation and thoroughly examining the elements that resonate with your audience. By doing so, you can identify the aspects of your campaigns that matter most to your audience and use them as a guide for future campaigns.

Now that you understand the different market research categories and types let's look at how to conduct your market research. Using our expertise and experience, we’ve created a step-by-step guide to conducting market research.

How to Do Market Research (Detailed Roadmap)

- Define the problem or objective of the research.

- Determine the type of data needed.

- Identify the sources of data.

- Collect the data.

- Analyze the data.

- Interpret the results.

- Report the findings.

- Take action based on the findings.

1. Define the problem or objective of the research

Defining the problem or objective of the research is the first step in conducting market research. This involves identifying the specific issue that the research is trying to address. It is essential to be clear and specific about the research problem or objective, as it will guide the entire research process.

2. Determine the type of data needed

After defining the research problem or objective, the next step is determining the data type needed to address the issue. This involves deciding whether to collect primary or secondary data. Primary data is collected directly from the source, while secondary data is collected from existing sources such as government reports or market research studies.

3. Identify the sources of data

Once the data type has been determined, the next step is identifying the data sources. This involves identifying potential sources of primary and secondary data that can be used to address the research problem or objective. Primary data sources can include surveys, focus groups, and interviews, while secondary data sources can include government reports, industry publications, and academic journals.

4. Collect the data

After identifying the data sources, the next step is to collect the data. This involves designing and implementing a data collection plan consistent with the research problem or objective. The data collection plan should specify the methods and procedures for collecting data, sample size, and sampling method.

5. Analyze the data

Once the data has been collected, the next step is to analyze the data. This involves organizing, summarizing, and interpreting the data to identify patterns, relationships, and trends. The research problem or objective should guide the data analysis process and be conducted using appropriate statistical methods and software.

6. Interpret the results

After analyzing the data, the next step is to interpret the results. This involves drawing conclusions from the data analysis and using the results to address the research problem or objective. It is essential to analyze the results objectively and to avoid making assumptions or drawing conclusions that are not supported by the data.

7. Report the findings

Try identifying common themes to create a story and action items.To make the process easier, use your favorite presentation software to create a report, as it will make it easy to add quotes, diagrams, or call clips.

Feel free to add your flair, but the following outline should help you craft a clear summary:

- Background: What are your goals, and why did you conduct this study?

- Participants: Who you talked to? A table works well to break groups down by persona and customer/prospect.

- Executive Summary: What were the most exciting things you learned? What do you plan to do about it?

- Key Findings: Identify the key findings using data visualizations and emphasize key points.

- Recommendations + Action Plan: Your analysis will uncover actionable insights to fuel strategies and campaigns you can run to get your brand in front of buyers earlier and more effectively. Provide your list of priorities, action items , a timeline, and its impact on your business.

8. Take action based on the findings