Policygenius does not allow the submission of personal information by users located within the EU or the UK. If you believe this action is in error, or have any questions, please contact us at [email protected]

- Search Search Please fill out this field.

- Life Insurance

- Definitions

What Is a Collateral Assignment of Life Insurance?

:max_bytes(150000):strip_icc():format(webp)/Group1805-3b9f749674f0434184ef75020339bd35.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

A collateral assignment of life insurance is a conditional assignment appointing a lender as an assignee of a policy. Essentially, the lender has a claim to some or all of the death benefit until the loan is repaid. The death benefit is used as collateral for a loan.

The advantage to using a collateral assignee over naming the lender as a beneficiary is that you can specify that the lender is only entitled to a certain amount, namely the amount of the outstanding loan. That would allow your beneficiaries still be entitled to any remaining death benefit.

Lenders commonly require that life insurance serve as collateral for a business loan to guarantee repayment if the borrower dies or defaults. They may even require you to get a life insurance policy to be approved for a business loan.

Key Takeaways

- The borrower of a business loan using life insurance as collateral must be the policy owner, who may or may not be the insured.

- The collateral assignment helps you avoid naming a lender as a beneficiary.

- The collateral assignment may be against all or part of the policy's value.

- If any amount of the death benefit remains after the lender is paid, it is distributed to beneficiaries.

- Once the loan is fully repaid, the life insurance policy is no longer used as collateral.

How a Collateral Assignment of Life Insurance Works

Collateral assignments make sure the lender gets paid only what they are due. The borrower must be the owner of the policy, but they do not have to be the insured person. And the policy must remain current for the life of the loan, with the policy owner continuing to pay all premiums . You can use either term or whole life insurance policy as collateral, but the death benefit must meet the lender's terms.

A permanent life insurance policy with a cash value allows the lender access to the cash value to use as loan payment if the borrower defaults. Many lenders don't accept term life insurance policies as collateral because they do not accumulate cash value.

Alternately, the policy owner's access to the cash value is restricted to protect the collateral. If the loan is repaid before the borrower's death, the assignment is removed, and the lender is no longer the beneficiary of the death benefit.

Insurance companies must be notified of the collateral assignment of a policy. However, other than their obligation to meet the terms of the contract, they are not involved in the agreement.

Example of Collateral Assignment of Life Insurance

For example, say you have a business plan for a floral shop and need a $50,000 loan to get started. When you apply for the loan, the bank says you must have collateral in the form of a life insurance policy to back it up. You have a whole life insurance policy with a cash value of $65,000 and a death benefit of $300,000, which the bank accepts as collateral.

So, you then designate the bank as the policy's assignee until you repay the $50,000 loan. That way, the bank can ensure it will be repaid the funds it lent you, even if you died. In this case, because the cash value and death benefit is more than what you owe the lender, your beneficiaries would still inherit money.

Alternatives to Collateral Assignment of Life Insurance

Using a collateral assignment to secure a business loan can help you access the funds you need to start or grow your business. However, you would be at risk of losing your life insurance policy if you defaulted on the loan, meaning your beneficiaries may not receive the money you'd planned for them to inherit.

Consult with a financial advisor to discuss whether a collateral assignment or one of these alternatives may be most appropriate for your financial situation.

Life insurance loan (policy loan) : If you already have a life insurance policy with a cash value, you can likely borrow against it. Policy loans are not taxed and have less stringent requirements such as no credit or income checks. However, this option would not work if you do not already have a permanent life insurance policy because the cash value component takes time to build.

Surrendering your policy : You can also surrender your policy to access any cash value you've built up. However, your beneficiaries would no longer receive a death benefit.

Other loan types : Finally, you can apply for other loans, such as a personal loan, that do not require life insurance as collateral. You could use loans that rely on other types of collateral, such as a home equity loan that uses your home equity.

What Are the Benefits of Collateral Assignment of Life Insurance?

A collateral assignment of a life insurance policy may be required if you need a business loan. Lenders typically require life insurance as collateral for business loans because they guarantee repayment if the borrower dies. A policy with cash value can guarantee repayment if the borrower defaults.

What Kind of Life Insurance Can Be Used for Collateral?

You can typically use any type of life insurance policy as collateral for a business loan, depending on the lender's requirements. A permanent life insurance policy with a cash value allows the lender a source of funds to use if the borrower defaults. Some lenders may not accept term life insurance policies, which have no cash value. The lender will typically require the death benefit be a certain amount, depending on your loan size.

Is Collateral Assignment of Life Insurance Irrevocable?

A collateral assignment of life insurance is irrevocable. So, the policyholder may not use the cash value of a life insurance policy dedicated toward collateral for a loan until that loan has been repaid.

What is the Difference Between an Assignment and a Collateral Assignment?

With an absolute assignment , the entire ownership of the policy would be transferred to the assignee, or the lender. Then, the lender would be entitled to the full death benefit. With a collateral assignment, the lender is only entitled to the balance of the outstanding loan.

The Bottom Line

If you are applying for life insurance to secure your own business loan, remember you do not need to make the lender the beneficiary. Instead you can use a collateral assignment. Consult a financial advisor or insurance broker who can walk you through the process and explain its pros and cons as they apply to your situation.

Progressive. " Collateral Assignment of Life Insurance ."

Fidelity Life. " What Is a Collateral Assignment of a Life Insurance Policy? "

Kansas Legislative Research Department. " Collateral Assignment of Life Insurance Proceeds ."

:max_bytes(150000):strip_icc():format(webp)/WhatIsGuaranteedUniversalLifeInsurance-72184b8ca9544d8a828dbefa752d79ed.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Understanding Life Insurance Assignments: Your Complete Guide

A life insurance assignment allows you to transfer the rights of your policy, either temporarily or permanently.

Learn how collateral and absolute assignments can be used for loan collateral, estate planning, and other financial purposes.

Medicaid Planning

What is a collateral assignment.

Collateral assignments are used to secure a lender’s financial interest in your policy in exchange for lending you money.

If you die, the collateral assignment allows the lender to collect your policy’s death benefit up to the amount of the outstanding loan balance.

How Do Collateral Assignments Work?

A typical scenario involves taking out a business loan .

The lender may require a life insurance policy as collateral.

The type of life insurance policy used, whether a term, whole life, or universal life doesn’t matter.

The insurance policy will pay off the balance if you die while the loan is outstanding.

One of the most common uses for collateral assignments is with SBA loans , especially if you do not have other assets to post as collateral.

The collateral assignment applies to the entire policy, including any life insurance rider benefits that may be included.

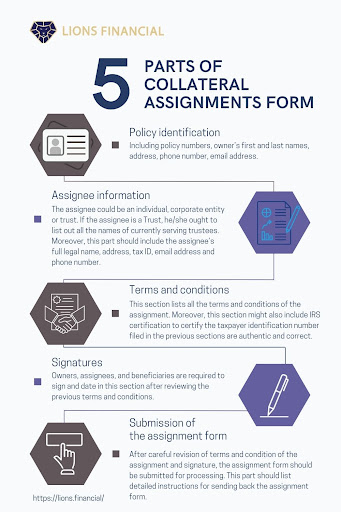

The Collateral Assignment Process: A Step-by-Step Guide

The process is similar whether you are adding the assignment to an existing policy or buying new coverage.

There are two parties to a collateral assignment.

- Assignor – Is the owner of the life insurance policy

- Assignee – Is the lender

Life insurance companies have standardized forms used for this purpose.

- The owner completes the form and sends it to the lender for review and signature.

- Once completed by the lender, the form is sent to the insurance company.

- The insurance company records the assignment and confirms to the owner and lender that it is complete.

This may all seem confusing if you haven’t used an assignment before, but the reality is that most life insurers make it pretty easy to complete.

Releasing a Collateral Assignment

When you pay off your loan, you have the right to have the collateral assignment released.

It’s a simple process :

- The policy owner completes the form and sends it to the lender.

- The lender signs off on the release. Many companies require a notary as a witness. The lender may return the form to the owner or the insurance company.

- Once completed and returned to the insurance company, the release is recorded, and all parties are notified.

Companies typically complete this process in about a week, and it’s a good idea to confirm everything with the home office to avoid potential issues.

Your agent can help with this.

What Happens to a Collateral Assignment if You Die?

How do collateral assignments work when you die?

Your beneficiary will file a death claim with the life insurer at some point.

Collateral Assignment Tip # 1

If your beneficiary is a loved one, it’s a good idea to let them know that your policy has a collateral assignment so they are not surprised when they file the claim.

Here’s an example of how a death claim with a collateral assignment works:

- Policy Face Amount = $5,000,000

- Beneficiary = Your Spouse

- Original Bank Loan = $200,000

- Outstanding Loan Balance at Death = $100,000

What happens next?

- Your beneficiary will file the death claim with the life insurance company.

- The life insurance company will review the claim and see a collateral assignment attached to your policy.

- The life insurer contacts the lender for an updated payoff figure.

- Payoff amounts are sent directly to the lender.

- Your beneficiary receives the balance of the policy death benefit .

For the above example, your lender would receive $100,000, and your beneficiary would receive the remaining $4,900,000.

Collateral Assignment Tip # 2

NEVER name your lender directly as a beneficiary. If you do, the lender will receive the entire death benefit, and your intended beneficiary will have to go through the lender to receive their share.

Collateral Assignments and Health Issues

While lenders may want a life insurance policy as collateral, obtaining life insurance can sometimes be difficult if the insured has substantial health issues .

If you have an existing life insurance policy in effect, you can use that for the assignment.

Another option that exists in some states is contingent coverage.

Contingent coverage is a one-year policy that you can renew.

The policy will exclude death from the known health issue but provide coverage for new health issues that develop or from accidental deaths .

Many lenders accept this coverage when it’s the only option available. And we’ve also seen lenders waive the collateral assignment requirement at times.

What is an Absolute Assignment?

An absolute assignment is a change of ownership of the policy.

When you want to permanently relinquish your rights to the life insurance policy, an absolute assignment is used.

Examples where absolute assignments are used include:

Life Insurance Settlements

1035 exchange, gifting life insurance to charities, irrevocable life insurance trusts (ilit), business insurance planning.

With this transaction, you are selling your life insurance policy to a third party.

If it is a term policy, you would convert a term policy to permanent insurance before it is sold. In some cases, a company will buy the term policy.

Another example may involve admitting seniors to a nursing home, where the nursing home may take over the policy you have.

A 1035 exchange is a tax-free transfer of cash value from universal life or whole life policy to another similar policy.

You can use absolute assignments to transfer your policy to your favorite charity.

You use absolute assignments to transfer your policy to an ILIT permanently.

An example would be a survivorship policy you and your spouse own that you are transferring to the trust.

Many other potential issues may arise with transfers to an ILIT that are beyond the scope of this article.

If you purchase key person life insurance on an employee, absolute assignments transfer ownership to the employee.

Many times, this happens if the employee leaves the company or retires.

You may have a policy permanently assigned to a nursing home or assisted living facility to help with long-term care expenses.

How Do Absolute Assignments Work?

Life insurance companies have forms used for Absolute Assignments.

Absolute assignment forms require:

- Current owner name, address, and tax ID information.

- New owner name, address, and tax ID information.

- Relationship to the proposed insured.

- Spousal consent in some states and situations.

The completed forms are submitted to the insurance company, recorded, and confirmations are sent to all parties.

Frequently Asked Questions About Life Insurance Assignments

You may have questions about your life insurance assignment and how it works.

The following are general guidelines, as each situation is uniquely different.

Can the collateral assignment change the beneficiary?

No, the collateral assignment does not change the beneficiary.

The life insurance assignment gives the lender the right to receive proceeds equal to their outstanding loan balance.

Can a business be a beneficiary in a collateral assignment of life insurance?

A business can be the beneficiary of a life insurance policy that is collaterally assigned.

Final Words

Life insurance assignments are common for absolute and collateral assignments.

What is most important is that you understand what is involved with this process.

That’s where we’ll help you make the best decision for your life insurance.

There is never any pressure or obligation with our life insurance service.

Please take a few minutes to submit your quote request today. Thank you.

Recent Articles

Seniors: Compare Our Life Insurance to Your AARP Coverage!

Replacing Life Insurance in New York

Cigar Smokers Never Pay Smoker Life Insurance Rates!

Chewing Tobacco & Life Insurance: Your Guide to Affordable Coverage

Cigarette Smokers Life Insurance

Pipe Smokers Life Insurance

About the author.

Michael Horbal

- Search Search Please fill out this field.

- Life Insurance

What Is Collateral Assignment (of a Life Insurance Policy)?

Meredith Mangan is a senior editor for The Balance, focusing on insurance product reviews. She brings to the job 15 years of experience in finance, media, and financial markets. Prior to her editing career, Meredith was a licensed financial advisor and a licensed insurance agent in accident and health, variable, and life contracts. Meredith also spent five years as the managing editor for Money Crashers.

:max_bytes(150000):strip_icc():format(webp)/Meredith_Mangan-d6d9ee392ba04deebb2d96b32c2b8cf2.jpg)

Definition and Examples of Collateral Assignment

How collateral assignment works, alternatives to collateral assignment.

Kilito Chan / Getty Images

If you assign your life insurance contract as collateral for a loan, you give the lender the right to collect from the policy’s cash value or death benefit in two circumstances. One is if you stop making payments; the other is if you die before the loan is repaid. Securing a loan with life insurance reduces the lender’s risk, which improves your chances of qualifying for the loan.

Before moving forward with a collateral assignment, learn how the process works, how it impacts your policy, and possible alternatives.

Collateral assignment is the practice of using a life insurance policy as collateral for a loan . Collateral is any asset that your lender can take if you default on the loan.

For example, you might apply for a $25,000 loan to start a business. But your lender is unwilling to approve the loan without sufficient collateral. If you have a permanent life insurance policy with a cash value of $40,000 and a death benefit of $300,000, you could use that life insurance policy to collateralize the loan. Via collateral assignment of your policy, you authorize the insurance company to give the lender the amount you owe if you’re unable to keep up with payments (or if you die before repaying the loan).

Lenders have two ways to collect under a collateral assignment arrangement:

- If you die, the lender gets a portion of the death benefit—up to your remaining loan balance.

- With permanent insurance policies, the lender can surrender your life insurance policy in order to access the cash value if you stop making payments.

Lenders are only entitled to the amount you owe, and are not generally named as beneficiaries on the policy. If your cash value or the death benefit exceeds your outstanding loan balance, the remaining money belongs to you or your beneficiaries.

Whenever lenders approve a loan, they can’t be certain that you’ll repay. Your credit history is an indicator, but sometimes lenders want additional security. Plus, surprises happen, and even those with the strongest credit profiles can die unexpectedly.

Assigning a life insurance policy as collateral gives lenders yet another way to secure their interests and can make approval easier for borrowers.

Types of Life Insurance Collateral

Life insurance falls into two broad categories: permanent insurance and term insurance . You can use both types of insurance for a collateral assignment, but lenders may prefer that you use permanent insurance.

- Permanent insurance : Permanent insurance, such as universal and whole life insurance, is lifelong insurance coverage that contains a cash value. If you default on the loan, lenders can surrender your policy and use that cash value to pay down the balance. If you die, the lender has a right to the death benefit, up to the amount you still owe.

- Term insurance : Term insurance provides a death benefit, but coverage is limited to a certain number of years (20 or 30, for example). Since there’s no cash value in these policies, they only protect your lender if you die before the debt is repaid. The duration of a term policy used as collateral needs to be at least as long as your loan term.

A Note on Annuities

You may also be able to use an annuity as collateral for a bank loan. The process is similar to using a life insurance policy, but there is one key difference to be aware of. Any amount assigned as collateral in an annuity is treated as a distribution for tax purposes. In other words, the amount assigned will be taxed as income up to the amount of any gain in the contract, and may be subject to an additional 10% tax if you’re under 59 ½.

A collateral assignment is similar to a lien on your home . Somebody else has a financial interest in your property, but you keep ownership of it.

The Process

To use life insurance as collateral, the lender must be willing to accept a collateral assignment. When that’s the case, the policy owner, or “assignor,” submits a form to the insurance company to establish the arrangement. That form includes information about the lender, or “assignee,” and details about the lender’s and borrower’s rights.

Policy owners generally have control over policies. They may cancel or surrender coverage, change beneficiaries, or assign the contract as collateral. But if the policy has an irrevocable beneficiary, that beneficiary will need to approve any collateral assignment.

State laws typically require you to notify the insurer that you intend to pledge your insurance policy as collateral, and you must do so in writing. In practice, most insurers have specific forms that detail the terms of your assignment.

Some lenders might require you to get a new policy to secure a loan, but others allow you to add a collateral assignment to an existing policy. After submitting your form, it can take 24 to 48 hours for the assignment to go into effect.

Lenders Get Paid First

If you die and the policy pays a death benefit , the lender receives the amount you owe first. Your beneficiaries get any remaining funds once the lender is paid. In other words, your lender takes priority over your beneficiaries when you use this strategy. Be sure to consider the impact on your beneficiaries before you complete a collateral assignment.

After you repay your loan, your lender does not have any right to your life insurance policy, and you can request that the lender release the assignment. Your life insurance company should have a form for that. However, if a lender pays premiums to keep your policy in force, the lender may add those premium payments (plus interest) to your total debt—and collect that extra money.

There may be several other ways for you to get approved for a loan—with or without life insurance:

- Surrender a policy : If you have a cash value life insurance policy that you no longer need, you could potentially surrender the policy and use the cash value. Doing so might prevent the need to borrow, or you might borrow substantially less. However, surrendering a policy ends your coverage, meaning your beneficiaries will not get a death benefit. Also, you’ll likely owe taxes on any gains.

- Borrow from your policy : You may be able to borrow against the cash value in your permanent life insurance policy to get the funds you need. This approach could eliminate the need to work with a traditional lender, and creditworthiness would not be an issue. But borrowing can be risky, as any unpaid loan balance reduces the amount your beneficiaries receive. Plus, over time, deductions for the cost of insurance and compounding loan interest may negate your cash value and the policy could lapse, so it’s critical to monitor.

- Consider other solutions : You may have other options unrelated to a life insurance policy. For example, you could use the equity in your home as collateral for a loan, but you could lose your home in foreclosure if you can’t make the payments. A co-signer could also help you qualify, although the co-signer takes a significant risk by guaranteeing your loan.

Key Takeaways

- Life insurance can help you get approved for a loan when you use a collateral assignment.

- If you die, your lender receives the amount you owe, and your beneficiaries get any remaining death benefit.

- With permanent insurance, your lender can cash out your policy to pay down your loan balance.

- An annuity can be used as collateral for a loan but may not be a good idea because of tax consequences.

- Other strategies can help you get approved without putting your life insurance coverage at risk.

NYSBA. " Life Insurance and Annuity Contracts Within and Without Tax Qualified Retirement Plans and Life Insurance Trusts ." Accessed April 12, 2021.

IRS. " Publication 575 (2020), Pension and Annuity Income ." Accessed April 12, 2021.

Practical Law. " Security Interests: Life Insurance Policies ." Accessed April 12, 2021.

Credit Cards

Financial planning.

- Cheapest Car Insurance

- Cheapest Full Coverage Car Insurance

- Car Insurance Cost Calculator

- Best Car Insurance

- Compare Car Insurance Costs

- Average Cost of Car Insurance

- Best Term Life Insurance

- Best Whole Life Insurance

- Best Life Insurance Companies

- Best Universal Life Insurance

- Best Life Insurance for Seniors

- Compare Quotes

- Best Auto and Home Insurance Bundle

- Homeowners Insurance

- Renters Insurance

- Health Insurance

- Pet Insurance

- Small Business Insurance

Insurance Guidance

- Conventional Mortgages

- Jumbo Loans

- Best HELOC Loans and Rates

- Get a HELOC With Bad Credit

- Pay Off Your Mortgage With a HELOC

- Pros and Cons of HELOCs

- The HELOC Approval Process

- Mortgage Payment Calculator

- Reverse Mortgage Calculator

- FHA vs. Conventional Loan Calculator

- Private Mortgage Insurance Calculator

- Debt-to-Income Ratio Calculator

Mortgage Guidance

- Best Balance Transfer Credit Cards

- Best Cash Back Credit Cards

- Best Travel Rewards Credit Cards

- Best Airline Credit Cards

- Best Credit Cards for Excellent Credit

- Best Business Credit Cards

- Best American Express Cards

- Best Capital One Credit Cards

- Best Chase Credit Cards

- Best Citi Credit Cards

- Best Bank of America Credit Cards

- Cash Back Calculator

- Pros and Cons of Balance Transfers

- Practical Guide for Improving Credit Fast

- Average Credit Score by Age

- Credit Cards For Bad Debt

- Credit Card Glossary

Recent Credit Card Reviews & Comparisons

- Best Personal Loans of 2024

- Best Personal Loans for Excellent Credit

- Best Personal Loans for Good Credit

- Best Personal Loans for Bad Credit

- Best Same-Day Approval Loans

- Best Personal Loans for Debt Consolidation

- Best Private Student Loans

- Best Student Loans for Bad Credit

- Best Student Loans for International Students

- Best Low-Interest Student Loans

- Best Student Loans Without a Co-Signer

- Personal Loan Calculator

- Auto Loan Calculator

- Student Loan Calculator

- How to Calculate Loan Payments

- Can You Get a Personal Loan With Bad Credit?

Loans Guidance

- Compound Interest Calculator

- Cost of Living Calculator

- Financial Literacy Handbook

- Guide to Retirement Planning

- Ultimate Guide to Budgeting

- Understanding Types of Debt

- How to Pay Down Student Loan Debt

- How to Start Saving & Investing

- Should You Rent or Buy a House

- How to Pay for College

- Guide to Buying a Car

- Guide to Negotiating Salary

- Safest Cities in America

- Top Cities for Job Seekers

- Most & Least Tax-Friendly States

- Most Dangerous Days for DUIs

What Is Collateral Assignment of Life Insurance?

Collateral assignment of life insurance designates a lender as the assignee of a policy, granting them the right to part or all of the death benefit until the loan is repaid.

Nathan Paulus

Director of Content Marketing, MoneyGeek

Nathan Paulus is the Head of Content Marketing at MoneyGeek, with nearly 10 years of experience researching and creating content related to personal finance and financial literacy. Paulus has a bachelor's degree in English from the University of St. Thomas, Houston. He enjoys helping people from all walks of life build stronger financial foundations.

Casie McCoskey

Content Editor

Casie McCoskey is a professional editor passionate about providing people with accessible information on personal finance. Before MoneyGeek, she worked in the legal field, drafting and editing briefs and motions.

Quality Verified

MoneyGeek is dedicated to providing trustworthy information to help you make informed financial decisions. Each article is edited, fact-checked and reviewed by industry professionals to ensure quality and accuracy.

Updated: June 5, 2024

- How It Works

- Overview of Application Process

Pros and Cons

- Impact on Beneficiaries

- Alternatives

Related Content

Advertising & Editorial Disclosure

Collateral assignment of life insurance is an arrangement where a policyholder uses the face value of their life insurance policy, which can be a term or permanent life insurance policy, as collateral to secure a loan. If the policyholder dies before they pay off the loan, the lender is prioritized to receive a portion of the death benefit equivalent to the outstanding loan balance. The remaining benefit then goes to the policy's beneficiaries. This agreement ensures that life insurance collateral assignment acts as a safety net for both the lender and the beneficiaries.

- Collateral assignment involves using a life insurance policy as security for a loan, where the lender has a claim on the death benefit if the borrower defaults or passes away before repaying the loan.

- The lender receives priority over the death benefit, which means they are paid first from the policy's payout before any beneficiaries if the loan remains unpaid.

- Various life insurance policies, including term, whole and universal, can be used for collateral assignment, depending on the insurance company's policies and the policy's value.

- If a life insurance policy lapses or is canceled during a collateral assignment, it can breach the loan agreement, potentially resulting in immediate repayment demands.

How Collateral Assignment of Life Insurance Works

The collateral assignment allows you to use your life insurance policy as security for a loan. The process involves legally designating your policy as collateral, which means if you pass away before fully repaying the loan, the lender can claim the death benefit to cover the remaining balance. You start by choosing either a term policy or whole life insurance and then complete a collateral assignment agreement. This agreement is legally binding and sets the terms for the lender to access the death benefit .

For your beneficiaries, the assignment of your life insurance policy as collateral could reduce the death benefit they receive. If you die with an outstanding loan balance, the lender is paid first from the policy's proceeds. Any remaining amount goes to your beneficiaries only after the loan is settled.

For example, a policyholder with a $500,000 policy uses their life insurance as collateral for a $200,000 loan. If the policyholder dies before settling the loan, the lender will receive $200,000 from the policy's death benefit. Meanwhile, the remaining $300,000 gets disbursed to the policy's beneficiaries.

Roles of the Policyholder, Lender and Insurance Provider

Role of the Policyholder

- Ensure consistent premium payments to keep the policy active and in force.

- Inform the lender of any policy changes, such as lapses or surrenders.

- Understand that active management upholds the collateral agreement's integrity.

Role of the Lender

- Accept the life insurance policy as collateral.

- Right to recover owed amounts from the policy's death benefit if the policyholder dies before loan repayment.

- Priority claim on the death benefit, with remaining funds disbursed to beneficiaries.

- Responsible for releasing the assignment after full loan repayment.

Role of the Insurance Provider

- Approve or reject the collateral assignment of the policy.

- Evaluate and ensure compliance with policy terms.

- Officially record the assignment as part of the policy.

Applying for Collateral Assignment

Applying for collateral assignment is a process moderated by your life insurance company designed to secure loans using your life insurance policy as collateral. It involves a series of steps:

Obtain a Collateral Assignment Form

Request a collateral assignment form from your life insurance provider. This form is vital for designating the lender as a collateral beneficiary for the loan amount. Ensure you obtain the correct form, as forms vary based on policy type and insurer.

Fill Out the Form Correctly

Complete the form with accurate details, including policy number, loan amount and lender information. Pay close attention to all sections to avoid errors that could delay or invalidate the assignment. Incomplete or incorrect information can lead to processing delays or rejection.

Sign the Paperwork

Ensure both the policyholder and lender sign the form, confirming the agreement. This dual signature legally binds both parties to the terms of the collateral assignment. Any discrepancy in signatures may question the form's validity.

Submit the Completed Form

Submit the signed form back to the insurance company for processing. Consider using a traceable delivery method for submission to confirm receipt. Delays in submission can impact the timeline of the loan approval process.

Await Approval or Rejection From the Insurance Company

Wait for the insurer to review and approve or reject the collateral assignment. The insurer may request additional information or clarification, which can extend the approval timeline.

Receive a Letter of Acknowledgment

You and your lender will receive a letter of acknowledgment from the insurer if your collateral assignment application is approved.

Obtaining Required Documentation

The required documentation for collateral assignment of life insurance is straightforward. Typically, you'll need to provide two main types of documents for the assignment of a life insurance policy as collateral:

- Collateral Assignment Form: This form is critical because it officially transfers a portion of your life insurance policy benefits to the lender as collateral. It demonstrates to the lender that you have taken the steps to secure your loan against your life insurance policy.

- Original Life Insurance Policy and Proof of Loan: Lenders may require your original life insurance policy to ensure it is valid and enforceable. Proof of the loan agreement or obligation, such as a mortgage note or other loan document, is also commonly required. This establishes the legitimacy of your loan and substantiates the life insurance collateral assignment.

If you need more clarification about documentation requirements, contact your lender to confirm the necessary details to avoid process delays.

Pros and Cons of Collateral Assignment

Using life insurance as collateral can offer a range of benefits and potential drawbacks. Collateral assignment of a policy allows you to secure loans and is often safer than using physical assets as collateral. However, you should also note the inherent risks, primarily that the lender retains the first right to your policy’s death benefit upon your death.

- Lower interest rates on loans.

- Allows you to use the policy and not physical assets as collateral.

- The cash value of your insurance policy continues to grow.

- The lender has the first right to the death benefit.

- Failure to repay the loan can reduce or even eliminate the death benefit.

- Any lapse or cancellation of the policy may lead to violating the loan terms.

Impact of Collateral Assignment on Beneficiaries

While the collateral assignment of life insurance has its benefits, it’s important to remember that it can impact the amount your beneficiaries receive. If you pass away with an outstanding balance on your loan:

Your Lender Will Be Paid First

In the collateral assignment arrangement, the lender is designated as the collateral beneficiary holding the primary claim to the death benefit for the outstanding loan amount. This means if you pass away before fully repaying the loan, the lender is entitled to receive payment from the death benefit first. The amount collected by the lender is limited to the remaining loan balance.

Any Remaining Death Benefit Will Be Disbursed to Your Beneficiaries

After the lender's claim is satisfied, the remaining death benefit is disbursed to your policy’s designated beneficiaries. The amount they receive depends on the loan balance at the time of your death. If the loan balance is substantial, your beneficiaries will receive significantly less than the policy's total death benefit.

This structure underscores the importance of carefully considering life insurance collateral loans and their impact on future financial planning. Policyholders using life insurance as collateral need to understand the terms set forth by loan companies that accept it.

Alternatives to Collateral Assignment

Alternatives to collateral assignment include personal loans , home equity loans or surrendering the life insurance policy for its cash value. None of these options require using life insurance as collateral, and each offers different benefits and risks compared to using life insurance as collateral.

| . | ||

FAQ About Collateral Assignment

These questions cover various topics related to collateral assignments, including their requirements, implications for beneficiaries and what happens in different scenarios.

A collateral assignment is a contractual arrangement in which a borrower uses their life insurance policy as collateral for a loan. This agreement grants the lender rights to the policy’s death benefit. The lender is prioritized over other beneficiaries until the loan is repaid in full.

In the context of a life insurance collateral assignment, the collateral is the policy's death benefit. This setup allows lenders to be listed as collateral beneficiaries, guaranteeing that they can recover the outstanding loan balance from the death benefit in the event of the borrower’s death before the debt is fully paid.

In a life insurance contract, a collateral assignment allocates the policy's death benefit as security for a loan. This means that if the borrower dies before repaying the loan, the lender, as the collateral assignee of the life insurance, can claim the owed amount from the death benefit. The remaining balance, if any, goes to the designated beneficiaries, ensuring the loan is covered without affecting other assets.

Collateral assignment allows a lender to claim the life insurance death benefit for an outstanding loan amount while naming a life insurance beneficiary designated who receives the death benefit. The lender's claim is prioritized over the beneficiaries' in collateral assignment.

Most types of life insurance policies , including term, whole and universal life, can be used for collateral assignment, provided the insurance company allows it and the policy has sufficient value.

Yes, the policyholder can change beneficiaries after a collateral assignment, but the lender's right to the death benefit amount remains until the loan is repaid. This ensures the lender's position as a collateral beneficiary.

Canceling your life insurance policy before repaying the debt can lead to a breach of the collateral assignment loan agreement. This action may prompt the lender to increase your interest rate or demand immediate repayment of the outstanding loan balance.

These related sections offer additional insights into concepts and alternatives connected to collateral assignments and life insurance:

Using Collateral for a Personal Loan — This link explains how to use various types of collateral for securing a personal loan, providing a broader context to the specific use of life insurance as collateral.

Term vs. Permanent Life Insurance — This resource compares term and permanent life insurance, helping to understand which policies can be used for collateral assignments.

Permanent Life Insurance — This page details permanent life insurance, a type commonly used in collateral assignments due to its cash value component.

Life Insurance Calculator — This page helps you calculate the appropriate amount of life insurance coverage needed, which is crucial when considering using a policy for collateral.

About Nathan Paulus

Nathan Paulus is the Head of Content Marketing at MoneyGeek, with nearly 10 years of experience researching and creating content related to personal finance and financial literacy.

Paulus has a bachelor's degree in English from the University of St. Thomas, Houston. He enjoys helping people from all walks of life build stronger financial foundations.

- Car Insurance

- Home Insurance

- Rental Insurance

- Life Insurance

- Refinancing

- Conventional Loan

- Business Credit Cards

- Student Credit Cards

- Balance Transfer Cards

- Credit Cards with Rewards

- Travel Credit Cards

- Cash Back Credit Cards

What Is A Collateral Assignment Of Life Insurance?

Our content follows strict guidelines for editorial accuracy and integrity. Learn about our editorial standards and how we make money.

A collateral assignment is sometimes a necessity if you’re applying for larger financing amounts such as a mortgage or business loan.

But what is a collateral assignment and how do you go about getting it on your life insurance policy?

In this article, we’ll cover what collateral assignment is, how you can add it to your life insurance, and what alternatives there are out there.

What Is Collateral Assignment?

A collateral assignment is a process by which a person uses their life insurance policy as collateral for a secured loan.

In simple terms, collateral assignment is reassigning priorities for who gets paid the death benefit of your life insurance policy.

What Is a death benefit?

A death benefit or face value of a life insurance contract is the amount of money that your beneficiaries will receive from your policy when you die.

Once you apply for collateral assignment and it’s approved, your specified debtor (the loan provider) will be paid first and then your beneficiaries will receive what is left over in your life insurance policy.

This is different from using your cash value to loan money as you are taking out a loan from another financial institution and using your policy as a guarantee that you’ll cover any debt when you die.

For example, let’s say you want to take out a secured loan from your local bank and want to use your life insurance policy as a collateral assignment.

In this situation, you’d still have to pay back any debt you have with interest during the loan period.

However, the life insurance policy would be used if the borrower dies and there was an outstanding loan balance remaining.

Secured Loans vs. Unsecured Loans

Secured loans are debts that are backed by assets that a lender can claim if the debt isn’t repaid. These types of loans often offer better interest rates and more generous payment terms.

Unsecured loans are debts that don’t have collateral. These types of loans are more expensive to repay and considered riskier than secured loans.

Source: Pexels

How Does Applying for Collateral Assignment Work?

The process for getting collateral assignments for life insurance is the same as when you apply for new life insurance coverage.

All you’ll be doing is indicating to your life insurance provider that your lender will be given priority for the amount of money you have borrowed through them.

There is an:

Application process.

Underwriting process.

Offer that you’ll receive.

You’ll be required to name beneficiaries as well as indicate ownership of the life insurance policy in the collateral assignment form which will be provided by your life insurance company.

This is because you’re changing the terms of your payout and your life insurance provider will need to follow these instructions once you die.

NB Some insurance companies don’t offer collateral assignment on new loans and generally only provide this feature to an existing life insurance policy.

You should check beforehand to see what will be required to apply for a collateral assignment. If you need help finding plans that offer this, send an email to a licensed insurance agent today.

Once you’ve assigned a new collateral assignee to your life insurance policy, they will be entitled to lay a claim on your death benefit for any debt you have with them.

For example, let’s say you take out a collateral assignment life insurance policy worth $200,000 for a loan of $75,000 over 7 years at an interest rate of 18%.

If you die after five years, based on these figures, you’ll still have $41,231.02 owed on your loan.

Your $200,000 life insurance plan will be used to cover this and your beneficiaries will receive the remaining $158 768.98 from your life insurance policy.

Your lender is only allowed to take the amount outstanding on the debt owed and cannot take more.

What about Missed Payments and Cash Value Life Insurance?

If you have a permanent life policy with a cash value account, sometimes called cash value life insurance, your lender will have access to it to cover missed payments on your loan.

For example, let’s say you miss a payment on your loan and have a collateral assignment. Your lender will be able to access your cash value account and withdraw that month’s payment to cover your debt.

Who Can You Add as a Collateral Assignee?

You can add any person or institution as a collateral assignee to your life insurance policy if you owe them money.

This can include banks, lenders, private individuals, businesses, or credit card companies.

The most common collateral assignments are for business loans and mortgages. This is because they are loans for high amounts that are paid off over several years.

In fact, some banks and financial lenders may require that you add them as collateral assignees when you apply for any of the financing options mentioned below.

Common Collateral Assignees Include:

💵 Bank loans

💳 Credit cards

🏡 Mortgages

💼 Business loans

What Do I Do If I’ve Paid Off My Debt?

If you’ve managed to pay off your debt - firstly, congratulations! Secondly, you’ll want to notify your life insurance company that you’ll be changing your collateral assignments on your life policy.

While there is no legal claim that a company can make to debts that aren’t owed anymore, there may be a hold up in paying out the death benefit to your beneficiaries and other collateral assignees.

Life insurance companies will have to figure out who must be paid first, according to the order stated in your collateral assignment terms.

In general, life insurance policies will settle claims within 24 hours of being notified of a policyholder’s death.

The process can be delayed if you do not release your collateral assignees from your life insurance contract.

Tips to Make Sure Your Life Policy Is Paid Out Quickly

Here are some tips if you want your beneficiary claims to be handled as fast as possible:

1) Keep a copy of your life insurance policy and policy number in a safe place or with your lawyer, financial advisor, or estate planner.

2) Speak to your beneficiaries about your policies and give them the contact details of the relevant life insurance company.

3) Make sure your life insurance contract is updated to reflect your latest list of beneficiaries.

4) Make sure you have your beneficiaries' details listed in the contract or with your lawyer.

The Benefits of Using Collateral Assignment of Life Insurance

While adding a collateral assignment to your current life insurance policy may require an application, paperwork, and time, there are benefits:

Many lenders like it: Banks and financial institutions sometimes prefer it when applicants use their life insurance policy as collateral for a loan. This is because they know that their debt will be serviced long-term by your insurance company which makes their loan to you a lower risk.

Your private property won’t be jeopardized: The last thing you want when you go into debt is to put your personal items, such as your car, investments, or home on the line as collateral. Using collateral assignment is an alternative to this and can protect you in the event that you can’t service your debt.

It can be affordable for some people: If you’re in good health and young, you may be paying affordable rates for permanent life cover. In situations like this, it can make sense to use your life cover as collateral for debts you’ve incurred.

What Are Some Alternatives to Collateral Assignment?

Term Life Insurance: Getting a term life insurance contract to cover specific debts is one way of ensuring your estate and family are protected when you die.

There are multiple types of term life insurance plans and they are more affordable than permanent life insurance. This makes options like level term life insurance and decreasing term life insurance ideal for different types of debts you may have over your lifetime.

What Is Term Life?

Term life is a temporary life coverage option that lasts for a specific period of time. It is different from permanent life insurance which lasts until you die or you stop paying premiums.

Term life contracts are typically between 5 to 20 years, however, you can get renewable term life plans and even a forty-year term life plan .

Borrow from your life insurance: If you have a permanent life insurance policy, such as universal, whole, or indexed life cover, you can borrow money from your cash value account.

However, keep in mind that you’ll be required to pay interest on any amount that you borrow and any amount of debt incurred will be deducted from your policy’s death benefit when you die.

What Is Cash Value?

Cash value is a feature of permanent life insurance plans that policyholders can contribute additional money toward while they have a policy in force.

This money is set aside in a cash value account which is tax-deferred and can be used in a number of ways.

In some cases, if your policy allows it, you can end your contract and get the cash surrender value of it. This amount is usually much less than the value of your total life insurance contract.

Our Verdict on Collateral Assignment

Many banks, lenders, and financial institutions want long-term guarantees that you’ll be able to service your debt if anything happens to you.

In some situations, getting collateral assignments on your life insurance to cover these debts is a good option for people who are trying to access finance from these institutions.

However, there is a risk that your death benefit payout may be delayed for your beneficiaries if you don’t keep your different collateral assignees up to date.

If you already have a life insurance policy, you should contact your provider to find out what the process is and what you’ll need to do to change the collateral assignees on your policy.

If you don’t have a policy yet, our advice is to look at all of your options before you decide to take a permanent life insurance contract with a collateral assignment.

There are alternatives out there that are more affordable if you’re looking to protect your family and estate from debt.

Term life is one such option that is adaptable to your life and easy to get.

For example, a decreasing term life insurance policy might be the right choice for someone who has recently bought a home and wants to cover their mortgage while they pay it back.

Another option is final expense insurance, which is a permanent life policy for smaller amounts, usually under $50,000.

With final expense insurance, your beneficiaries can pay for anything they want, including any debts you may have had in your life.

The process for applying is simple and you won't have to go through a medical exam or intensive underwriting as you would with traditional permanent life insurance.

If you need any assistance with finding, comparing, or learning about the different life insurance options to cover your debts, speak to one of our expert advisors today at 1-888-912-2132 or [email protected] .

Where Can I Learn More about Life Insurance?

If you’re looking to learn more about life insurance, different kinds of coverage, or costs, visit our life insurance hub to find our latest articles.

We do the research so that you don’t have to and our articles cover complicated topics like what is a cash value account, what is key person insurance, or how long life insurance takes to pay out a death benefit.

If you need help with quotes, try out a life insurance quote finder or reach out to us via email at [email protected] to get in touch with a licensed life insurance agent for your state.

Collateral assignment of life insurance

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Our content is backed by Coverage.com, LLC, a licensed insurance producer (NPN: 19966249). Coverage.com services are only available in states where it is licensed . Coverage.com may not offer insurance coverage in all states or scenarios. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not modify any insurance policy terms in any way.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn LinkedIn

- Share this article via email Email

At Bankrate, we take the accuracy of our content seriously.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

- • Auto insurance

- • Life insurance

- Connect with Mary Van Keuren on LinkedIn LinkedIn

- Get in contact with Mary Van Keuren via Email Email

- Connect with Natasha Cornelius, CLU on LinkedIn LinkedIn

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money . This content is powered by HomeInsurance.com (NPN: 8781838). For more information, please see our Insurance Disclosure .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Insurance Disclosure

This content is powered by HomeInsurance.com, a licensed insurance producer (NPN: 8781838) and a corporate affiliate of Bankrate.com. HomeInsurance.com LLC services are only available in states where it is licensed and insurance coverage through HomeInsurance.com may not be available in all states. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions (such as approval for coverage, premiums, commissions and fees) and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not modify any insurance policy terms in any way.

Secured loans are often used by individuals needing financial resources for any reason, whether it’s to fund a business, remodel a home or pay medical bills. One asset that may be used for a secured loan is life insurance. Although there are pros and cons to this type of financial transaction, it can be an excellent way to access needed funding. Bankrate’s insurance editorial team discusses what a collateral assignment of life insurance is and when it might—or might not—be the best loan option for you.

What is collateral assignment of life insurance?

A collateral assignment of life insurance is a method of securing a loan by using a life insurance policy as collateral . If you pass away before the loan is repaid, the lender can collect the outstanding loan balance from the death benefit of your life insurance policy . Any remaining funds from the death benefit would then be disbursed to the policy’s designated beneficiary(ies).

Why use life insurance as collateral?

Collateral assignment of life insurance may be a useful option if you want to access funds without placing any of your assets, such as a car or house, at risk. If you already have a life insurance policy, it can be a simple process to assign it as collateral. You may even be able to use your policy as collateral for more than one loan, which is called cross-collateralization, if there is enough value in the policy.

Collateral assignment may also be a credible choice if your credit rating is not high, which can make it difficult to find attractive loan terms. Since your lender can rely on your policy’s death benefit to pay off the loan if necessary, they are more likely to give you favorable terms despite a low credit score.

Pros and cons of using life insurance as collateral

If you are considering collateral assignment, here are some pros and cons of this type of financial arrangement.

- It may be an affordable option, especially if your life insurance premiums are less than your payments would be for an unsecured loan with a higher interest rate.

- You will not need to place personal property, such as your home, as collateral, which you would need to do if you take out a secured loan. Instead, if you pass away before the loan is repaid, lenders will be paid from the policy’s death benefit. Any remaining payout goes to your named beneficiaries.

- You may find lenders who are eager to work with you since life insurance is generally considered a good choice for collateral.

- The amount that your beneficiaries would have received will be reduced if you pass away before the loan is paid off since the lender has first rights to death benefits.

- You may not be able to successfully purchase life insurance if you are older or in poor health.

- If you are using a permanent form of life insurance as collateral, there may be an impact on your ability to use the policy's cash value during the life of the loan. If the loan balance and interest payments exceed the cash value, it can erode the policy's value over time.

What types of life insurance can I use as collateral for a loan?

You may use either of the main types of life insurance— term and permanent —for collateral assignment. If you are using term life insurance, you will need a policy with a term length that is at least as long as the term of the loan. In other words, if you have 20 years to pay off the loan, the term insurance you need must have a term of at least 20 years.

Subcategories of permanent life insurance, such as whole life , universal life and variable life, may also be used. Depending on lender requirements, you may be able to use an existing policy or could purchase a new one for the loan. A permanent policy with cash value may be especially appealing to a lender, considering the added benefit of the cash reserves they could access if necessary.

How do I take out a loan using a collateral assignment of life insurance?

If you already have enough life insurance to use for collateral assignment, your next step is to find a lender who is willing to work with you. If you don’t yet have life insurance, or you don’t have enough, consider the amount of coverage you need and apply for a policy . You may need to undergo a medical exam and fill out an application .

Once your policy has been approved, ask your insurance company or agent for a collateral assignment form, which you will complete and submit with your loan application papers. The form names your lender as an assignee of the policy—meaning that they have a stake in its benefits for as long as the loan exists. You will also name beneficiaries or a single beneficiary, who will receive whatever is left over from the death benefits after the loan is repaid.

Note that you will need to stay current on your life insurance premium payments while the collateral assignment is active. This will be stated in the loan agreement, and failure to do so could have serious repercussions.

Alternatives to life insurance as collateral

If you are considering a collateral assignment of life insurance, there are a few alternative funding options that might be worth exploring. Since many factors determine each option, working with a financial advisor may be the best way to find the ideal solution for your situation.

Unsecured loan

Depending on your situation, an unsecured loan may be more affordable than a secured loan with life insurance as collateral. This is more likely to be the case if you have good enough credit to qualify for a low-interest rate without having to offer any type of collateral. There are many different types of unsecured loans, including credit cards and personal loans.

Secured loan

In addition to life insurance, there are other items you can use as collateral for a secured loan . Your home, a car or a boat, for example, could be used if you have enough equity in them. Typically, secured loans are easier to qualify for than unsecured, since they are not as risky for the lender, and you are likely to find a lower interest rate than you would with an unsecured loan. The flip side, of course, is that if you default on the loan, the lender can take the asset that you used to secure it and sell it to recoup their losses.

Life insurance loan

Some permanent life insurance policies accumulate cash value over time that you can use in different ways. If you have such a policy, you may be able to partially withdraw the cash value or take a loan against your cash value. However, there are implications to using the cash value in your life insurance policy, so be sure to discuss this solution with a life insurance agent or your financial advisor before making a decision.

Home equity line of credit (HELOC)

A home equity line of credit (HELOC) is a more flexible way to access funds than a standard secured loan. While HELOCs carry the downside of risking your home as collateral, you retain more control over the amount you borrow. Instead of receiving one lump sum, you will have access to a line of credit that you can withdraw from as needed. You will only have to pay interest on the actual amount borrowed.

Frequently asked questions

What is the best life insurance company, what type of loans are collateral assignments usually associated with, what are other common forms of collateral, what are the two types of life insurance assignments, related articles.

Guaranteed issue life insurance

Life insurance death benefits

What does life insurance cover?

What is collateral insurance and how does it work?

Collateral Assignment of Life Insurance

Collateral assignment of life insurance means using a policy as collateral for a loan. If the borrower dies before paying it back, the lender can take the unpaid amount from the insurance payout upon the borrower’s death.

In this guide, you’ll learn how collateral assignments work, why they’re used, and the pros and cons of using life insurance as collateral.

Table of Contents

What Is Collateral Assignment?

- Policy Options for Collateral Assignment

How to Use Life Insurance as Collateral for a Loan

- Life Insurance as Collateral: Pros & Cons

- Alternatives to Life Insurance

Did you know you can use life insurance to secure an SBA loan for your growing business? Get started today.

Valuable assets (like a home or vehicle) typically serve as collateral for a mortgage or an auto loan. If you default on payments, the lender can repossess it to recover their money.

Lenders require reassurance for loans that aren’t directly tied to a physical asset. You can use a life insurance policy as loan collateral in these cases.

As owner of the life insurance policy , you collaterally assign it to the lender, which means:

- If you die before the loan is repaid, the death benefit covers your remaining loan balance

- Any remaining proceeds go to your named beneficiaries

Collateral vs Absolute Assignment of Life Insurance

There are two types of assignment for life insurance: collateral and absolute.

Collateral assignment of life insurance : You control the policy. It’s commonly used to secure a small business loan.

Absolute assignment : You transfer all policy rights to the assignee. It’s often used when a policy owner sells it to a third party for an immediate cash benefit.

Similarities between collateral and absolute assignment:

- Both involve the transfer of rights under a policy.

- Both require the consent of the insurance company.

- Both can be used as a means of managing financial risks or responsibilities.

Differences between collateral and absolute assignment:

Collateral assignment:

- Used to secure a loan or other financial obligation.

- The policy owner maintains ownership and control over the asset, except for the rights assigned as collateral.

- The lender (assignee) only has rights to the asset in the event of death or, in some cases, default.

- The assignment is temporary and removed when the loan is repaid.

Absolute assignment:

- The policy is fully transferred to a new owner.

- The original owner gives up all rights and control over the policy, including the right to name beneficiaries and access cash value.

- The new owner can manage the policy however they see fit, including selling it, borrowing against it, or changing its terms.

- The assignment is permanent; the original owner can’t reclaim rights to the policy without the new owner’s consent.

Life Insurance Assignee vs Beneficiary

A life insurance assignee is a person or entity to whom a policy’s rights have been transferred.

A beneficiary is a person, trust, or entity designated by a policy owner to receive the death benefit when the insured person dies.

Whether used for collateral assignment or not, your policy needs designated beneficiaries .

Here’s why:

- The lender only has a legal claim to the death benefit if you die before the loan is paid.

- If you pass away, the lender gets their payment, and the rest goes to your beneficiaries.

- If you repay the loan in full and die, the lender receives nothing, and your beneficiaries receive the full benefit.

Life Insurance Policy Options for Collateral Assignment

Using life insurance for collateral assignment when applying for loans is a common practice that almost every life insurance company and lender is equipped to handle.

Examples of when life insurance can be collaterally assigned include:

- Personal loans

- Business loans

There are two types of life insurance—term life insurance and permanent life insurance—and both kinds can be used for collateral assignment.

Term Life Insurance

Lenders typically accept term life insurance as collateral, provided that the policy aligns with the size and duration of the loan.

Coverage and term length must equal the loan’s terms– or exceed them.

For example, if you’re securing a 20-year loan, you would need a term life insurance policy that spans 20 years.

If you pass away before repayment, the insurance company pays the outstanding loan balance to the lender from your policy’s death benefit first. Any remaining amount after the loan is fully paid would then be distributed to the beneficiaries you have named on your policy.

If you repay the loan before passing, the collateral assignment ends, and the total death benefit amount is reserved for your beneficiaries.

Permanent Life Insurance

Lenders often find permanent life insurance policies appealing as collateral due to their unique cash value component.

Life insurance with cash value provides an added level of reassurance to the lender, ensuring the cash value will offset the loan if the borrower defaults.

However, even though the policy’s worth grows over time, the death benefit must cover the entire loan.

If you pass away before the loan is repaid, the company would first pay the loan balance from your policy’s death benefit to the lender.

Any remaining proceeds from the death benefit would then be distributed to the beneficiaries named on your policy.

Learn more about the differences between term and permanent life insurance .

See what you’d pay for life insurance

If you’re looking to secure a loan with life insurance, you can buy a policy to do so or collaterally assign a policy you already own.

Collateral Assignment of a Life Insurance Policy You Already Own

To collaterally assign an existing policy, you and your lender must fill out a short form confirming the details.

You or your agent can request this form directly from the life insurance company.

Once the completed forms are back in the insurance company’s possession, they will review them and send confirmation in a few weeks.

- If you already own a life insurance policy worth enough to cover the loan, you can usually use it as collateral.

- If you currently have term life insurance, the remaining years on your term must be longer than the loan’s term.

Collateral Assignment of a New Life Insurance Policy

Buying a new life insurance policy for collateral assignment is similar to that of any other purpose for life insurance.

- Step 1: Determine the amount of life insurance coverage you need . While the coverage should be sufficient to cover the loan, you may consider additional obligations like income replacement for your family, mortgage payments, and more.

- Step 2: Apply for a life insurance policy as you would normally. List your chosen beneficiaries, such as your spouse, adult child, etc. At this stage, there’s no need to list the lender as a beneficiary.

- Step 3: Activate your policy. Then, request a collateral assignment form from your agent or insurer directly.

- Step 4: Complete the form and return it to the insurance company. After processing, the insurer acknowledges the collateral assignment. Then the lender obtains rights to the death benefit, up to the amount owed on the loan, if you die before the loan is repaid. Any remaining death benefit would be distributed to the other named beneficiaries.

- Step 5: While collateral assignment is active, policy control may be limited. The specifics of what actions are permissible can vary, so reviewing the terms of the loan and collateral assignment agreement is essential.

- Step 6: Collateral assignment terminates when the loan is paid. Your full ownership rights are then restored.

Explore the various ways business owners use life insurance to protect their business and their loved ones.

Life Insurance as Collateral: Pros and Cons

Overall, using life insurance as collateral can be a sound and effective strategy for obtaining a loan, provided that it aligns with your financial circumstances and goals.

Collateral assignment impacts your control and financial protection for beneficiaries positively and negatively.

- Access to loans

- Loan approval

- Protection for beneficiaries

- Limited policy control

- Risk to beneficiaries

- Additional costs

- Policy loss

Alternatives to Collateral Assignment

Collateral assignment isn’t the only way to secure a loan. Knowing alternatives can help you decide what best aligns with your financial circumstances and goals.

Some examples include:

- Cash value: If you already own a permanent life insurance policy with accumulated cash value, you can borrow against this amount through policy loans .

- Unsecured loans: These do not require collateral and are primarily based on your creditworthiness. They often come with higher interest rates.

- Secured loans: These are backed by collateral that isn’t life insurance, like investments, savings accounts, or valuable property. If you default on a secured loan, the lender seizes the collateral.

- Home Equity Line of Credit (HELOC): This uses your home as collateral if you’ve built enough equity.

- Credit cards: Interest rates are higher than other loans, but credit cards can be used in a pinch.

- Grants or government programs: Grants or government programs might be available to provide funds with attractive terms.

Compare Life Insurance Quotes and Apply Today

The primary purpose of life insurance is to provide financial protection to those who depend on you. But life insurance has other uses as well, such as collateral assignment.

If you don’t yet have life insurance, start by getting quotes . Here at Quotacy, you can see quotes instantly without giving away any contact information. Compare policies from multiple top-rated insurers and apply with confidence.