Penalty analysis

Penalty analysis detects product characteristics that could be improved to increase quality. Do it in Excel using the XLSTAT add-on statistical software.

What is penalty analysis

Penalty analysis is a method used in sensory data analysis to identify potential directions for the improvement of products , on the basis of surveys performed on consumers or experts.

Two types of data are used:

- Preference data (or liking scores) that correspond to a global satisfaction index for a product (for example, liking scores on a 9 point scale for a chocolate bar), or for a characteristic of a product (for example, the comfort of a car rated from 1 to 10).

- Data collected on a JAR (Just About Right) scale. These correspond to ratings ranging from 1 to 6 for one or more characteristics of the product of interest. 1 corresponds not « Not enough at all », 2 to « Not enough », 3 to « JAR » (Just About Right), an ideal for the consumer, 4 to « Too much » and 5 to « Far too much ». For example, for a chocolate bar, one can rate the bitterness, and for the comfort of the car, the sound volume of the engine.

The method, based on multiple comparisons such as those used in ANOVA , consists in identifying, for each characteristic studied on the JAR scale, if the rankings on the JAR scale are related to significantly different results in the liking scores.

For example, if a chocolate is too bitter, does that significantly impact the liking scores?

The word penalty comes from the fact that we are looking for the characteristics which can penalize the consumer satisfaction for a given product. The penalty is the difference between the mean of the liking scores for the JAR category, and the mean of the scores for the other categories.

Principle of penalty analysis

Penalty analysis is subdivided into three phases:

- The data of the JAR scale are aggregated: on one hand, categories 1 and 2 are grouped, and on the other hand categories 4 and 5 are grouped, which leads to a three point scale. We now have three levels: "Not enough", "JAR", and "Too much".

- We then compute and compare the means of the liking scores for the three categories, to identify significant differences. The difference between the means of the 2 non-JAR categories and the JAR category is called mean drops.

- We compute the penalty and test if it is significantly different from 0.

Results for penalty analysis in XLSTAT

After the display of the basic statistics and the correlation matrix for the liking scores and the JAR data , XLSTAT displays a table that shows for each JAR dimension the frequencies for the 5 levels (or 7 or 9 depending on the selected scale). The corresponding stacked bar diagram is then displayed. The table of the collapsed data on three levels is then displayed, followed by the corresponding relative frequencies table and the stacked bar diagram . The penalty table allows you to visualize the statistics for the 3 point scale JAR data, including the means, the mean drops, the penalties and the results of the multiple comparisons tests.

Last, the summary charts enable you to quickly identify the JAR dimensions for which the differences between the JAR category and the 2 non-JAR categories ("Not enough", "Too much") are significantly different: when the difference is significant, the bars are displayed in red color, whereas they are displayed in green color when the difference is not significant. The bars are displayed in grey when the size of a group is lower than the select threshold (see the Options tab of the dialog box).

The mean drop vs % chart displays the mean drops as a function of the corresponding % of the population of testers. The threshold % of the population over which the results are considered significant is displayed with a dotted line.

analyze your data with xlstat

Included in

Related features

Penalty Plus: Attribute-related survey data analysis

Recorded: October 26, 2023

With: Brian Briskey , Senior Director of Strategic Consulting

Product Leaders team up to solve the biggest threat to product innovation - VUCA!

- VUCA is creating more noise , that leads to insufficient data , which distracts attention, ruins focus, and frustrates efforts to sift through weak signals of consumer demand.

- VUCA is creating more dynamism , that negates or outdates models , which leads to poor conclusions, weakens decision making, and damages confidence needed for strategic alignment across the organization.

Hear innovation experts in your industry articulate the symptoms of VUCA which you must immediately recognize to know if you have it truly bad (and can't afford to make any more excuses), followed by two novel approaches they discovered to help overcome those challenges - starting with a practical first step you can do immediately.

Join us to assess your situation and follow along as we walkthrough the steps to resolve VUCA!

Dolores Oreskovich

Assoc. Director, Head Consumer Sensory Insights

Nestle Health Science

Kris Wright

V.P, Research & Operations

InsightsNow

Brian Briskey

Senior Director Strategic Consulting

Dave Lundahl

Recording date: thursday, august 17 .

With: Greg Stucky , Chief Research Officer

70% of brand extensions fail to survive their first two years on the market. This high failure rate is most often associated with the brand missing its brand fingerprint. Either it was positioned too far away from current brand equity, or it the product itself didn’t deliver on the sensory brand fingerprint and clearly deliver an authentic experience.

What cues tell you it's a genuine Nutella, Reese’s or Pringles brand?

A sensory brand fingerprint is a clear definition of the implicit benefits and associated sensory cues which make consumers intuitively “know” that a product is an authentic branded product. The sensory cues associated with the brand become its signature and are the foundation of all products in a line. This core sensory profile is critical to build into all line extensions for the brand to gain implicit recognition. Clearly articulating the sensorial fingerprint within the product strategy assures alignment with the brand strategy.

You will learn:

- Learn what best communicates the sensory-brand fingerprint within your team.

- See how a sensory-brand fingerprint can integrate with your product strategy to better fit category and go-to-market strategies.

- Learn how to best fix gaps between sensory cues, design, messaging and communications, design, imagery, and packaging.

Greg Stucky

Chief Research Officer

InsightsNow Inc.

Penalty analysis in Excel tutorial

This tutorial helps you set up and interpret a penalty analysis in Excel using the XLSTAT statistical software.

Dataset to run a penalty analysis

Two types of data are used in this example:

Preference data (or liking scores) that example corresponds to a survey where a given brand/type of potato chips has been evaluated by 150 consumers. Each consumer gave a rating on a 1 to 5 scale for four attributes (Saltiness, Sweetness, Acidity, Crunchiness) - 1 means "little", and 5 "a lot" -, and then gave an overall liking score on a 1-10 Likert scale.

Data was collected on a JAR (Just About Right) 5-point scale. These correspond to ratings ranging from 1 to 5 for four attributes (Saltiness, Sweetness, Acidity, Crunchiness). 1 corresponds not «’ Not enough at all», 2 to «’ Not enough’», 3 to «’ JAR’»’ (Just About Right), an ideal for the consumer, 4 to «’ Too much’» and 5 to «’ Far too much».

Goal of this tutorial

Our goal is to identify some possible directions for the development of a new product.

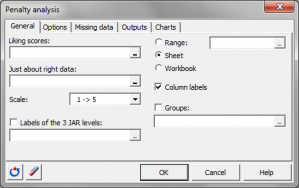

Setting up a penalty analysis

Once XLSTAT is open, click on Sensory / Rapid Tasks / Penalty analysis .

The Penalty analysis dialog box appears.

We select the liking scores, and then the JAR data. The 3 levels JAR labels are also selected. They make the results easier to interpret.

In the Options tab, we define the threshold of the sample size below which the comparison tests won't be performed because they might not be reliable enough.

In the Outputs , the Spearman correlation was chosen because the data are ordinal.

The computations begin once you have clicked OK . The results will then be displayed.

Interpreting the results of a penalty analysis

The first results are the descriptive statistics for the liking data and the various JAR variables. The correlation matrix is then displayed.

However, if a correlation between a JAR variable and a liking variable is significantly different from 0, which could mean that the JAR variable has a low impact on the liking: if it had a strong impact, the correlation should ideally be 0. If the "too much" cases have a lower impact than the "too little", the correlation might be positive, and vice-versa for the negative correlations.

The next table is a summary of the JAR data. The chart that follows is based on that table and allows visualizing quickly how the JAR scores are distributed for each dimension.

The name of the JAR dimension.

The 3 collapsed levels of the JAR data.

The frequencies corresponding to each level.

The % corresponding to each level.

The sum of the liking scores corresponding to each level.

The average liking for each level.

The mean drops for the "too much" and "too little" levels (this is the difference between the liking mean for the JAR levels minus the "too much" or "too little" levels. This information is interesting as it shows how many points of liking you lose for having a product "too much" or "too little" for a consumer.

The standardized differences are intermediate statistics that are then used for the comparison tests.

The p-values correspond to the comparison test of the mean for the JAR level and the means for the two other levels (this is a multiple comparison with 3 groups).

An interpretation is then automatically provided and depends on the selected significance level (here 5%).

The penalty is then computed. It is a weighted difference between the means (Mean of Liking for JAR - Mean of Liking for the two other levels taken together). This statistic has given its name to the method. It shows how many points of liking you lose for not being as expected by the consumer.

The standardized difference is an intermediate statistic that is then used for the comparison test.

The p-value corresponds to the comparison test of the mean for the JAR level with the mean of the other levels. This is equivalent to testing if the penalty is significantly different from 0 or not.

For the saltiness dimension, we see that the customers strongly penalize the product when they consider it not salty enough. Both mean drops are significantly different from 0, and so is the overall penalty.

For the sweetness dimension, none of the tests is significant.

For the acidity dimension, the overall penalty is slightly significant, although the two mean drops are not. This means that acidity does matter for the customers, but this survey may not have been powerful enough to detect which specific mean drop (not enough acid and/or too acid) is concerned.

For the crunchiness, the mean drops test could not be computed for the "too much" level because the % of cases in this level is lower than the 20% threshold set earlier. When the product is not crunchy enough, the product is highly penalized.

The next two charts summarize the results described above. When a bar is red it means the difference is significant, when it is green, the difference is not significant, and when it is grey, the test was not computed because there were not enough cases.

Was this article useful?

Similar articles

- Flash Profiling in Excel

- RATA data analysis in Excel

- Multivariate analysis and clustering on JAR (Just-About-Right) data in Excel

- Create a Products/Assessors table in Excel

- Sample size calculator for sensory discrimination tests in Excel

- Free choice profiling analysis with STATIS in Excel

Expert Software for Better Insights, Research, and Outcomes

- Data Stories

- Integrations

CAPABILITIES

- Survey Analysis

- Data Visualization

- Dashboarding

- Automatic Updating

- PowerPoint Reporting

- Finding Data Stories

- Data Cleaning

- New Product Development

- Tracking Analysis

- Customer Feedback

- Segmentation

- Brand Analytics

- Pricing Research

- Advertising Research

- Statistical Testing

- Text Analysis

- Factor Analysis

- Driver Analysis

- Correspondence Analysis

- Cluster & Latent Class

- Success Stories

- Demo Videos

- Book a Demo

- Ebooks & Webinars

- Help Center

- Product Roadmap

ON-DEMAND WEBINAR

- Book a demo

- Choice Modeling/Conjoint Analysis

- Dimension Reduction

- Principal Component Analysis

- Machine Learning

- Linear Regression

- Cluster Analysis

- Latent Class Analysis

- Customer Feedback Surveys

- Dive Into Data

- Data Stories Tutorials

- Account Administration

- Beginner's guides

- Dashboard Best Practices

- Getting Started

- Reporting/Exporting

- Troubleshooting Common Issues

- JavaScript How To...

- JavaScript in Displayr

- R How To...

- R in Displayr

- Visualizations

How to Calculate Penalty Analysis in Displayr

Want to get the jump on your colleagues by learning how to calculate penalty analysis? I'll show you how you can easily create a way to show penalty analysis using Displayr.

What is penalty analysis?

Penalty analysis is a tool used to work out which attributes of a product have the greatest effect on how much people like it. For example, if our product is a chocolate cookie, which of these attributes - crunchiness, flavor, or coating effect - have the biggest impact on how much people like the cookie?

Respondents are asked to rate how much they like the product, often on a 9-point scale. Then, respondents are asked about a set of specific attributes of the product and asked to rate them on the basis of 'too much', 'just about right', or 'not enough'. As usual, these scales vary.

Penalty analysis calculations take this data and aims to work out which of the attributes cause the biggest drop-offs in how much people like the product when an attribute is "too much" or "not enough". This is called the 'penalty'. In this post I'll show you how to do some common penalty analysis calculations in Displayr using R.

1. Prepare your data

The variables for your just-about-right scale (JAR) must be combined as a Variable Set with the Structure of Grid with mutually exclusive categories (Nominal - Multi) . For this particular calculation you need to group the scale as three categories. The order of the categories must be "Not enough" on the left, followed by "Just about right", followed by "Too much". The resulting table should look like the one below.

If you have not combined your variables, follow these steps:

- Select the variables in the Data Sets tree in the bottom left pane (select the variables by holding down your CTRL key).

- From the Data Manipulation > Variables menu, click Combine .

- Right-click on the combined variables in the Data Sets tree, select Rename and enter an appropriate name.

- From the Object Inspector in the right pane, change the Structure drop-down box to Grid with mutually exclusive categories (Nominal - Multi) .

If your scale has more than three categories you may need to group them together:

- Highlight the column labels to group.

- From the Data Manipulation > Rows/Columns menu, click Merge .

- Again from the Data Manipulation > Rows/Columns menu, click Rename and enter a new column name.

Set the "liking" scale as a Number question. Your table should look like the one below:

If you need to change the Structure , find the question in the Date Sets tree and from the Object Inspector, change the Structure in the INPUTS section to Numeric .

2. Create your 'Just-About-Right' table

You can create all the statistics you need to compute the penalties by following these steps:

- Create a new table by dragging the "JAR Distribution" question onto the page.

- With the table selected, go to the Object Inspector and select the "Liking Score" from the By drop-down box.

- From the Object Inspector , select the Cells drop-down box in the STATISTICS section and ensure that the Average and Weighted Row Sample Size statistics are selected.

Your table should look like this:

The Averages show the average liking score among people who consider each attribute "Not enough", "Just about right", and "Too much". The Weighted Row Sample Size shows the weighted sample size for each of these groups.

Finally, to make the calculations easier:

- Click on the Properties tab in the Object Inspector and right-click the name.

- In the GENERAL section, change the Name of the object to jar.scores .

This determines how we can refer to this table of results when doing calculations in R.

3. Calculate the total penalty

Calculate the penalty by working out how much the average liking score drops between "Just about right" and "Not enough", and between "Just about right" and "Too much". These drops are weighted by the proportion of respondents in the "Not enough" and "Too much" categories and then added together to give the total penalty for each attribute.

To compute the total penalties we can use a little R code:

- Select Insert > R Output (Analysis)

- Paste in the code below.

- Click Calculate .

The code for the penalty is as follows:

This will produce a table like the following, showing which attributes have the biggest penalty.

To make a visualization of this:

- Select Insert > More (Analysis) > Visualization > Bar Chart .

- From DATA SOURCE section in the Object Inspector , select the table (called total.penalty ) from the Output in 'Pages' drop-down box.

- Select formatting options in the Chart section of the options on the right.

4. Chart penalty vs % of consumers

It is also important to consider the penalties in comparison to the proportion of the sample who regard the product as being "not right" according to each attribute. This is the percentage of people who rated each attribute as either "too much" or "not enough".

For this calculation we scale each penalty by the proportion of people who rated that attribute as "not right", and we plot this weighted penalty against that percentage.

To work out the proportion of respondents who rated each attribute as "not right" and calculate the weighted penalties:

- Select Insert > R Output (Analysis).

- Enter the code below.

The resulting table will look like this:

To visualize the results:

- Select Insert > More (Analysis) > Visualization > Scatterplot .

- Select the table (called penalty.not.right ) from the Output in 'Pages' drop-down box in the Object Inspector .

- From the Chart section, select On chart from the Show labels drop-down box.

Product attributes which are top-most and right-most present the most concern as they both have a large drop-off on the liking scale and have the largest proportion of people who feel the product is "not right" in this area.

Want to find out how to do more in Displayr? Check out the Using Displayr section of our blog!

Prepare to watch, play, learn, make, and discover!

Get access to all the premium content on displayr, last question, we promise, what type of survey data are you working with (select all that apply).

Market research Social research (commercial) Customer feedback Academic research Polling Employee research I don't have survey data

PENALTY REWARD ANALYSIS (PRA)

Contact Prof. Dr. Heiko Schimmelpfennig + 49 40 25 17 13 35 hschimmelpfennig@ifad. de

FACTORS ON CUSTOMER SATISFACTION AND THEIR IMPACT

With driver analyses such as the penalty reward analysis , we we use quantitative market research to find out which factors influence the satisfaction of your customers in which way. We often use penalty reward analysis ( PRA ) in the areas of customer feedback, customer satisfaction, customer experience consumer empathy, but also in employee satisfaction studies. After a driver analysis, the drivers are divided into different categories based on their mode of action. Through this multivariate analysis, you can take targeted measures to increase customer satisfaction and purchase intent and thus be successful in the long term. Typical questions you can answer with a penalty reward analysis:

- How is a feature influenced by one or more other features?

- Are certain product features or services features hygiene factors or delighter factors?

- What factors should be prioritized to improve customer satisfaction?

- How can budget decisions be made in relation to these factors?

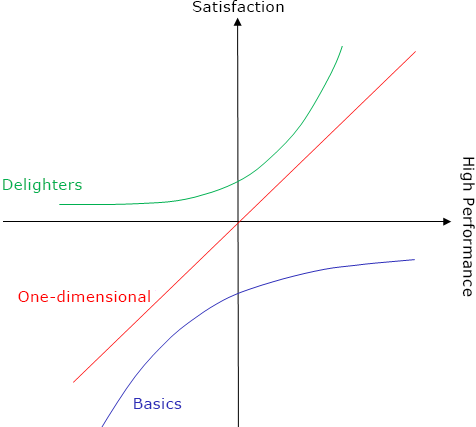

THE KANO MODE OF CUSTOMER SATISFACTION

The relationship between features is not always linear, as is assumed in many other procedures (e.g., regression analysis , structural equation modeling). According to the Kano Model of Customer Satisfaction three types of drivers can be distinguished:

- Basic drivers There are expectations regarding a minimal standard. If these expectations are not fulfilled it leads to dissatisfaction. But if the hygiene factors are met, it does not lead to satisfaction.

- Delighters Regarding this driver there are no expectations. If it performs, nevertheless, satisfaction is achieved. But if the delighter does not perform there are no consequences.

- One-dimensional driver Both satisfaction and dissatisfaction can occur according to the degree to performance.

Penalty Reward Analysis: Types of Drivers according to Kano

HOW PENALTY REWARD ANALYSIS WORKS

These two basic prerequisites must be met for the variables in order for a penalty reward analysis to be carried out:

- The relationships between the independent variables and the dependent variable must be positive. Otherwise, recoding is necessary. If this is not the case, this requirement can be fulfilled with a simple recoding.

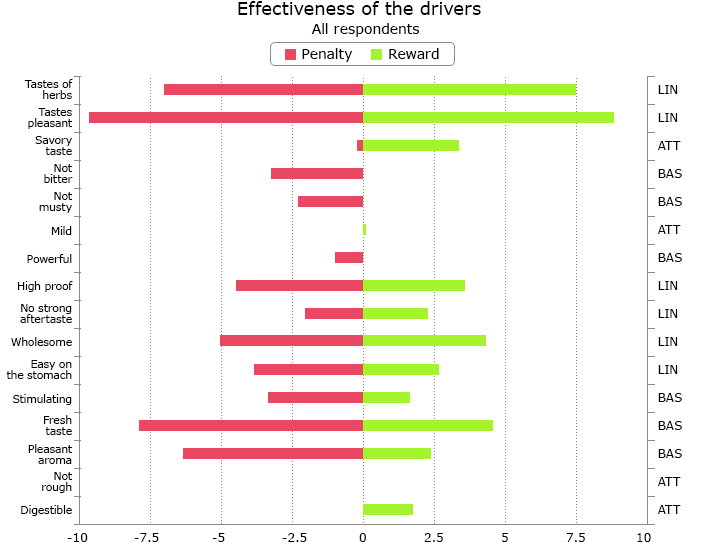

The relationship arising from the amount of Penalty and Reward is decisive for determining the type of the driver. When Penalty is dominant it is a Basic Driver , when Reward is dominant it is a Delighter . When Penalty and Reward are roughly equal, it is a One-dimensional driver or a performance driver . From the relation of the sum of Penalty and Reward of a driver to the total of the sums of all drivers, the importance of the driver can also be derived.

Penalty Reward analysis: Categorization of Drivers

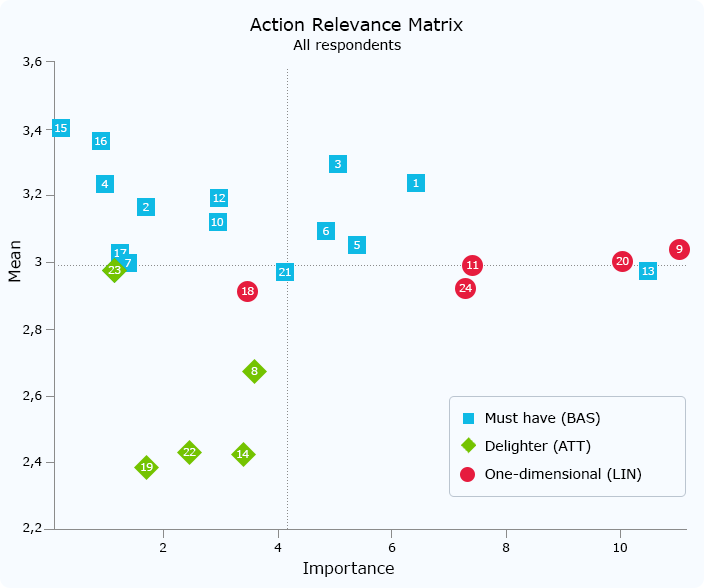

PENALTY REWARD ANALYSIS WITH ACTION RELEVANCE MATRIX

The results of the Penalty Reward Analysis can be clearly displayed in an Action Relevance Matrix . For this purpose, the importance of the drivers on the x-axis and the mean value of the drivers on the y-axis are mapped. The driver types are distinguished by colored icons. The space is divided into four ranges by the average of all driver strengths (x-axis) and all driver averages (y-axis).

Penalty Reward Analysis: Action Relevance Matrix

PENALTY REWARD ANALYSIS WITH YOUR OWN DATA

PRA is the ADABOX tool for the analysis of non-linear influences on target values such as satisfaction, Now in unexpected, new speed dimensions! Analysis results also in a dynamic action relevance matrix with numerous display options.

Penalty-Reward Analysis with Uninorms: A Study of Customer (Dis)Satisfaction

- First Online: 01 January 2005

Cite this chapter

- Koen Vanhoof 1 ,

- Pieter Pauwels 2 ,

- Jószef Dombi 3 ,

- Tom Brijs 1 &

- Geert Wets 1

Part of the book series: Studies in Computational Intelligence ((SCI,volume 5))

453 Accesses

4 Citations

In customer (dis)satisfaction research, analytic methods are needed to capture the complex relationship between overall (dis)satisfaction with a product or service and the underlying (perceived) performance on the product’s or service’s attributes. Eventually, the method should allow to identify the attributes that need improvement and that most significantly enhance the business relationship with the customer. This paper presents an analytic design based on uninorms, which is able to capture the nature of the relationship between attribute-level (dis)satisfaction and overall (dis)satisfaction in the context of different attributes. In contrast to alternative statistical approaches, ours allows for full reinforcement and compensation in the satisfaction model without a priori defining the formal role of each attribute. Impact curves visualize the relationships between attribute-level (dis)satisfaction and overall satisfaction. Penalty-reward analysis on the basis of uninorms is illustrated on a satisfaction study of an energy supply firm. The analysis confirms the three-factor structure of (dis)satisfaction. The interpretation of the impact curves allow managers optimizing their attribute scores in order to maximize customer (dis)satisfaction.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

Institutional subscriptions

Unable to display preview. Download preview PDF.

Similar content being viewed by others

Millennial Customers and Hangout Joints: An Empirical Study Using the Kano Quantitative Model

How to Reduce Halo in Attribute-Specific Customer Satisfaction Measures: An Empirical Investigation

Defining Customer Satisfaction: A Strategic Company Asset?

Author information, authors and affiliations.

Dept. of Economics, Limburgs Universitair Centrum, Belgium, Universitaire Campus, 3590 Diepenbeek, Belgium

Koen Vanhoof, Tom Brijs & Geert Wets

Dept. of Marketing, Maastricht University, The Netherlands

Pieter Pauwels

Dept. of Applied Informatics, University of Szeged, Hungary

Jószef Dombi

You can also search for this author in PubMed Google Scholar

Editor information

Rights and permissions.

Reprints and permissions

About this chapter

Vanhoof, K., Pauwels, P., Dombi, J., Brijs, T., Wets, G. Penalty-Reward Analysis with Uninorms: A Study of Customer (Dis)Satisfaction. In: Ruan, D., Chen, G., E. Kerre, E., Wets, G. (eds) Intelligent Data Mining. Studies in Computational Intelligence, vol 5. Springer, Berlin, Heidelberg. https://doi.org/10.1007/11004011_12

Download citation

DOI : https://doi.org/10.1007/11004011_12

Published : 25 July 2005

Publisher Name : Springer, Berlin, Heidelberg

Print ISBN : 978-3-540-26256-5

Online ISBN : 978-3-540-32407-2

eBook Packages : Engineering Engineering (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Advertisement

Supported by

What’s Behind All the Stock Market Drama?

Analysts and investors have many explanations, including worries about the health of the U.S. economy and shifts in the value of the Japanese yen.

- Share full article

By Joe Rennison and Danielle Kaye

Reporting from New York

The wild swings in markets recently are a case study in how seemingly distinct pillars around the globe are connected through the financial system — and the domino effect that can follow if one of them falls.

Some of the turmoil in stocks reflected rising fear that the American labor market may be cracking , and that the U.S. Federal Reserve may have waited too long to cut interest rates .

But it’s more complicated than that. This time around, there are also more technical reasons for the sell-off, analysts and investors say. Stocks staged a modest recovery on Tuesday , but it fizzled by Wednesday afternoon, showing that the volatility has rattled investors.

Factors like a slow buildup of risky bets, the sudden undoing of a popular way to fund such trades and diverging decisions by global policymakers are each playing a role. Some of these forces can be traced back years, while others emerged only recently.

Here are some of the key reasons for the swings.

A long stretch of low interest rates led investors to take more risks.

The buildup of risks in the financial system can partly be traced back to 2008, when the housing crisis prompted the Federal Reserve to cut interest rates aggressively and keep them low for years. That encouraged investors to seek returns from riskier bets, since borrowing was cheap and cash parked in safe assets like money market funds earned next to nothing.

Rates were also cut back to near zero in the early stages of the coronavirus pandemic, reviving these sorts of trades.

We are having trouble retrieving the article content.

Please enable JavaScript in your browser settings.

Thank you for your patience while we verify access. If you are in Reader mode please exit and log into your Times account, or subscribe for all of The Times.

Thank you for your patience while we verify access.

Already a subscriber? Log in .

Want all of The Times? Subscribe .

U.S. Housing Market Nears $50 Trillion in Value as Number of Trillion-Dollar Metros Doubles

- There are now eight trillion-dollar metros, up from four a year ago, with Anaheim, CA, Washington, DC, Chicago and Phoenix joining the list of places where the total value of homes tops $1 trillion.

- Two New Jersey metros within commuting distance of New York saw the fastest growth in aggregate home value, while Sun Belt metros grew more slowly.

- The total value of homes owned by millennials grew by more than 20% as the Silent Generation’s home value fell for the fifth consecutive quarter.

- Majority Asian neighborhoods experienced the largest spike in total home value, rising 9% to $1.4 trillion.

The total value of U.S homes gained $3.1 trillion over the past 12 months to reach a record $49.6 trillion.

This is according to an analysis of the Redfin Estimate for more than 95 million U.S. residential properties as of June 2024. This data is subject to revision.

In percentage terms, the total value of the U.S. housing market grew 6.6% year over year. Zooming out further, the total value of U.S. homes has more than doubled in the past decade, climbing nearly 120% from $22.7 trillion in June 2014.

Home values are being pushed higher because supply is still being outweighed by demand. Home inventory levels remain low compared to before the pandemic, with many owners staying put due to the rate lock-in effect . While elevated mortgage rates are keeping many buyers on the sidelines as well, there are still enough of them to compete over a relatively small pool of homes, and that demand is driving values up.

“The value of America’s housing market will likely cross the $50 trillion threshold in the next 12 months as there are not enough homes being listed to push prices down,” said Redfin Economics Research Lead Chen Zhao . “Mortgage rates have started falling, but many potential sellers and buyers are waiting to make a move, meaning we are likely to continue seeing a pattern where prices slowly tick up. That’s great news for the millions of American homeowners who see their equity rising, but first-time buyers are going to keep finding it tough to find an affordable home.”

New construction was another factor driving the overall increase in market valuation. Our analysis examined the Redfin Estimate for roughly 97.6 million homes, compared to 96.8 million homes a year earlier.

New Jersey metros close to New York City recorded the largest jumps in value

Thirteen major metros posted double-digit percentage gains in total property value over the last year, led by relatively-affordable New Jersey metros within commuting distance of New York, where property is more expensive. The value of properties in New Brunswick, NJ, rose 13.3% to $582.6 billion, while Newark, NJ, climbed 13.2% to $406.2 billion. Anaheim, CA (up 12.1% to $1.1 trillion), Charleston, SC, (up 11.8% to $188.9 billion) and New Haven, CT, (up 11.8% to $91 billion) rounded out the five metros with the highest gains.

Redfin examined the 100 most-populous metro areas and included the 95 that had sufficient data in this analysis.

Cape Coral, FL, was the only metro to record a fall in total home value, dropping 1.6% to $204.2 billion. Sun Belt metros—especially those in Texas—grew slower than those in other regions, with New Orleans (up 0.8% to $128.2 billion), Austin, TX, (up 1.9% to $392.8 billion), North Port, FL, (up 2.1% to $251.8 billion) and Fort Worth, TX, (up 2.3% to $293.7 billion) rounding out the bottom five metros.

Anaheim, Chicago, Phoenix and Washington, DC reach trillion-dollar status

The number of metros where the total value of homes topped $1 trillion grew to eight—doubling from four a year ago—with Anaheim, CA, Chicago, Phoenix and Washington, DC, joining New York, Los Angeles, Atlanta and Boston in the trillion-dollar club. San Diego and Seattle look like they will join them in the next 12 months if home values keep increasing at a similar pace.

It’s worth noting that while San Francisco’s aggregate home value is roughly $700 billion, when combined with neighbors Oakland, CA, and San Jose, CA, the combined Bay Area housing market is worth nearly $2.5 trillion. Likewise, the combined Dallas ($734 million) and Fort Worth ($294 million) metro area also surpasses the $1 trillion mark.

Total value of suburban homes reaches $30 trillion, but rural home values rising the fastest

Rural home values outpaced those in urban areas and the suburbs, jumping 7% year over year to $7.8 trillion. The total value of homes in urban areas rose 6% to $10.3 trillion, while the value of homes in the suburbs cracked the $30 trillion mark for the first time, increasing 6.8% to $30.1 trillion.

There are around 57 million homes in the suburbs, compared to 22 million in urban areas and 21 million in rural areas.

The total value of millennial-owned homes rises more than 20%

The total value of homes owned by millennials rose 21.5% year over year to $8.6 trillion in the first quarter of 2024—the most recent period for which generational data is available—nearly four times as fast as any other generation.

The increase is partly due to the overall growth in home prices, but also because millennials are now the largest generation by population and have reached an age and financial position where they make up a larger share of the homebuying market. Around two-thirds of the mortgages taken out in 2023 were issued to homebuyers under the age of 45.

Meanwhile, the total value of homes owned by the Silent Generation fell for the fifth straight quarter, dropping 1.6% to $4.6 trillion. The value of homes owned by baby boomers increased 6.1% to $19 trillion, while Gen X home values rose 5.9% to $13.6 trillion.

Asian neighborhoods experience largest increase in home value

After falling in 2022-2023, the total value of homes in neighborhoods that are majority Asian bounced back over the past 12 months, rising 9% to $1.4 trillion. The increased value is being caused by price growth in West Coast cities—where many Asian neighborhoods are located.

In comparison, majority white neighborhoods experienced a 6.6% increase in value to $39.4 trillion, while majority Black neighborhoods saw a 5.4% increase in value to $1.4 trillion. The value of homes in majority Hispanic neighborhoods increased 6.4% to $2 trillion.

Metro-Level Home Value Summary: June 2024

The table below comes from a list of the 100 most populous metro areas, five of which were excluded due to insufficient data .

| Akron, OH | $71,507,837,917 | 8.60% | $5,691,780,943 |

| Albany, NY | $111,156,713,953 | 10.20% | $10,263,571,997 |

| Allentown, PA | $108,362,627,501 | 7.20% | $7,302,956,563 |

| Anaheim, CA | $1,118,903,198,701 | 12.10% | $121,035,890,228 |

| Atlanta, GA | $1,287,842,232,673 | 5.10% | $62,317,379,190 |

| Austin, TX | $392,835,749,871 | 1.90% | $7,489,237,729 |

| Bakersfield, CA | $88,170,745,600 | 7.30% | $5,960,674,417 |

| Baltimore, MD | $430,859,600,992 | 5.60% | $22,931,751,541 |

| Baton Rouge, LA | $80,374,160,457 | 3.60% | $2,772,236,041 |

| Birmingham, AL | $56,892,374,726 | 5.70% | $3,080,827,853 |

| Boise City, ID | $131,470,713,243 | 4.30% | $5,466,718,209 |

| Boston, MA | $1,275,370,527,296 | 7.10% | $85,007,545,179 |

| Bridgeport, CT | $222,843,118,480 | 11.30% | $22,569,159,656 |

| Buffalo, NY | $110,180,279,369 | 9.80% | $9,843,944,073 |

| Camden, NJ | $157,236,751,037 | 10.40% | $14,871,235,924 |

| Cape Coral, FL | $204,220,656,414 | -1.60% | -$3,252,052,182 |

| Charleston, SC | $188,912,598,142 | 11.80% | $19,965,797,862 |

| Charlotte, NC | $474,569,800,605 | 7.70% | $33,799,650,840 |

| Chicago, IL | $1,078,649,184,844 | 8.50% | $84,942,434,115 |

| Cincinnati, OH | $248,125,736,738 | 8.70% | $19,858,508,741 |

| Cleveland, OH | $212,019,381,117 | 8.80% | $17,099,190,619 |

| Colorado Springs, CO | $116,860,144,651 | 3.10% | $3,481,336,981 |

| Columbia, SC | $82,333,334,835 | 6.50% | $5,034,778,173 |

| Columbus, OH | $259,346,029,031 | 9.00% | $21,316,171,788 |

| Dallas, TX | $734,366,921,304 | 2.90% | $20,981,625,375 |

| Dayton, OH | $63,611,247,149 | 8.60% | $5,045,920,033 |

| Denver, CO | $702,908,302,711 | 2.90% | $20,037,052,066 |

| Des Moines, IA | $66,000,290,047 | 8.20% | $4,995,437,415 |

| Detroit, MI | $150,391,957,355 | 7.20% | $10,130,448,986 |

| El Paso, TX | $59,466,456,390 | 2.40% | $1,413,785,087 |

| Elgin, IL | $88,905,904,691 | 10.00% | $8,051,024,866 |

| Fort Lauderdale, FL | $395,562,194,981 | 4.50% | $17,175,498,825 |

| Fort Worth, TX | $293,710,469,823 | 2.30% | $6,519,121,811 |

| Frederick, MD | $301,280,638,354 | 5.20% | $14,913,805,387 |

| Fresno, CA | $104,703,988,082 | 6.00% | $5,959,667,198 |

| Grand Rapids, MI | $153,295,546,591 | 8.30% | $11,791,873,963 |

| Greensboro, NC | $70,462,657,728 | 8.30% | $5,402,893,908 |

| Greenville, SC | $115,421,800,202 | 6.50% | $7,049,155,377 |

| Hartford, CT | $139,354,059,826 | 10.80% | $13,541,679,208 |

| Honolulu, HI | $285,003,640,899 | 2.50% | $7,027,178,627 |

| Houston, TX | $792,213,853,791 | 2.70% | $20,881,993,888 |

| Jacksonville, FL | $263,728,665,969 | 3.40% | $8,742,057,670 |

| Kansas City, MO | $130,918,859,657 | 4.50% | $5,649,151,402 |

| Knoxville, TN | $130,079,218,539 | 7.20% | $8,695,334,290 |

| Lake County, IL | $132,824,959,883 | 8.50% | $10,387,514,873 |

| Lakeland, FL | $83,353,935,504 | 3.10% | $2,500,904,193 |

| Las Vegas, NV | $423,859,448,170 | 9.40% | $36,281,106,957 |

| Little Rock, AR | $64,545,167,374 | 9.80% | $5,783,297,968 |

| Los Angeles, CA | $2,188,583,730,489 | 6.20% | $127,975,276,850 |

| Louisville, KY | $93,559,694,999 | 8.10% | $7,024,419,146 |

| McAllen, TX | $45,967,888,123 | 2.50% | $1,130,055,006 |

| Memphis, TN | $97,686,564,291 | 6.00% | $5,537,369,195 |

| Miami, FL | $575,369,332,563 | 9.00% | $47,728,285,664 |

| Milwaukee, WI | $182,731,111,907 | 9.00% | $15,146,404,990 |

| Minneapolis, MN | $560,324,665,792 | 3.70% | $19,883,259,987 |

| Montgomery County, PA | $368,352,806,315 | 5.80% | $20,324,907,151 |

| Nashville, TN | $372,931,822,429 | 6.20% | $21,741,389,259 |

| Nassau County, NY | $784,637,544,272 | 6.90% | $50,646,043,187 |

| New Brunswick, NJ | $582,591,478,538 | 13.30% | $68,578,737,760 |

| New Haven, CT | $91,039,886,819 | 11.80% | $9,585,351,731 |

| New Orleans, LA | $128,237,217,375 | 0.80% | $972,678,395 |

| New York, NY | $2,479,781,753,057 | 8.30% | $189,976,135,666 |

| Newark, NJ | $406,184,773,098 | 13.20% | $47,387,594,318 |

| North Port, FL | $251,827,798,447 | 2.10% | $5,091,464,188 |

| Oakland, CA | $917,001,437,387 | 5.30% | $46,528,675,596 |

| Oklahoma City, OK | $148,087,986,166 | 5.50% | $7,756,043,581 |

| Orlando, FL | $442,425,009,812 | 5.20% | $22,031,351,806 |

| Oxnard, CA | $216,820,174,569 | 10.10% | $19,805,366,484 |

| Philadelphia, PA | $241,323,289,050 | 5.10% | $11,661,573,843 |

| Phoenix, AZ | $1,001,000,889,736 | 5.50% | $52,632,267,259 |

| Pittsburgh, PA | $224,090,172,896 | 5.20% | $11,140,889,999 |

| Portland, OR | $493,216,822,701 | 2.80% | $13,457,216,928 |

| Providence, RI | $99,020,693,824 | 7.20% | $6,658,950,564 |

| Raleigh, NC | $266,795,390,623 | 8.40% | $20,626,036,449 |

| Richmond, VA | $220,074,864,958 | 9.90% | $19,839,291,719 |

| Riverside, CA | $798,103,535,038 | 4.90% | $37,013,092,795 |

| Rochester, NY | $128,375,412,731 | 10.10% | $11,820,797,849 |

| Sacramento, CA | $467,598,362,079 | 4.40% | $19,795,334,569 |

| San Antonio, TX | $295,555,458,757 | 2.80% | $8,129,379,279 |

| San Diego, CA | $986,866,999,457 | 9.70% | $87,633,883,434 |

| San Francisco, CA | $703,064,775,136 | 7.20% | $47,429,953,751 |

| San Jose, CA | $866,563,392,375 | 11.20% | $87,625,147,933 |

| Seattle, WA | $970,865,521,164 | 8.40% | $75,384,091,030 |

| St. Louis, MO | $270,445,545,527 | 5.40% | $13,868,952,276 |

| Stockton, CA | $112,763,887,961 | 5.00% | $5,342,520,240 |

| Tacoma, WA | $165,424,986,115 | 7.90% | $12,173,859,185 |

| Tampa, FL | $540,290,061,764 | 4.10% | $21,243,493,963 |

| Tucson, AZ | $140,552,507,285 | 6.80% | $8,947,418,744 |

| Tulsa, OK | $96,796,961,891 | 6.50% | $5,881,872,587 |

| Virginia Beach, VA | $239,651,787,494 | 7.10% | $15,797,503,939 |

| Warren, MI | $373,083,975,746 | 8.00% | $27,667,266,760 |

| Washington, DC | $1,053,880,089,173 | 6.80% | $67,099,426,402 |

| West Palm Beach, FL | $470,400,943,117 | 6.80% | $29,891,193,271 |

| Wilmington, DE | $80,509,564,644 | 5.50% | $4,218,312,956 |

| Worcester, MA | $165,479,340,473 | 7.70% | $11,848,296,629 |

Methodology

This analysis estimated current (June 2024) home values using the Redfin Estimate , MLS data and public records. The Redfin Estimate covers more than 95 million single-family homes, condos, townhouses and 2-4 unit multifamily properties, and is available in most but not all parts of the U.S. Historical values were imputed using public records and MLS data on price per square foot trends by zip code (or city, county or state when zip-code data was insufficient). Both existing homes and new-construction homes are included in this dataset, which dates back to the year 2000. Homes are not added to the dataset until they are first built or sold.

Homes are determined to be rural, suburban or urban based on categories for the census tract of the property from the U.S. Department of Housing and Urban Development (HUD). HUD has a model that describes neighborhood types based on responses to the 2017 American Housing Survey.

Mark Worley

As a data journalist, Mark helps to explain the range of economic factors impacting the housing market. Prior to joining Redfin, he spent seven years in content operations at real-time information company Dataminr, following reporting and editing roles in Australia, SE Asia and the Middle East.

Chen Zhao leads the economics team at Redfin, where she produces research on the housing market for public and internal audiences. Previously, she was an executive director leading housing finance and financial markets research at the JPMorgan Chase Institute. Prior to joining JPMCI, Chen was an economics consultant at Analysis Group, Inc., where she worked on financial litigation cases and led teams conducting health economics and outcomes research on behalf of pharmaceutical companies. While in graduate school, Chen was with the Center for Economic Studies and the Social Economic and Housing Statistics Division at the US Census Bureau, where she conducted applied microeconomics research using large scale restricted-access linked survey-administrative data. She started her career at the White House Council of Economic Advisers, where she focused on labor and health economics.

Follow Redfin

Be the first to see the latest real estate news:.

- Email This field is for validation purposes and should be left unchanged.

By submitting your email you agree to Redfin’s Terms of Use and Privacy Policy

Looking for tips and advice about buying, selling, and home improvement? Visit our blog!

- Albuquerque Real Estate

- Alexandria Real Estate

- Anchorage Real Estate

- Arlington Real Estate

- Ashburn Real Estate

- Atlanta Real Estate

- Aurora Real Estate

- Austin Real Estate

- Bakersfield Real Estate

- Baltimore Real Estate

- Baton Rouge Real Estate

- Beaverton Real Estate

- Bend Real Estate

- Birmingham Real Estate

- Boca Raton Real Estate

- Boise Real Estate

- Boston Real Estate

- Boulder Real Estate

- Bowie Real Estate

- Brentwood Real Estate

- Buffalo Real Estate

- Burlington Real Estate

- Cape Coral Real Estate

- Chandler Real Estate

- Charleston Real Estate

- Charlotte Real Estate

- Chattanooga Real Estate

- Chicago Real Estate

- Cincinnati Real Estate

- Colorado Springs Real Estate

- Columbia Real Estate

- Columbus Real Estate

- Dallas Real Estate

- Denver Real Estate

- Des Moines Real Estate

- Detroit Real Estate

- El Paso Real Estate

- Elk Grove Real Estate

- Eugene Real Estate

- Fairfax Real Estate

- Flagstaff Real Estate

- Fort Collins Real Estate

- Fort Lauderdale Real Estate

- Fort Myers Real Estate

- Fort Worth Real Estate

- Frederick Real Estate

- Fremont Real Estate

- Fresno Real Estate

- Frisco Real Estate

- Gilbert Real Estate

- Glenview Real Estate

- Henderson Real Estate

- Honolulu Real Estate

- Houston Real Estate

- Indianapolis Real Estate

- Irvine Real Estate

- Jacksonville Real Estate

- Jersey City Real Estate

- Kansas City Real Estate

- Knoxville Real Estate

- Lake Tahoe Real Estate

- Las Vegas Real Estate

- Little Rock Real Estate

- Long Island Real Estate

- Los Angeles Real Estate

- Louisville Real Estate

- Madison Real Estate

- Manhattan Real Estate

- Manteca Real Estate

- Memphis Real Estate

- Mesa Real Estate

- Miami Real Estate

- Milwaukee Real Estate

- Minneapolis Real Estate

- Modesto Real Estate

- Myrtle Beach Real Estate

- Naperville Real Estate

- Naples Real Estate

- Nashua Real Estate

- Nashville Real Estate

- New Orleans Real Estate

- New York Real Estate

- Newton Real Estate

- Oakland Real Estate

- Oklahoma City Real Estate

- Omaha Real Estate

- Orland Park Real Estate

- Orlando Real Estate

- Palm Springs Real Estate

- Philadelphia Real Estate

- Phoenix Real Estate

- Pittsburgh Real Estate

- Plainfield Real Estate

- Plano Real Estate

- Portland Real Estate

- Providence Real Estate

- Quincy Real Estate

- Raleigh Real Estate

- Rancho Cucamonga Real Estate

- Reno Real Estate

- Richmond Real Estate

- Riverside Real Estate

- Rochester Real Estate

- Sacramento Real Estate

- Salem Real Estate

- Salt Lake City Real Estate

- San Antonio Real Estate

- San Diego Real Estate

- San Francisco Real Estate

- San Jose Real Estate

- San Luis Obispo Real Estate

- Santa Clarita Real Estate

- Santa Fe Real Estate

- Sarasota Real Estate

- Savannah Real Estate

- Schaumburg Real Estate

- Scottsdale Real Estate

- Seattle Real Estate

- Silver Spring Real Estate

- Sioux Falls Real Estate

- St. Louis Real Estate

- Stamford Real Estate

- Stockton Real Estate

- Tacoma Real Estate

- Tampa Real Estate

- Temecula Real Estate

- Tucson Real Estate

- Tulsa Real Estate

- Virginia Beach Real Estate

- Washington, DC Real Estate

- West Palm Beach Real Estate

- Wilmington Real Estate

- Woodbridge Real Estate

- Worcester Real Estate

- Alabama • Homes for sale

- Alaska • Homes for sale

- Arizona • Homes for sale

- Arkansas • Homes for sale

- California • Homes for sale

- Colorado • Homes for sale

- Connecticut • Homes for sale

- Delaware • Homes for sale

- Florida • Homes for sale

- Georgia • Homes for sale

- Hawaii • Homes for sale

- Idaho • Homes for sale

- Illinois • Homes for sale

- Indiana • Homes for sale

- Iowa • Homes for sale

- Kansas • Homes for sale

- Kentucky • Homes for sale

- Louisiana • Homes for sale

- Maine • Homes for sale

- Maryland • Homes for sale

- Massachusetts • Homes for sale

- Michigan • Homes for sale

- Minnesota • Homes for sale

- Mississippi • Homes for sale

- Missouri • Homes for sale

- Nebraska • Homes for sale

- Nevada • Homes for sale

- New Hampshire • Homes for sale

- New Jersey • Homes for sale

- New Mexico • Homes for sale

- New York • Homes for sale

- North Carolina • Homes for sale

- Ohio • Homes for sale

- Oklahoma • Homes for sale

- Oregon • Homes for sale

- Pennsylvania • Homes for sale

- Rhode Island • Homes for sale

- South Carolina • Homes for sale

- South Dakota • Homes for sale

- Tennessee • Homes for sale

- Texas • Homes for sale

- Utah • Homes for sale

- Vermont • Homes for sale

- Virginia • Homes for sale

- Washington • Homes for sale

- West Virginia • Homes for sale

- Wisconsin • Homes for sale

- Albuquerque apartments for rent

- Alexandria apartments for rent

- Arlington apartments for rent

- Atlanta apartments for rent

- Augusta apartments for rent

- Austin apartments for rent

- Bakersfield apartments for rent

- Baltimore apartments for rent

- Barnegat apartments for rent

- Baton Rouge apartments for rent

- Birmingham apartments for rent

- Boston apartments for rent

- Charlotte apartments for rent

- Chattanooga apartments for rent

- Chicago apartments for rent

- Cincinnati apartments for rent

- Cleveland apartments for rent

- Columbia apartments for rent

- Columbus apartments for rent

- Dallas apartments for rent

- Dayton apartments for rent

- Denver apartments for rent

- Detroit apartments for rent

- Durham apartments for rent

- Fayetteville apartments for rent

- Fort Worth apartments for rent

- Fresno apartments for rent

- Greensboro apartments for rent

- Houston apartments for rent

- Huntsville apartments for rent

- Indianapolis apartments for rent

- Irving apartments for rent

- Jacksonville apartments for rent

- Kansas City apartments for rent

- Knoxville apartments for rent

- Las Vegas apartments for rent

- Los Angeles apartments for rent

- Louisville apartments for rent

- Macon apartments for rent

- Marietta apartments for rent

- Melbourne apartments for rent

- Memphis apartments for rent

- Mesa apartments for rent

- Miami apartments for rent

- Milwaukee apartments for rent

- Minneapolis apartments for rent

- Mobile apartments for rent

- Murfreesboro apartments for rent

- Nashville apartments for rent

- New York apartments for rent

- Norfolk apartments for rent

- Oklahoma City apartments for rent

- Omaha apartments for rent

- Orlando apartments for rent

- Pensacola apartments for rent

- Philadelphia apartments for rent

- Phoenix apartments for rent

- Pittsburgh apartments for rent

- Plano apartments for rent

- Portland apartments for rent

- Raleigh apartments for rent

- Reno apartments for rent

- Richmond apartments for rent

- Riverside apartments for rent

- Rochester apartments for rent

- Sacramento apartments for rent

- Saint Louis apartments for rent

- Saint Petersburg apartments for rent

- San Antonio apartments for rent

- San Diego apartments for rent

- Savannah apartments for rent

- Seattle apartments for rent

- Springfield apartments for rent

- Tampa apartments for rent

- Tempe apartments for rent

- Tucson apartments for rent

- Tulsa apartments for rent

- Virginia Beach apartments for rent

- Washington apartments for rent

- Abilene houses for rent

- Albany houses for rent

- Amarillo houses for rent

- Arlington houses for rent

- Atlanta houses for rent

- Augusta houses for rent

- Austin houses for rent

- Bakersfield houses for rent

- Birmingham houses for rent

- Charlotte houses for rent

- Chesapeake houses for rent

- Chicago houses for rent

- Clarksville houses for rent

- Columbia houses for rent

- Columbus houses for rent

- Concord houses for rent

- Dallas houses for rent

- Dayton houses for rent

- Denver houses for rent

- Destin houses for rent

- Dothan houses for rent

- El Paso houses for rent

- Eugene houses for rent

- Fayetteville houses for rent

- Fort Wayne houses for rent

- Fresno houses for rent

- Greensboro houses for rent

- Greenville houses for rent

- Griffin houses for rent

- Hampton houses for rent

- Henderson houses for rent

- Houston houses for rent

- Huntsville houses for rent

- Indianapolis houses for rent

- Jackson houses for rent

- Jacksonville houses for rent

- Kissimmee houses for rent

- Knoxville houses for rent

- Lafayette houses for rent

- Lakeland houses for rent

- Lancaster houses for rent

- Lansing houses for rent

- Lawton houses for rent

- Macon houses for rent

- Marietta houses for rent

- Memphis houses for rent

- Mesa houses for rent

- Mobile houses for rent

- Montgomery houses for rent

- Murfreesboro houses for rent

- Nashville houses for rent

- Orlando houses for rent

- Pensacola houses for rent

- Phoenix houses for rent

- Port Saint Lucie houses for rent

- Portland houses for rent

- Raleigh houses for rent

- Reno houses for rent

- Richmond houses for rent

- Riverside houses for rent

- Roanoke houses for rent

- Sacramento houses for rent

- Saint Petersburg houses for rent

- Salem houses for rent

- San Antonio houses for rent

- Savannah houses for rent

- Spokane houses for rent

- Springfield houses for rent

- Stockton houses for rent

- Tampa houses for rent

- Toledo houses for rent

- Tucson houses for rent

- Tyler houses for rent

- Valdosta houses for rent

- Vancouver houses for rent

- Waco houses for rent

- Warner Robins houses for rent

- Wichita houses for rent

- Wilmington houses for rent

Updated January 2020: By searching, you agree to the Terms of Use , and Privacy Policy .

REDFIN IS COMMITTED TO AND ABIDES BY THE FAIR HOUSING ACT AND EQUAL OPPORTUNITY ACT. READ REDFIN’S FAIR HOUSING POLICY .

Copyright: © 2022 Redfin. All rights reserved. Patent pending.

REDFIN and all REDFIN variants, TITLE FORWARD, WALK SCORE, and the R logos, are trademarks of Redfin Corporation, registered or pending in the USPTO.

California DRE #01521930

NY Standard Operating Procedures

TREC: Info About Brokerage Services , Consumer Protection Notice

If you are using a screen reader, or having trouble reading this website, please call Redfin Customer Support for help at 1-844-759-7732.

IMAGES

COMMENTS

Penalty Analysis Data Analysis There are several statistical methods for analyzing JAR scale data and conducting a PA in the literature (see Rothman & Parker, 2009 for details). Here, we present the basic method common across studies in the literature for simplicity. During analysis, participants are separated into three cate-

What is penalty analysis. Penalty analysis is a method used in sensory data analysis to identify potential directions for the improvement of products, on the basis of surveys performed on consumers or experts.. Two types of data are used: Preference data (or liking scores) that correspond to a global satisfaction index for a product (for example, liking scores on a 9 point scale for a ...

When it is implemented correctly, a penalty analysis research approach is a functional method that all researchers can use. Our sophisticated, model-based approaches help you perform significance testing, and set up parameters to identify product testing study participants who fall outside of the "Just-About-Right" range. Penalty Plus eBook

This tutorial helps you set up and interpret a penalty analysis in Excel using the XLSTAT statistical software. What is Penalty analysis? Penalty analysis is a method used in sensory data analysis to identify potential directions for the improvement of products, on the basis of surveys performed on consumers or experts. Two types of data are used:

To make a visualization of this: Select Insert > More (Analysis) > Visualization > Bar Chart. From DATA SOURCE section in the Object Inspector, select the table (called total.penalty) from the Output in 'Pages' drop-down box. Select formatting options in the Chart section of the options on the right. 4.

Penalty Analysis One of the key questions in product development is, to which extent certain properties have an impact the overall assessment of a product or a service. The penalty analysis reveals these correlations by taking into account the JAR questions (just about right) and consumer satisfaction indicators, such as the overall satisfaction or the purchase intention. One

1. Introduction. Just-about-right (JAR) questions (Lawless & Heymann, 1998) typically refer to product attributes and are used by market researchers and product developers to better understand product pluses and minuses.The integer JAR scale has an odd number of levels, c, with the just-about-right level in the middle, (c + 1)/2.Scale values less than the JAR level correspond to varying ...

Abstract. Penalty analysis is a very popular method in the food industry. We show how to enrich the analysis by visualizing, in the usual graphic, the uncertainty in penalties by the way of lines representing confidence intervals. It is the occasion to discuss the data on which the penalties are calculated: we show the interest to use ...

With driver analyses such as the penalty reward analysis, we we use quantitative market research to find out which factors influence the satisfaction of your customers in which way. We often use penalty reward analysis (PRA) in the areas of customer feedback, customer satisfaction, customer experience consumer empathy, but also in employee ...

The penalty analysis is known as the "killer app for food sensory quality diagnosis" (Pagès et al., 2014). It is a consumer preference evaluation method that provides valuable insights into ...

Penalty analysis, or mean drop analysis, is an emerging method in the food industry to provide direction in product development and optimization. Penalty analysis combines just-about-right ( JAR ) and overall liking tests to relate a decrease in consumer acceptance to attributes not at the JAR level ( Lawless and Heymann, 2010 ).

Importance-grid analysis (IGA) and penalty-reward-contrast analysis (PRCA) have been used in marketing research to identify the determinants of customer satisfaction (Albayrak & Caber, 2013 ...

Traditional penalty analysis (TPA) is an application meant to help product developers better understand product strengths and weaknesses. TPA uses just-about-right (JAR) attributes in conjunction ...

Penalty-Reward-Contrast Analysis: a review of its application in customer satisfaction research. Tahir Albayrak Faculty of Tourism, Akdeniz University, Campus, Antalya, Turkey & ... It is widely observed that researchers use Penalty-Reward-Contrast Analysis (PRCA) to identify the asymmetric influences of product/service attributes on ...

InsightsNow's Penalty Plus is our approach to mean-drop analysis used to gain an understanding of the product attributes that most affect consumer liking, purchase interest or any other product-related measure. Market researchers and product developers use these insights to hone or innovate products for the maximum impact in market.

The market penalty diffuses through director networks and leads to the collective punishment of interlocked firms. CSR has an insurance-like effect that buffers market penalties and collective punishment for environmental violations. ... Open Research. DATA AVAILABILITY STATEMENT. Data will be made available on reasonable request. REFERENCES

Interpreting the results from penalty analysis The descriptive statistics for the liking data and JAR variables are shown in Table 1. The correlation matrix displays whether the JAR variables have either "low" or "high" impact on the overall liking and which direction it would be manifested ("too much" or "too little").

Use of Check-all-that-apply (CATA) and Penalty Analysis for Product Development Guidance: A Case Study with Mexican-Style Sauces by Sheri Lynn Gordon B.S., University of Cincinnati, 1993 M.S., University of Cincinnati College of Medicine, 1998 A THESIS submitted in partial fulfillment of the requirements for the degree MASTER OF SCIENCE

Penalty-reward analysis on the basis of uninorms is illus- trated on a satisfaction study of an energy supply firm. The analysis confirms the three-factor structure of (dis)satisfaction. The interpretation of the impact curves allow managers optimizing their attribute scores in order to maximize customer (dis)satisfaction. 1 Introduction.

1. Introduction. New product development has been regarded as a strategy for gaining competitive advantage and long-term financial success (Costa & Jongen, 2006).The implementation of a market-orientation and consumer-driven approach has been recognized as the best way to develop successful products (Grunert et al., 1996, Stewart-Knox and Mitchell, 2003).

Penalty analysis was used in CATA to identify the attributes that reflect the preferences of honey consumers considering that there is a discrepancy between the ideal product and the actual product.

Analysts and investors have many explanations, including worries about the health of the U.S. economy and shifts in the value of the Japanese yen.

"The value of America's housing market will likely cross the $50 trillion threshold in the next 12 months as there are not enough homes being listed to push prices down," said Redfin Economics Research Lead Chen Zhao. "Mortgage rates have started falling, but many potential sellers and buyers are waiting to make a move, meaning we are ...

Nevertheless, a further adapted penalty analysis showed subtle differences in consumers' penalisation of sensory attributes depending on MA level. These findings could be used for future research and the development of PBMAs based on consumers' MA; they could also be extended for application in a meal context where the PBMAs are consumed.

7.2. Company Market Position Analysis/ Heap Map Analysis 7.3. Estimated Company Market Share Analysis, 2023 7.4. Strategy Mapping 7.4.1. Mergers & Acquisitions 7.4.2. Partnerships & Collaborations ...

Higher penalty values may result in an increase of the net cost of the capacity market (obtained by subtracting the option value and the penalty charges from the capacity-market cost). However, this increase can be counterweighted and overcome by the decrease in the energy-market cost (new units reduce short-term market prices) and in the non ...