- Search Search Please fill out this field.

- Managing Your Debt

Debt Validation Requirements for Collectors

Know your rights when collection agencies call

:max_bytes(150000):strip_icc():format(webp)/bio_LaToyaIrby-d7b87e77d6c441e5a61deecedbb3861a.png)

- Why Request Validation?

Debt Validation Is Time-Sensitive

Submitting a validation request.

- The Collector's Response

If the Collector Verifies the Debt

Settling your debt, frequently asked questions (faqs).

The Balance / Theresa Chiechi

Has a debt collector ever contacted you about a debt that you weren’t sure was yours? Or maybe you weren't sure the collector had the right to collect the debt? Any time a collector attempts to collect a debt, you have the right to ask them to send proof of that debt, the amount they claim you owe, and their legal ability to collect the debt from you.

The Fair Debt Collection Practices Act (FDCPA), a federal law regulating third-party debt collectors, allows you to request the debt collector to send proof of the debt through a process called debt validation.

Why You Should Request Validation Before You Pay

You might want to just pay the collection and get it over with, particularly if you know the debt is yours and you need to pay it off to have a loan application approved. However, there are some strong reasons to exercise your right to request validation of the debt.

- Verify the debt is yours : Debt collectors have been known to send bills or make calls for bogus debts , so don't assume that a bill from a debt collector automatically means you owe. The letter may look legitimate, but in this digital age, it's easy to gather enough information about a person and their financial dealings to create a fake debt collection notice.

- Confirm you haven't already paid : What if you already paid the debt? You may vaguely remember owing the creditor named on the collection notice or you may recall paying that debt at some point. To be certain, ask for proof. It's your right.

- Force the debt collector to prove the debt is real : Sometimes debt collectors resurrect old debts in an attempt to make some money. With old debts, there's a good chance the collector doesn't have the original documents proving that you even owe. Would you really pay money to someone who says you owe them, but can't prove it? Of course not.

- Make sure the collector is authorized to collect the debt : Even if you really owe the money, how do you know the creditor actually hired this company to collect the debt on their behalf? What if you paid the collector, only to have the creditor or another collector come after you because the collector you paid was never hired in the first place? Sending a debt validation letter would help you be sure you're paying the right company for the right debt.

Within five days of its first communication to you, the debt collector is required to send a written debt validation notice to you. This notice will state your right to dispute the validity of the debt within 30 days. The FDCPA allows the collector to include the debt validation notice in the initial communication if that communication is a letter. When the debt collector’s first communication with you is a phone call, you should receive a debt validation letter from them within five days.

If you don’t dispute the debt in writing within 30 days, the debt collector has the right to assume the debt is valid. During the 30-day period, the collector can continue attempts to collect the debt from you until they receive your validation request.

To be legally valid, your request for proof must be made in writing. A verbal phone request for debt validation is not enough to protect your rights under the FDCPA. In your validation letter , you can dispute the entire debt, part of the debt, or request the name of the original creditor. Once the debt collector receives your validation request, they cannot contact you again until they've provided you with the proof you've asked for.

The best way to send your debt validation request is via certified mail with return receipt requested. This way, you have proof that the letter was mailed, the date you mailed it, and verification of when the debt collector received your letter. If you have to file a lawsuit against the debt collector, the certified and return receipts will help strengthen your case.

The certified mail receipt shows that you mailed the letter within the 30-day time frame and that the collector received it.

The Collector's Response

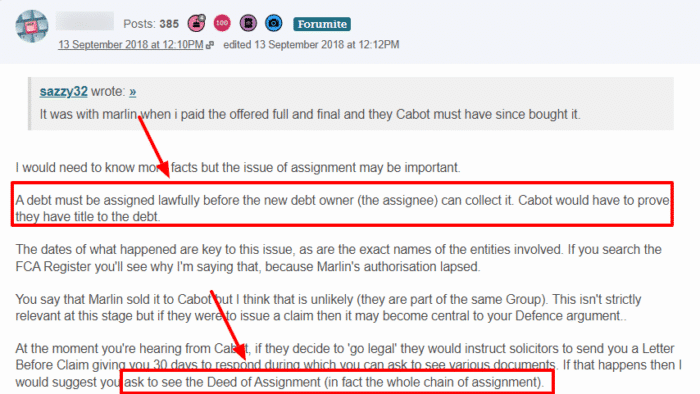

After receiving your dispute, the collection agency must send you proof that it owns or has been assigned the debt by the original creditor. Verification that you owe the debt and the amount of the debt needs to include documentation from the original creditor (you'll receive the proof from the debt collector, not the original creditor). You can also specifically request the name and address of the creditor for your own follow-up.

If the debt collector does not send sufficient proof of the debt, they are not allowed to continue pursuing you for the debt. That includes listing the debt on your credit report—you can dispute the debt that hasn't been adequately validated with the credit bureaus. Send the credit bureau a copy of your debt validation letter along with the certified and return receipts to help get the account removed from your credit report .

Always send copies of your proof and keep the originals for yourself. You can make additional copies if you need to dispute again in the future.

If you receive sufficient validation of the debt, you have to decide what to do next. Confirm the debt is within the statute of limitations —that's the amount of time a creditor or collector can use the courts to collect a debt from you. A debt that's outside the statute of limitations poses less of a threat to you since the collector can't win a judgment against you in court (as long as you can prove the statute of limitations has passed).

Check to see whether the debt is still within the credit reporting time limit, too. Most negative information—like a debt collection—can only be listed on your credit report seven years from the date of the delinquency. If the date of your delinquency is more than seven years ago, the debt should not appear on your credit report and, in that case, it won't hurt your credit to continue not paying the debt.

If the debt is old and scheduled to be removed from your credit report in less than two years, you may decide to simply let it fall off your credit report, especially if you're not planning to get a major loan in that time period.

What if the debt collection has been verified and is within the statute of limitations or the credit reporting time limit? You can try to settle with the collector for a percentage of the amount owed or offer a pay for delete agreement if the account is listed on your credit report. You'll have to be in a position to pay the account off quickly for this to work, however.

Paying in full is also an option—one you might choose if you plan to apply for a major loan before the debt drops off your credit report.

Ignoring the debt can have negative consequences, including damage to your credit, continuous debt collection attempts, and possibly even a lawsuit.

How long does a debt collector have to respond to your debt validation request?

There isn't a set time limit that determines when a debt collector has to respond to your validation request. However, they will not be able to try to collect the debt until they validate it, so debt collectors are likely to respond quickly if the debt is legitimate.

How do you write the letter to request debt validation?

The Consumer Financial Protection Bureau has a sample letter for this and several other situations you may encounter with a debt collector. In general, you want to provide and ask for as much detail as you can. Explain exactly when you were first contacted and what you were told. Ask for details about the debt including names and addresses on the account, a copy of the last billing statement from the original creditor, when the debt became due, and when it became delinquent.

U.S. Federal Trade Commission. " Fair Debt Collection Practices Act ."

Consumer Financial Protection Bureau. " How to Tell the Difference Between a Legitimate Debt Collector and Scammers ."

Consumer Financial Protection Bureau. " A Debt Collector Contacted Me About a Debt I Already Paid. What Should I Do? "

Consumer Financial Protection Bureau. " What Information Does a Debt Collector Have to Give Me About the Debt? "

State of California Department of Justice. " Debt Collectors ."

FTC Consumer Information. " Debt Collection FAQs ."

Experian. " How Long Does It Take for Information to Come Off Your Credit Reports? "

:max_bytes(150000):strip_icc():format(webp)/struggling-with-debt-586720824-5884060b5f9b58bdb3fe303e.jpg)

- Search Search Please fill out this field.

- Corporate Finance

- Corporate Debt

Debt Assignment: How They Work, Considerations and Benefits

Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle.

:max_bytes(150000):strip_icc():format(webp)/daniel_liberto-5bfc2715c9e77c0051432901.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Katrina Ávila Munichiello is an experienced editor, writer, fact-checker, and proofreader with more than fourteen years of experience working with print and online publications.

:max_bytes(150000):strip_icc():format(webp)/KatrinaAvilaMunichiellophoto-9d116d50f0874b61887d2d214d440889.jpg)

Investopedia / Ryan Oakley

What Is Debt Assignment?

The term debt assignment refers to a transfer of debt, and all the associated rights and obligations, from a creditor to a third party. The assignment is a legal transfer to the other party, who then becomes the owner of the debt . In most cases, a debt assignment is issued to a debt collector who then assumes responsibility to collect the debt.

Key Takeaways

- Debt assignment is a transfer of debt, and all the associated rights and obligations, from a creditor to a third party (often a debt collector).

- The company assigning the debt may do so to improve its liquidity and/or to reduce its risk exposure.

- The debtor must be notified when a debt is assigned so they know who to make payments to and where to send them.

- Third-party debt collectors are subject to the Fair Debt Collection Practices Act (FDCPA), a federal law overseen by the Federal Trade Commission (FTC).

How Debt Assignments Work

When a creditor lends an individual or business money, it does so with the confidence that the capital it lends out—as well as the interest payments charged for the privilege—is repaid in a timely fashion. The lender , or the extender of credit , will wait to recoup all the money owed according to the conditions and timeframe laid out in the contract.

In certain circumstances, the lender may decide it no longer wants to be responsible for servicing the loan and opt to sell the debt to a third party instead. Should that happen, a Notice of Assignment (NOA) is sent out to the debtor , the recipient of the loan, informing them that somebody else is now responsible for collecting any outstanding amount. This is referred to as a debt assignment.

The debtor must be notified when a debt is assigned to a third party so that they know who to make payments to and where to send them. If the debtor sends payments to the old creditor after the debt has been assigned, it is likely that the payments will not be accepted. This could cause the debtor to unintentionally default.

When a debtor receives such a notice, it's also generally a good idea for them to verify that the new creditor has recorded the correct total balance and monthly payment for the debt owed. In some cases, the new owner of the debt might even want to propose changes to the original terms of the loan. Should this path be pursued, the creditor is obligated to immediately notify the debtor and give them adequate time to respond.

The debtor still maintains the same legal rights and protections held with the original creditor after a debt assignment.

Special Considerations

Third-party debt collectors are subject to the Fair Debt Collection Practices Act (FDCPA). The FDCPA, a federal law overseen by the Federal Trade Commission (FTC), restricts the means and methods by which third-party debt collectors can contact debtors, the time of day they can make contact, and the number of times they are allowed to call debtors.

If the FDCPA is violated, a debtor may be able to file suit against the debt collection company and the individual debt collector for damages and attorney fees within one year. The terms of the FDCPA are available for review on the FTC's website .

Benefits of Debt Assignment

There are several reasons why a creditor may decide to assign its debt to someone else. This option is often exercised to improve liquidity and/or to reduce risk exposure. A lender may be urgently in need of a quick injection of capital. Alternatively, it might have accumulated lots of high-risk loans and be wary that many of them could default . In cases like these, creditors may be willing to get rid of them swiftly for pennies on the dollar if it means improving their financial outlook and appeasing worried investors. At other times, the creditor may decide the debt is too old to waste its resources on collections, or selling or assigning it to a third party to pick up the collection activity. In these instances, a company would not assign their debt to a third party.

Criticism of Debt Assignment

The process of assigning debt has drawn a fair bit of criticism, especially over the past few decades. Debt buyers have been accused of engaging in all kinds of unethical practices to get paid, including issuing threats and regularly harassing debtors. In some cases, they have also been charged with chasing up debts that have already been settled.

Federal Trade Commission. " Fair Debt Collection Practices Act ." Accessed June 29, 2021.

Federal Trade Commission. " Debt Collection FAQs ." Accessed June 29, 2021.

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1363841505-1b4696df34204380bd1d776481d91ae6.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Assignment Of Debt: Definition & Sample

Jump to section, what is an assignment of debt.

Assignment of debt is an agreement that transfer debt, rights, and obligations from a creditor to a third party. Assignment of debt agreements are commonly found when a creditor issues past due debt to a debt collection agency. The original lender will be relieved of all obligations and the agency will become the new owner of the debt. Debt assignment allows creditors to improve liquidity by reducing their financial risk. If a creditor has taken on a large amount of unsecured debt, an assignment of debt agreement is a quick way to transfer some of the unsecured loans to another party.

Common Sections in Assignments Of Debt

Below is a list of common sections included in Assignments Of Debt. These sections are linked to the below sample agreement for you to explore.

Assignment Of Debt Sample

Reference : Security Exchange Commission - Edgar Database, EX-10 19 ex107.htm ASSIGNMENT OF DEBT AND SECURITY , Viewed October 25, 2021, View Source on SEC .

Who Helps With Assignments Of Debt?

Lawyers with backgrounds working on assignments of debt work with clients to help. Do you need help with an assignment of debt?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate assignments of debt. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Meet some of our Assignment Of Debt Lawyers

Jo Ann has been practicing for over 20 years, working primarily with high growth companies from inception through exit and all points in between. She is skilled in Mergers & Acquisitions, Contractual Agreements (including founders agreements, voting agreements, licensing agreements, terms of service, privacy policies, stockholder agreements, operating agreements, equity incentive plans, employment agreements, vendor agreements and other commercial agreements), Corporate Governance and Due Diligence.

Jeremiah C.

Creative, results driven business & technology executive with 24 years of experience (15+ as a business/corporate lawyer). A problem solver with a passion for business, technology, and law. I bring a thorough understanding of the intersection of the law and business needs to any endeavor, having founded multiple startups myself with successful exits. I provide professional business and legal consulting. Throughout my career I've represented a number large corporations (including some of the top Fortune 500 companies) but the vast majority of my clients these days are startups and small businesses. Having represented hundreds of successful crowdfunded startups, I'm one of the most well known attorneys for startups seeking CF funds. I hold a Juris Doctor degree with a focus on Business/Corporate Law, a Master of Business Administration degree in Entrepreneurship, A Master of Education degree and dual Bachelor of Science degrees. I look forward to working with any parties that have a need for my skill sets.

Benjamin W.

I am a California-barred attorney specializing in business contracting needs. My areas of expertise include contract law, corporate formation, employment law, including independent contractor compliance, regulatory compliance and licensing, and general corporate law. I truly enjoy getting to know my clients, whether they are big businesses, small start-ups looking to launch, or individuals needing legal guidance. Some of my recent projects include: -drafting business purchase and sale agreements -drafting independent contractor agreements -creating influencer agreements -creating compliance policies and procedures for businesses in highly regulated industries -drafting service contracts -advising on CA legality of hiring gig workers including effects of Prop 22 and AB5 -forming LLCs -drafting terms of service and privacy policies -reviewing employment contracts I received my JD from UCLA School of Law and have been practicing for over five years in this area. I’m an avid reader and writer and believe those skills have served me well in my practice. I also complete continuing education courses regularly to ensure I am up-to-date on best practices for my clients. I pride myself on providing useful and accurate legal advice without complex and confusing jargon. I look forward to learning about your specific needs and helping you to accomplish your goals. Please reach out to learn more about my process and see if we are a good fit!

Texas licensed attorney specializing for 22 years in Business and Contract law with a focus on construction law and business operations. My services include General Business Law Advisement; Contract Review and Drafting; Legal Research and Writing; Business Formation; Articles or Instructive Writing; and more. I am able to draft and review contracts, and have experience with, contract law and business formation in any state. For more insight into my skills and experience, please feel free to visit my LinkedIn profile or contact me with any questions.

I am a licensed attorney and a member of the California Bar. I graduated from the University of Dayton School of Law's Program in Law and Technology. I love IP, tech transfers, licensing, and how the internet and developing technology is changing the legal landscape. I've interned at both corporations and boutique firms, and I've taken extensive specialized classes in intellectual property and technology law.

Charlotte L.

I hold a B.S. in Accounting and a B.A. in Philosophy from Virginia Tech (2009). I received my J.D. from the University of Virginia School of Law in 2012. I am an associate member of the Virginia Bar and an active member of the DC bar. Currently, I am working as a self-employed legal consultant and attorney. Primarily my clients are start-up companies for which I perform various types of legal work, including negotiating and drafting settlement, preparing operating agreements and partnership agreements, assisting in moving companies to incorporate in new states and setting up companies to become registered in a state, assisting with employment matters, drafting non-disclosure agreements, assisting with private placement offerings, and researching issues on intellectual property, local regulations, privacy laws, corporate governance, and many other facets of the law, as the need arises. I have previously practiced as an attorney at a small DC securities law firm and worked at Deloitte Financial Advisory Services LLC. My work experience is dynamic and includes many short-term and long term experience that span across areas such as maintaining my own blog, freelance writing, and dog walking. My diverse background has provided me with a stong skill set that can be easily adapted for new areas of work and indicates my ability to quickly learn for a wide array of clients.

With over 25 years of experience in the technology sector, I am a strategic business counsel, outsourced general counsel, and a leader of high-performing legal teams aimed to help maximize the efficiency of all stakeholders. I recently joined the renewable energy space with the addition of a new client on its way to becoming the first Chinese battery company to build a battery manufacturing presence in the US beginning with a 1+ GWh cell and pack plant, and a domestic anode and cathode plant. In my most recent full-time role, I served as the Sr. Director and Assistant General Counsel at SMART Global Holdings, where I served as the general counsel for the HPC and AI division of this publicly traded holding company, comprised of four companies, before becoming the global head of the commercial legal function across all portfolio companies, including two multinational industry leaders. During much of my career, I provided outside legal services on a recurring basis for several years advising several high growth start-ups and venture firms as well as house hold names, and also led one of the country's fastest growing infrastructure resellers and managed services providers. My core competencies include contract review, commercial negotiation, legal operations, information security, privacy, supply chain and procurement, alliances and channel sales, HR, and general corporate. I am passionate about leveraging my legal skills to achieve business solutions, supporting innovation and growth in the technology sector, and helping maximize the commercial flow and efficiency at growing companies. I hold an undergraduate business degree, a JD, a MSBA Taxation, and certifications from the California Bar Association, Six Sigma, and ISM.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Financial lawyers by top cities

- Austin Financial Lawyers

- Boston Financial Lawyers

- Chicago Financial Lawyers

- Dallas Financial Lawyers

- Denver Financial Lawyers

- Houston Financial Lawyers

- Los Angeles Financial Lawyers

- New York Financial Lawyers

- Phoenix Financial Lawyers

- San Diego Financial Lawyers

- Tampa Financial Lawyers

Assignment Of Debt lawyers by city

- Austin Assignment Of Debt Lawyers

- Boston Assignment Of Debt Lawyers

- Chicago Assignment Of Debt Lawyers

- Dallas Assignment Of Debt Lawyers

- Denver Assignment Of Debt Lawyers

- Houston Assignment Of Debt Lawyers

- Los Angeles Assignment Of Debt Lawyers

- New York Assignment Of Debt Lawyers

- Phoenix Assignment Of Debt Lawyers

- San Diego Assignment Of Debt Lawyers

- Tampa Assignment Of Debt Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

- How Does Debt Assignment Work?

Chloe Meltzer | December 07, 2023

Legal Expert Chloe Meltzer, MA

Chloe Meltzer is an experienced content writer specializing in legal content creation. She holds a degree in English Literature from Arizona State University, complemented by a Master’s in Marketing from California Polytechnic State University-San Luis Obispo.

Edited by Hannah Locklear

Editor at SoloSuit Hannah Locklear, BA

Hannah Locklear is SoloSuit’s Marketing and Impact Manager. With an educational background in Linguistics, Spanish, and International Development from Brigham Young University, Hannah has also worked as a legal support specialist for several years.

Summary: What are your options when your debt has been assigned to a debt collector? Find out why a creditor might have assigned your debt and how to deal with it.

Debt assignment refers to a transfer of debt. This includes all of the associated rights and obligations, as it goes from a creditor to a third party. Debt assignment is essentially the legal transfer of debt to a debt collector (or debt collection agency). After this agency purchases the debt, they will have the responsibility to collect the debt, meaning you will pay your debt to them.

File a response with SoloSuit to win against debt collectors.

Find Out How Debt Assignment Works

When a creditor or lender no longer wants to be responsible for attempting to collect your debt, they will sell your debt to a third party. When this occurs, a Notice of Assignment (NOA) is sent out to you. This should inform you of who is responsible for collecting the rest of your loan or debt.

Legally you must be notified if your debt is assigned to someone new. This is to ensure that you know where to make payments to. If you are not aware of the new assignment, you may send payments to the wrong location which could force you into unintentional default.

Know How the FDCPA Protects You

Third-party debt collectors must act according to the Fair Debt Collection Practices Act (FDCPA). This federal law restricts the methods by which a debt collector can contact you, and attempt to collect debts. The FDCPA regulates the time of day or night a collector can make contact, how often they can call, as well as what they say and how they say it.

If you believe that a debt collector has violated the FDCPA, then you may be able to file a suit against that company. You may also be able to sue for damages or attorney fees.

Stand up to debt collection agencies with SoloSuit.

Learn Why a Creditor Assigns Debt

There are a few reasons why a creditor may assign your debt. Typically, the most common reason is to reduce their risk. By assigning and selling the debt it is no longer their liability. They can ensure they recoup some of their money, and appease investors as well.

Discover How Purchasing a Debt Differs from Debt Assignment

The purchase of debt occurs before assignment. Before the assignment of delinquent debt, a collection agency will be required to purchase it. This is often done at a far lower price, while they still attempt to recoup the entire debt. Because of this, it allows you to attempt to settle your debt for less.

Understand Why Debt Assignment Is Often Criticized

The process of assigning debt is often seen as unethical. With threats, harassment, and lies of all kinds, many debt buyers have been accused of violating the FDCPA. Because of this, debt assignment has seen a good amount of criticism. Some cases have even seen consumers charged with debts that have already been settled or paid .

Nevertheless, this shows how important it is to be on top of your debts. The number one choice you should make with any debt or debt assignment is to respond to all correspondence. This will ensure that you stay in compliance, and act when you need to.

What is SoloSuit?

SoloSuit makes it easy to respond to a debt collection lawsuit.

How it works: SoloSuit is a step-by-step web-app that asks you all the necessary questions to complete your answer. Upon completion, you can either print the completed forms and mail in the hard copies to the courts or you can pay SoloSuit to file it for you and to have an attorney review the document.

Respond with SoloSuit

"First time getting sued by a debt collector and I was searching all over YouTube and ran across SoloSuit, so I decided to buy their services with their attorney reviewed documentation which cost extra but it was well worth it! SoloSuit sent the documentation to the parties and to the court which saved me time from having to go to court and in a few weeks the case got dismissed!" – James

>>Read the FastCompany article: Debt Lawsuits Are Complicated: This Website Makes Them Simpler To Navigate

>>Read the NPR story on SoloSuit: A Student Solution To Give Utah Debtors A Fighting Chance

How to Answer a Summons for debt collection in all 50 states

Here's a list of guides on how to respond to a debt collection lawsuit in each state:

The Ultimate 50 State Guide

- Connecticut

- Massachusetts

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Vermont ; Vermont (Small Claims court)

- West Virginia

Guides on how to resolve debt with every debt collector

Are you being sued by a debt collector? We’re making guides on how to resolve debt with each one.

- 11 Charter Communications

- AAA Collections

- Aargon Agency Inc

- Absolute Resolutions Investments LLC

- ACEI Collections

- Account Services

- Accredited Collection Services

- Advanced Recovery Systems

- AFNI Collections

- Alco Capital Group LLC

- Aldous and Associates

- Alliance Collections

- Alliance One

- Alliant Capital Management

- Alpha Recovery Corp

- Alltran Financial

- Alltran Health

- Alorica Inc.

- Amcol Clmbia in Court

- American Coradius International

- American Profit Recovery

- American Recovery Service

- Americollect

- AmSher Collection Services

- Apelles LLC

- AR Resources

- ARC Collections

- ARM Solutions

- Arrow Financial Services

- ARS National Services

- ARSC Debt Collectors

- AscensionPoint Recovery Services

- Asset Acceptance LLC

- Asset Recovery Solutions

- Associated Credit Services

- Atlantic Credit and Finance

- Atradius Collections

- Automated Collection Services, Inc.

- Autovest LLC

- AWA Collections

- Balekian Hayes

- Bay Area Receivables

- BCA Financial Services

- BC Services

- Benuck and Rainey

- Berlin-Wheeler

- Bluebonnet Financial LLC

- Bonneville Collections

- Bull City Financial

- Bureaus Investment Group

- Caine and Weiner

- Capio Partners

- Capital Accounts

- Capital Collections

- Capital Management Services

- Carmel Financial/New Coast Direct

- Cavalry SPV I LLC

- CBCS Collections

- CBV Collections

- CCB Credit Services

- CCS Collections

- CCS Offices

- Central Mediation Services

- Central Portfolio Control

- Cerastes LLC

- Choice Recovery

- Choice Recovery Inc

- CKS Financial

- CKMS Financial

- Client Services

- CMRE Financial Services

- Coast Professional

- Comenity Bank Debt Collection

- Commonwealth Financial

- ConServe Debt Collection

- Consumer Collection Management

- Contract Callers Inc

- Convergent Healthcare Recoveries

- Convergent Outsourcing

- Couch Conville & Blitt

- Covington Credit

- Credco in Court

- Credence Resource Management

- Credit Bureau Systems

- Credit Control Corporation

- Credit Management Company

- Credit Management LP

- Credit Systems

- CTC Debt Collector

- CVCS Debt Collection

- Cypress Financial Recoveries

- D&A Services

- Daniels, Norelli, Cecere & Tavel P.C.

- DCM Services

- Debt Recovery Solutions

- Delanor Kemper & Associates

- Department Stores National Bank

- Direct Recovery Associates

- Discover Collections

- Diversified Adjustment

- Diversified Consultants

- Diversified Recovery Bureau

- DNF Associates, LLC

- Dynamic Collectors

- Eagle Accounts Group, Inc.

- Eastern Account System

- Ellington and Associates Collections

- Encore Capital Group

- Enerson Law

- Enerson Law LLC

- Enhanced Recovery Company

- ERC Collections

- ERSolutions

- Estate Information Services

- Equable Ascent Financial

- Everest Business Funding

- Executive Credit Management

- Faber and Brand

- Factual Data

- Falls Collection Service

- FCO Collections and Outsourcing

- FIA Card Services

- fin rec svc (Financial Recovery Services)

- First Federal Credit Credit Control

- First Financial Bank

- First Portfolio Ventures LLC

- First Progress

- FirstPoint Collection Resources

- Firstsource Advantage

- FMA Alliance

- Forster & Garbus

- Franklin Collection Services

- Freedom Plus

- Freshview Solutions

- Frontline Asset

- Frost Arnett

- Fulton Friedman & Gullace LLP

- Galaxy International Purchasing, LLC

- GC Debt Collection

- GC Services

- General Revenue Corporation

- GLA Collections

- Glass Mountain Capital

- Glasser and Glasser

- Global Credit Collection Corp

- Global Trust Management

- GMAC Financing

- Golden 1 Credit Union

- Grant and Weber

- Grant Mercantile Agency

- Gulf Coast Collection Bureau

- Halsted Financial Services

- Harris and Harris

- Harvard Collection

- Harvest Credit Management

- Helvey and Associates

- Hollis Cobb

- Holloway Moxley

- Hosto Buchan

- Howard Lee Schiff

- H&R Accounts

- Hudson & Keyse LLC?

- Hunter Warfield

- Impact Receivables Management

- Innovative Recovery

- Integras Capital Recovery LLC

- Javitch Block

- JHPDE Finance 1 LLC

- JP Receivables Management Partners

- Kenneth Eisen and Associates

- KeyBank student loans

- Kirschenbaum, Phillips & Levy P.C.

- KLS Financial Services

- Kramer & Frank

- Lakeside Collection

- Lending Club

- Lincoln and Morgan Kabbage

- Linebarger Goggan Blair & Sampson LLP

- Lockhart Collection Agency

- LJ Ross Associates

- LTD Collections

- Malcolm S. Gerald and Associates

- Malen & Associates

- Mandarich Law Group

- Mannbracken

- Marcam Associates

- MARS Inc. Collections

- MCA Management Company

- McCarthy, Burgess & Wolff

- Meade & Associates

- Mercantile Adjustment Bureau

- Merchants Credit Association

- MGM Collections

- Michael J Adams PC

- Midland Funding LLC

- Mid-South Adjustment

- Monarch Recovery

- Monterey Financial

- Moss Law Firm

- Mountain Land Collections

- MRS Associates

- MSW Capital LLC

- Mullooly, Jeffrey, Rooney & Flynn

- Nathan and Nathan PC

- National Collegiate Trust

- National Credit Adjusters

- National Credit Care

- National Credit Systems

- National Enterprise Systems

- National Recovery Agency

- National Recovery Solutions

- Nationwide Credit

- Nationwide Recovery Services

- Nationwide Recovery Systems

- NCO Financial Systems Incorporated

- North American Recovery

- Northland Group

- Northstar Capital Acquisition

- Northstar Location Services

- NRC Collection Agency

- Oliver Adjustment Company

- Oliphant Financial, LLC

- P&B Capital Group

- PCB Collections Agency

- Palisades Collection LLC

- Pallida LLC

- Paragon Contracting Services

- Paragon Revenue Group

- Payday Loan Debt Collectors

- Pendrick Capital Partners

- Penn Credit

- Perdue Brandon

- Persolve LLC

- Phillips & Cohen Associates

- Phoenix Financial Services

- Pioneer Credit Recovery

- PRA Group, Inc.

- Pressler, Felt & Warshaw LLP

- Prestige Services, Inc.

- Prince Parker and Associates

- Professional Finance Company

- Progressive Management Systems

- Provest Law

- Quaternary Collection Agency

- RAB Collection Agency

- Rash Curtis and Associates

- Radius Global SOL

- Radius Global Solutions

- Rawlings Company

- Razor Capital

- Real Time Resolutions

- Receivables Performance Management

- Regents and Associates

- Reliant Capital Solutions

- Resurgent Capital Services and LVNV Funding

- Revco Solutions

- Revenue Enterprises LLC

- Revenue Group

- RGS Financial, Inc.

- RMP LLC in Court

- RMP Services

- RS Clark and Associates

- RTR Financial Services

- Rubin & Rothman

- Salander Enterprises LLC

- Samara Portfolio Management

- SCA Collections

- Scott Parnell and Associates

- Second Round Collections

- Second Round Sub LLC

- Selip & Stylianou LLP

- Sequium Asset Solutions

- Sessoms and Rogers

- Sherman Acquisition

- Sherman Financial Group

- SIMM Associates

- Source Receivables Management

- Southern Management Systems

- Southwest Credit Group

- Spire Recovery Solutions

- SRS Company

- Stark Collection Agency

- State Collection Service

- Stenger and Stenger

- Stillman Law Office

- Summit Account Resolution

- Sunrise Credit Services

- Superlative RM Debt Collector

- Suttell and Hammer

- Synergetic Communication

- Synerprise Consulting

- The Law Office of Michael J Scott

- Trellis Company

- Troy Capital

- TRS Recovery Services

- Tulsa Teachers Credit Union

- UCB Collection

- Unifin Debt Collector

- Universal Credit Services

- US Bank Collections

- USAA collections

- USCB America

- Valentine and Kebartas

- Valley Servicing

- Vance & Huffman LLC

- Van Ru Credit Corporation

- Velo Law Office

- Velocity Investments

- Viking Client Services

- Wakefield and Associates

- Waypoint Resource Group

- Weinberg and Associates

- Weltman, Weinberg & Reis

- Westwood Funding

- Williams and Fudge

- Wilshire Consumer Credit

- Wolpoff & Abramson

- Worldwide Asset Purchasing

- www.AutomotiveCredit.com

- Zarzaur & Schwartz

- Zwicker & Associates

Resolve your debt with your creditor

Some creditors, banks, and lenders have an internal collections department. If they come after you for a debt, Solosuit can still help you respond and resolve the debt. Here’s a list of guides on how to resolve debt with different creditors.

- American Express ; American Express – Debt Collection

- Bank of America

- Best Buy Credit Card

- Capital One

- Credit One Bank

- Old Navy Credit Card

- PayPal Synchrony Card

- Regional Finance

- Retailers National Bank

- Reunion Student Loan Finance Corporation

- SYNCB/PPEXTR

- Synchrony Bank

- Synchrony Walmart Card

- Target National Bank

- Wells Fargo

- Can I Pay My Original Creditor Instead of a Debt Collection Agency?

- Can I Settle a Debt with the Original Creditor?

Settle your medical debt

Having a health challenge is stressful, but dealing medical debt on top of it is overwhelming. Here are some resources on how to manage medical debt.

- Am I Responsible for My Spouse's Medical Debt?

- Do I Need a Lawyer for Medical Bills?

- Do I Need a Lawyer to Fight Medical Bill Debt?

- Does Bankruptcy Clear Medical Debt?

- How Much Do Collection Agencies Pay for Medical Debt?

- How to Find Medical Debt Forgiveness Programs

- Is There a Statute of Limitations on Medical Bills?

- Medical Debt Statute of Limitations by State

- Summoned to Court for Medical Bills — What Do I Do?

- Summoned to Court for Medical Bills? What to Do Next

Guides on arbitration

If the thought of going to court stresses you out, you’re not alone. Many Americans who are sued for credit card debt utilize a Motion to Compel Arbitration to push their case out of court and into arbitration.

Below are some resources on how to use an arbitration clause to your advantage and win a debt lawsuit.

- How Arbitration Works

- How to Find an Arbitration Clause in Your Credit Agreement

- How to Make a Motion to Compel Arbitration

- How to Make a Motion to Compel Arbitration in Florida

- How to Make a Motion to Compel Arbitration Without an Attorney

- How Credit Card Arbitration Works

- Sample Motion to Compel Arbitration

Stop calls from debt collectors

Do you keep getting calls from an unknown number, only to realize that it’s a debt collector on the other line? If you’ve been called by any of the following numbers, chances are you have collectors coming after you, and we’ll tell you how to stop them.

- 1-800-390-7584

- 800-289-8004

- 800-955-6600

- 877-366-0169

- 877-591-0747

- 800-278-2420

- 800-604-0064

- 800-846-6406

- 877-317-0948

- 888-899-4332

- 888-912-7925

- 202-367-9070

- 502-267-7522

Federal debt collection laws can protect you

Knowing your rights makes it easier to stand up for your rights. Below, we’ve compiled all our articles on federal debt collection laws that protect you from unfair practices.

- 15 USC 1692 Explained

- Does the Fair Credit Reporting Act Work in Florida?

- FDCPA Violations List

- How to File an FDCPA Complaint Against Your Debt Collector (Ultimate Guide)

- How to Make a Fair Debt Collection Practices Act Demand Letter

- How to Submit a Transunion Dispute

- How to Submit an Equifax Dispute

- How to Submit an Experian Dispute

- What Debt Collectors Cannot Do — FDCPA Explained

- What Does Account Information Disputed by Consumer Meets FCRA Requirements Mean?

- What does “meets FCRA requirements” mean?

- What does FCRA stand for?

- What is the Consumer Credit Protection Act

Get debt relief in your state

We’ve created a specialized guide on how to find debt relief in all 50 states, complete with steps to take to find relief, state-specific resources, and more.

Debt collection laws in all 50 states

Debt collection laws vary by state, so we have compiled a guide to each state’s debt collection laws to make it easier for you to stand up for your rights—no matter where you live.

- Debt Collection Laws in Alabama

- Debt Collection Laws in Alaska

- Debt Collection Laws in Arizona

- Debt Collection Laws in Arkansas

- Debt Collection Laws in California

- Debt Collection Laws in Colorado

- Debt Collection Laws in Connecticut

- Debt Collection Laws in Delaware

- Debt Collection Laws in Florida

- Debt Collection Laws in Georgia

- Debt Collection Laws in Hawaii

- Debt Collection Laws in Kansas

- Debt Collection Laws in Idaho

- Debt Collection Laws in Illinois

- Debt Collection Laws in Indiana

- Debt Collection Laws in Iowa

- Debt Collection Laws in Kentucky

- Debt Collection Laws in Louisiana

- Debt Collection Laws in Massachusetts

- Debt Collection Laws in Michigan

- Debt Collection Laws in Minnesota

- Debt Collection Laws in Mississippi

- Debt Collection Laws in Missouri

- Debt Collection Laws in Montana

- Debt Collection Laws in Nebraska

- Debt Collection Laws in Nevada

- Debt Collection Laws in New Hampshire

- Debt Collection Laws in New Jersey

- Debt Collection Laws in New Mexico

- Debt Collection Laws in New York

- Debt Collection Laws in North Carolina

- Debt Collection Laws in North Dakota

- Debt Collection Laws in Ohio

- Debt Collection Laws in Oklahoma

- Debt Collection Laws in Oregon

- Debt Collection Laws in Pennsylvania

- Debt Collection Laws in Rhode Island

- Debt Collection Laws in South Carolina

- Debt Collection Laws in South Dakota

- Debt Collection Laws in Tennessee

- Debt Collection Laws in Texas

- Debt Collection Laws in Vermont

- Debt Collection Laws in Virginia

- Debt Collection Laws in Washington

- Debt Collection Laws in West Virginia

- Debt Collection Laws in Wisconsin

- Debt Collection Laws in Wyoming

Statute of limitations on debt state guides

Like all debt collection laws, the statute of limitations on debt varies by state. So, we wrote a guide on each state’s statutes. Check it out below.

Statute of Limitations on Debt Collection by State (Best Guide)

- Statute of Limitations on Debt Collection in Alabama

- Statute of Limitations on Debt Collection in Alaska

- Statute of Limitations on Debt Collection in Arizona

- Statute of Limitations on Debt Collection in Arkansas

- Statute of Limitations on Debt Collection in California

- Statute of Limitations on Debt Collection in Connecticut

- Statute of Limitations on Debt Collection in Colorado

- Statute of Limitations on Debt Collection in Delaware

- Statute of Limitations on Debt Collection in Florida

- Statute of Limitations on Debt Collection in Georgia

- Statute of Limitations on Debt Collection in Hawaii

- Statute of Limitations on Debt Collection in Illinois

- Statute of Limitations on Debt Collection in Indiana

- Statute of Limitations on Debt Collection in Iowa

- Statute of Limitations on Debt Collection in Kansas

- Statute of Limitations on Debt Collection in Louisiana

- Statute of Limitations on Debt Collection in Maine

- Statute of Limitations on Debt Collection in Maryland

- Statute of Limitations on Debt Collection in Michigan

- Statute of Limitations on Debt Collection in Minnesota

- Statute of Limitations on Debt Collection in Mississippi

- Statute of Limitations on Debt Collection in Missouri

- Statute of Limitations on Debt Collection in Montana

- Statute of Limitations on Debt Collection in Nebraska

- Statute of Limitations on Debt Collection in Nevada

- Statute of Limitations on Debt Collection in New Hampshire

- Statute of Limitations on Debt Collection in New Jersey

- Statute of Limitations on Debt Collection in New Mexico

- Statute of Limitations on Debt Collection in New York

- Statute of Limitations on Debt Collection in North Carolina

- Statute of Limitations on Debt Collection in North Dakota

- Statute of Limitations on Debt Collection in Oklahoma

- Statute of Limitations on Debt Collection in Oregon

- Statute of Limitations on Debt Collection in Oregon (Complete Guide)

- Statute of Limitations on Debt Collection in Pennsylvania

- Statute of Limitations on Debt Collection in Rhode Island

- Statute of Limitations on Debt Collection in South Carolina

- Statute of Limitations on Debt Collection in South Dakota

- Statute of Limitations on Debt Collection in Tennessee

- Statute of Limitations on Debt Collection in Texas

- Statute of Limitations on Debt Collection in Utah

- Statute of Limitations on Debt Collection in Vermont

- Statute of Limitations on Debt Collection in Virginia

- Statute of Limitations on Debt Collection in Washington

- Statute of Limitations on Debt Collection in West Virginia

- Statute of Limitations on Debt Collection in Wisconsin

- Statute of Limitations on Debt Collection in Wyoming

Check the status of your court case

Don’t have time to go to your local courthouse to check the status of your case? We’ve created a guide on how to check the status of your case in every state, complete with online search tools and court directories.

- Alabama Court Case Search—Find Your Lawsuit

- Alaska Court Case Search — Find Your Lawsuit

- Arizona Court Case Search - Find Your Lawsuit

- Arkansas Court Case Search — Find Your Lawsuit

- California Court Case Search- Find Your Lawsuit

- Colorado Court Case Search — Find Your Lawsuit

- Connecticut Case Lookup — Find Your Court Case

- Delaware Court Case Search — Find Your Lawsuit

- Florida Court Case Search — Find Your Lawsuit

- Georgia Court Case Search — Find Your Lawsuit

- Hawaii Court Case Search — Find Your Lawsuit

- Idaho Court Case Search – Find Your Lawsuit

- Illinois Court Case Search — Find Your Lawsuit

- Indiana Court Case Search — Find Your Lawsuit

- Iowa Court Case Search — Find Your Lawsuit

- Kansas Court Case Search — Find Your Lawsuit

- Kentucky Court Case Search — Find Your Lawsuit

- Louisiana Court Case Search — Find Your Lawsuit

- Maine Court Case Search — Find Your Lawsuit

- Maryland Court Case Search — Find Your Lawsuit

- Massachusetts Court Case Search — Find Your Lawsuit

- Michigan Court Case Search — Find Your Lawsuit

- Minnesota Court Case Search — Find Your Lawsuit

- Mississippi Court Case Search — Find Your Lawsuit

- Missouri Court Case Search — Find Your Lawsuit

- Montana Court Case Search — Find Your Lawsuit

- Nebraska Court Case Search — Find Your Lawsuit

- Nevada Court Case Search — Find Your Lawsuit

- New Hampshire Court Case Search — Find Your Lawsuit

- New Jersey Court Case Search—Find Your Lawsuit

- New Mexico Court Case Search - Find Your Lawsuit

- New York Case Search — Find Your Lawsuit

- North Carolina Court Case Search — Find Your Lawsuit

- North Dakota Court Case Search �� Find Your Lawsuit

- Ohio Court Case Search — Find Your Lawsuit

- Oklahoma Court Case Search — Find Your Lawsuit

- Oregon Court Case Search — Find Your Lawsuit

- Pennsylvania Court Case Search — Find Your Lawsuit

- Rhode Island Court Case Search — Find Your Lawsuit

- South Carolina Court Case Search — Find Your Lawsuit

- South Dakota Court Case Search — Find Your Lawsuit

- Tennessee Court Case Search — Find Your Lawsuit

- Texas Court Case Search — Find Your Lawsuit

- Utah Court Case Search — Find Your Lawsuit

- Vermont Court Case Search — Find Your Lawsuit

- Virginia Court Case Search — Find Your Lawsuit

- Washington Court Case Search — Find Your Lawsuit

- West Virginia Court Case Search — Find Your Lawsuit

- Wisconsin Court Case Search — Find Your Lawsuit

- Wyoming Court Case Search — Find Your Lawsuit

How to stop wage garnishment in your state

Forgot to respond to your debt lawsuit? The judge may have ordered a default judgment against you, and with a default judgment, debt collectors can garnish your wages. Here are our guides on how to stop wage garnishment in all 50 states.

- Stop Wage Garnishment in Alabama

- Stop Wage Garnishment in Alaska

- Stop Wage Garnishment in Arizona

- Stop Wage Garnishment in Arkansas

- Stop Wage Garnishment in California

- Stop Wage Garnishment in Colorado

- Stop Wage Garnishment in Connecticut

- Stop Wage Garnishment in Delaware

- Stop Wage Garnishment in Florida

- Stop Wage Garnishment in Georgia

- Stop Wage Garnishment in Hawaii

- Stop Wage Garnishment in Idaho

- Stop Wage Garnishment in Illinois

- Stop Wage Garnishment in Indiana

- Stop Wage Garnishment in Iowa

- Stop Wage Garnishment in Kansas

- Stop Wage Garnishment in Kentucky

- Stop Wage Garnishment in Louisiana

- Stop Wage Garnishment in Maine

- Stop Wage Garnishment in Maryland

- Stop Wage Garnishment in Massachusetts

- Stop Wage Garnishment in Michigan

- Stop Wage Garnishment in Minnesota

- Stop Wage Garnishment in Mississippi

- Stop Wage Garnishment in Missouri

- Stop Wage Garnishment in Montana

- Stop Wage Garnishment in Nevada

- Stop Wage Garnishment in New Hampshire

- Stop Wage Garnishment in New Jersey

- Stop Wage Garnishment in New Mexico

- Stop Wage Garnishment in New York

- Stop Wage Garnishment in North Carolina

- Stop Wage Garnishment in North Dakota

- Stop Wage Garnishment in Ohio

- Stop Wage Garnishment in Oklahoma

- Stop Wage Garnishment in Oregon

- Stop Wage Garnishment in Pennsylvania

- Stop Wage Garnishment in Rhode Island

- Stop Wage Garnishment in South Carolina

- Stop Wage Garnishment in South Dakota

- Stop Wage Garnishment in Tennessee

- Stop Wage Garnishment In Texas

- Stop Wage Garnishment In Utah

- Stop Wage Garnishment in Vermont

- Stop Wage Garnishment in Virginia

- Stop Wage Garnishment in Washington

- Stop Wage Garnishment in West Virginia

- Stop Wage Garnishment in Wisconsin

- Stop Wage Garnishment in Wyoming

Other wage garnishment resources

- Bank Account Garnishment and Liens in Texas

- Can I Stop Wage Garnishment?

- Can My Wife's Bank Account Be Garnished for My Debt?

- Can Payday Loans Garnish Your Wages?

- Can pensions be garnished?

- Can Private Disability Payments Be Garnished?

- Can Social Security Disability Be Garnished?

- Can They Garnish Your Wages for Credit Card Debt?

- Can You Stop a Garnishment Once It Starts?

- Guide to Garnishment Limits by State

- How Can I Stop Wage Garnishments Immediately?

- How Long Before a Creditor Can Garnish Wages?

- How Long Does It Take to Get Garnished Wages Back?

- How to Fight a Wage Garnishment

- How to Prevent Wage Garnishment

- How to Stop a Garnishment

- How to Stop Social Security Wage Garnishment

- How to Stop Wage Garnishment — Everything You Need to Know

- New York Garnishment Laws – Overview

- Ohio Garnishment Laws — What They Say

- Wage Garnishment Lawyer

- What Is Wage Garnishment?

How to settle a debt in your state

Debt settlement is one of the most effective ways to resolve a debt and save money. We’ve created a guide on how to settle your debt in all 50 states. Find out how to settle in your state with a simple click and explore other debt settlement resources below.

- How to Settle a Debt in Alabama

- How to Settle a Debt in Alaska

- How to Settle a Debt in Arizona

- How to Settle a Debt in Arkansas

- How to Settle a Debt in California

- How to Settle a Debt in Colorado

- How to Settle a Debt in Delaware

- How to Settle a Debt in Florida

- How to Settle a Debt in Hawaii

- How to Settle a Debt in Idaho

- How to Settle a Debt in Illinois

- How to Settle a Debt in Indiana

- How to Settle a Debt in Iowa

- How to Settle a Debt in Kansas

- How to Settle a Debt in Kentucky

- How to Settle a Debt in Louisiana

- How to Settle a Debt in Maryland

- How to Settle a Debt in Massachusetts

- How to Settle a Debt in Michigan

- How to Settle a Debt in Minnesota

- How to Settle a Debt in Mississippi

- How to Settle a Debt in Missouri

- How to Settle a Debt in Montana

- How to Settle a Debt in Nebraska

- How to Settle a Debt in Nevada

- How to Settle a Debt in New Hampshire

- How to Settle a Debt in New Jersey

- How to Settle a Debt in New Mexico

- How to Settle a Debt in New York

- How to Settle a Debt in North Carolina

- How to Settle a Debt in North Dakota

- How to Settle a Debt in Ohio

- How to Settle a Debt in Oklahoma

- How to Settle a Debt in Oregon

- How to Settle a Debt in Pennsylvania

- How to Settle a Debt in South Carolina

- How to Settle a Debt in South Dakota

- How to Settle a Debt in Tennessee

- How to Settle a Debt in Texas

- How to Settle a Debt in Utah

- How to Settle a Debt in Vermont

- How to Settle a Debt in Virginia

- How to Settle a Debt in West Virginia

- How to Settle a Debt in Wisconsin

- How to Settle a Debt in Wyoming

How to settle with every debt collector

Not sure how to negotiate a debt settlement with a debt collector? We are creating guides to help you know how to start the settlement conversation and increase your chances of coming to an agreement with every debt collector.

- American Express

- Capitol One

- Cavalry SPV

- Midland Funding

- Moore Law Group

- Navy Federal

- NCB Management Services

- Portfolio Recovery

Other debt settlement resources

- Best Debt Settlement Companies

- Can I Settle a Debt After Being Served?

- Can I Still Settle a Debt After Being Served?

- Can You Settle a Warrant in Debt Before Court?

- Debt Management vs. Debt Settlement

- Debt Settlement Pros and Cons

- Debt Settlement Scam

- Do I Need to Hire a Debt Settlement Lawyer?

- Do You Need a Debt Settlement Attorney in Houston Texas?

- Do You Owe Taxes on Settled Debt?

- Here’s a Sample Letter to Collection Agencies to Settle Debt

- How Can I Settle My Credit Card Debt Before Going to Court?

- How Do I Know if a Debt Settlement Company Is Legitimate?

- How Long Does a Lawsuit Take to Settle?

- How Much Do Settlement Companies Charge?

- How I Settled My Credit Card Debt With Discover

- How to Make a Debt Settlement Agreement

- How to Make a Settlement Offer to Navient

- How to Negotiate a Debt Settlement with a Law Firm

- How to send Santander a settlement letter

- How to Settle Debt for Pennies on the Dollar

- How to Settle Debt in 3 Steps

- How to Settle Debt with a Reduced Lump Sum Payment

- How to Settle a Credit Card Debt Lawsuit — Ultimate Guide

- How to Settle Credit Card Debt When a Lawsuit Has Been Filed

- If You Are Using a Debt Relief Agency, Can You Settle Yourself with the Creditor?

- Largest Debt Settlement Companies

- Should I Settle a Collection or Pay in Full?

- Summary of the Equifax Data Breach Settlement

- The Advantages of Pre-Settlement Lawsuit Funding

- The FTC Regulates Debt Settlement Through the Telemarketing Sales Rule

- The Pros and Cons of Debt Settlement

- What Happens if I Reject a Settlement Offer?

- What Happens if You Don't Pay a Debt Settlement?

- What Happens When You Settle a Debt?

- What Is A Debt Settlement Agreement?

- What is Debt Settlement?

- What Percentage Should I Offer to Settle Debt?

- What to Ask for in a Settlement Agreement

- Who Qualifies for Debt Settlement?

- Will Collection Agencies Settle for Less?

- 5 Signs of a Debt Settlement Scam

Personal loan and debt relief reviews

We give a factual review of the following debt consolidation, debt settlement, and loan organizations and companies to help you make an informed decision before you take on a debt.

- Accredited Debt Relief Debt Settlement Reviews

- Advance America Loan Review

- ACE Cash Express Personal Loan Review

- BMG Money Loan Review

- BMO Harris Bank Review: Pros and Cons

- Brite Solutions Debt Settlement Reviews

- Caliber Home Loans Mortgage Review

- Cambridge Debt Consolidation Review

- Campus Debt Solutions Review

- CashNetUSA Review

- Century Debt Settlement Reviews

- ClearPoint Debt Management Review

- Click N Loan Reviews

- CuraDebt Debt Settlement Review

- CuraDebt Reviews: Debt Relief Assistance For California Residents

- Debt Eraser Review

- Debtconsolidation.com Debt Settlement Reviews

- Eagle One Debt Settlement Reviews

- Freedom Debt Relief Debt Settlement Reviews

- Global Holdings Debt Settlement Reviews

- Golden 1 Credit Union Personal Loan Review

- Honda Financial Services Review

- iLending Reviews

- Infinite Law Group Debt Settlement Reviews

- JG Wentworth Debt Settlement Reviews

- LoanMart Reviews

- Mastriani Law Firm Review

- Milestone ® Mastercard ® Review

- ModoLoan Review

- Money Management International Reviews

- M&T Mortgage Company Review

- National Debt Relief Debt Settlement Reviews

- New Era Debt Settlement Reviews

- OppLoans Review

- Pacific Debt Relief Reviews

- Palisade Legal Group Debt Settlement Reviews

- PCG Debt Consolidation Review

- PenFed Auto Loan Review

- Priority Plus Financial Reviews

- Roseland Associates Debt Consolidation Review

- SDCCU Debt Consolidation Review

- Speedy Cash Loans Review

- Symple Lending Reviews

- Tripoint Lending Reviews

- TurboDebt Debt Settlement Reviews

- Turnbull Law Group Debt Settlement Reviews

- United Debt Settlement Reviews

- Upgrade Auto Loans Reviews

How to repair and improve your credit score

Debt has a big impact on your credit. Below is a list of guides on how to repair and improve your credit, even while managing major debt.

- 3 Ways to Repair Your Credit with Debt Collections

- 5 Pros and Cons of Credit Cards & How to Use Them Wisely

- 6 Reasons Your Credit Score Isn't Going Up

- Bankruptcy vs Debt Settlement: Which is Better for Your Credit Score?

- Does Debt Consolidation Hurt Your Credit Score?

- Does Wage Garnishment Affect Credit?

- Guide to Disclosing Income on Your Credit Card Application

- How Long Does It Take to Improve My Credit Score After Debt Settlement?

- How Often Does Merrick Bank Increase Your Credit Limit?

- How to fix your credit to buy a house

- How to Handle Debt and Improve Credit

- How to Raise My Credit Score 40 Points Fast

- If I Settle with a Collection Agency, Will It Hurt My Credit?

- Is 600 a Good Credit Score?

- Obama Credit Card Debt Relief Program – How to Use It

- Sample credit report dispute letter

- Should I Use Credit Journey?

- Understanding myFICO: Your Gateway to Better Credit

- What Does "DLA" Mean on a Credit Report?

- What Is A Good Credit Score For Businesses?

- What is American Credit Acceptance?

- What is CBNA on my credit report?

- What is CreditFresh?

- Who Made the Credit Score?

- Why is THD/CBNA on my credit report?

How to resolve student loan debt

Struggling with student debt? SoloSuit’s got you covered. Below are resources on handling student loan debt.

- Budgeting Strategies for Students: How to Manage Your Finances Wisely

- Can You Go to Jail for Not Paying Student Loans?

- Can You Settle Student Loan Debt?

- Do Student Loans Go Away After 7 Years? (2022 Guide)

- Do You Need a Student Loan Lawyer? (Complete Guide)

- Does Student Debt Die With You?

- How to Manage a Student Debt

- How to Get Rid of Student Loan Debt

- Mandatory Forbearance Request Student Loan Debt Burden

- Negative Economic Effects of Student Loan Debt on the US Economy

- Pros and Cons of Taking a Student Loan

- Regional Adjustment Bureau Student Loans – How to Win

- The Real Impact of Student Debt: How Our Brains Handle It

- Why It's Important to Teach Students How to Manage Debt

- 5 Alternatives to Taking a Student Loan

- 5 Tips for Students: How to Create a Realistic and Effective Budget

- 7 College Financial Planning Tips for Students

- 7 Things to Consider When Taking a Student Loan

- 7 Tips to Manage Your Student Loans

Civil law legal definitions

You can represent yourself in court. Save yourself the time and cost of finding an attorney, and use the following resources to understand legal definitions better and how they may apply to your case.

- Accleration Clause — Definition

- Adjuster - Defined

- Adverse Action — Definition

- Affidavit — A Definition

- Annulment vs. divorce – what's the difference?

- Anticipatory Repudiation — Definition

- Bench Trial — Defined

- Certificate of Debt: A Definition

- Commuted Sentence – Definition

- Constructive Eviction - Defined

- Constructive Discharge - Definition

- Defendant - Definition and Everything You Need to Know

- Demurred – Definition

- Dischargeable - Definition

- Disclosures — Definition

- False Imprisonment Defined

- Good Faith Exception – Definition

- Hearsay — A Definition

- HOEPA – Definition

- Implied Contract – Definition

- Injunctive Relief — A Definition

- Intestate–Defined

- Irrevocable Agreement — Defined

- Joint Custody–Defined

- Litigator — A Definition

- Mediation - Definition

- Medical Malpractice — Definition

- Mistrial — A Definition

- Mitigating Circumstances — Definition

- Motion for Summary Judgment — Definition

- Nolle Prosequi – Definition

- Nunc Pro Tunc — A Definition

- Plaintiff - Definition and Everything You Need to Know

- Pro Se - Defined

- Probable Cause Hearing — Definition

- Restitution – Definition

- Sole Custody-Defined

- Statute of Limitations—Definition and Everything You Need to Know

- Summons—Definition

- Tenancy in Common – Defined

- Time Is of the Essence – Definition

- What Is the Bankruptcy Definition of Consumer Debt?

- Wrongful Termination–Defined

Get answers to these FAQs on debt collection

- Am I Responsible for My Husband's Debts If We Divorce?

- Am I Responsible for My Parent's Debt if I Have Power of Attorney?

- Can a Collection Agency Add Fees on the Debt?

- Can a Collection Agency Charge Interest on a Debt?

- Can a Credit Card Company Sue Me?

- Can a Debt Collector Freeze Your Bank Account?

- Can a Debt Collector Leave a Voicemail?

- Can a Debt Collector Take My Car in California?

- Can a Judgment Creditor Take my Car?

- Can a Process Server Leave a Summons Taped to My Door?

- Can an Eviction Be Reversed?

- Can Credit Card Companies Garnish Your Wages?

- Can Credit Cards Garnish Wages?

- Can Debt Collectors Call From Local Numbers?

- Can Debt Collectors Call You at Work in Texas?

- Can Debt Collectors Call Your Family?

- Can Debt Collectors Leave Voicemails?

- Can I Pay a Debt Before the Court Date?

- Can I Rent an Apartment if I Have Debt in Collection?

- Can I Sue the President for Emotional Distress?

- Can the SCRA Stop a Default Judgment?

- Can the Statute of Limitations be Extended?

- Can You Appeal a Default Judgement?

- Can You Get Unemployment if You Quit?

- Can You Go to Jail for a Payday Loan?

- Can You Go to Jail for Credit Card Debt?

- Can You Negotiate with Westlake Financial?

- Can You Record a Call with a Debt Collector in Your State?

- Can You Serve Someone with a Collections Lawsuit at Their Work?

- Can You Sue Someone Who Has Filed Chapter 7 Bankruptcy?

- Capital One is Suing Me – How Can I Win?

- Debt Snowball vs. Debt Avalanche: Which One Is Apt for You?

- Do 609 Letters Really Work?

- Do Debt Collectors Ever Give Up?

- Do I Have Too Much Debt to Divorce My Spouse?

- Do I Need a Debt Collection Defense Attorney?

- Do I Need a Debt Negotiator?

- Do I Need a Legal Coach?

- Do I Need a Payday Loans Lawyer?

- Does a Living Trust Protect Your Assets from Lawsuits?

- Does Chase Sue for Credit Card Debt?

- Does Debt Consolidation Have Risks?

- Does Midland Funding Show Up to Court?

- How Can I Get Financial Assistance in PA?

- How do Debt Relief Scams Work?

- How Do I Find Out If I Have Any Judgments Against Me?

- How Do I Get Rid of a Judgment Lien on My Property?

- How Do I Register on the Do Not Call List?

- How Does a Flex Loan Work?

- How Does Debt Affect Your Ability to Buy a Home?

- How Does Finwise Bank Work?

- How does Navy Credit debt forgiveness work?

- How Does Payments.tsico Work?

- How Important is it to Protect your Assets from Unexpected Events?

- How is Debt Divided in Divorce?

- How Long Do Creditors Have to Collect a Debt from an Estate?

- How long do debt collectors take to respond to debt validation letters?

- How Long Does a Judgement Last?

- How Long Does a Judgment Last?

- How Long Does a Levy Stay on a Bank Account?

- How Long Does an Eviction Stay on Your Record?

- How Many Calls from a Debt Collector is Considered Harassment?

- How Many Times Can a Judgment Be Renewed in North Carolina?

- How Many Times Can a Judgment be Renewed in Oklahoma?

- How Much Do Collection Agencies Pay for Debt?

- How Much Do You Have to Be in Debt to File Chapter 7?

- How Much Does College Actually Cost?

- How Often Do Credit Card Companies Sue for Non-Payment?

- How Should You Respond to the Theft of Your Identity?

- I am being sued because my identity was stolen - What do I do?

- If a Car is Repossessed Do I Still Owe the Debt?

- Is Debt Forgiveness Taxable?

- Is Freedom Debt Relief a Scam?

- Is it Legal for Debt Collectors to Call Family Members?

- Is it Smart to Consolidate Debt?

- Is LVNV Funding a Legitimate Company? - Them in Court

- Is My Case in the Right Venue?

- Is Portfolio Recovery Associates Legit? — How to Win

- Is Severance Pay Taxable?

- Is SoloSuit Worth It?

- Is Someone with Power of Attorney Responsible for Debt After Death?

- Is the NTB Credit Card Safe?

- Is There a Judgment Against Me Without my Knowledge?

- Is transworld systems legitimate? — How to win in court

- Liquidate–What Does it Mean?

- Litigation Finance: Is it a Good Investment?

- Received a 3-Day Eviction Notice? Here's What To Do

- Should I File Bankruptcy Before or After a Judgment?

- Should I Hire a Civil Litigation Attorney?

- Should I Hire a Civil Rights Lawyer?

- Should I Hire a Litigation Attorney?

- Should I Marry Someone With Debt?

- Should I Pay Off an Old Apartment Debt?

- Should I Send a Demand Letter Before a Lawsuit?

- Should I Use My IRA to Pay Off Credit Card Debt?

- Should You Communicate with a Debt Collector in Writing or by Telephone?

- Should You Invest in Stocks While In Debt?

- Subsidized vs. Unsubsidized Loans: Which is Better?

- The Truth: Should You Never Pay a Debt Collection Agency?

- What are the biggest debt collector companies in the US?

- What are the different types of debt?

- What Bank Is Behind Best Buy's Credit Card?

- What Bank Issues Kohl's Credit Card?

- What Bank Owns Old Navy Credit Card?

- What Credit Bureau does Aqua Finance Use?

- What Credit Bureau Does Truliant Use?

- What Does “Apple Pay Transaction Under Review” Mean?

- What Does a Debt Collector Have to Prove in Court?

- What Does BAC Stand For?

- What does HAFA stand for?

- What Does Payment Deferred Mean?

- What Does Reaffirmation of Debt Mean?

- What Happens After a Motion for Default Is Filed?

- What Happens at a Motion for Summary Judgment Hearing?

- What Happens If a Defendant Does Not Pay a Judgment?

- What Happens If a Process Server Can't Serve You?

- What Happens if a Tenant Wins an Eviction Lawsuit?

- What Happens If Someone Sues You and You Have No Money?

- What Happens If You Avoid Getting Served Court Papers?

- What Happens If You Don’t Pay Speedy Cash?

- What Happens If You Ignore a Debt Collector?

- What Happens If You Never Answer Debt Collectors?

- What Happens When a Debt Is Sold to a Collection Agency

- What Happens When a Debt Is Sold to a Collection Agency?

- What If a Summons Was Served to the Wrong Person?

- What If an Order for Default Was Entered?

- What if I default on an Avant payment?

- What If the Wrong Defendant Is Named in a Lawsuit?

- What Is a Case Number?

- What is a Certificate of Judgment in Ohio?

- What Is a Certificate of Service?

- What Is a Civil Chapter 61 Warrant?

- What is a Civil Litigation Lawyer?

- What Is a Consent Judgment?

- What Is a CPN Number?

- What Is a Debt Brokerage?

- What Is a Debt-to-Sales Ratio?

- What Is a Defamation Lawsuit?

- What is a default judgment?— What do I do?

- What Is a Libel Lawsuit?

- What is a Lien on a House?

- What is a Lien Release on a Car?

- What is a Lien?

- What Is a Motion to Strike?

- What Is a Motion to Suppress?

- What Is a Non-Dischargeable Debt in Tennessee?

- What Is a Nonsuit Without Prejudice?

- What Is a Preliminary Hearing?

- What Is a Reaffirmation Agreement?

- What Is a Request for Dismissal?

- What Is a Rule 3.740 Collections Defense in California?

- What Is a Slander Lawsuit?

- What is a Stipulated Judgment?

- What Is a Warrant in Debt?

- What is ABC Financial Club Charge?

- What is ACS Ed Services?

- What is Advanced Call Center Technologies?

- What is Alimony?

- What Is Allied Interstate's Phone Number?

- What is an Affirmative Defense?

- What Is an Assignment of Debt?

- What Is an Attorney Malpractice Lawsuit?

- What Is an Unlawful Detainer Lawsuit?

- What is Bank of America CashPro?

- What is Bitty Advance?

- What Is Celtic Bank?

- What is Consumer Portfolio Services?

- What Is Credence Resource Management?

- What Is Debt Internment?

- What Is Discover's 60/60 plan?

- What is Evading the Police?

- What Is Extinguishment of Debt?

- What is First Investors Financial Services?

- What is Global Lending Services?

- What is homicide?

- What Is Lexington Law Firm?

- What is LGFCU Personal Loan?

- What is Moral Turpitude?

- What is Online Information Services?

- What is Oportun?

- What Is Service of Process in Texas?

- What is sewer service?

- What Is Summary Judgment?

- What is Synchrony Bank's Hardship Program?

- What Is T-Mobile's Phone Number for Debt Collection?

- What Is the Amount of Money You Still Owe to Their Credit Card Company Called?

- What is the Deadline for a Defendant's Answer to Avoid a Default Judgment?

- What Is the Formula for Calculating Closing Costs?

- What Is the Minimum Amount That a Collection Agency Will Sue For?

- What Is the Phone Number for IQ Data?

- What is the Purpose of the Truth in the Lending Act?

- What is the status of my case?

- What Is the Statute of Limitations on Debt in Washington?

- What is the Telemarketing Sales Rule?

- What is Unsecured Credit Card Debt?

- What is WCTCB?

- What is WFDS?

- What is WUVISAAFT?

- What is Zombie Debt, and How Do I Deal With It?

- What Personal Property Can Be Seized in a Judgment?

- What Should I Do If Crown Asset Management Suing Me?

- What Should I Do If OneMain Financial Is Taking Me to Court?

- What Should You Do if You Can't Pay Your Mortgage?

- What states require a professional licensing number for debt collectors?

- When Does Exeter Finance Repo Cars?

- When Is My Rent Due Legally?

- Where’s My Amended Tax Return?

- Which Bank Does Macy's Credit Card Use?

- Who is EOSCCA?

- Who is Over the Loan Forgiveness Program at KHESLC?